Get the free Form 8937

Get, Create, Make and Sign form 8937

How to edit form 8937 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8937

How to fill out form 8937

Who needs form 8937?

Form 8937: How to Guide

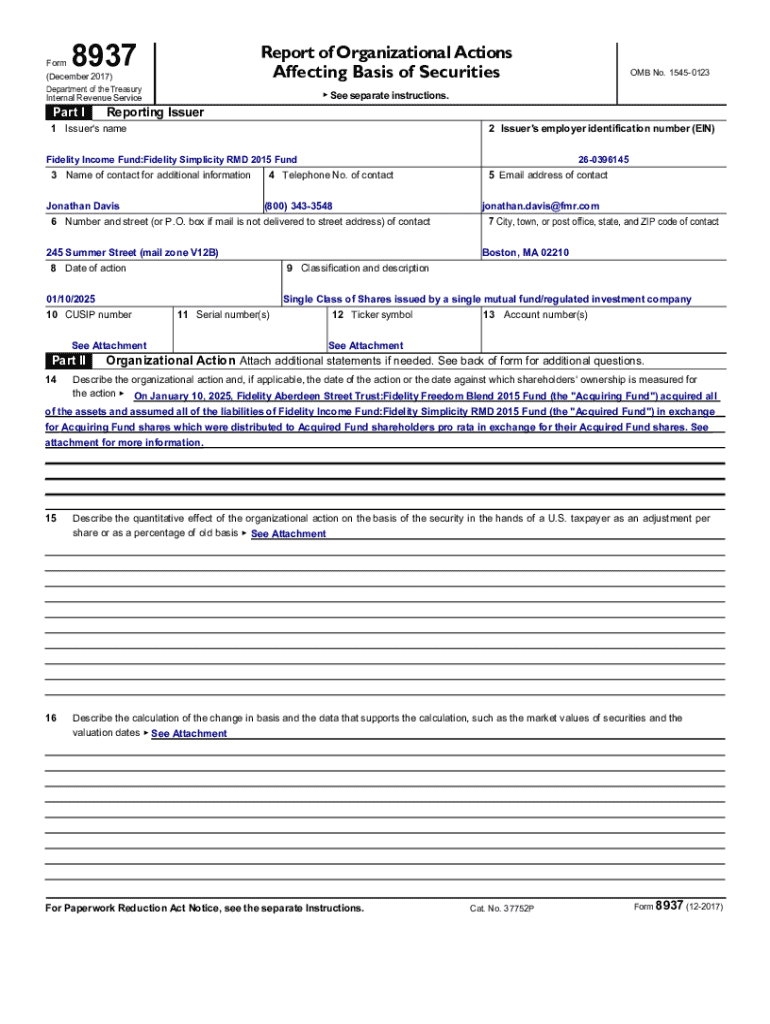

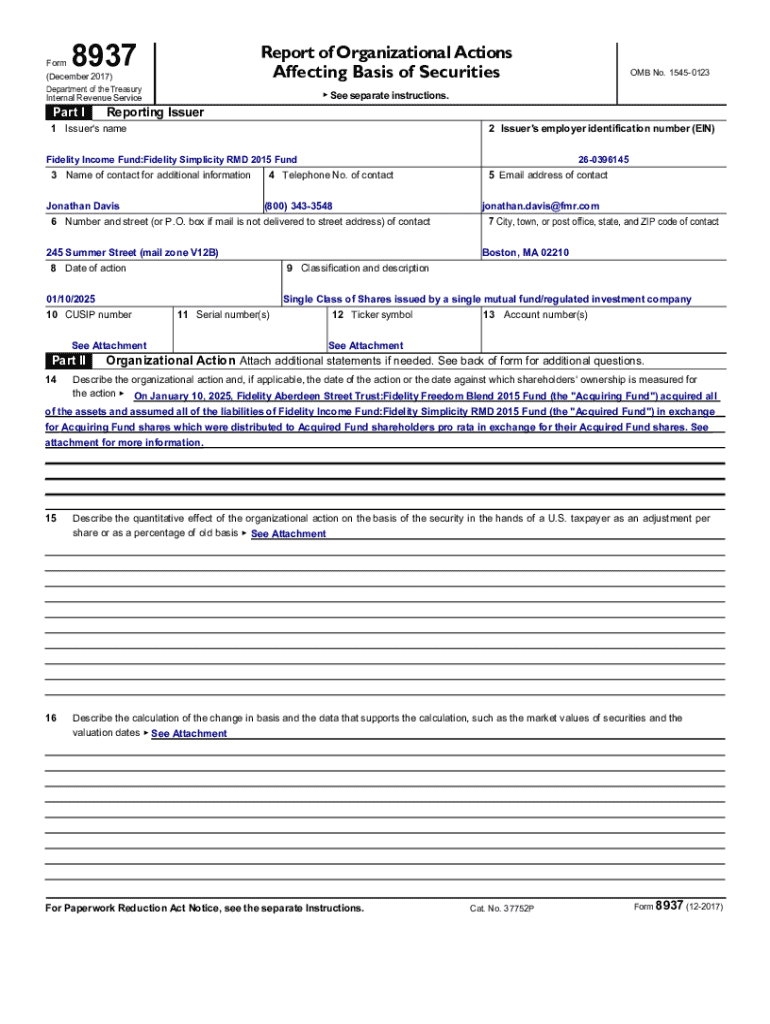

Overview of Form 8937

Form 8937 is employed to report organizational actions that impact the tax attributes of a security. It plays a crucial role in tax reporting, particularly for events that affect the basis or character of securities, such as mergers, spinoffs, and stock splits. Understanding this form's significance is vital for anyone involved in the management of these assets.

