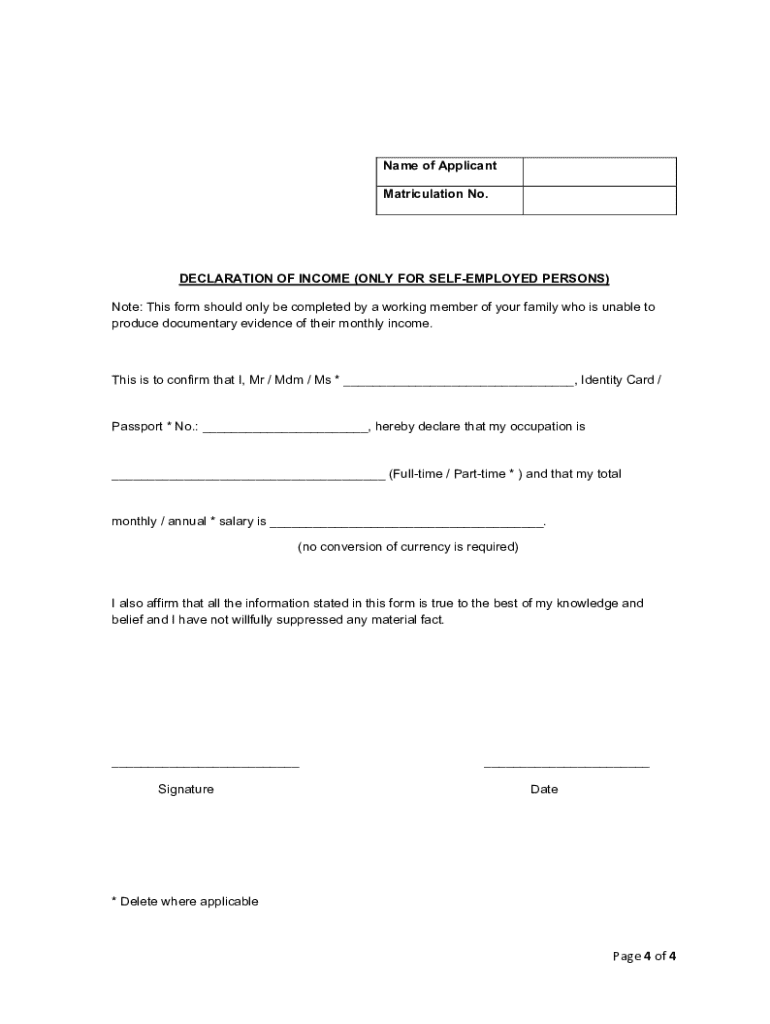

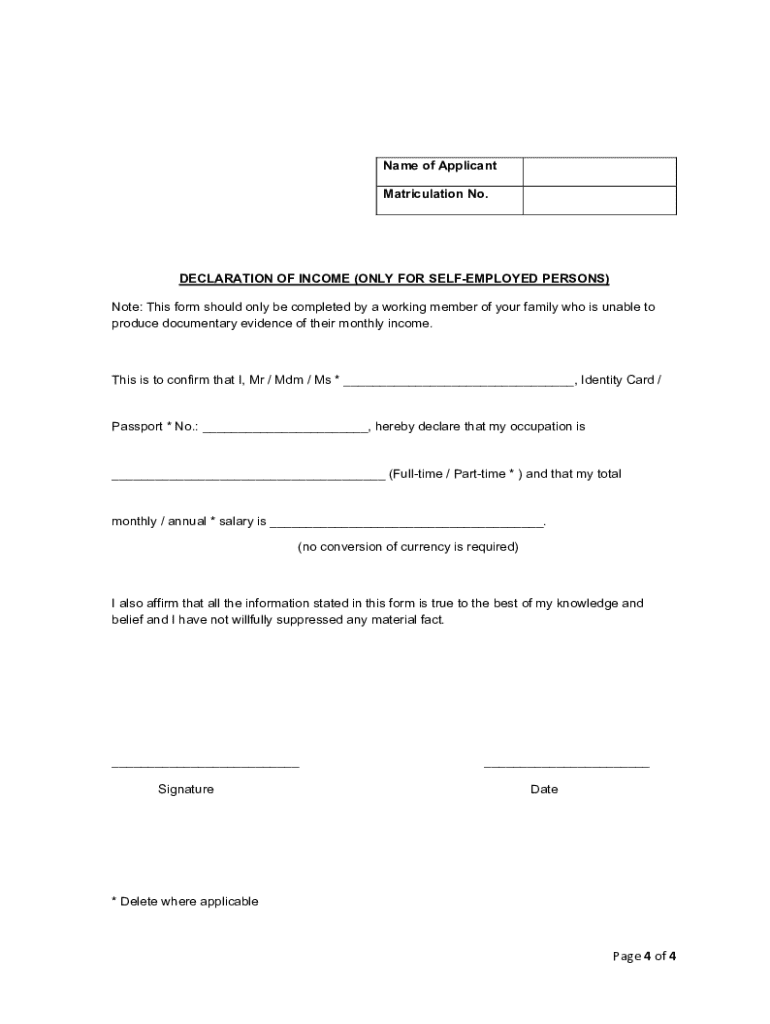

Get the free Declaration of Income

Get, Create, Make and Sign declaration of income

Editing declaration of income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out declaration of income

How to fill out declaration of income

Who needs declaration of income?

Declaration of Income Form - How-to Guide Long-Read

Understanding the declaration of income form

The declaration of income form is a crucial document that individuals and organizations use to report their income to government authorities or banks. This form serves as a transparent declaration of earnings, essential for tax assessments, loan applications, and various financial evaluations.

Completing this form accurately is vital for compliance with tax regulations and ensuring financial accountability. Users often encounter the declaration of income form in situations such as applying for a mortgage, seeking financial aid, or establishing eligibility for various benefits. Given its wide-ranging applications, being well-versed in its completion can streamline many financial processes.

Who needs to fill out the declaration of income form?

Various individuals and entities are required to complete the declaration of income form, depending on their employment status and the financial aid they seek. Understanding who needs this form is the first step toward accurate completion.

Preparing to complete the declaration of income form

Preparation is key when it comes to filling out the declaration of income form. Collecting the necessary documentation will ensure that you can provide an accurate and complete representation of your financial status.

Additionally, organizing your financial information ahead of time can facilitate a smoother completion process. Consider creating a checklist of documents to ensure nothing is overlooked.

Step-by-step guide to filling out the declaration of income form

Filling out the declaration of income form can initially seem daunting, but with a clear step-by-step approach, it can become manageable. Here’s how to proceed.

Editing and revising your declaration of income form

Mistakes can occur at any point in the document completion process. That's where pdfFiller’s editing tools come into play. They allow users to revise and correct entries effortlessly before the final submission.

Utilizing these features can significantly reduce the risk of errors, ensuring that your declaration of income form is not only accurate but also presented professionally.

Submitting the declaration of income form

Once you've completed the declaration of income form, the next step is submission. Depending on your circumstances, you can choose to submit the form either online or via mail.

