Get the free Irs990schedulea

Get, Create, Make and Sign irs990schedulea

Editing irs990schedulea online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs990schedulea

How to fill out irs990schedulea

Who needs irs990schedulea?

IRS 990 Schedule A Form: A Comprehensive How-to Guide

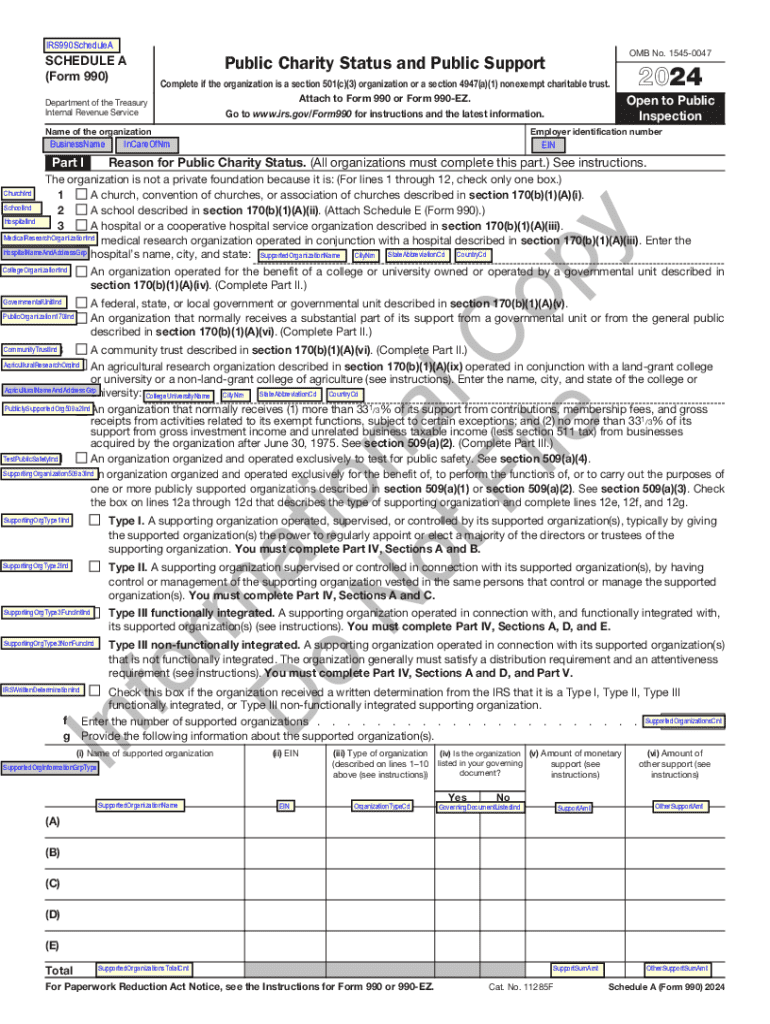

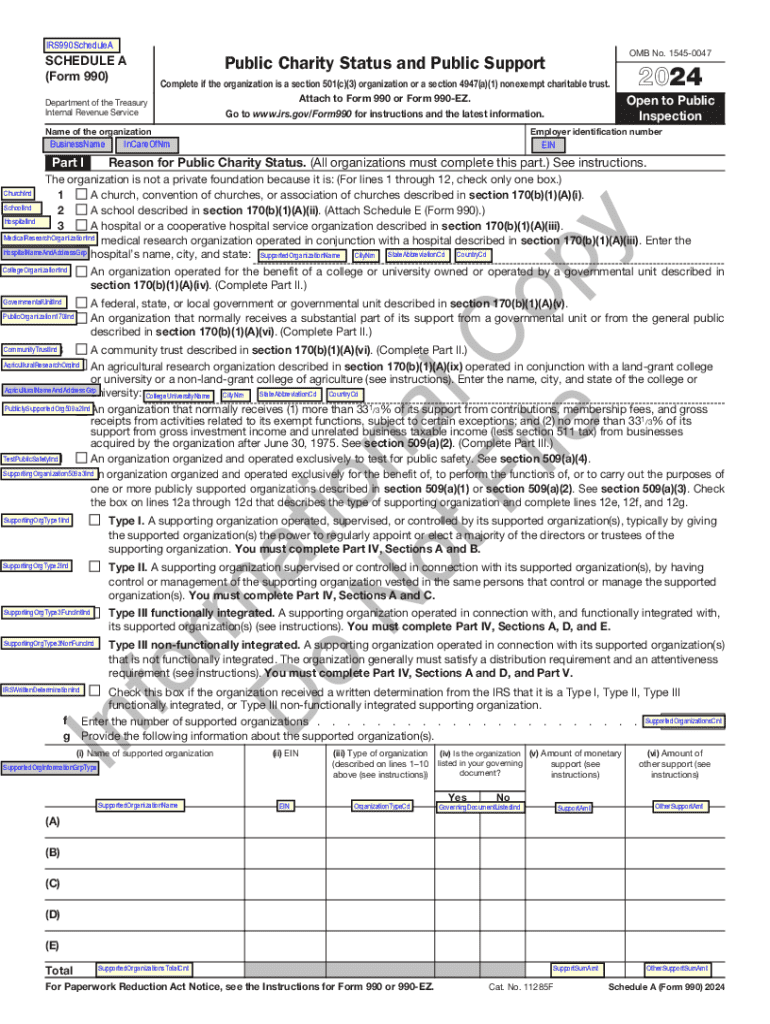

Understanding IRS Form 990 Schedule A

IRS Form 990 Schedule A serves as a vital component for public charities in the United States, allowing these organizations to maintain their tax-exempt status. This form provides the IRS with detailed information regarding the organization's public support, which is critical for determining whether an organization qualifies as a public charity rather than a private foundation.

The importance of Schedule A cannot be overstated, as many donors are specifically looking for public charities that meet the public support test. This test essentially assesses how much of the organization’s funding comes from the general public versus private sources, reinforcing transparency and accountability within the nonprofit sector.

Who needs to file Form 990 Schedule A?

Various types of organizations need to file IRS Form 990 Schedule A, particularly those that qualify as public charities under IRS regulations. This includes organizations that generally receive most of their financial support from the public or government sources. Nonprofits categorized under Sections 509(a)(1) and 509(a)(2) must adhere to filing requirements unless they meet specific exemption criteria.

Understanding the filing thresholds is crucial. For example, organizations with gross receipts under $200,000 and total assets less than $500,000 may qualify for a simplified version of Form 990, but they still need to submit Schedule A.

