Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

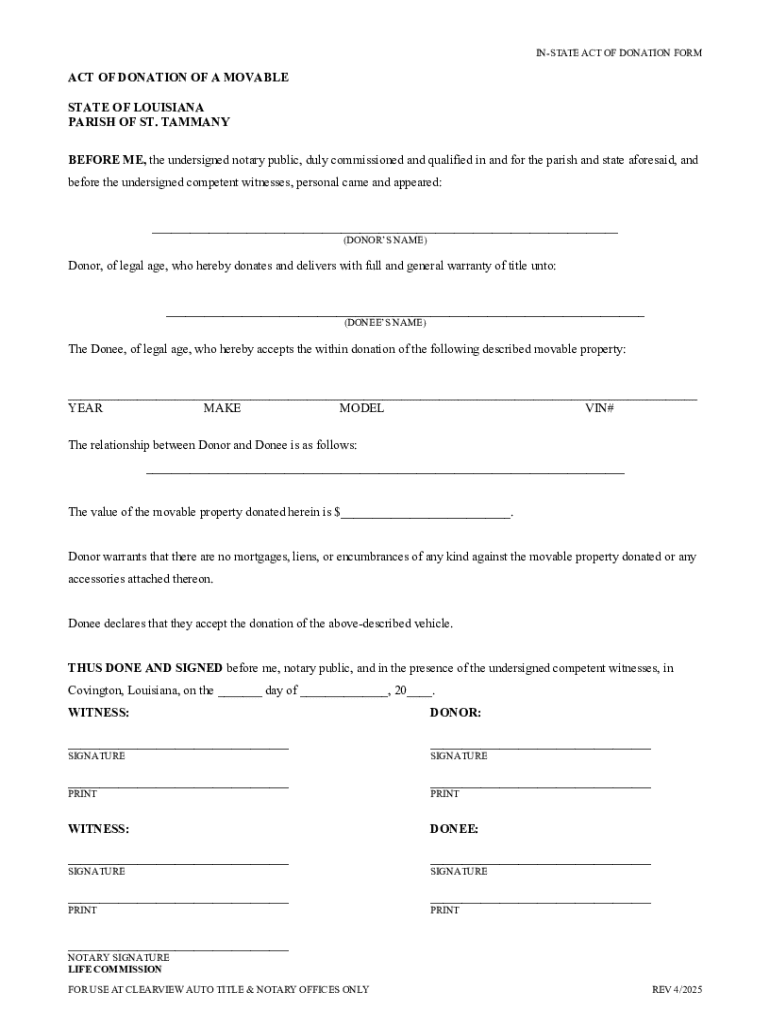

How to fill out in-state act of donation

Who needs in-state act of donation?

