Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Comprehensive Guide to Credit Application Forms

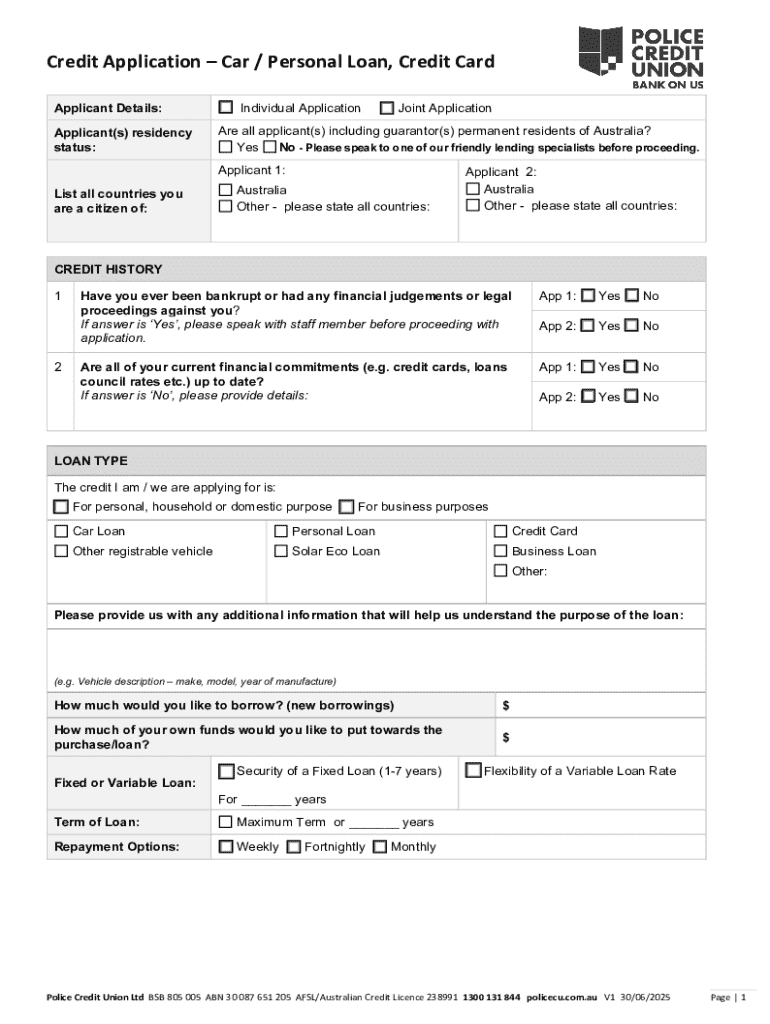

Understanding the credit application form

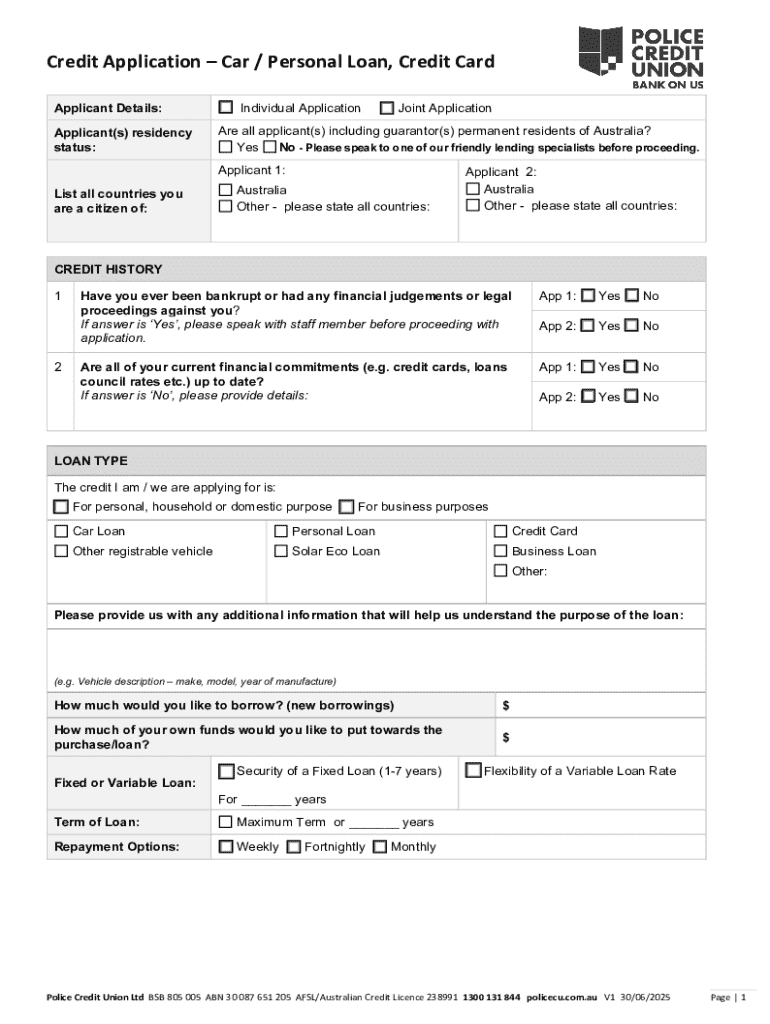

A credit application form is a crucial document that individuals or businesses fill out when seeking credit from lenders. This form collects vital information about the applicant to help the lender assess creditworthiness and determine loan eligibility.

The importance of this form cannot be overstated. It serves as the initial step in the credit approval process, enabling lenders to evaluate applicants based on their financial profiles, including income, debts, and credit history.

Credit application forms are commonly submitted to various institutions, including banks, credit unions, and online lenders. Each destination may have its specific requirements, emphasizing the need for applicants to understand the nuances of their chosen lender.

Key components of a credit application form

A well-structured credit application form gathers essential information that influences the approval process. The primary sections typically include:

Types of credit application forms

Credit application forms vary significantly based on the applicant's needs and circumstances. Notably, there are several types that you should be familiar with:

Step-by-step process for filling out the credit application form

Completing a credit application form requires careful attention to detail. Here is a step-by-step guide to help you through the process:

Editing and eSigning the credit application form

With tools like pdfFiller available, editing your credit application form has never been easier. The following steps outline how to utilize such a platform effectively:

Managing your credit application form after submission

Once your credit application has been submitted, it’s crucial to manage it effectively. Here’s how you can stay on top of the process:

Frequently asked questions about credit application forms

As applicants navigate the credit application process, they often have related concerns that can be addressed through common questions, such as:

Best practices for a successful credit application

To improve your chances of a successful credit application, consider these best practices:

Conclusion: Maximizing your chances for approval

The credit application form is a vital document in securing financing, and understanding the intricacies surrounding it can significantly improve your chances of approval. From gathering documentation to effectively managing your submission, each step plays a pivotal role.

Utilizing platforms like pdfFiller can streamline this process, offering tools for editing, eSigning, and managing your application from anywhere. By applying the tips and strategies outlined in this guide, you can navigate the credit application landscape with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in credit application?

Can I create an electronic signature for the credit application in Chrome?

How do I edit credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.