Get the free Act of Donation

Get, Create, Make and Sign act of donation

Editing act of donation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out act of donation

How to fill out act of donation

Who needs act of donation?

Comprehensive Guide to the Act of Donation Form

Overview of the Act of Donation Form

An Act of Donation Form serves as a legal document that formally records a donation made by an individual or entity to another individual or organization. Its primary purpose is to ensure clarity and accountability between the donor and the recipient regarding the transfer of goods, services, or funds. Utilizing this form is crucial for documenting the intention behind the donation, as well as any specific terms and conditions attached to it.

The importance of the Act of Donation within the philanthropic sphere cannot be overstated. It provides not just a legal safeguard for both parties involved but also fosters a culture of transparency and trust in charitable contributions. For donors, it often plays a critical role in tax deductions that might arise from their generous acts. Furthermore, it helps recipients to formally acknowledge and process the contributions they receive, thereby enhancing their operational credibility.

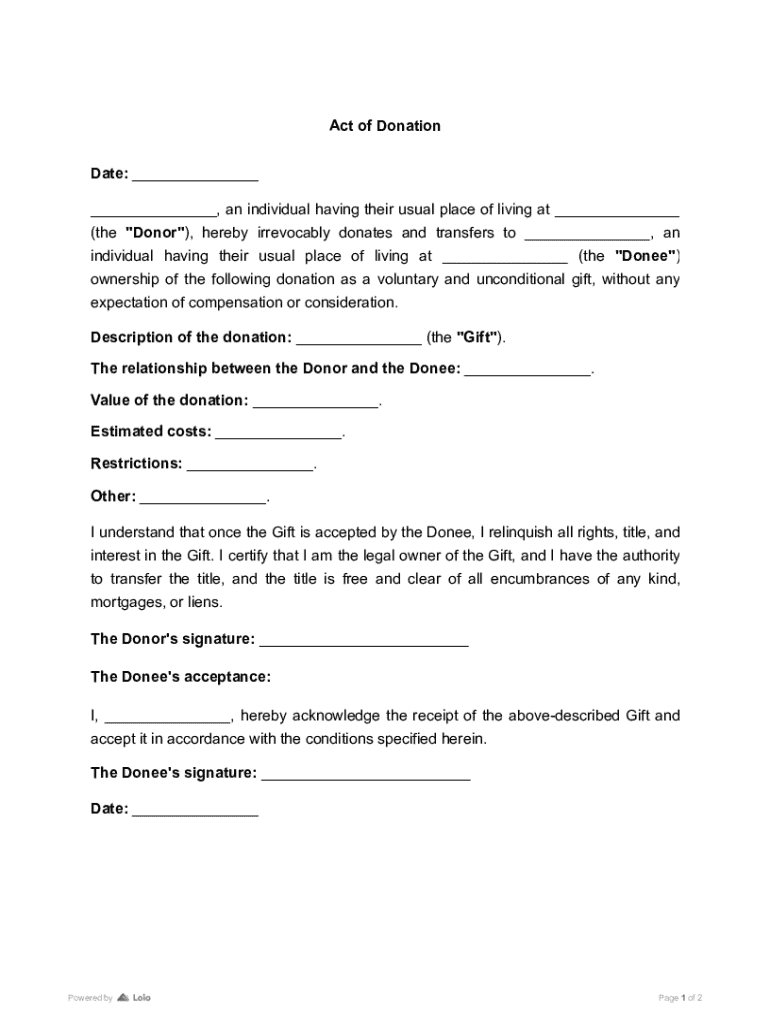

Template description

A standard Act of Donation Form comprises several key components that ensure all pertinent information is captured efficiently. The details within the form serve to affirm the legitimacy and intentions behind the donation. Understanding each element is essential for both donors and recipients.

When to use an Act of Donation Form

There are numerous situations that may necessitate the formal documentation of a donation through an Act of Donation Form. One primary scenario is for charitable contributions made to non-profit organizations. In these cases, the documentation not only substantiates the donation but also enhances the likelihood of receiving tax benefits.

Gift donations to individuals or smaller groups also merit using an Act of Donation Form, especially if the items or cash involved represent significant value. For instance, gifting a vehicle requires proper documentation for both parties to clarify the transaction's legal standing. Moreover, keeping a record of donations can resolve any tax implications and facilitate potential future audits.

Understanding the parties involved

When executing an Act of Donation Form, it is critical to recognize the roles of all parties involved. The donor is the individual or entity making the donation, and their personal information needs to be accurately recorded within the form.

The recipient refers to the individual or organization receiving the goods or funds, and it is their responsibility to ensure they will utilize the donation appropriately. In some cases, especially with larger donations or corporate sponsorships, a witness may also be included in the process to confirm its validity. Each party has specific roles and responsibilities that help guarantee a smooth transfer and the ongoing relationship between the donor and recipient.

