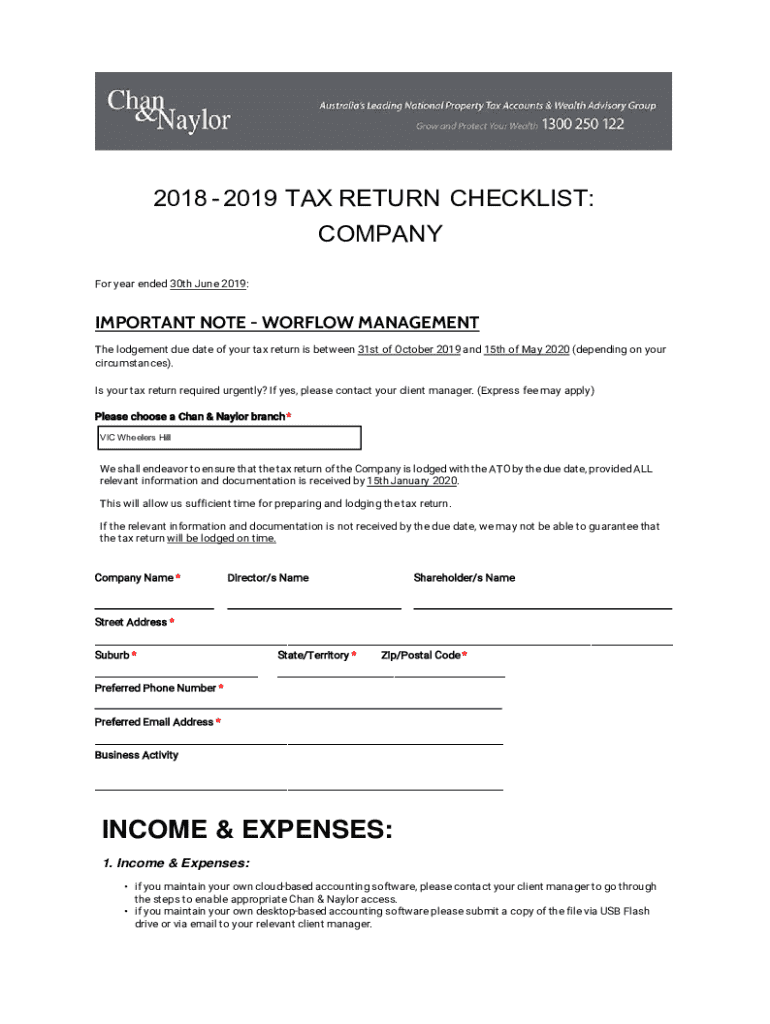

Get the free 2018 - 2019 Tax Return Checklist

Get, Create, Make and Sign 2018 - 2019 tax

How to edit 2018 - 2019 tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2018 - 2019 tax

How to fill out 2018 - 2019 tax

Who needs 2018 - 2019 tax?

Understanding the 2018 - 2019 Tax Form: A Comprehensive Guide

Overview of the 2018 - 2019 tax form

The 2018 - 2019 tax form is crucial for individuals and businesses navigating the complexities of their tax obligations during these years. Understanding its purpose ensures that you comply with federal regulations while maximizing your deductions and credits. With tax regulations frequently changing, being informed about the specifics of the tax form for these years helps minimize errors and potential audits.

Significant changes from the Tax Cuts and Jobs Act were introduced in 2018, impacting deductions, credits, and tax rates. The most notable differences for the 2019 tax year included adjustments to standard deductions and modifications in tax brackets that could substantially alter tax liability.

Accessing your 2018 - 2019 tax form

Finding the right tax form is a simple process when you know where to look. The official IRS website provides downloadable PDFs of all necessary forms, including the 1040 series for both 2018 and 2019. Additionally, many tax preparation software solutions, such as those found on pdfFiller, offer seamless access to these documents.

Printable versions are available for those who prefer completing their forms manually. However, digital forms on platforms like pdfFiller provide a more convenient option, allowing edits, signature capture, and easier collaboration on shared forms.

Step-by-step instructions for completing the 2018 - 2019 tax form

Completing your 2018 - 2019 tax form requires thorough preparation and organization. Start by gathering all necessary information and documentation to ensure a smooth filing process.

Gathering necessary information and documents

Essential documents include W-2 forms from all employers, 1099 forms for contractors, and any other income statements. You will also need personal identification information such as your Social Security number, filing status, and bank account details for potential refunds.

Completing the basic information section

Filling out the personal information section requires accuracy. You'll need to enter your name, address, Social Security number, and filing status correctly. Be mindful of common mistakes, such as incorrect Social Security numbers or mismatched names that can lead to delays or issues with your tax return.

