Get the free Tc-721 - finserve byu

Get, Create, Make and Sign tc-721 - finserve byu

Editing tc-721 - finserve byu online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-721 - finserve byu

How to fill out tc-721

Who needs tc-721?

Guide to the TC-721 - FinServe BYU Form

Understanding the TC-721 – FinServe BYU Form

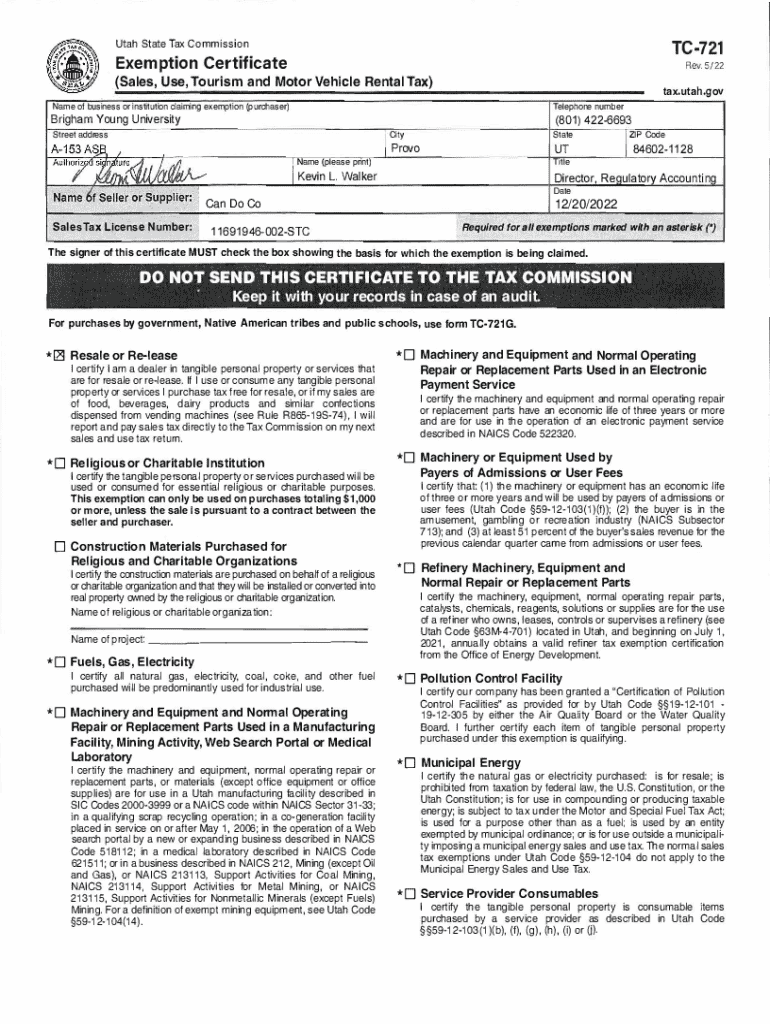

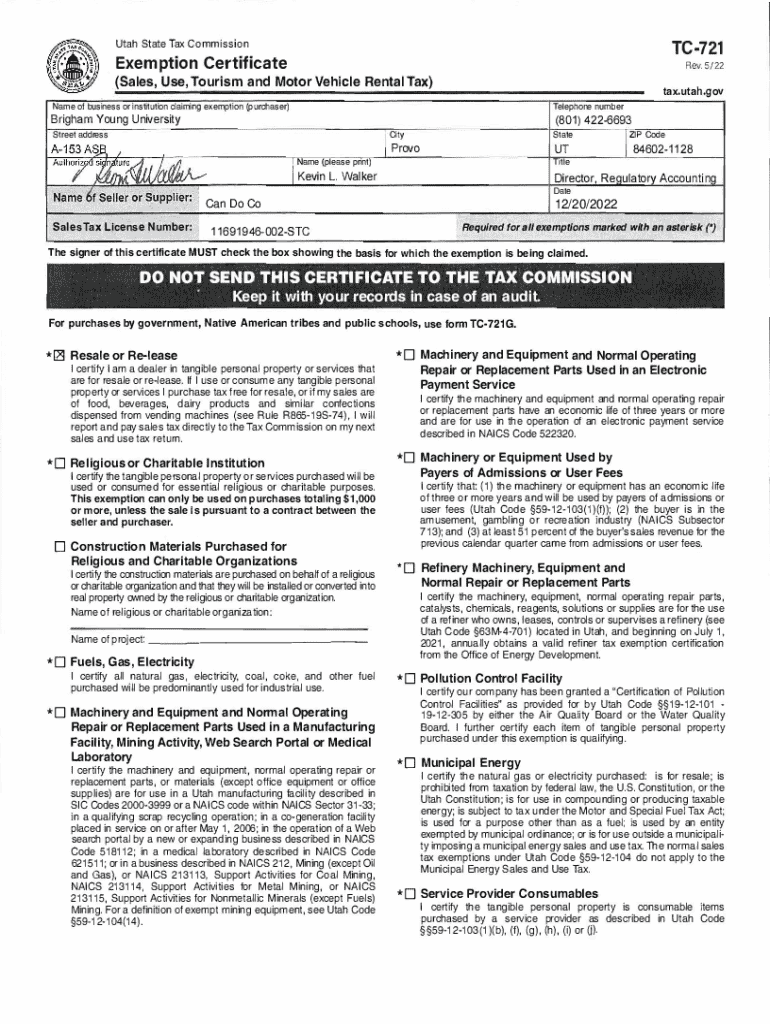

The TC-721 form, commonly referred to as the FinServe BYU Form, is a critical document designed specifically for individuals and teams in the financial services industry. Its primary purpose is to facilitate the assessment and documentation of various financial qualifications and information necessary for processing loans, grants, or financial aid applications.