A comprehensive guide to the in-state act of donation form

Understanding the in-state act of donation form

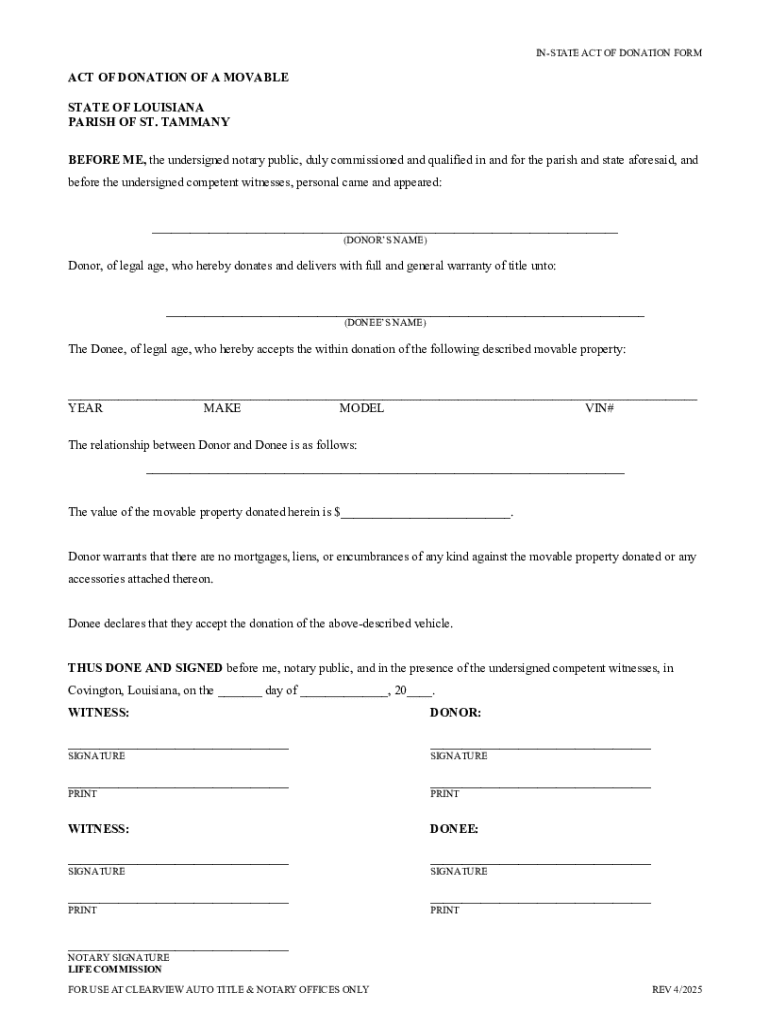

The in-state act of donation form serves as a crucial legal document that formalizes the transfer of ownership of property from one individual (the donor) to another (the recipient) without any monetary exchange. This document ensures that the donation is legally recognized, protecting the rights of both parties and clarifying the terms under which the transfer is made. Using an official form is essential, as it adheres to state laws and regulations, making the process transparent and accountable.

In many cases, informal gifts may lead to disputes or confusion about ownership, especially concerning significant assets like real estate or valuable personal property. Having a legally binding document mitigates these risks, ensuring that the intentions of the donor and recipient are clear and documented. Thus, the in-state act of donation form plays a pivotal role in various personal and financial scenarios.

When and why to use an in-state act of donation form

There are various scenarios where the act of donation is beneficial or necessary. Common examples include gifting property to family members or friends, especially in cases where individuals wish to pass on assets without the complexities of inheritance laws. For instance, parents may choose to donate a house to their child, streamlining the transfer of ownership and avoiding potential probate costs.

Additionally, there are tax implications and potential benefits associated with using an in-state act of donation form. In many states, gifting assets may allow the donor to claim certain tax deductions, while the recipient may benefit from the stepped-up basis for property value calculation. Formalizing donations with this document not only fulfills legal requirements but can also optimize tax benefits, making it a wise financial decision.

Key components of the in-state act of donation form

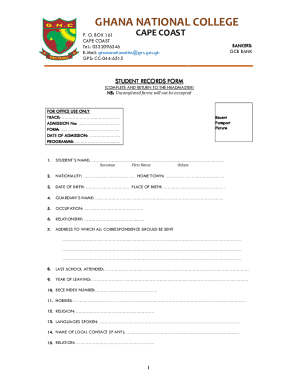

An in-state act of donation form contains several essential elements that must be accurately filled out for the document to be valid and enforceable. This includes detailed information about both the donor and the recipient, such as their full names, addresses, and contact information. Additionally, a comprehensive description of the property being donated is required, which should include all relevant details to avoid ambiguity.

Moreover, the form should contain clauses that outline the terms and conditions of the donation, such as whether it is a revocable or irrevocable gift. It is crucial for both parties to thoroughly understand these terms before signing. For easy completion, individuals should prepare all necessary information beforehand, including property titles and legal identification, to ensure a smooth filling process.

Parties involved in the act of donation

The primary parties involved in an act of donation are the donor and the recipient. The donor is the person transferring ownership, while the recipient is the one receiving the property. Each party has specific rights and responsibilities under the act of donation. For instance, the donor must ensure that the property is free of encumbrances and provide truthful information, while the recipient should thoroughly understand the implications of accepting the gift.

In some cases, third parties, such as co-signers or witnesses, may be required to validate the process legally. This importantly adds an additional layer of protection and credibility to the transaction, particularly in cases where the donation involves substantial assets. Understanding the legal considerations pertaining to the rights of each party is paramount to ensure the transfer is executed smoothly and legally.

State-specific legal requirements

Legal requirements for the act of donation can vary significantly from one state to another. Each state may have specific laws affecting the validity and enforceability of donation forms, particularly concerning property types and asset values. Therefore, it is crucial for individuals to familiarize themselves with local legislation to ensure compliance and protect their rights during the donation process.

