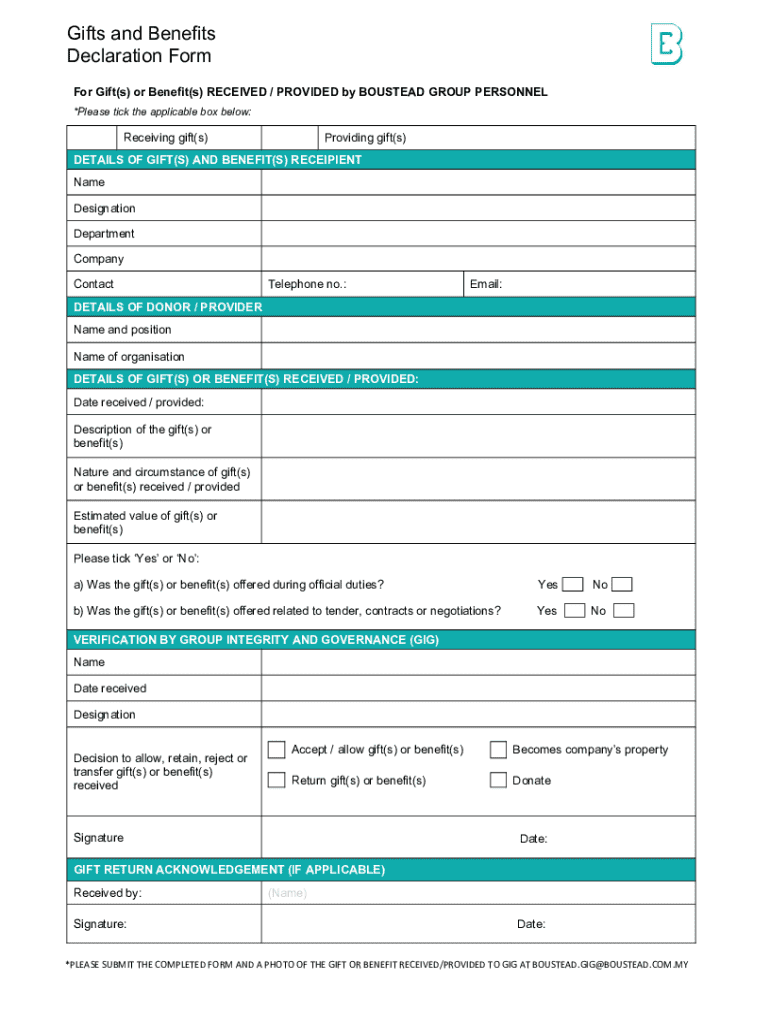

Get the free Gifts and Benefits Declaration Form

Get, Create, Make and Sign gifts and benefits declaration

Editing gifts and benefits declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gifts and benefits declaration

How to fill out gifts and benefits declaration

Who needs gifts and benefits declaration?

