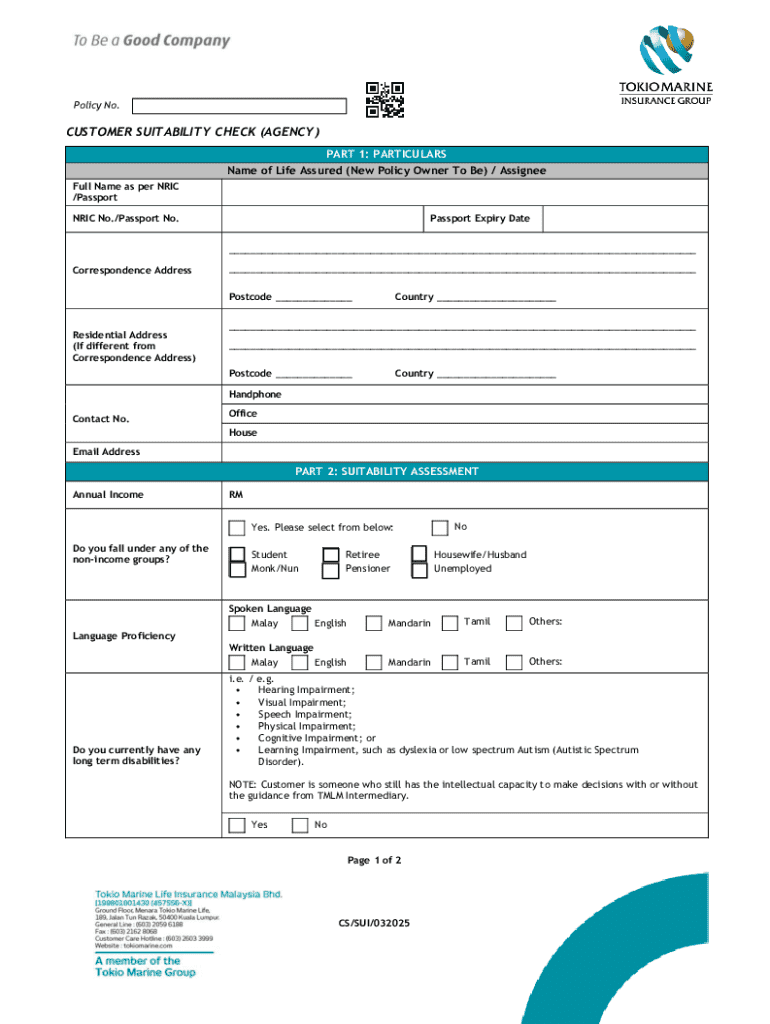

Get the free Customer Suitability Check (agency)

Get, Create, Make and Sign customer suitability check agency

How to edit customer suitability check agency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer suitability check agency

How to fill out customer suitability check agency

Who needs customer suitability check agency?

Customer Suitability Check Agency Form: How-to Guide

Understanding the customer suitability check agency form

The Customer Suitability Check is a critical assessment used to determine whether a specific financial product or service is appropriate for a customer's individual circumstances. This check plays a vital role in customer onboarding by ensuring that the services provided align with the client's goals, risk tolerance, and financial situation. By conducting this assessment, agencies can mitigate risks associated with customer investments, thus fostering responsible financial practices.

In many industries, particularly in finance and investment, understanding customer suitability is not merely a best practice but a regulatory requirement. Regulators mandate these checks to protect customers from unsuitable products and services that do not match their profiles or needs.

Who needs this form?

Both individuals and teams may need to fill out a Customer Suitability Check Agency Form. For individuals, this assessment helps personal financial advisors tailor their services to meet specific investment goals. Teams, particularly those managing corporate funds or collective investments, also require this form to ensure that the collective strategies align with the group's financial objectives.

Certain situations necessitate a customer suitability assessment. For instance, when a client is looking to invest in high-risk products or during a major life change, such as retirement or inheritance, a suitability check becomes essential. This assessment ensures that the financial advice provided aligns not only with current financial circumstances but also future goals.

