Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out 2025 individual income tax

Who needs 2025 individual income tax?

Your Complete Guide to the 2025 Individual Income Tax Form

Understanding the 2025 Individual Income Tax Form

The 2025 individual income tax form is essential for taxpayers, reflecting changes that could impact your tax situation significantly. Notably, the 2025 tax year introduces several updates in deductions, credits, and income limits that taxpayers must navigate to ensure compliance.

Accurate tax filing is crucial as the IRS monitors returns closely. Inaccuracies can lead to delays, penalties, or audits. Familiarizing yourself with the changes for the 2025 tax year is not only wise but necessary to optimize your tax strategy.

How to access the 2025 Individual Income Tax Form

Accessing the 2025 individual income tax form has never been easier, especially with digital platforms like pdfFiller. By following simple steps, you can locate and retrieve the necessary forms without hassle.

To access the form on pdfFiller, navigate to the appropriate section and search for '2025 Individual Income Tax Form.' You can utilize filters that optimize your search based on form types and years.

Step-by-step guide to filling out the 2025 Individual Income Tax Form

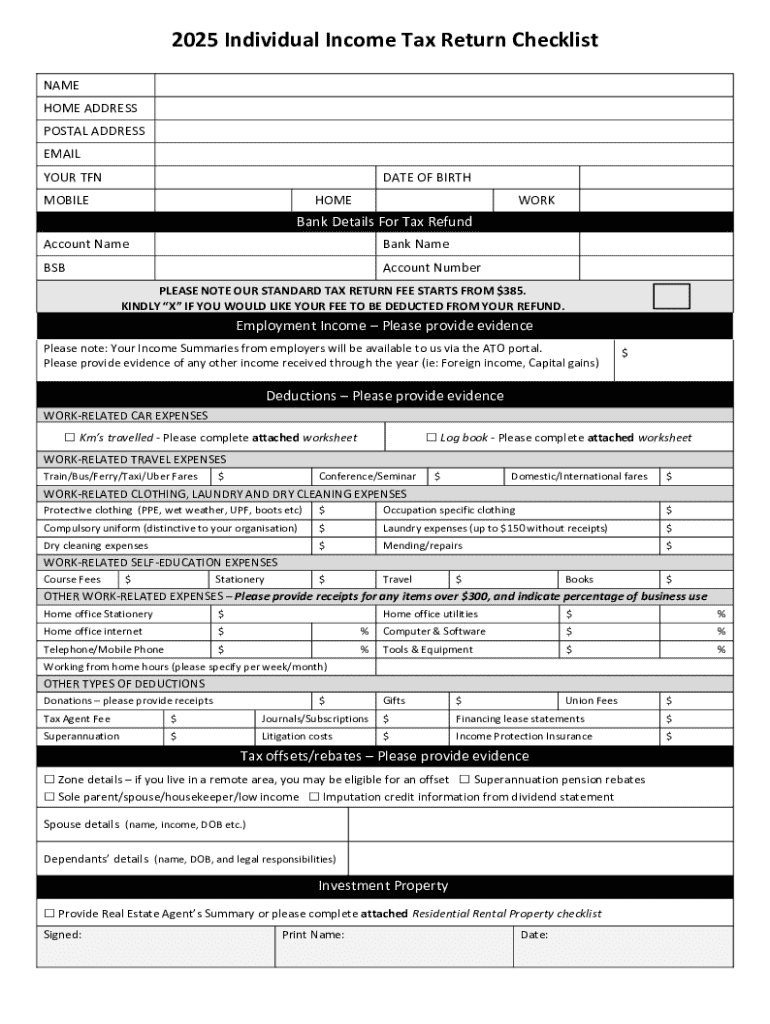

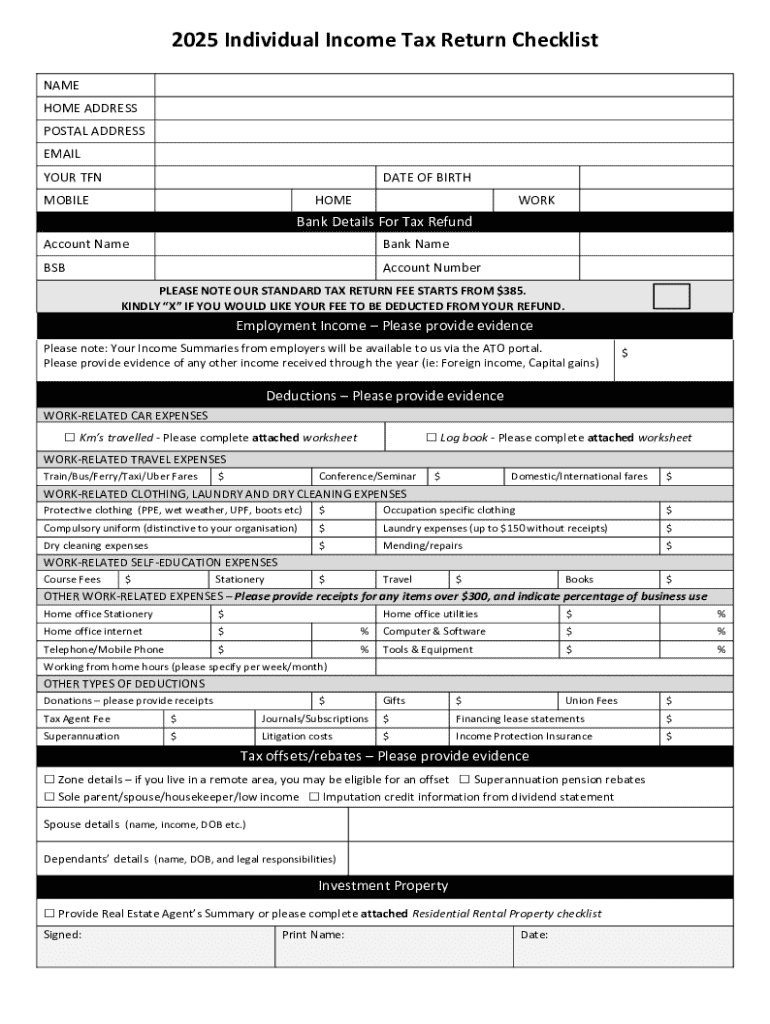

Filling out the 2025 individual income tax form requires careful attention to detail. Let's break down each section to ensure you provide the required information accurately.

Section-by-Section Breakdown

Begin with personal information, ensuring that all names, addresses, and Social Security numbers are entered correctly. Following this, report all sources of income, including wages, dividends, and side hustles.

When it comes to deductions and credits, you must choose between standard and itemized deductions. The IRS specifies limits annually, which can significantly affect your taxable income. Familiarize yourself with common credits available for 2025, as they can lower your tax liability.

To calculate your tax, refer to the tax rates and slabs applicable for the assessment year 2025-26. Utilizing an online calculator can simplify this process and ensure accuracy.

Avoid common mistakes such as calculation errors or incorrect filing status. Review your form meticulously before submission.

Editing and signing your completed form

Once you've filled out the 2025 individual income tax form, it may be necessary to make edits. pdfFiller offers powerful editing tools to modify your document efficiently.

Highlight important sections, add comments, or modify entries directly within the platform, ensuring your document remains up-to-date.

eSigning your completed form is straightforward. pdfFiller allows for secure electronic signatures, which hold legal validity in many jurisdictions. Simply follow the designated steps to sign your form electronically.

