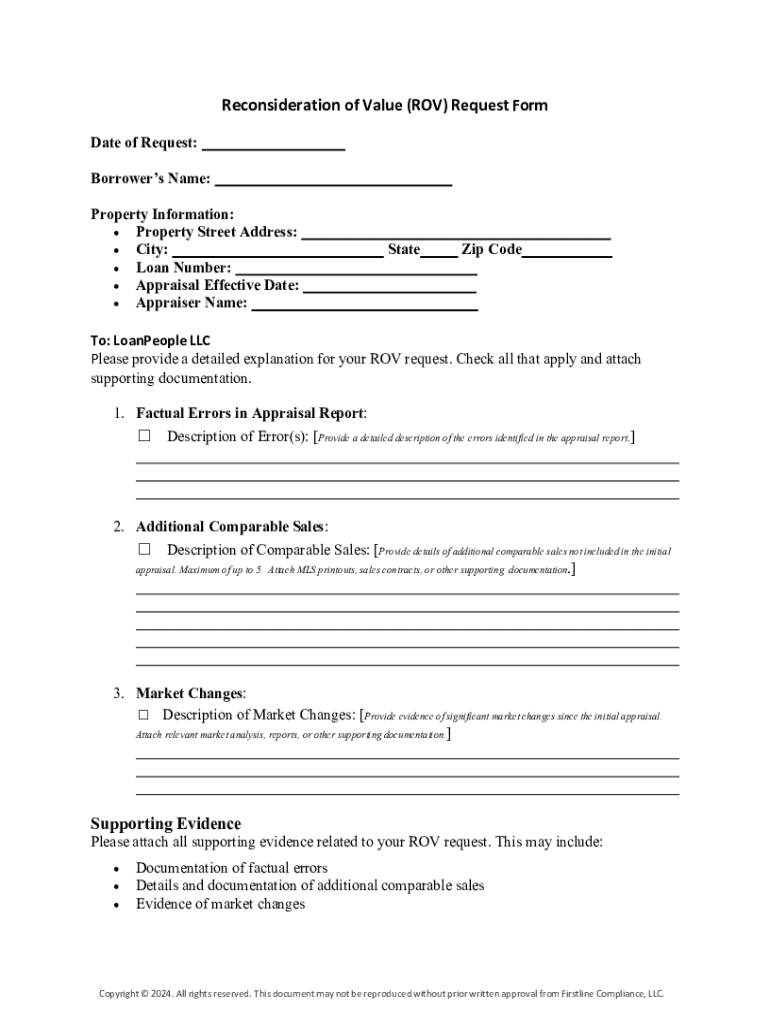

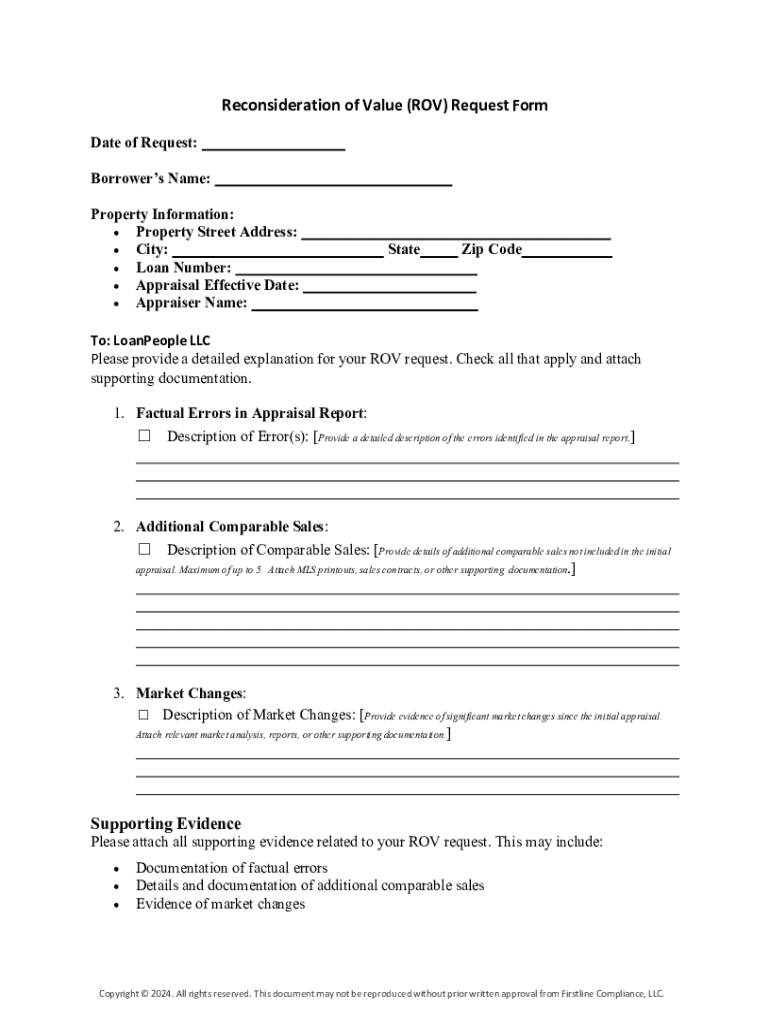

Get the free Reconsideration of Value (rov) Request Form

Get, Create, Make and Sign reconsideration of value rov

Editing reconsideration of value rov online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reconsideration of value rov

How to fill out reconsideration of value rov

Who needs reconsideration of value rov?

