Get the free Independent Foreign Tax Conversion Form

Get, Create, Make and Sign independent foreign tax conversion

Editing independent foreign tax conversion online

Uncompromising security for your PDF editing and eSignature needs

How to fill out independent foreign tax conversion

How to fill out independent foreign tax conversion

Who needs independent foreign tax conversion?

Independent Foreign Tax Conversion Form: A Comprehensive How-To Guide

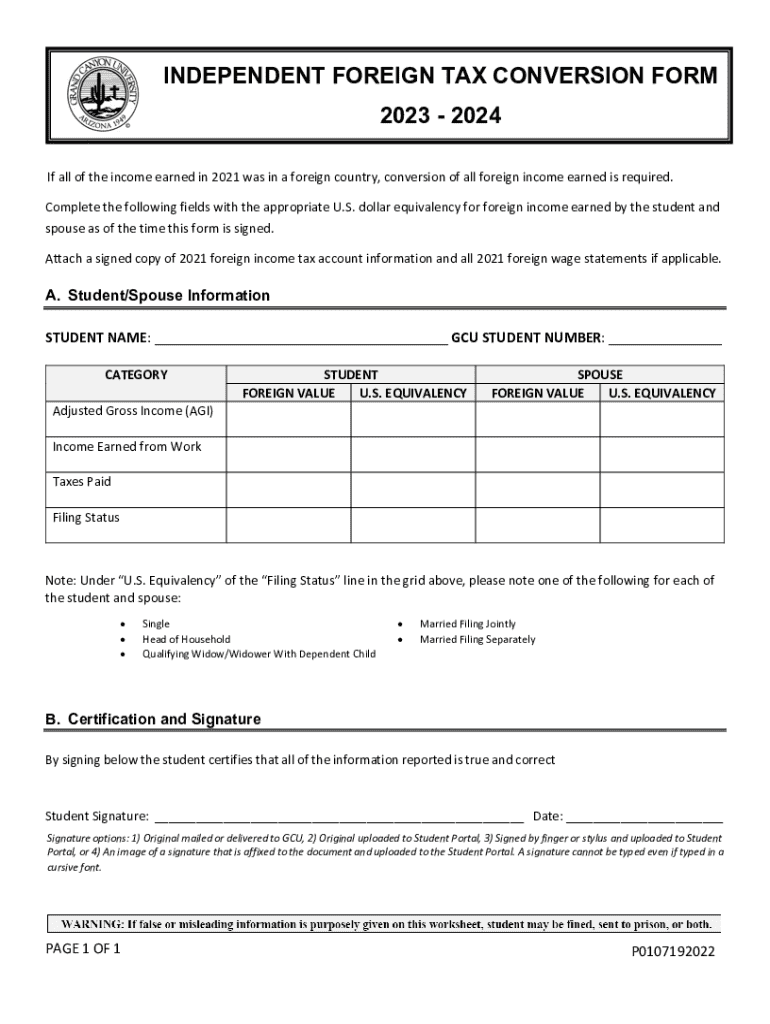

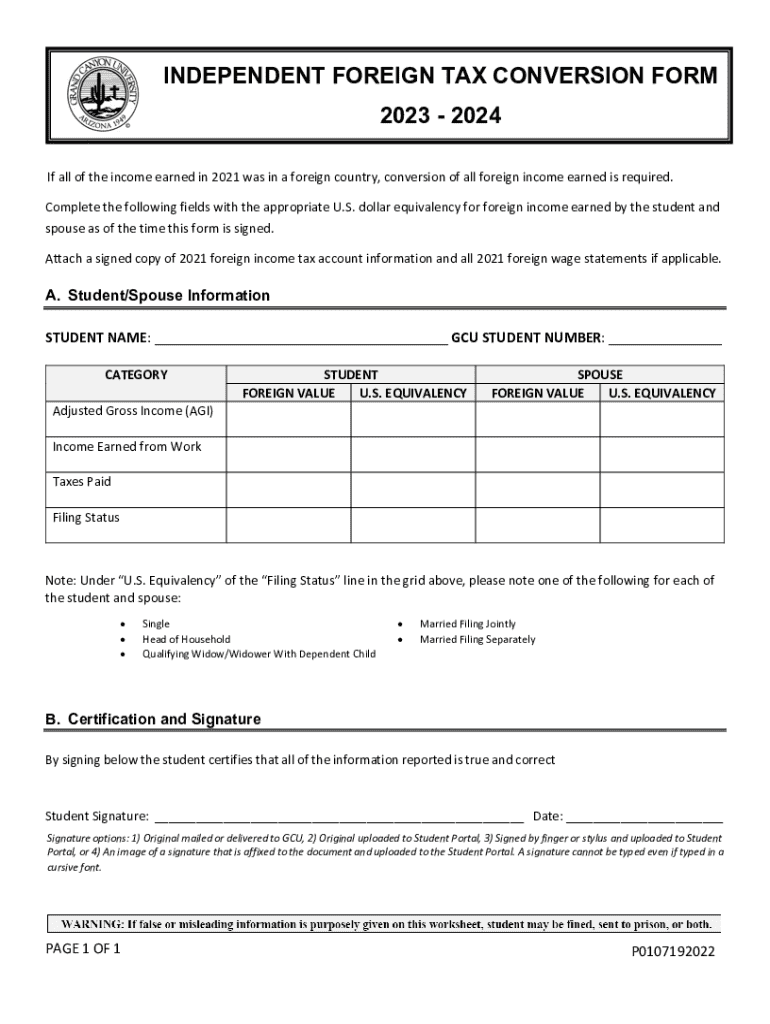

Understanding the independent foreign tax conversion form

The Independent Foreign Tax Conversion Form serves as a vital document for individuals and businesses managing taxes associated with foreign investments. It essentially helps filers to report foreign tax credit claims and convert foreign currency values accurately into the local currency. This form is crucial for ensuring compliance with tax laws and maximizing tax benefits derived from overseas investments.

