Get the free Medicare Supplement Policy Checklist

Get, Create, Make and Sign medicare supplement policy checklist

How to edit medicare supplement policy checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out medicare supplement policy checklist

How to fill out medicare supplement policy checklist

Who needs medicare supplement policy checklist?

Medicare supplement policy checklist form: Your guide to effective planning

Overview of Medicare supplement policies

Medicare supplement policies, often referred to as Medigap, are insurance plans designed to cover some of the healthcare costs that Original Medicare does not. These policies are crucial for individuals who wish to minimize out-of-pocket expenses related to hospitalizations, doctor visits, and other essential health services. Without a supplement plan, you may face significant bills for deductibles, copayments, and coinsurance.

Understanding the importance of having a supplement plan cannot be understated. As healthcare costs continue to rise, having Medigap coverage helps ensure more predictable expenses. It's particularly vital to grasp the differences between standard Medicare and supplemental plans. While Medicare covers a broad spectrum of medical needs, it may not cover everything, leading many beneficiaries to seek additional coverage to fill these gaps.

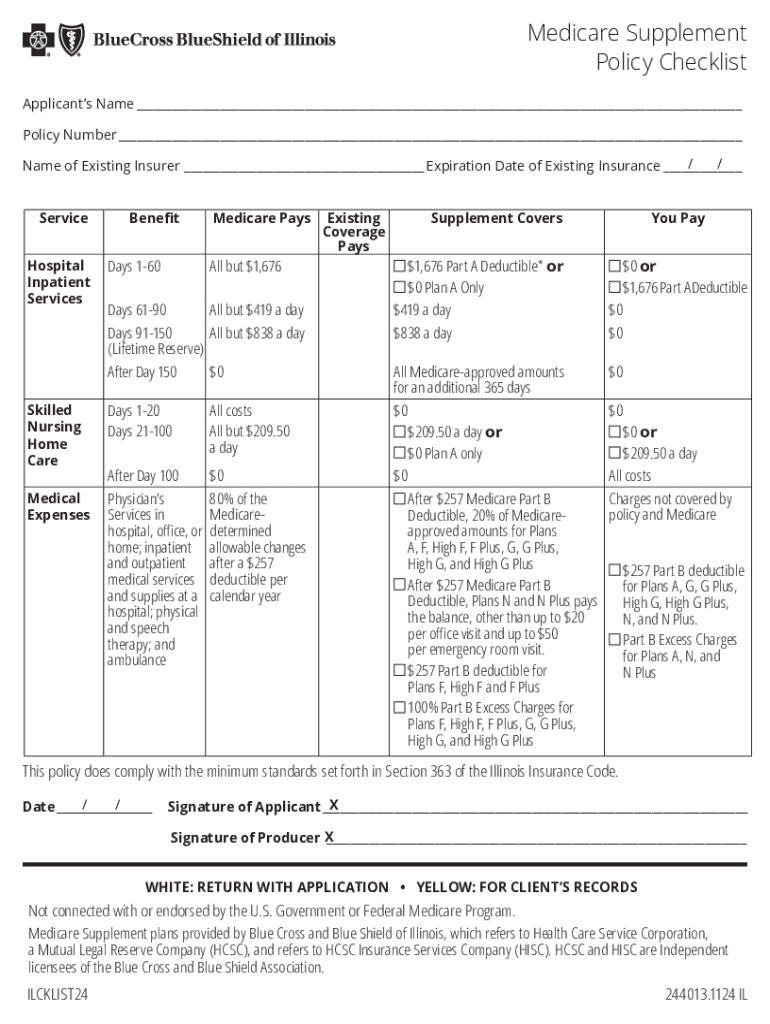

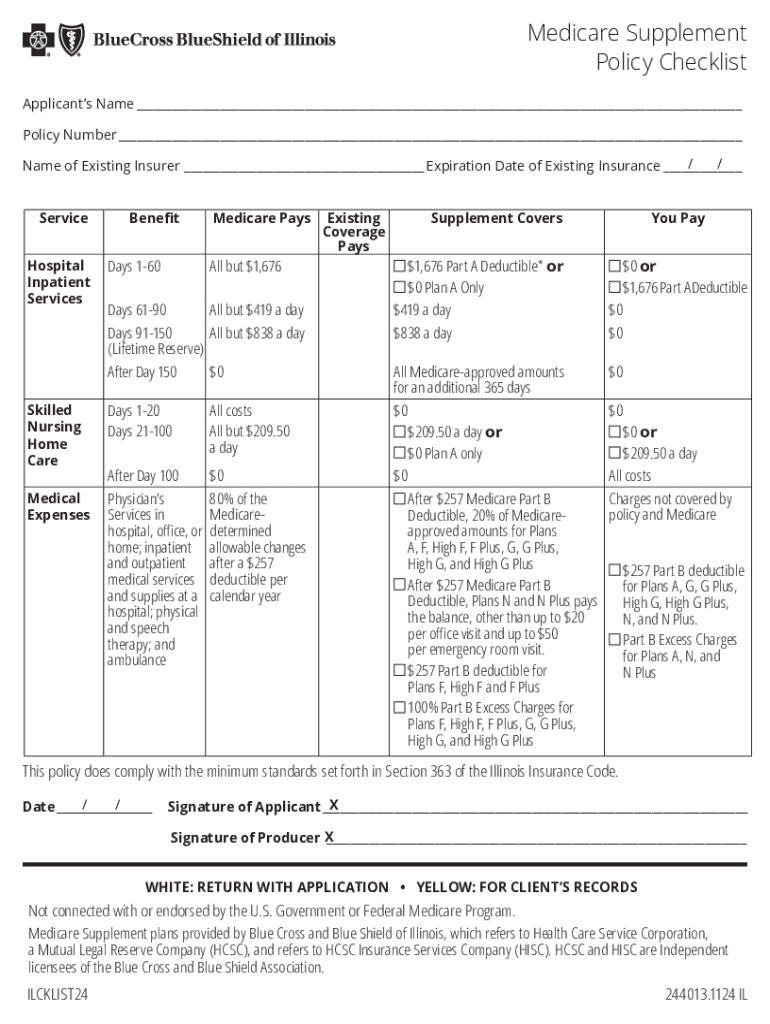

Understanding the Medicare supplement policy checklist

The Medicare supplement policy checklist is a tool designed to streamline the enrollment process for individuals considering a Medigap plan. Its primary purpose is to ensure that you gather all essential information and documentation needed to apply for a supplement policy effectively. This checklist serves as a roadmap, helping guide users through the critical steps and requirements necessary for a successful enrollment.

Utilizing this checklist simplifies your enrollment process by breaking it down into manageable parts. Each component of the checklist prompts you to think about different aspects of your Medicare coverage, ensuring that no detail is overlooked. This systematic approach avoids the frustration of last-minute paperwork issues, making the process smoother and more efficient.

