Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: The Essential Guide for Public Companies

Understanding Form 8-K

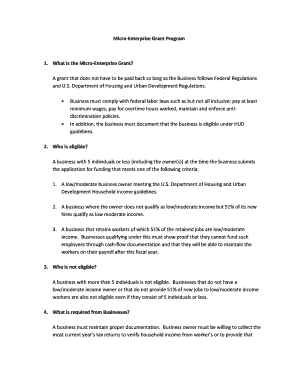

The Form 8-K serves as a critical document for publicly traded companies, fulfilling a vital role in corporate transparency. This document is utilized to report unscheduled material events that are important to shareholders or the SEC, ensuring that investors receive timely, relevant information regarding a company's financial status and operations.

The importance of Form 8-K in the realm of corporate finance cannot be overstated. By mandating the disclosure of significant events, companies maintain transparency with investors, reflect good governance practices, and comply with SEC regulations. This builds trust and accountability, which are crucial in today's market.

Overview of Form 8-K Requirements

Publicly traded companies are bound by legal obligations to file a Form 8-K whenever certain events occur. This requirement stems from the SEC's efforts to keep the investing public informed about significant developments that could affect the price or trading of their stock. Companies must adhere strictly to these regulations, ensuring integrity and compliance in their reporting practices.

Timeliness is essential when it comes to filing Form 8-K. Companies typically have four business days from the date of the event to submit their filing. This prompt reporting helps safeguard against misinformation and allows investors to make decisions based on the most current data.

Key components of Form 8-K

The structure of Form 8-K is designed to provide clarity and facilitate efficient communication of significant corporate events. Its detailed components ensure that all necessary information is included to keep shareholders fully informed.

The form comprises multiple item numbers, each addressing specific events that require disclosure. Among these items, the most commonly utilized include:

Additional items (Items 5-16) cover a range of other scenarios that necessitate timely disclosure. These items cater to various corporate and financial events, which collectively enhance the full disclosure regime upheld by the SEC.

Reading Form 8-K

Understanding how to correctly read and interpret a Form 8-K is essential for investors and analysts. The standardized terminology within the document is crafted to minimize ambiguity, allowing readers to grasp the significant implications of the reported information quickly.

To effectively interpret financial data within the form, it is crucial to focus on key metrics and management’s discussion and analysis (MD&A). The MD&A provides context and insight on how management perceives the company's performance and future prospects, offering a narrative that helps investors understand the numbers better.

Historical context of Form 8-K

Form 8-K has undergone significant changes since its introduction, reflecting the evolving landscape of corporate financial disclosure. Historical amendments have primarily focused on enhancing the reporting requirements to better protect investors and improve the overall transparency of the markets.

Several landmark filings have shaped the application and perception of Form 8-K over the years. Through these examples, we can see how the form adapts to the regulatory environment and responds to the needs of the investing public.

Impact of regulatory changes on Form 8-K filings

Various regulatory changes have consistently affected how companies approach Form 8-K filings. Enhanced rules around disclosure continue to shape corporate reporting practices, ensuring that they align with best practices in transparency and accountability.

The SEC's recent push toward real-time reporting has significant implications for Form 8-K obligations. Companies are now expected to provide information more rapidly, reflecting the necessity for immediate access to data that can affect investment decisions.

Benefits of Form 8-K

Adhering to Form 8-K filing requirements not only enhances investor relations but also serves as a strategic advantage for companies. Timely and accurate disclosure helps to mitigate risks and potentially shield firms from unwanted legal repercussions.

Furthermore, transparency promotes trust between the company and its stakeholders. This resulting trust can lead to a more stable share price and increased investor confidence.

Compliance and best practices for filing Form 8-K

Filing a Form 8-K involves several crucial steps to ensure compliance. Consider creating a compliance checklist that focuses on gathering necessary documentation and information, ensuring teams are sufficiently informed about reporting obligations.

To improve accuracy and timeliness in filing, companies should invest in thorough training for their finance teams that includes specific scenarios likely to trigger 8-K reporting.

Legal considerations

Form 8-K operates within a framework of legal obligations alongside other SEC filings. Corporations must understand the nuances between these forms to ensure comprehensive compliance.

Liability arising from misreporting or non-reporting can be severe, ranging from financial penalties to reputational damage. It's essential to establish a protocol for corrective action in response to any discrepancies identified during or after filing.

Specialized topics related to Form 8-K

Recent trends in Form 8-K filings reveal a greater focus on the timeliness and accuracy of disclosures. Companies are increasingly recognizing that detailed and prompt reporting is critical to maintaining investor confidence and navigating market dynamics.

Different industries exhibit unique patterns when it comes to Form 8-K filings, driven by their specific operational requirements and compliance environments.

How pdfFiller can simplify your Form 8-K process

pdfFiller is designed to streamline the Form 8-K filing process with features tailored specifically for document management. Its cloud-based platform allows teams to facilitate real-time editing and collaboration, ensuring that all relevant stakeholders have access to the latest information as events unfold.

By leveraging pdfFiller’s tools, companies can enhance their workflow efficiency, ensuring compliance is maintained through standardized processes.

User testimonials and case studies

Numerous publicly traded companies have successfully adopted pdfFiller into their Form 8-K filing workflows. These firms report significant reductions in time spent preparing filings, as well as enhanced compliance,

For instance, Company XYZ improved its filing accuracy by utilizing pdfFiller’s automated features, thus reducing the chances of potential errors and subsequent liability.

Frequently asked questions about Form 8-K

Many professionals have questions regarding Form 8-K filing procedures. Typically, queries revolve around the types of events that necessitate a filing, the timelines for submission, and the implications of failure to report accurately.

Understanding these FAQs can clarify common misunderstandings and empower companies to manage their reporting requirements more efficiently.

Subscribe for alerts on regulatory updates and insights

Staying updated with changes to Form 8-K regulations is paramount for companies aiming to remain compliant and proactive in their reporting. Subscribing to alerts can provide timely insights and updates, ensuring that organizations are informed of upcoming changes.

Utilizing modern technologies can facilitate more efficient communication and compliance strategies, helping firms navigate the complexities of regulatory requirements with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 8-k from Google Drive?

How can I send form 8-k to be eSigned by others?

How do I complete form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.