Get the free Checklist Reference No. 20

Get, Create, Make and Sign checklist reference no 20

How to edit checklist reference no 20 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out checklist reference no 20

How to fill out checklist reference no 20

Who needs checklist reference no 20?

Checklist Reference No 20 Form: A Comprehensive How-to Guide

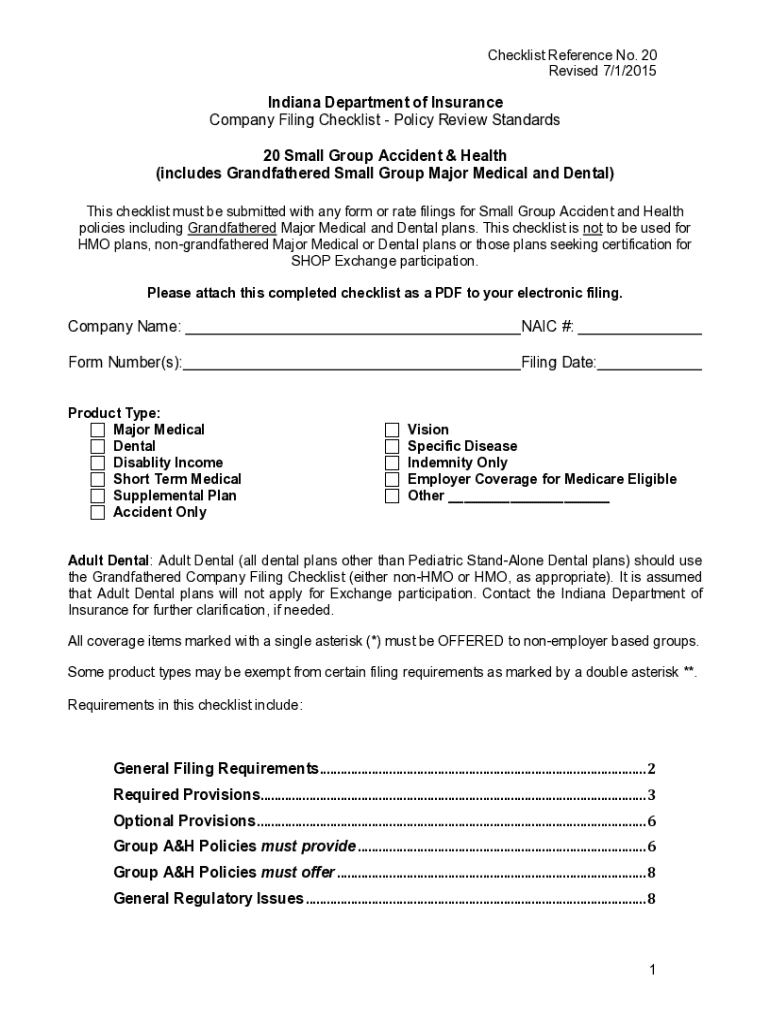

Understanding the Checklist Reference No 20 Form

The Checklist Reference No 20 Form serves as an essential document utilized primarily in regulatory and compliance settings. Its primary purpose is to ensure transparency and accountability within various industries, including finance, healthcare, and manufacturing. By maintaining a structured format, this form guides users through critical processes, allowing for streamlined audits and assessments.

Common use cases for the Checklist Reference No 20 Form include company compliance checks, project management audits, and operational assessments. These forms help organizations confirm adherence to standards and regulations, providing a clear record of processes followed.

Key features of the Checklist Reference No 20 Form

This form is composed of several key sections designed to capture a comprehensive range of information necessary for effective evaluations. Essential components typically include sections such as Personal Information, Financial Details, Compliance Check, and Review Summary. These components facilitate the organization of information in a manner that is straightforward and methodical.

In terms of interactive tools, pdfFiller provides unique features that enhance the user's experience with the Checklist Reference No 20 Form. These tools include customizable fields, electronic signature inclusion, and collaboration features. By using pdfFiller, users can efficiently fill out and manage their forms with ease.

Preparing to fill out the Checklist Reference No 20 Form

Before beginning the process of filling out the Checklist Reference No 20 Form, it’s crucial to gather all necessary information. To ensure you are fully prepared, compile the following documents:

Understanding where and to whom the form needs to be submitted is equally important. Organizations typically require this form for internal compliance and audits, but external stakeholders such as regulatory bodies may also request it. Verify the specific submission guidelines for your industry for proper compliance.

Step-by-step guide to completing the Checklist Reference No 20 Form

Accessing the Checklist Reference No 20 Form through pdfFiller is the first step. You can find the form by searching the templates section or using the link provided directly on the platform. Once located, open the form to begin filling it out.

Next, fill in the required sections meticulously. Here are detailed tips for accuracy:

Utilizing pdfFiller's editing features allows you to make modifications easily. You can add or delete information as your needs change, making the form dynamic and tailored to your specific situation.

Be sure to take into account any legal considerations associated with the form. This may involve understanding liability or ensuring that you meet any essential legal obligations attached to the information being submitted.

Signing the Checklist Reference No 20 Form

Once you have filled out the Checklist Reference No 20 Form, the next step involves signing the document. Using pdfFiller, electronic signatures can be added seamlessly. Follow the straightforward workflow to ensure your signature is securely affixed to the document.

Regarding notarization, it’s essential to verify whether it is required. Some organizations or legal contexts may necessitate notarization. If this is the case, follow the specific steps to ensure that your form is signed and notarized accordingly.

Managing and storing the Checklist Reference No 20 Form

Proper management of your completed Checklist Reference No 20 Form is critical. Ensure that you save your work frequently to prevent data loss. pdfFiller allows for secure storage and easy retrieval of your forms, so make sure to utilize these features.

When it comes to sharing your form, utilizing pdfFiller’s secure sharing options can enhance collaboration. Whether sending the form to a colleague for review or submitting it to regulatory agencies, ensure that the information remains confidential and secure.

Troubleshooting common issues with the Checklist Reference No 20 Form

As with any document, challenges may arise while working with the Checklist Reference No 20 Form. Common concerns often include misplaced forms or sections that seem unclear. To alleviate these issues, consider referring to the FAQ section on the pdfFiller website for answers.

Additionally, here are some tips to avoid common pitfalls:

Real-life use cases and testimonials

Numerous individuals and organizations have successfully utilized the Checklist Reference No 20 Form. For instance, a mid-sized manufacturing firm reported improved compliance checks leading to a significant reduction in audit findings. They attributed their success to effectively implementing the Checklist Reference No 20 Form through pdfFiller.

Furthermore, a non-profit organization sharing compliance documents found that using the form simplified their reporting process, making it easier to manage regulatory requirements efficiently. These success stories demonstrate the value and effectiveness of utilizing the Checklist Reference No 20 Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete checklist reference no 20 online?

Can I create an eSignature for the checklist reference no 20 in Gmail?

How do I complete checklist reference no 20 on an iOS device?

What is checklist reference no 20?

Who is required to file checklist reference no 20?

How to fill out checklist reference no 20?

What is the purpose of checklist reference no 20?

What information must be reported on checklist reference no 20?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.