Essential components of the Medicare supplement policy checklist

Your Medicare supplement policy checklist should include a variety of essential components to ensure completeness and accuracy. The first item is personal information requirements, which include your full name, date of birth, contact information, and Social Security number. These details are fundamental to identifying you and processing your application.

Beyond personal data, the checklist must also incorporate an overview of your health history. This includes current medical conditions, medications you are taking, and any significant past health events. Lastly, it’s crucial to provide current Medicare benefits information, encompassing your existing Medicare plan details and any prior supplement plans you may have had. This comprehensive view aids insurers in assessing your needs and determining the right coverage options.

Step-by-step instructions for filling out the checklist

Filling out the Medicare supplement policy checklist can be broken down into clear steps. Step 1 involves gathering necessary documentation. You’ll need sufficient identification, including your Medicare card, and emergency contact details. In addition, it’s essential to assemble your health records, including past diagnoses and treatment history, as well as any previous insurance policies you have.

Step 2 centers around completing the personal information section accurately. Be thorough with the details; inaccuracies could lead to processing delays. Double-check information like your Social Security number and date of birth for correctness. Step 3 involves assessing your current Medicare coverage. Look critically at your existing plans to identify gaps that a Medigap policy could fill. Understanding your needs helps you make informed decisions about which supplement plan will best suit your financial situation.

Interactive tools for efficient checklist management

Incorporating technology into your Medicare supplement policy checklist management can significantly enhance your experience. pdfFiller offers a suite of document creation tools that allows you to create a polished, professional checklist tailored to your needs. You can easily customize the form to include any additional information pertinent to your situation.