Key components of IRS Form 990 Schedule A

IRS Form 990 Schedule A comprises multiple sections detailing various aspects of a nonprofit's financial activities. Part I covers a justification for public charity status, while Parts II and III engage in support schedules that track income from contributions and activities. These sections help the IRS ascertain the level of public support received.

Moreover, Parts IV and V focus on supporting organizations, distinguishing between Type I and Type III supporting entities, which can significantly affect the determination of public support status. Finally, Part VI requires supplemental information, emphasizing full disclosure and transparency.

The filing process for Form 990 Schedule A

Filing IRS Form 990 Schedule A requires adherence to specific deadlines, which are generally aligned with the tax-exempt organization's fiscal year. Typically, forms are due on the 15th day of the 5th month following the end of the fiscal year. Organizations needing additional time can file for a six-month extension, but late fees and penalties can accumulate if the filing deadline is missed.

When preparing for filing, it’s essential to determine the appropriate accounting method—either cash or accrual basis. The chosen method can significantly affect how public support is reported, especially in terms of recognizing contributions and expenses.

Step-by-step instructions for completing Schedule A

To accurately fill out Schedule A, begin with Part I, which inquires about the reason your organization qualifies as a public charity. You'll need to provide detailed information such as how the organization raises funds and the types of public support it relies on.