Preparing to fill out the customer suitability check agency form

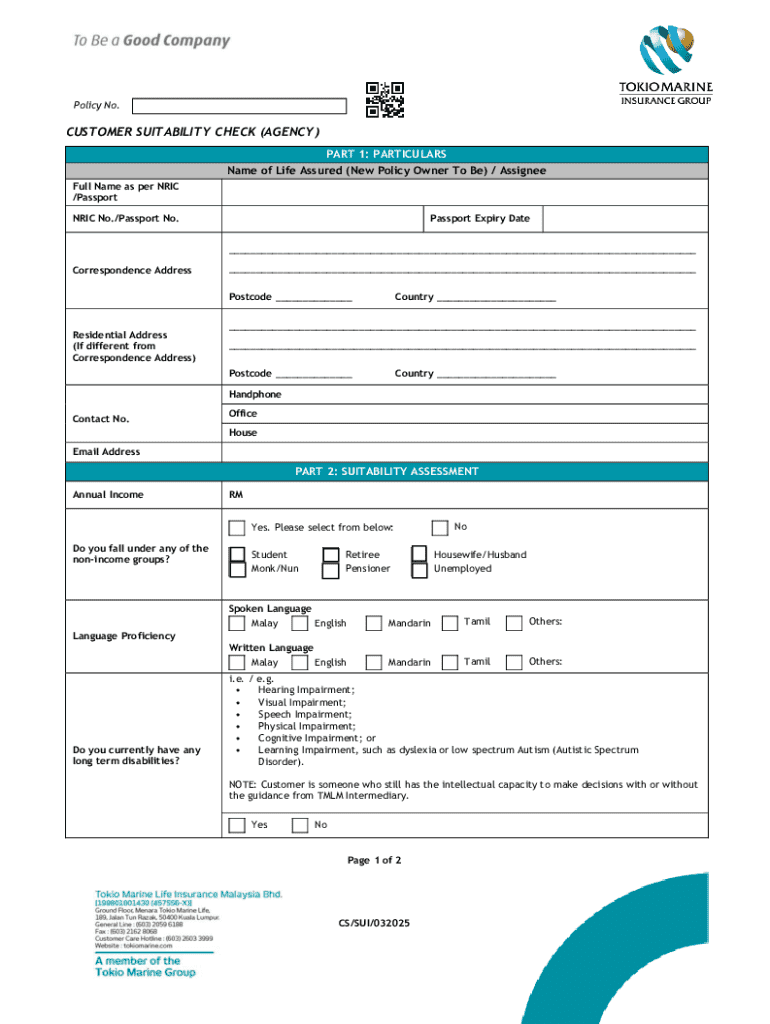

Before diving into the actual filling-out process, it’s crucial to prepare adequately. Knowing what information to have on hand will smooth the completion of the Customer Suitability Check Agency Form. Firstly, you’ll need to provide personal details such as your full name, contact information, and address. These details help the agency create a profile tailored to your situation.

Additionally, you’ll need to outline your financial background and experience. Be prepared to share information about your current income, debts, and assets, as these elements construct a complete picture of your financial health. Also, you should articulate specific needs and objectives - including your investment goals and risk tolerance – to guide the agency’s recommendations effectively.

Documents to gather

Gathering necessary documentation is vital for a comprehensive Customer Suitability Check. Typically, agencies require verified identification documents, such as a government-issued ID or a passport, to confirm the individual’s identity. This extra layer of verification protects both the client and the agency from fraudulent activities.

Moreover, having your financial statements and proof of income at hand is essential. These documents provide undeniable evidence of your current financial standing, which can influence the suitability assessment. Additionally, if applicable, collect any regulatory documentation relevant to your financial decisions, such as tax forms or earlier investment statements.

Step-by-step guide to completing the customer suitability check agency form

Accessing the Customer Suitability Check Agency Form is your first step. You can find the form conveniently on the pdfFiller platform, where it is securely stored and easily accessible. Make sure to log in using secure credentials to ensure your privacy during the access.

Filling out the form requires attention to detail. Start with the personal information section, ensuring that each entry is accurate and up to date. Any discrepancies can lead to potential issues down the line. Next, move to the financial information section, where providing detailed and precise data showcases credibility and fortifies your application.

Following this, you should carefully review your responses. Double-checking entries is crucial, as this prevents mistakes that could alter the outcome of your suitability check. Fortunately, pdfFiller provides editing tools that allow users to make corrections effortlessly before submitting.

Interactive tools provided by pdfFiller

pdfFiller enhances your document workflow through various interactive tools that streamline the completion of the Customer Suitability Check Agency Form. One of the most valuable features is the document editing capability. Users can seamlessly adjust any part of the form, whether it's correcting typos or updating financial details. This flexibility ensures that your submission is not only accurate but also reflects your current situation comprehensively.

Furthermore, pdfFiller offers eSigning capabilities, allowing you to electronically sign your completed form. This feature not only expedites the submission process but significantly enhances security, eliminating the need for physical copies. The benefits of eSigning include immediate processing and a clear digital trail that verifies your consent.

Collaboration options are also available within pdfFiller. Users can share the form with team members for feedback, allowing for a more thorough review process. The platform supports comments and suggestions, which can foster teamwork and improve the overall quality of submissions.

Managing your customer suitability check agency form

After filling out and submitting the Customer Suitability Check Agency Form, managing your documents is essential. pdfFiller provides several options for saving your form, including cloud storage and local downloads. Best practices for document management involve organizing files methodically and establishing a naming convention, making retrieval easy when needed.

Additionally, keeping track of your submission’s status is crucial. pdfFiller allows users to check if their form has been processed. If any issues arise during submission, the support team is readily available to assist in resolving any problems swiftly.

Frequently asked questions (FAQs)

Understanding the nuances of the customer suitability check process can raise various questions. Clients often inquire about the specific requirements of the form and the steps involved in the suitability assessment. Some seek clarifications on document requirements and the implications of inaccurate information.

Moreover, troubleshooting issues with the pdfFiller platform, such as access problems or document edits, is common. Providing clear, concise information in this FAQ section can alleviate confusion and empower users to navigate the process smoothly.

Related categories and next steps

In addition to the Customer Suitability Check, users may find themselves needing other forms related to customer assessments, such as Know Your Customer (KYC) forms or risk assessment documents. Understanding industry standards and best practices for suitability checks further improves the overall process.

For those seeking deeper insight, additional resources on document management, compliance regulations, and effective financial planning strategies can provide valuable information for navigating their investment journeys.

Key takeaways

Navigating the Customer Suitability Check Agency Form is a vital step in ensuring that financial advice aligns with individual needs and goals. pdfFiller streamlines this process by offering comprehensive tools for editing, eSigning, and collaborating on forms to enhance document workflows.

Utilizing these capabilities empowers users to manage their documents effectively and confidently, ensuring every submission supports their financial future optimally.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the customer suitability check agency form on my smartphone?

How do I edit customer suitability check agency on an iOS device?

How can I fill out customer suitability check agency on an iOS device?

What is customer suitability check agency?

Who is required to file customer suitability check agency?

How to fill out customer suitability check agency?

What is the purpose of customer suitability check agency?

What information must be reported on customer suitability check agency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.