The form is typically utilized in scenarios such as corporate reorganizations or when a company distributes shares to shareholders, affecting their earnings. Proper use of Form 8937 helps ensure taxpayers report the correct information, assisting them in complying with IRS requirements.

Key components of the form

Form 8937 consists of several sections, each designed to capture specific information about the taxpayer, the action taken, and its impact on tax attributes. Accurate data entry in each section is crucial to prevent misreporting, which can lead to erroneous tax calculations.

Eligibility for filing Form 8937

Form 8937 is not limited to a specific type of taxpayer; both individuals and organizations may be required to file it in certain situations. Generally, anyone involved in transactions that involve tax attribute changes to securities should consider filing this form.

Moreover, entities like C corporations, partnerships, trusts, and even estates may find themselves obliged to report. Understanding the criteria that necessitate the use of Form 8937 is crucial for maintaining compliance with IRS guidelines.

Step-by-step instructions for filling out Form 8937

Preparing to complete Form 8937 requires gathering essential information such as the tax year, details of the organizational action, and any specific tax attributes relevant to the situation. Having organized records simplifies the filing process considerably.

Detailed breakdown of each section

Section 1 contains key identifying information that establishes who is filing the form. Ensure that the name, address, and taxpayer identification number are accurately entered. Any errors in these details can complicate IRS processing.

In Section 2, clearly describe the organizational action. For instance, if shares are being divided due to a stock split, include specifics about how many shares were held and the new quantity shareholders will receive.

For Section 3, it's important to specify the taxable years that pertain to the reported action. This ensures that both the reporting and the understanding of the event align properly.

Finally, Section 4 requires reporting specific tax attributes. List capital gains, ordinary earnings, or any losses associated with the action to ensure that taxpayers receive the proper tax treatment.

Tips for completing Form 8937 accurately

Filing Form 8937 accurately is crucial in maintaining compliance with federal tax regulations. One common mistake is failing to provide complete information in each section, which can lead to notices from the IRS. Double-check all entries, ensuring no details have been overlooked.

Another frequent error is misreporting tax attributes. Familiarize yourself with the tax landscape concerning your organizational action to report accurately. Additional best practices include reviewing similar previous filings for reference and utilizing reliable software for assistance.

Using pdfFiller for Form 8937 management

pdfFiller offers a robust platform for managing Form 8937. Users can easily edit the form with various capabilities, enabling the addition of text, data fields, and signatures. This streamlined process eliminates the hassle of manual adjustments and provides flexibility.

One of the standout features of pdfFiller is its eSigning options, allowing users to securely sign and send Form 8937 directly from the platform. This not only saves time but also enhances security during submission, reducing the risk of data breaches associated with traditional methods.

Managing Form 8937 after filing

Post-filing, it’s essential to maintain meticulous records of Form 8937 submissions. Keeping copies and confirmation of filings aids in mitigating issues that may arise with the IRS. A reliable tracking system ensures that all correspondence is accessible for future reference.

If errors are discovered after filing, swift action is necessary. Amendments can be made by submitting a corrected Form 8937. Clear communication with the IRS about the changes will facilitate smoother resolutions, should additional questions arise.

Interactive tools and resources for Form 8937

pdfFiller’s interactive tools make filling out Form 8937 easier than ever. Tools such as field highlighting and hints directly improve understanding of the data required in each section. The intuitive interface allows users to navigate through the form smoothly, reducing time spent on completion.

Additionally, pdfFiller hosts a comprehensive FAQ section dedicated to address user queries regarding Form 8937. This resource helps eliminate confusion and ensures that users are well-informed before submitting their forms.

Exploring additional tax reporting forms

Several related forms exist that taxpayers may also need to be aware of, including Form 1099 for various income reports, Form W-2 for wage reporting, and Form 1040 for individual income tax returns. Each form serves a unique purpose within the broader tax framework, and understanding when to use them is essential for comprehensive tax reporting.

Accurate filings across all forms are critical; errors can lead to audits or additional liabilities. Familiarity with the implications of different forms can empower users to be proactive in their tax reporting strategy.

Choosing pdfFiller enables users to manage, edit, and sign Form 8937 efficiently, providing an accessible solution for both individuals and teams. Collaborative features assist in enhancing the submission experience while maintaining documentation accuracy.

Take advantage of these tools today and ensure that your tax reporting complies with the ever-evolving tax landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8937 directly from Gmail?

Can I create an eSignature for the form 8937 in Gmail?

How do I fill out form 8937 on an Android device?

What is form 8937?

Who is required to file form 8937?

How to fill out form 8937?

What is the purpose of form 8937?

What information must be reported on form 8937?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.