Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

How to Fill Out Form 990

Understanding Form 990

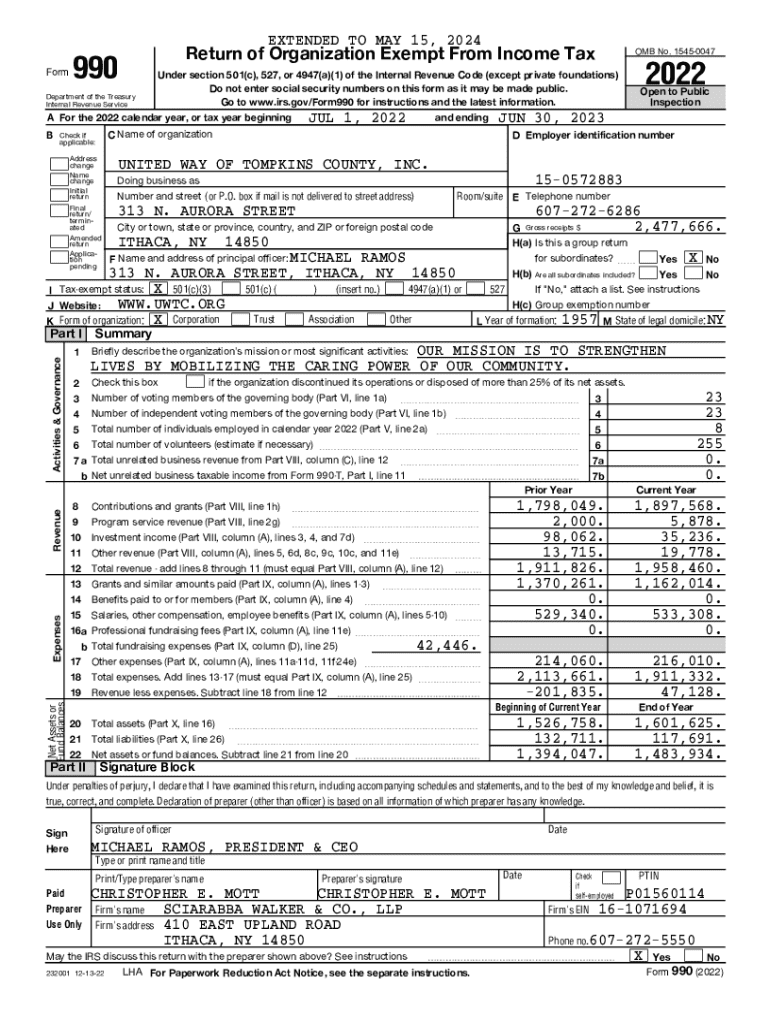

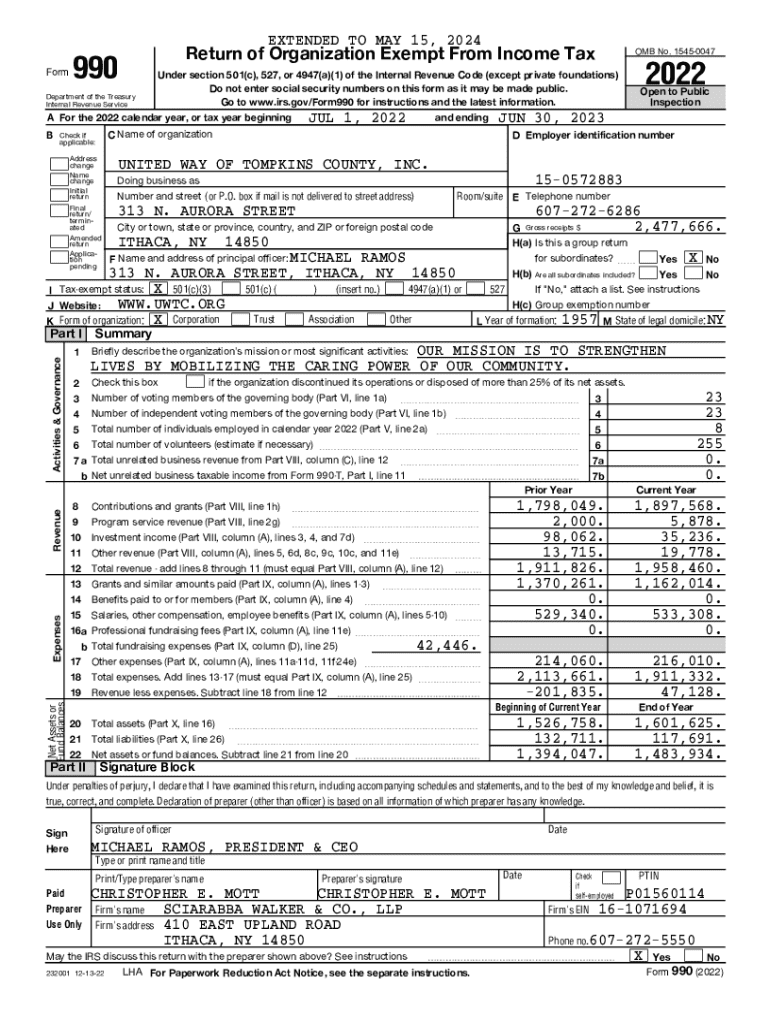

Form 990 is a crucial document that nonprofit organizations in the United States must file annually with the Internal Revenue Service (IRS). Its primary purpose is to provide detailed financial information, ensuring accountability and transparency in the nonprofit sector. This form is often referred to as the ‘return of organizations exempt from income tax' and plays a key role in maintaining public trust in charities.