Reconsideration of Value ROV Form: A Comprehensive Guide

Understanding the reconsideration of value (ROV) process

The Reconsideration of Value (ROV) process plays a crucial role in ensuring property tax assessments are fair and accurate. Essentially, an ROV allows a property owner to formally contest the assessed value of their property when they believe it does not reflect the true market value. This process is essential for maintaining equity in property tax burdens and ensuring that all property owners are assessed fairly.

It is important for property owners to understand when to consider an ROV. Common situations that warrant reconsideration include significant drops in property values due to economic changes, market fluctuations, or factors affecting comparable properties in the area. Misconceptions often arise; many believe ROVs are only applicable to drastic value revisions, but even minor discrepancies can justify initiating the process.

Getting started with the ROV form

To embark on the ROV journey, you need to familiarize yourself with the specific ROV form required for submission. Typically, this form is available through local government or tax assessor websites, where you can find downloadable PDFs and detailed submission instructions.

The ROV form generally includes key elements such as the property owner’s details, property location, assessed values, and the specific reasons for disputing the current assessment. You’ll also need to gather necessary documentation to support your case. Required documents often include current appraisals, recent sales data of comparable properties, or a market analysis report.

Step-by-step guide to completing the ROV form

Completing the ROV form requires careful attention to detail. The first section typically asks for property information, including the address and owner's contact information. Ensure to provide accurate details to avoid any processing delays.

Moving on to the Valuation Details section, you will need to discuss the rationale behind your disagreement with the assessed value. Use this opportunity to clearly compare the market value of your property with the assessed value, as this will form the crux of your argument.

In the Supporting Evidence section, present your selected documents that substantiate your claims. Clear, well-organized presentations of evidence can make a significant difference. Don’t forget to format your supporting documents in a manner that’s easy for evaluators to understand, utilizing bullet points for clarity.

Lastly, remember the importance of signatures. If submitting electronically, an eSignature may be necessary. You can submit the ROV form either online or via postal mail, depending on your local guidelines.

Navigating potential challenges in the ROV process

While initiating the ROV process might seem straightforward, numerous challenges can arise during submission. Common issues include missing documents, incomplete forms, and unexpected delays in processing and response from the tax authority.

To overcome these obstacles, ensure that you check your form multiple times for completeness before submitting. Maintaining organized records and a checklist of required documents ahead of time can help you streamline your submission process, making it more efficient.

Understanding the outcome of your ROV submission

After submitting the ROV form, you may receive various responses, depending on the review outcome. Adjustments may be made to the property's assessed value, which could lead to lower tax bills if your ROV is successful.

Alternatively, there may be a denial of your ROV application. In this case, it’s vital to understand your options for appeal. Many localities provide an appeals process where you can further contest the assessment if necessary.

Utilizing pdfFiller for your ROV needs

When handling ROV forms and documentation, pdfFiller provides an invaluable platform. It streamlines the editing of PDFs and simplifies the eSignature process, ensuring that your forms are filled out clearly and professionally.

With collaborative tools, users can easily share documents with stakeholders, enhancing communication and ensuring everyone involved stays on the same page. The ease of accessing ROV forms and managing them through pdfFiller enhances your efficiency while minimizing the potential for errors.

Frequently asked questions about the ROV process

Many individuals have queries about the timeline for processing ROV requests. While it can vary by jurisdiction, typically, expect initial responses within a few weeks to a couple of months. Understanding how often you can submit reconsiderations is also crucial; most regions limit submissions to once a year unless there are substantial changes.

The impact of a successful ROV can also extend to future assessments and taxes. If your assessed value decreases significantly, it could lead to a reduced tax burden in subsequent years, providing both immediate and long-term financial relief.

Contacting support and additional resources

If you encounter difficulties or have specific inquiries regarding the ROV process, reaching customer support through platforms like pdfFiller is a great step. Their support team can guide you through complex cases or help with technical issues related to document management.

Moreover, many online resources provide valuable insights. Websites often offer direct links to ROV forms, as well as additional guides that can help you navigate the intricacies of property assessments and taxation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my reconsideration of value rov in Gmail?

How do I make changes in reconsideration of value rov?

How do I edit reconsideration of value rov in Chrome?

What is reconsideration of value rov?

Who is required to file reconsideration of value rov?

How to fill out reconsideration of value rov?

What is the purpose of reconsideration of value rov?

What information must be reported on reconsideration of value rov?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.