Utilizing pdfFiller’s eSigning features can streamline the process further. You can sign your checklist electronically, which saves time and allows for immediate submission. Additionally, collaborative options enable team review and input. If you’re working with an advisor or family members, they can easily provide feedback and assistance directly on the document, promoting collaborative efforts in your application process.

Frequently asked questions about Medicare supplement policies

As you prepare your Medicare supplement policy checklist, you may have some common concerns. For instance, 'What if I make an error on my checklist?' If you discover mistakes after submission, you should contact your Medicare provider or insurance company immediately to discuss corrections. They can guide you through any necessary amendments.

Another query might be, 'How do I change information after submission?' Generally, you should be able to submit a written request for changes, along with verification of the new information, to your insurance provider. Lastly, if you face denial for a supplement plan, it's important to understand that you can appeal the decision. Contact your insurer for specifics on their appeal process and seek assistance if needed.

Filing requirements for Medicare supplement policies

Filing requirements for Medicare supplement policies can vary based on federal and state regulations. Typically, applications must be submitted within specific open enrollment periods, as dictated by Medicare rules. It's essential to be aware of key deadlines to avoid missing out on your opportunity to enroll. Many states also have standardized filing requirements, mandating that certain information be disclosed to prospective enrollees.

To navigate this process smoothly, familiarize yourself with common mistakes in filing. Some individuals may overlook crucial details like additional documentation needed or may miss deadlines for submissions. Keeping an organized file throughout your application process can significantly reduce errors and help keep you on track.

Standard risk rates for Medicare supplement plans

Understanding the standard risk rates for Medicare supplement plans is essential for budgeting and ensuring that the right plan is chosen. Pricing structures can vary widely depending on various factors including location, the insurance provider, and your health history. Generally, plans are priced on a community-rated basis, attained-age rated, or issue-age rated, each affecting premiums.

When comparing Medicare supplement plans, consider creating a side-by-side comparison chart to easily evaluate costs, coverage options, and benefits. This can help you understand how different plans stack up against one another. By being informed about these elements, you can select a plan that not only meets your healthcare needs but also fits your financial constraints.

Record keeping and document management strategies

Effective record-keeping for your Medicare supplement policy checklist is vital in preventing issues down the road. Best practices include storing your completed checklist in a secure digital format, using cloud-based services like pdfFiller for easy access from anywhere. This approach ensures that you always have a copy of your application and related documents readily available.

Setting up alerts for renewal dates and policy changes can also help maintain your coverage. Utilize calendar reminders or task management apps to keep important dates in front of you. Organizing your records meticulously will not only promote clarity in your healthcare decisions but also provide peace of mind as you navigate the Medicare landscape.

Troubleshooting common issues with Medicare supplement policies

Enrollment in Medicare supplement policies is not without its challenges. Common issues may arise, such as difficulties in the enrollment process or disputes about coverage. It is helpful to keep detailed records of your correspondence with insurers, as this documentation can support your case if disputes occur.

If you need to update or switch policies, familiarity with the procedures involved in transferring coverage is beneficial. Generally, you will need to choose a new plan by going through the application process again. Understanding the terms and how they apply to existing coverage can save time and potential headaches down the line.

Key resources for further assistance

For further assistance with Medicare supplement policies, several key resources are available. Official Medicare websites offer a wealth of information, including plan comparisons and FAQs that can help clarify your options. Additionally, consider reaching out to local Medicare advisors who provide personalized assistance; they can guide you through the intricacies of choosing a supplement policy best suited for your needs.

Furthermore, pdfFiller provides support for document management issues, ensuring that users can navigate the process of filling out, editing, and managing their Medicare supplement policy checklist efficiently. Leverage these resources to bolster your understanding and management of your supplement policy needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute medicare supplement policy checklist online?

Can I create an electronic signature for the medicare supplement policy checklist in Chrome?

Can I edit medicare supplement policy checklist on an Android device?

What is medicare supplement policy checklist?

Who is required to file medicare supplement policy checklist?

How to fill out medicare supplement policy checklist?

What is the purpose of medicare supplement policy checklist?

What information must be reported on medicare supplement policy checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.