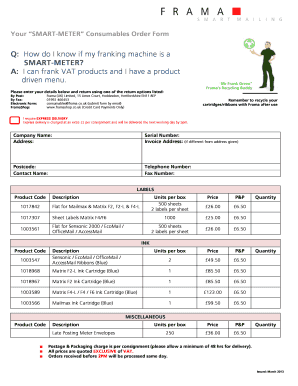

Get the free Form 10-q

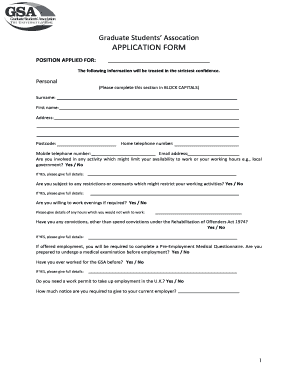

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding the Form 10-Q: A Comprehensive Guide

Understanding Form 10-Q

Form 10-Q is a quarterly report mandated by the U.S. Securities and Exchange Commission (SEC) for publicly traded companies. Its primary purpose is to provide ongoing disclosures about a company’s financial status and operations, ensuring transparency for investors and stakeholders. Unlike the annual Form 10-K, which serves as a comprehensive overview of the company’s yearly performance, the Form 10-Q presents a more frequent snapshot of the company's ongoing business and financial position.

The importance of the Form 10-Q in financial reporting cannot be overstated. It offers vital insights into a company's operational performance, trends, and risks in a timely manner, which plays a crucial role in informed investment decision-making. Investors and analysts use these reports to evaluate the company’s health and future prospects.

Who must file Form 10-Q?

All publicly traded companies in the United States must file Form 10-Q for each of the first three quarters of their fiscal year. This obligation includes both large and small companies, although smaller reporting companies may have some specific accommodations. Key stakeholders interested in these filings include investors, analysts, regulators, and financial media, all of whom rely on accurate and timely disclosures to make informed decisions.

Components of Form 10-Q

Form 10-Q is structured to provide a comprehensive overview of crucial financial information, typically divided into several key sections. The main financial statements presented in the Form 10-Q include:

Additionally, the Management’s Discussion and Analysis (MD&A) section is pivotal. This narrative allows management to give context to the numbers, discussing operational results, liquidity, and capital resources. It also highlights significant changes and potential future impacts on financial performance, including key metrics and disclosures.

Market risk disclosures, such as interest rate risk and credit risk, are also crucial for investors evaluating a company’s exposure to a fluctuating economic environment. Other required disclosures address changes in internal controls and any ongoing legal proceedings that may pose risks to the company.

Detailed breakdown of Form 10-Q items

A Form 10-Q consists of several specific items, each of which provides valuable insights into the company's operations. These include:

When interpreting these items, key ratios and indicators such as the current ratio, debt-to-equity ratio, and profit margins are informative. Investors can glean crucial insights by examining trends in these figures over time, providing context for a company's growth or challenges.

Filing process for Form 10-Q

Filing a Form 10-Q requires a systematic approach. The process begins with the preparation of accurate financial statements and disclosures. Companies generally establish an internal review and approval process to ensure the accuracy of the information reported. Subsequently, the Form is electronically filed using the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system.

Compliance deadlines are essential for companies to keep in mind. Form 10-Q must typically be filed within 40 days after the end of the reporting period for large accelerators, and within 45 days for smaller companies. Late filings can lead to fines and adversely affect investor confidence.

Consequences of non-compliance

The risks associated with late or inaccurate Form 10-Q filings are serious. Companies may face penalties and fines imposed by regulatory authorities, damaging not just their finances but also their reputation in the market. Additionally, investors may react negatively to these failures, potentially leading to a decline in stock prices and erosion of trust in management’s capabilities.

Notable case studies of filing failures exist, some resulting in significant financial repercussions for companies and boardroom shake-ups. Such occurrences underline the need for strict adherence to filing requirements.

How to access and analyze Form 10-Q filings

Accessing Form 10-Q filings is straightforward through the SEC EDGAR database. Users can search by company name, Central Index Key (CIK) number, or date. To perform effective searches, users should narrow down use filters, searching for specific quarters or fiscal years to locate the most relevant reports.

For extensive analysis of these filings, utilizing document management tools like pdfFiller can enhance efficiency. Features like editing, e-signing, and collaboration tools support teams in managing financial documents effectively, streamlining the review process.

Practical applications of Form 10-Q insights

Investors use Form 10-Q filings to analyze the financial health of companies. By studying trends in revenues, expenses, and key financial ratios, investors can make more informed decisions about buying or selling stock. This essential data allows them to identify which companies are thriving and which may be struggling, critical for portfolio management.

Additionally, Form 10-Q plays a crucial role in corporate governance. For board members and executives, these reports highlight areas that may require strategic adjustments. Moreover, transparency fostered through timely disclosures promotes accountability, which is fundamental in maintaining investor trust and long-term success.

Key highlights from recent Form 10-Q filings

Recent Form 10-Q filings reveal trends and changes in financial disclosures that can significantly impact investors' perceptions. Increased transparency regarding market risks and operational adjustments has emerged as a focus among companies, leading to pivotal market reactions. Evaluating these trends can provide valuable insights into broader market movements and emerging challenges or opportunities.

Using pdfFiller for your Form 10-Q needs

pdfFiller offers a robust suite of features that empowers users to manage Form 10-Q documents seamlessly. Tools for editing, signing, and collaboration are fully integrated into a cloud-based platform, providing teams accessibility from anywhere. This flexibility tends to enhance teamwork, especially for those involved in the financial reporting process.

To streamline document management, pdfFiller enables efficient ways to fill out and manage forms. Utilizing features such as reusable templates and efficient annotation tools can significantly enhance the review process in your Form 10-Q analysis, minimizing time spent on document preparation and increasing productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 10-q online?

Can I create an electronic signature for signing my form 10-q in Gmail?

Can I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.