Get the free Boe-571-l (p1) Rev. 24 (05-18)

Get, Create, Make and Sign boe-571-l p1 rev 24

Editing boe-571-l p1 rev 24 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out boe-571-l p1 rev 24

How to fill out boe-571-l p1 rev 24

Who needs boe-571-l p1 rev 24?

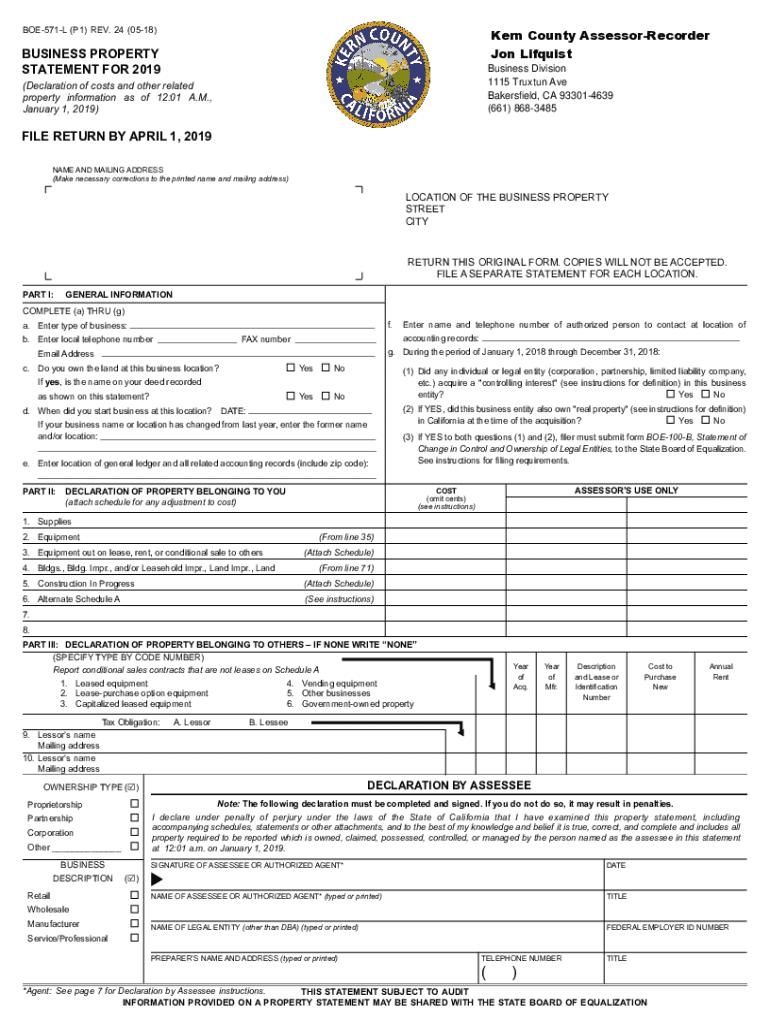

Comprehensive Guide to the BOE-571- P1 Rev 24 Form

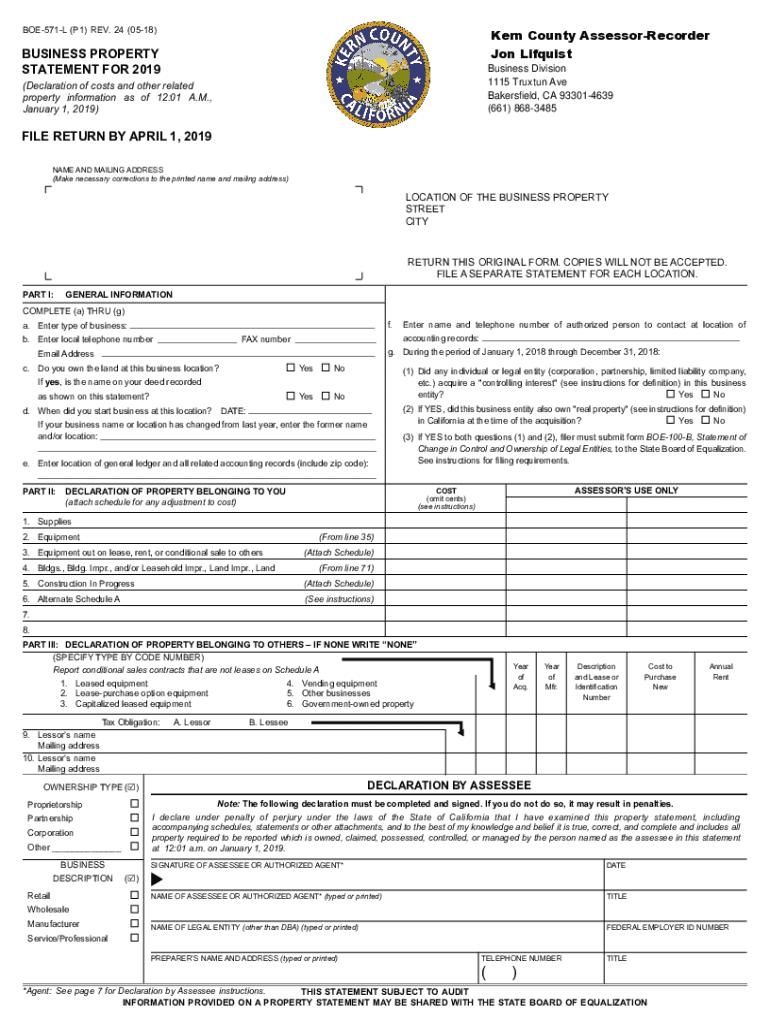

Overview of the BOE-571- P1 Rev 24 Form

The BOE-571-L P1 Rev 24 Form is an essential document used by taxpayers in California to report and claim property tax exemptions. This form specifically caters to applications regarding homeowners' exemptions and is crucial in determining the eligibility for tax reductions. Understanding this form is vital for ensuring that homeowners and business owners accurately benefit from available tax breaks.

The importance of the BOE-571-L cannot be overstated, as it not only impacts the financial burden of property taxes on individuals and families but also plays a role in the broader context of California's tax revenue. Taxpayers must keep abreast of changes in form revisions, ensuring that they are using the latest version to avoid complications in their applications.

Who should use the BOE-571- Form?

The BOE-571-L Form is specifically designed for California homeowners seeking to claim exemptions from property taxes. However, it is also beneficial for business owners who may have properties registered under their business names. Understanding the eligibility criteria helps in determining who should fill out this form.

Key features of the BOE-571- P1 Rev 24 Form

The BOE-571-L P1 Rev 24 Form comes with several interactive fields designed to make filling out the form easier for users. Each section has been laid out clearly to ensure that the necessary information can be provided efficiently. The form requires essential information such as property details, ownership information, and any relevant exemptions claimed.

Compared to previous versions, the current revision of the BOE-571-L offers improved clarity and usability. Noteworthy changes include the addition of digital field markers for online submissions, ensuring accuracy and ease of navigation within the document.

Step-by-step guide to completing the BOE-571- form

Completing the BOE-571-L form can seem daunting at first, but following these steps will help streamline the process.

Editing and customizing your BOE-571- form

After filling out the BOE-571-L form, users may find the need to edit or make adjustments before submitting it. Using pdfFiller's editing tools allows for a seamless experience in managing these documents. Users can easily add comments, revise information, or even include electronic signatures without any hiccups.