Gifts and Benefits Declaration Form: A Comprehensive Guide

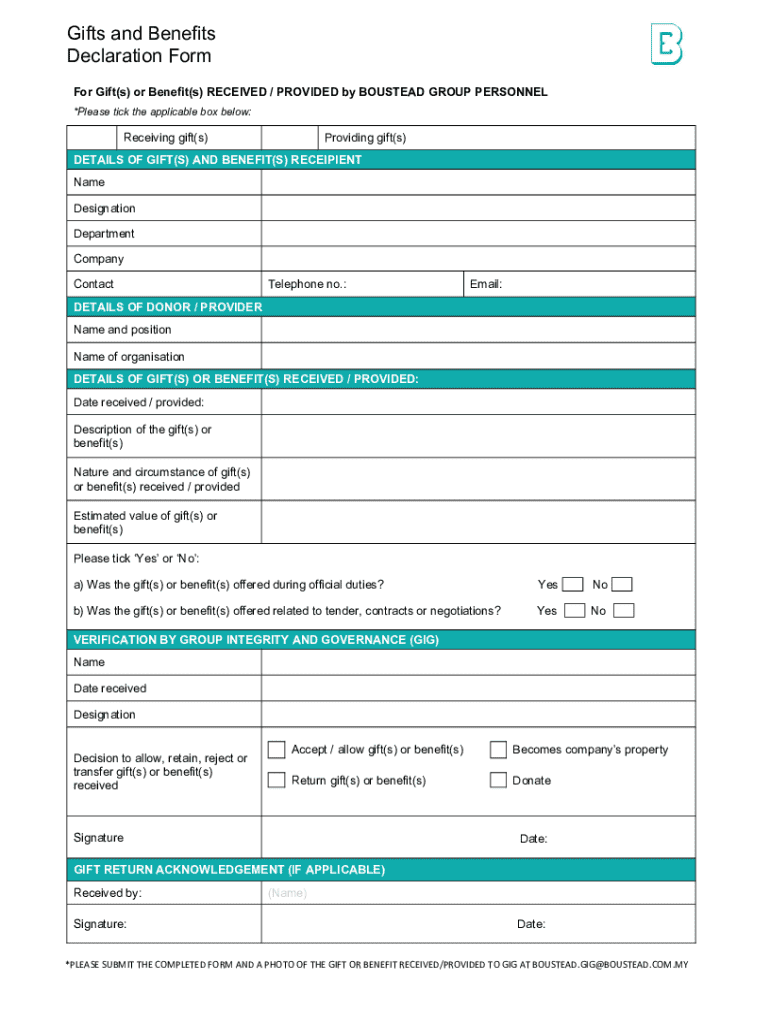

Understanding the Gifts and Benefits Declaration Form

The gifts and benefits declaration form serves as a crucial tool for individuals and organizations in documenting and managing gifts that may influence their professional decisions. It helps establish transparency and accountability in various settings, ensuring that any received gifts or benefits are reported accurately.

Declaring gifts and benefits is not only about maintaining compliance with organizational policies but also about upholding ethical standards. By reporting these items, professionals can avoid potential conflicts of interest and preserve the integrity of their work environment. Understanding both the form and its implications is the first step toward responsible management.

Who Needs to Complete the Form?

The gifts and benefits declaration form is required for a variety of individuals across different sectors. Public sector employees are often mandated to declare any gifts in order to prevent conflicts of interest, as their actions are directly funded by taxpayers. On the other hand, private sector professionals may have similar obligations depending on their organization's policies regarding gifts and benefits.

Moreover, teams within organizations that offer incentives or receive gifts from clients or suppliers must adopt a transparent approach. Employees in sales, marketing, and procurement, in particular, should regularly complete the form to maintain ethical standards and avoid any misrepresentation in their operations.

Common Situations Requiring Declaration

There are various scenarios where a gifts and benefits declaration form must be completed. For instance, any monetary gifts received by an employee must be promptly reported. Non-monetary gifts, such as complimentary meals, trips, or promotional items, also fall under the declaration requirement. These gifts can easily cause real or perceived conflicts, especially in environments where decisions may significantly affect financial outcomes.

It is also essential to declare benefits provided by suppliers or clients that could be considered preferential treatment. This includes discounts that are not available to the general public or exclusive learning opportunities that could bias the recipient's professional responsibility. Being cautious in these matters not only avoids negative repercussions but also fosters a respectful professional atmosphere.

Step-by-step guide to completing the gifts and benefits declaration form

Completing the gifts and benefits declaration form efficiently involves a few structured steps. The first step is to gather all necessary information. Ensure that you note down who received the gift, provide a brief description, and include the estimated value and date of receipt. Having this information ready will streamline the process significantly.

The second step is to access the appropriate declaration form. You can easily find the gifts and benefits declaration form through pdfFiller, where templates are available based on various organizational needs. Upon accessing the correct form, it’s essential to fill it out section by section to avoid missing any detail.

Tips for using pdfFiller’s editing tools include utilizing the drag-and-drop feature for easy text input and reviewing sections thoroughly before submission to prevent any errors.