Types of Form 990

There are three primary variations of Form 990: Form 990, Form 990-EZ, and Form 990-N (e-Postcard). Each version caters to different types of organizations based on their financial activities and revenue thresholds. Understanding which form to use is critical for compliance.

Key components of Form 990

Form 990 is organized into multiple sections, each serving a distinct purpose. Understanding these sections is essential for accurate reporting. Part I begins with a summary of the organization’s revenue, expenses, and assets, presenting an overview of financial health. Part II details the organization’s program accomplishments, highlighting its impact on the community.

Subsequent sections further elaborate on revenue sources in Part III, outline expenses in Part IV, and present a balance sheet in Part V. Each part is interrelated, presenting a holistic view of the organization’s financial status.

Understanding schedules

In addition to the standard sections, Form 990 includes various schedules tailored to report specific information. For instance, Schedule A provides insights into the organization's public charity status, while Schedule B records significant donors. Understanding when these additional schedules are required is imperative for compliance.

Filing requirements and deadlines

Understanding who must file Form 990 is vital for compliance. Most tax-exempt organizations classified under 501(c)(3) must submit Form 990 annually. Other entities such as 501(c)(4), 501(c)(6), and others may also have filing obligations depending on their structure and activities.

Filing deadlines are set for the 15th day of the 5th month after the end of the organization’s accounting period. Organizations can request an extension, typically granting an additional six months for submission, but the extension must be filed before the original due date.

The filing process

Filling out Form 990 can seem daunting, but breaking it into manageable steps simplifies the process. Begin with preparation; gather financial records, program details, and board meeting minutes. Understanding your organization’s financial transactions over the past year is crucial for accurate reporting.

Once prepared, organizations can choose between e-filing and paper filing. E-filing is the preferred option as it minimizes errors and streamlines submission. Services like pdfFiller offer intuitive platforms to facilitate electronic filing, allowing users to fill out, edit, and sign forms easily.

How to use pdfFiller to complete Form 990

pdfFiller simplifies the Form 990 filing process with interactive tools designed for ease of use. Users can easily fill out the form online, making edits and adjustments as needed without any hassle. The platform supports collaborative efforts, allowing multiple users to work on the document simultaneously, ensuring that everyone involved can contribute effectively.

Additionally, the pdfFiller interface supports electronic signatures, which can speed up the approval process. With the convenience of cloud access, users can manage their documents from anywhere, making it easier to stay on top of filing deadlines.

Common pitfalls and tips

Organizations often encounter pitfalls when filing Form 990, which could lead to penalties or non-compliance. Common errors include overlooking specific financial reporting requirements, failing to report all revenue sources, and providing inaccurate donor information. Each of these mistakes can have serious implications, underscoring the importance of careful review before submission.

To avoid these issues, organizations should establish best practices for accuracy. This includes a thorough review process and consultation with accounting professionals. Using tools like pdfFiller can also provide a structured approach to filling out Form 990, helping eliminate common errors.

Penalties for non-compliance

Failing to file Form 990 or late submission can lead to significant penalties from the IRS. These penalties can escalate quickly, impacting the financial health of the organization. For example, organizations may face fines based on their gross receipts or be forced to forfeit their tax-exempt status if non-compliance is persistent.

Mitigating risks of non-compliance involves establishing a robust filing system. Organizations should set reminders well ahead of the deadline, utilize electronic filing tools, and ensure they allocate sufficient resources for the preparation of Form 990.

Public inspection and transparency

Form 990 plays a pivotal role in assuring public transparency, as it is accessible to anyone who wishes to view it, often via the IRS website or through various nonprofit databases. This public access allows donors and stakeholders to assess the operational efficiency and financial accountability of nonprofit organizations.

The importance of transparency cannot be overstated. Donor trust is primarily built on the transparency of financial reporting, and Form 990 serves as a critical tool in fostering that trust. Nonprofits can leverage the information in Form 990 to build credibility and attract more funding.

Navigating historical context and future changes

Over the years, Form 990 has undergone various changes to improve its effectiveness and relevance. Originally designed to capture basic financial data, it has evolved into a comprehensive overview of nonprofit operations. The current version promotes transparency and encourages organizations to disclose more detailed information about their activities, expenses, and governance.

Looking ahead, organizations should stay informed about anticipated changes to Form 990. The IRS periodically reviews the form and may introduce updated requirements to enhance compliance and transparency. Organizations must be proactive in adapting to these changes to maintain their standing and ensure compliance.

Resources for further learning

Organizations seeking additional support in filling out Form 990 can benefit from various third-party tools and resources. Notably, professional accounting services and consulting firms specialize in nonprofit compliance. Additionally, websites offering insights and templates can provide invaluable guidance.

Engaging with professional communities, both online and offline, can also prove beneficial. Nonprofit organizations can connect with experts and access peer resources, learning from others' experiences in navigating Form 990 filings.

Advanced considerations

Advanced users of Form 990 can leverage its data not only for compliance but also for research purposes. Researchers can analyze trends in nonprofit operations, understanding how organizations allocate resources and serve communities. This data is particularly valuable for assessing the impact of charitable efforts in specific regions.

Furthermore, understanding fiduciary responsibilities related to Form 990 is crucial for board members and nonprofit leaders. It is their duty to ensure accurate reporting and transparency, upholding the ethical standards of their organization while fostering accountability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 on a smartphone?

How do I edit form 990 on an iOS device?

How do I complete form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.