Helpful features include the ability to save a draft, ensuring that users can return to their work without losing any information. Tips for effective form management include organizing your forms in folders, labeling them correctly for easy retrieval, and keeping track of your submission statuses within the platform.

FAQ section on the BOE-571- form

There are numerous questions that arise when dealing with the BOE-571-L form, many of which can be resolved through a simple FAQ section.

Additional resources and support

Access to additional resources on the BOE-571-L form is crucial for taxpayers. Official guidelines can be found on the California Board of Equalization's website, offering comprehensive assistance. Furthermore, pdfFiller’s platform is designed to provide solid support for users, enhancing their document management experience with cloud-based tools.

Some of the benefits of using pdfFiller include ease of access from anywhere, collaborative features that allow teams to work together on document preparation, and the ability to eSign directly on the platform.

Related forms and documents

Navigating the world of tax forms can be overwhelming. Understanding related forms and documents is essential for comprehensive tax management. Below is a list of important tax forms you may also need to reference.

User testimonials and case studies

Getting insights from users who have successfully navigated the BOE-571-L process can be tremendously informative. Testimonials showcase how effective the BOE-571-L form is in aiding homeowners and business owners in claiming their rightful exemptions.

For instance, one small business owner shared how using pdfFiller allowed them to quickly and efficiently complete their paperwork without having to worry about errors. Their positive experience illustrates the importance of having user-friendly tools when dealing with important tax documents.

Important notices and updates

It is crucial for taxpayers to stay informed about annual changes to the BOE-571-L form. Each year may bring slight adjustments to eligibility criteria, deadlines, or procedures, and tax authorities often release announcements that are vital for compliance.

Regularly checking authoritative websites will help you stay up to date. Taking proactive measures geared toward understanding changes ensures that taxpayers are always applying with the correct information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get boe-571-l p1 rev 24?

How do I complete boe-571-l p1 rev 24 online?

How do I complete boe-571-l p1 rev 24 on an iOS device?

What is boe-571-l p1 rev 24?

Who is required to file boe-571-l p1 rev 24?

How to fill out boe-571-l p1 rev 24?

What is the purpose of boe-571-l p1 rev 24?

What information must be reported on boe-571-l p1 rev 24?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.