Essential features of pdfFiller for managing your form

pdfFiller provides an array of features that streamline the management of the gifts and benefits declaration form. Firstly, the platform’s seamless editing capabilities let users modify text and fields effortlessly, ensuring information is always accurate and up to date. This makes it easier to comply with evolving organizational policies regarding gifts and benefits.

In addition to editing, pdfFiller offers eSigning functionalities, allowing individuals to add signatures electronically to their forms quickly. Collaboration is another key feature, as team members can share forms for cross-verification and validation, enhancing transparency. Finally, the cloud-based access ensures that the document is available when and where it is needed, providing flexibility in submission and review processes.

Common mistakes to avoid

When filling out the gifts and benefits declaration form, there are a few common mistakes you should strive to avoid. Incomplete declarations can occur when essential details are left out, leading to compliance issues and possible penalties. When in doubt, it is always best to err on the side of caution and include every relevant piece of information.

Another frequent error is failing to provide adequate descriptions of gifts received; vague details can cause confusion during the review process. Ignoring organizational guidelines is also problematic, as each organization might have specific protocols and stipulations regarding what must be declared and how. Make sure to review these guidelines before submission!

Frequently asked questions (FAQs)

In the context of the gifts and benefits declaration form, it's common to have questions about the process. For example, what should you do if you receive a gift after the declaration period? Typically, you should declare it in your next submission and include justification for the timing. Another frequent inquiry is about how often you need to submit a form; this can vary by organization. Many require declarations on an annual or quarterly basis.

Additionally, it's important to know if you can amend a submitted declaration. Most organizations allow amendments if you realize an error or find additional information regarding the gift after submission. Ensuring you familiarize yourself with these aspects makes the process more efficient.

Best practices for gift and benefit management

To ensure effective management of gifts and benefits, maintaining a clear record of received items is vital. This not only helps in preparing future declarations but also promotes self-awareness among employees about their interactions with clients and suppliers. Regularly reviewing the company's policies on gifts and benefits is equally important, as these guidelines can change and need to be understood fully.

Transparency in declaring received gifts is paramount, as it builds trust within teams and with stakeholders. Promoting an open dialogue about the implications of accepting gifts can foster a culture of integrity and responsibility within an organization. Making it a habit to discuss such matters not only enhances ethical business practices but also contributes positively to the overall work environment.

Leveraging pdfFiller to stay compliant

In addition to the features already mentioned, pdfFiller offers tools that help track submissions and their statuses. Users can monitor which forms have been submitted, approved, or are still pending, ensuring that nothing falls through the cracks. Setting reminders for upcoming declaration deadlines is also a feature that enhances compliance efforts, which mitigates the risk of non-declaration.

Utilizing pdfFiller not only simplifies the process of filling out the gifts and benefits declaration form but also assists with comprehensive tracking and management, all of which contribute to a compliant organizational framework. By integrating these functionalities, individuals and teams can navigate the complexities of gift and benefit declarations more effectively.

Conclusion on effective declaration practices

Understanding the gifts and benefits declaration form is essential for maintaining compliance and ethical practices in any organization. The importance of declaring received gifts cannot be overstated, as it establishes a baseline of trust and transparency among colleagues, clients, and stakeholders. By diligently following procedures and leveraging innovative tools like pdfFiller, individuals can simplify their reporting efforts, minimize mistakes, and focus on their work with confidence.

In conclusion, staying informed about company policies, avoiding common pitfalls, and making declarations a routine practice will not only support professional integrity but also enhance your organization's reputation. Commit to ethical conduct in managing gifts and benefits, recognizing that how you handle these situations speaks volumes about your professionalism.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gifts and benefits declaration without leaving Google Drive?

Can I edit gifts and benefits declaration on an Android device?

How do I complete gifts and benefits declaration on an Android device?

What is gifts and benefits declaration?

Who is required to file gifts and benefits declaration?

How to fill out gifts and benefits declaration?

What is the purpose of gifts and benefits declaration?

What information must be reported on gifts and benefits declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.