Understanding the nuances of foreign tax credit applications is essential for optimizing your tax situation, particularly for expatriates or businesses with international dealings. It minimizes the risk of double taxation, providing a credit for taxes paid to foreign governments.

Eligibility criteria for filing

Individuals with foreign income or businesses engaging in international transactions must leverage the Independent Foreign Tax Conversion Form. For instance, expatriates, who often have complex financial situations due to cross-border income, can benefit significantly from this form. Similarly, multinational corporations that operate in multiple jurisdictions must file this form to ensure they are complying with varying local tax regulations.

Common scenarios requiring the form include expatriates who have income sourced from foreign territories, as well as enterprises engaged in cross-border trade. This form effectively helps in outlining earned income and tax paid overseas, guiding users in correctly reporting their finances.

Preparing to fill out the form

Preparation is key to filing the Independent Foreign Tax Conversion Form accurately. Begin by gathering all necessary documentation required for completion. This includes past tax returns, evidence of foreign income, W-2 forms from any foreign employers, and documentation of foreign taxes paid. If these documents are missing, it can significantly delay the filing process.

Organizing your data efficiently can ease the process of filling out this form. Consider creating a checklist to track all required documents and ensure you have the correct figures, particularly for foreign income and taxes paid.

Step-by-step guide to completing the form

When filling out the Independent Foreign Tax Conversion Form, it’s important to tackle it section by section. Start with personal information, ensuring all details are accurate. Next, report your income specifics, including salaries, dividends, and interest earned from foreign sources. Once the income is accurately recorded, delve into foreign tax details, documenting all taxes paid to foreign jurisdictions.

It's also crucial to perform conversion calculations accurately. Many individuals find this part challenging, but tools like pdfFiller can significantly mitigate errors. The platform features built-in calculators and editing tools that streamline this process, allowing you to input data seamlessly and check it against current exchange rates.

Common mistakes to avoid

When completing the Independent Foreign Tax Conversion Form, it's easy to make errors that can lead to significant issues later. Misreporting income is a common mistake that can trigger audits or penalties, so maintain accurate records and double-check numbers before submission. Additionally, mistakes in calculating foreign tax credits can affect your overall tax burden and financial standing.

To minimize mistakes, utilize pdfFiller's collaborative features. Engage with team members or tax professionals during the review process, ensuring every detail is meticulously checked. This practice can prevent common pitfalls and help ensure all information is reported accurately.

Managing the form after submission

Once the Independent Foreign Tax Conversion Form is submitted, it’s crucial to understand what happens next. Typically, processing can take several weeks depending on the jurisdiction. You may find tracking your submission beneficial; keeping a record of your submission confirmation will help you follow up if necessary.

Record-keeping remains a vital aspect of successful tax management. Best practices involve storing copies of the completed form and associated documentation securely in pdfFiller. This ensures you have everything you need for future reference or audits, cultivating peace of mind regarding your filings.

Frequently asked questions (FAQs)

Filing the Independent Foreign Tax Conversion Form comes with a set of common inquiries. One frequent question is what to do if a mistake occurs post-submission. In such cases, it's typically possible to amend your form through the appropriate channels. Understanding these processes can help alleviate concerns about errors.

Another common concern relates to penalties for late filing. Each jurisdiction may have different rules, so it's essential to stay informed about local deadlines and requirements to avoid incurring fines.

Utilizing pdfFiller for document management

pdfFiller serves as an invaluable resource for managing the Independent Foreign Tax Conversion Form efficiently. The platform's features simplify the process of filling, signing, and managing tax-related documents from anywhere. Its intuitive interface allows users to collaborate, ensuring accuracy and compliance while saving significant time.

User testimonials reflect the real-world applications of pdfFiller, showcasing how individuals and teams have streamlined their tax filing processes through this platform. From accountants to expatriates, the satisfaction with pdfFiller underscores its pivotal role in navigating complex tax environments.

Conclusion: empowering your tax filing experience

Navigating the Independent Foreign Tax Conversion Form doesn’t have to be daunting. With the right resources, particularly pdfFiller's digital capabilities, you can enhance the accuracy and efficiency of your tax filings. From easy edits to collaborative efforts, pdfFiller truly empowers users to manage their tax obligations seamlessly.

By leveraging technology, you not only maximize your potential tax credits but also align with compliance requirements, ultimately achieving peace of mind. Embracing platforms like pdfFiller positions you to tackle your tax challenges head-on, ensuring that every detail is attended to with precision.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in independent foreign tax conversion without leaving Chrome?

Can I edit independent foreign tax conversion on an Android device?

How do I complete independent foreign tax conversion on an Android device?

What is independent foreign tax conversion?

Who is required to file independent foreign tax conversion?

How to fill out independent foreign tax conversion?

What is the purpose of independent foreign tax conversion?

What information must be reported on independent foreign tax conversion?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.