Subsequently, move on to Part II, which requires you to document the different types of support your organization has received. It’s crucial to categorize support correctly and maintain thorough documentation as proof of contributions. Part III is dedicated to Section 509(a)(2) organizations, requiring precise reporting of income and contributions that meet the public support test's thresholds.

Common challenges and how to overcome them

Many nonprofits struggle with comprehending the public support test, which assesses whether they fulfill the necessary conditions to remain classified as public charities. Understanding what constitutes public support is paramount; this includes donations from the general public, government grants, and contributions from organizations that vary in nature. Organizations can often avoid confusion by maintaining comprehensive records of all income sources.

Another common pitfall arises from miscalculations in the support schedules. Failing to accurately report all sources of income or incorrectly categorizing support can lead to complications with the IRS. Implementing practices like double-checking figures, consulting with financial professionals, and using software solutions can help mitigate these issues.

Resources for accurate filing

Utilizing the right tools can significantly enhance the filing process for IRS Form 990 Schedule A. Platforms like pdfFiller offer a suite of interactive tools for form management, enabling users to edit PDFs, eSign, and collaborate directly within a secure cloud-based environment. These tools not only streamline the process but also enhance document management, making it easier to track submissions.

Additionally, the IRS provides extensive documentation and FAQs to clarify uncertainties surrounding tax regulations. Community forums and support networks can also offer valuable insights into specific challenges faced by nonprofits, nurturing a sense of cooperative problem-solving.

Best practices for nonprofit compliance

Adhering to best practices is instrumental in ensuring compliance with IRS guidelines. A frequently asked question among nonprofits involves their legal obligations concerning financial reporting and how to maintain their public charity status. Familiarizing oneself with federal and state regulations is crucial, as is actively engaging with tax professionals when uncertainties arise.

Equally important is maintaining document retention policies. Organizations should develop a structured approach to retain financial records, including tax filings, donations, and correspondence for at least three to seven years, as these documents are vital during audits and other compliance checks.

Support and additional help

Nonprofits can greatly benefit from consulting with tax professionals to avoid pitfalls associated with filing IRS Form 990 Schedule A. Recognizing when to seek expert advice—whether for complex issues or simple inquiries—can save organizations time and money while ensuring compliance.

Additionally, leveraging the knowledge base offered by platforms like pdfFiller provides a treasure trove of resources. With access to comprehensive guides, video tutorials, and current updates on IRS guidelines, organizations can stay informed and better equipped to navigate their filing requirements.

Interactive sections and tools

To streamline the completion of IRS Form 990 Schedule A, pdfFiller provides several interactive tools designed to enhance user experience. An interactive step-by-step filing tool guides users through each section, ensuring that all necessary details are accurately captured. This directed approach can minimize confusion and errors during form completion.

Moreover, the eSignature process allows organizations to quickly sign and submit their form securely. Users can leverage pdfFiller's features to export pre-filled forms, allowing for easier management and tracking of submissions, significantly reducing administrative burdens for nonprofits.

Understanding the context: Why filing matters

Accurate reporting through IRS Form 990 Schedule A significantly impacts the sustainability and credibility of nonprofit organizations. Incorrect filings can lead to reputational damage, tax liabilities, and loss of tax-exempt status. Thus, maintaining precision is essential not only for compliance but for fostering trust among donors and stakeholders.

Moreover, Form 990 Schedule A integrates into broader financial strategies, helping organizations assess and communicate their financial health to stakeholders. Organizations that fulfill the public support test strengthen their position in attracting contributions, ensuring their capacity to pursue their missions effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irs990schedulea without leaving Google Drive?

How do I edit irs990schedulea in Chrome?

How do I edit irs990schedulea on an Android device?

What is irs990schedulea?

Who is required to file irs990schedulea?

How to fill out irs990schedulea?

What is the purpose of irs990schedulea?

What information must be reported on irs990schedulea?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.