For instance, some states require notarization or witnesses to affirm the authenticity of the donation, while others may have restrictions on certain types of property. Additionally, understanding local tax regulations and any potential repercussions can facilitate smoother transactions. Consulting with a legal expert to verify eligibility and requirements can save considerable time and reduce future complications.

Steps for completing the in-state act of donation form

Completing the in-state act of donation form involves several systematic steps to ensure accuracy and legality. Here’s a breakdown of the process:

Following these steps diligently will help ensure that the act of donation is legally recognized and can prevent potential disputes or misunderstandings in the future.

Common mistakes to avoid when filling out the form

While completing the in-state act of donation form, individuals often overlook specific critical sections or make common errors. Being aware of these pitfalls can enhance accuracy and efficacy. One frequent mistake is neglecting to fill out all required sections, especially those defining the property description or terms of the donation.

Another common issue is failing to adhere to required formatting or using incorrect legal jargon, which can lead to misunderstandings. Furthermore, not notarizing or witnessing the document as required can render the form invalid. By being thorough and methodical while filling out the form, individuals can prevent future complications.

Interactive tools for managing your act of donation

Utilizing pdfFiller’s features can streamline the overall process of managing your act of donation. This web-based platform allows users to edit documents from any device, ensuring accessibility and ease of use for all parties involved. You can effortlessly make changes and updates as needed, facilitating collaboration between the donor and recipient.

Additionally, pdfFiller provides functionalities to track updates and ensure compliance with state regulations, reducing the chances of oversight. The integration of eSigning features also simplifies the signing process, ensuring that the required parties can easily collaborate to finalize the document.

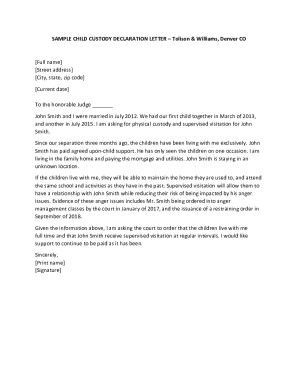

Real-life examples of utilizing in-state act of donation forms

Real-life case studies can shed light on the practical applications of in-state act of donation forms. For example, a family successfully used the act of donation to transfer the family home from parents to their adult child. They noted that having the official form minimized family disputes and clarified ownership.

Another testimonial involves a couple who decided to donate a valuable heirloom to a niece, highlighting how formal documentation not only honored their intent but also served as a protective measure against potential claims from other relatives. These examples illustrate that effective use of the in-state act of donation form can have lasting positive impacts on family relationships and asset management.

FAQs about the in-state act of donation form

Common questions arise about the act of donation and its implications. One frequent inquiry concerns the differences between in-state and out-of-state donations. The laws governing property transfers can vary significantly by jurisdiction, which may impact tax responsibilities and legal protections.

Another common concern is the act of donation’s impact on taxes. Gifts above a certain value may necessitate the filing of tax forms. Many individuals also wonder if the form can be used for real estate versus personal property; the answer is yes, it is applicable to both types, although certain additional documentation may be necessary for real estate transactions.

Exploring related document templates

In addition to the in-state act of donation form, various other documents might be relevant for those engaging in property transfers or donations. Transfer of ownership agreements lays down the terms for property transfer, while gift letters can help clarify tax-related issues, especially for larger gifts.

Navigating these documents effectively is key to ensuring legal compliance and protecting all parties involved. pdfFiller offers templates for these related documents, making it easier to manage all your documentation needs seamlessly.

Final thoughts on the importance of in-state act of donation forms

In conclusion, the in-state act of donation form represents a vital step in the formal donation process, ensuring clarity, legality, and proper documentation. Understanding its requirements and completing it correctly can lead to significant benefits for both donors and recipients. Proactive documentation promotes smooth asset transfers and helps individuals avoid potential disputes.

Utilizing tools like pdfFiller not only simplifies the process but ensures that users are equipped to handle their documentation needs in an efficient, compliant manner. Prioritizing proper documentation and utilizing available resources can ultimately strengthen personal relationships and facilitate effective estate planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pdffiller form without leaving Google Drive?

Can I sign the pdffiller form electronically in Chrome?

How do I fill out the pdffiller form form on my smartphone?

What is in-state act of donation?

Who is required to file in-state act of donation?

How to fill out in-state act of donation?

What is the purpose of in-state act of donation?

What information must be reported on in-state act of donation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.