Understanding the importance of the TC-721 form is vital for anyone navigating financial services, as it represents a structured approach to gathering essential data. This is particularly relevant in academic institutions such as BYU, where finance-related services require precise and accurate documentation to ensure compliance and effective decision-making.

Who needs the TC-721 form?

The TC-721 form is typically used by students, working professionals, and academic institutions involved in financial transactions. Scenarios requiring this form include applying for scholarships, financial aid, or loans where financial information must be verified and documented. Individuals looking to consolidate their financial obligations or seeking financial counseling may also find this form beneficial.

Moreover, departments within educational institutions, financial advisors, and external auditors are also part of the target audience, as they rely on the TC-721 form for accurate financial assessments.

Key features of the TC-721 form

The TC-721 form is structured into several key sections, each serving a specific purpose that contributes to the overall objective of financial assessment. The first section typically gathers personal information, including the name, contact details, and student ID number. This section is crucial for ensuring that the information provided can be correctly associated with the individual.

Following personal details, the form delves into financial specifics, such as income, savings, and liabilities. This section is pivotal for enabling respondents to paint a full picture of their financial context, qualified to support their applications.

The TC-721 form sets itself apart from other financial documents by incorporating built-in checks and balances aimed at ensuring accuracy and completeness, ultimately speeding up the processing time when submitted.

How to access the TC-721 form

Accessing the TC-721 form is straightforward, especially with the increasing trend toward digital documentation. To obtain the TC-721 form, individuals can visit the official FinServe resources on the BYU website or search through specific document libraries.

Users looking to utilize resources like pdfFiller can locate the form through online searches, where forms are often available in PDF format. This allows easy access for both viewing and downloading.

Upon locating the form, users can download it in various formats conducive to their needs, including PDF and Word formats, ensuring availability for immediate use.

Filling out the TC-721 form

Completing the TC-721 form correctly is essential for successful submissions. The first section requires personal information, where users must fill in their name, date of birth, SSN, and relevant contacts. Precision is paramount to prevent any processing delays.

Moving on to the financial details section, respondents need to detail their current income, assets, and liabilities. This information should be presented clearly to ensure it can be verified without ambiguity.

It's advisable to keep a checklist handy while filling out the form to avoid typical pitfalls. Common mistakes include omitting signatures or providing incorrect figures in the financial section.

Editing the TC-721 form with pdfFiller

pdfFiller streamlines the editing process for the TC-721 form, providing users with sophisticated tools to ensure that all changes are easily made. Accessible through a simple interface, users can upload the PDF version of the TC-721 form and use various editing features to modify content as needed.

Collaboration options also allow multiple users to contribute to the form, making it an ideal tool for teams that need to work together on financial assessments. With revision tracking, users can monitor changes and revert to previous versions if necessary.

Signing and securing the TC-721 form

To finalize the TC-721 form, electronic signatures provide a convenient and secure way of signing documents. With pdfFiller, users can easily add a digital signature by following straightforward steps, ensuring that the document is actionable and legally binding.

In addition to signing, it is critical to secure the TC-721 form to protect sensitive financial information. Utilizing encryption and password protection offered by pdfFiller can safeguard sensitive details.

Submitting the TC-721 form

Once the TC-721 form is filled out and signed, the final step is submission. There are various suitable methods for submitting the completed form: digital submission via email or a secure online portal, or mailing a physical copy to the appropriate department.

When submitting the TC-721 form, users should be aware of specific submission deadlines and requirements set by the reviewing institution. Ensuring timely submissions can greatly influence the outcome of financial applications.

Frequently asked questions about the TC-721 form

Many users have questions regarding the TC-721 form's usage, primarily focusing on common inquiries such as where to access the form, how to ensure it is filled out correctly, and understanding what financial details are truly necessary.

Clarifications on specific aspects of the TC-721 form are often sought after, including applicable submission timelines and troubleshooting on missing information. Further assistance is typically available through contact information listed on financial service websites.

Enhancing your document management with pdfFiller

Utilizing pdfFiller for managing the TC-721 form not only improves organization but also enhances collaboration features among team members. Its simplicity and efficiency allow users to create, edit, and share financial documents without complication.

Integrating pdfFiller into your financial documentation processes can significantly optimize workflows. By employing templates and collaborative tools, teams can streamline their approach to document management, ensuring that each person involved has access to the latest information.

Appendix: Additional tips and best practices

For users working with the TC-721 form or any financial document, keeping a quick reference guide can substantially aid in completing tasks more effectively. This guide should outline the critical sections that need attention and serve as a reminder of the required documentation.

Best practices for managing forms in financial services include maintaining accurate records, adhering to deadlines, and confirming eligibility criteria specific to funding opportunities. Leveraging features within pdfFiller, such as autofill options, can also streamline the filling process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tc-721 - finserve byu from Google Drive?

How do I fill out tc-721 - finserve byu using my mobile device?

How do I fill out tc-721 - finserve byu on an Android device?

What is tc-721?

Who is required to file tc-721?

How to fill out tc-721?

What is the purpose of tc-721?

What information must be reported on tc-721?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.