Always ensure that you include all required documentation with your submission, as this can greatly impact processing time and eventual outcomes.

Tracking the status of your declaration

After submitting your declaration of income form, tracking its status is essential. Knowing what to expect during the processing phase can reduce anxiety and keep you informed.

Most platforms provide a way to monitor your submission and may offer estimated processing times. Be prepared to follow up if you don't receive feedback within the expected timeframe.

Common issues and solutions

As common as the declaration of income form is, some users encounter challenges. Being aware of these issues can help you navigate them more proficiently.

If further assistance is needed, don't hesitate to contact support through the resources available on pdfFiller.

Additional tips for successful document management

Effective document management extends beyond simply filling out the declaration of income form. Leveraging pdfFiller's capabilities can significantly enhance your experience.

In addition to these features, implementing best practices for digital document storage and security can protect your sensitive information while allowing easy access.

Government and regulatory information

It's essential to remain informed about the regulations surrounding the declaration of income form. These regulations can vary widely by jurisdiction.

For comprehensive details, consider accessing official governmental resources. Such information can provide insights into your rights and responsibilities when submitting the declaration of income form.

How to reach us for support

If you find yourself facing challenges while completing the declaration of income form on pdfFiller, reaching out for support is straightforward.

Participating in community forums can also be a fantastic way to gain insights from other users.

Footer navigation

As you navigate the declaration of income form and other related documents, pdfFiller provides a range of services to streamline your document management needs.

Explore additional related forms, templates, and solutions tailored to enhance your experience and ensure your compliance with financial documentation requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send declaration of income to be eSigned by others?

How do I fill out the declaration of income form on my smartphone?

How do I complete declaration of income on an Android device?

What is declaration of income?

Who is required to file declaration of income?

How to fill out declaration of income?

What is the purpose of declaration of income?

What information must be reported on declaration of income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.