Submitting your 2025 Individual Income Tax Form

With your form completed and signed, it's time for submission. You have multiple submission methods to choose from when filing the 2025 individual income tax form.

E-filing is generally faster and often results in quicker processing times, while mailing your form allows for traditional filing methods. Choose the method that suits your preferences, but e-filing through pdfFiller can streamline the process.

After submission, tracking your submission status is critical. This can be done through the IRS website or via updates from pdfFiller. If you face any issues, handling them promptly will ease potential complications.

Managing your tax documents post-filing

Once you complete the filing process, managing your tax documents becomes essential. pdfFiller provides a user-friendly interface for storing your completed tax forms securely.

Organizing your tax documents ensures that you can reference them quickly in the future. Create well-labeled folders and use pdfFiller’s search functionality to make your filing effective.

Secure document management is paramount, especially when dealing with sensitive information. Regularly back up your documents and keep track of all submissions.

Frequently asked questions (FAQs) about the 2025 Individual Income Tax Form

As tax season approaches, many individuals have questions about the 2025 individual income tax form. Here are some common inquiries that may help you navigate the process.

Resources for assistance and further information

Navigating the 2025 individual income tax form can be complex, but various resources can provide assistance. pdfFiller offers online tools and calculators designed to simplify the process.

Additionally, consider reaching out to tax support services for personalized consultation, ensuring you’re making the most of your filing.

Conclusion

Efficient tax management is vital, especially during the filing season. By utilizing resources like pdfFiller, you can navigate the 2025 individual income tax form confidently. Make use of the tools available to enhance your filing experience and minimize stress.

Remember, staying informed about tax regulations and taking advantage of online solutions can make a significant difference in managing your taxes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pdffiller form directly from Gmail?

How do I execute pdffiller form online?

How do I complete pdffiller form on an iOS device?

What is individual income tax?

Who is required to file individual income tax?

How to fill out individual income tax?

What is the purpose of individual income tax?

What information must be reported on individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.