Key terms explained

Familiarity with terminology surrounding the Act of Donation Form is essential for both donors and recipients. One key distinction is between 'donation' and 'gift'; while often used interchangeably, a donation is typically associated with charitable contributions that may offer tax deductions, whereas a gift can simply involve personal transfers without financial incentives.

Tax deductions on donations are crucial for donors, as they can potentially lower taxable income based on the value of the contribution. Understanding how to value goods is another aspect that requires attention, as it involves assessing fair market value for donated items. Lastly, it is important to note that donations can be revoked under certain circumstances, such as misrepresentation of the donation's nature or changes in the donor's financial situation.

How to write an Act of Donation Form

Creating a personalized Act of Donation Form involves several critical steps. Initially, gather all necessary information, including donor and recipient details and specifics about the type and estimated value of the donation. This groundwork ensures that the resulting form is comprehensive and accurate.

Once the information is collected, proceed to fill out the form. You may utilize a provided template or an online tool like pdfFiller, which simplifies editing and customization. After completion, it is vital to review and edit the document for accuracy. Correctly captured information reduces the chance of disputes later on. For signatures, consider implementing an e-signature process, which allows for easier compliance with legal standards and facilitates remote collaboration.

Interactive tools for document management

pdfFiller offers an array of interactive tools aimed at enhancing the document management process. With pdfFiller, users can easily edit and customize the Act of Donation Form, ensuring all details are up to date and reflective of the actual donation. Their cloud-based platform enables secure storage and management of documents, providing peace of mind.

Moreover, pdfFiller allows users to share forms with relevant parties for real-time collaboration. This feature is particularly advantageous for teamwork environments where multiple stakeholders may need to contribute or review the documentation prior to finalization. By leveraging these tools, users streamline their document creation process, thereby increasing efficiency and reducing the potential for errors.

Practical tips for successful donations

Before executing a donation, consider this essential checklist to ensure a comprehensive and successful contribution. Start by verifying the legitimacy of the recipient; confirmation of their status as a registered non-profit organization or established entity is fundamental to prevent fraudulent transactions.

Navigating these aspects can significantly improve the donation experience and ensure that it is beneficial and meaningful for both parties involved.

Real-world examples of donation scenarios

Understanding practical scenarios can provide clarity on how the Act of Donation Form operates in real-world contexts. For example, an individual may decide to donate their used furniture to a local shelter. By completing the Act of Donation Form, they not only document the transaction, but they may also claim a tax deduction based on the fair market value of the items.

Corporate sponsorships involving donations present another common case. In this scenario, a business may provide financial support to a non-profit event. An Act of Donation Form details the contribution and clarifies any promotional expectations in return, ensuring all parties understand their roles. Finally, donations to non-profit organizations—whether monetary or in-kind—benefit from the form by validating the contributions, which is essential for transparent reporting and accountability.

Legal considerations and compliance

When dealing with donations, understanding the legal framework is critical. Various laws govern the donation process and impact how transactions are documented. For instance, charitable contributions often involve tax laws that stipulate the required documentation to qualify for deductions. In these matters, having a well-crafted Act of Donation Form ensures compliance with federal and state regulations.

Within the form itself, incorporating precise legal language helps in defining terms clearly and safeguarding both parties' interests. It's often beneficial to consult legal resources or professionals to review the form, especially for high-value donations or complex structures. Proper legal consultation can provide additional assurance against potential disputes in the future.

Next steps after completing an Act of Donation Form

After finalizing the Act of Donation Form, it is important to take the necessary follow-up actions. Begin by keeping thorough records for tax purposes; this includes a copy of the signed donation form as well as any acknowledgment letters received. These documents are essential should the donor ever need to substantiate claims during tax season.

Sending a formal acknowledgment letter from the recipient not only fulfills any courteous obligations but also reinforces the legitimacy of the donation process. Lastly, in the unfortunate event of disputes regarding the donation, having a legal document like the Act of Donation Form can help clarify intentions and terms agreed upon at the outset.

Also read: Additional topics

To broaden your understanding of contributions and documentation, consider exploring related topics. Insights on 'Understanding Other Types of Donation Forms' delve into varying formats based on donation types, while 'How to Make a Charitable Donation Efficiently' provides practical tips on seamless contributions. Finally, 'Best Practices for Documenting Contributions' ensures you are equipped with the knowledge to maintain meticulous and effective records of all donations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send act of donation to be eSigned by others?

Can I create an electronic signature for the act of donation in Chrome?

How do I edit act of donation on an iOS device?

What is act of donation?

Who is required to file act of donation?

How to fill out act of donation?

What is the purpose of act of donation?

What information must be reported on act of donation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.