Entering income and adjustments

Each income section must reflect all earnings accurately. Separate sections exist for wages, interests, and any additional sources of income. For the best results, utilize pdfFiller’s tools to input and calculate entries, ensuring that deductions chosen are relevant for the 2018 - 2019 tax years, as regulations changed significantly.

Reviewing tax calculations

Tax brackets for 2018 and 2019 differed in significant ways, so it's important to be familiar with these in order to verify your calculations. pdfFiller’s automated tools can help you with this process. Ensure your taxable income is accurate, as this directly affects any refund or balance due.

Filing your 2018 - 2019 tax form

Once your 2018 - 2019 tax form is complete, it’s time to file. You have various options for submission: traditional paper filing or e-filing. Each has its pros and cons, making it crucial to choose the method that suits your needs.

Options for filing

E-filing is often faster, providing immediate confirmation of submission, while paper filing may take longer to process and confirm receipt. Using pdfFiller for e-filing streamlines the process, granting you easy access to professional-grade filing capabilities.

Deadlines and important dates

Different deadlines apply for the 2018 and 2019 tax years, so knowing these can prevent unwanted penalties. The due date generally falls on April 15, unless that date falls on a weekend or holiday. Familiarize yourself with your obligations to avoid late fees.

What to do if you miss the filing deadline

If you find yourself in a position where you missed the tax filing deadline, it's crucial to act quickly. Filing late can incur additional penalties, so consider using pdfFiller to manage your late filings efficiently. Assess the reasons for the delay and remedy any documentation needed.

Frequently asked questions about the 2018 - 2019 tax form

As you navigate your 2018 - 2019 tax form, you may encounter questions regarding specific regulations or procedures. Let’s address some of the most common concerns.

Common concerns and clarifications

The changes from previous tax years might be puzzling at times, especially regarding deductions and how to report them. Understanding these changes is essential to optimizing your return and preventing any mistakes, particularly errors involving deductions or credits, which may trigger audits.

Special circumstances

Certain taxpayer scenarios require special consideration, such as filing for dependents or managing forms as self-employed individuals. Understanding the nuances of these categories can greatly affect your individual tax liability, so insightful preparation and consultation are key.

Advanced features of pdfFiller for tax form management

pdfFiller stands out in the realm of document management, especially for tax forms. It equips users with robust features that simplify the form-filling experience.

Editing and customizing your 2018 - 2019 tax form

With pdfFiller, you can easily edit and customize your 2018 - 2019 tax forms. This flexibility is invaluable when making last-minute changes before filing. User-friendly tools allow for smooth alterations without the stress of complex software.

Digital signing options and security features

Security remains paramount when managing sensitive tax information. pdfFiller provides integrated digital signing options that allow you to secure your documents effortlessly, ensuring that your signatures maintain authenticity and compliance with IRS standards.

Collaborating with a tax professional using pdfFiller's tools

If you’re working with a tax professional, pdfFiller simplifies collaboration. You can share documents, track changes, and make real-time edits together, creating a more streamlined and organized filing process.

Accessing additional support and resources

As you work through the 2018 - 2019 tax form process, having additional support is invaluable. pdfFiller provides resources and customer service options tailored to meet user needs.

Customer support options for pdfFiller users

Customer support can guide you through any questions you may have. pdfFiller offers multiple avenues, including live chat options and extensive online help documents that cover a breadth of tax-related issues.

Links to related forms and templates

For ease of navigation, pdfFiller provides links to a variety of related forms and templates to assist in your filing process. This user-friendly approach facilitates quick access to necessary documents.

Popular searches for easy navigation within pdfFiller

pdfFiller enhances user experience through popular search options, allowing you to quickly locate essential documents. This saves valuable time and promotes an efficient filing process.

User testimonials and case studies

Hearing from real users can offer valuable insight into how pdfFiller aids in tax filing and management. User experiences highlight the versatility and efficiency of pdfFiller's tools.

Individuals report smoother submission processes, emphasizing ease of use and accessibility to necessary forms. Businesses benefit from collaborative features that facilitate teamwork in tax preparation.

Connect with pdfFiller

For individuals and teams looking to stay ahead in their tax filing, connecting with pdfFiller ensures access to updates, resources, and community engagement. Regular newsletters and informative webinars are an excellent way to stay informed about tax form shifts.

Joining community discussions can provide further learning opportunities and networking experiences with others navigating similar tax situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2018 - 2019 tax?

How do I execute 2018 - 2019 tax online?

Can I create an electronic signature for signing my 2018 - 2019 tax in Gmail?

What is tax?

Who is required to file tax?

How to fill out tax?

What is the purpose of tax?

What information must be reported on tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.