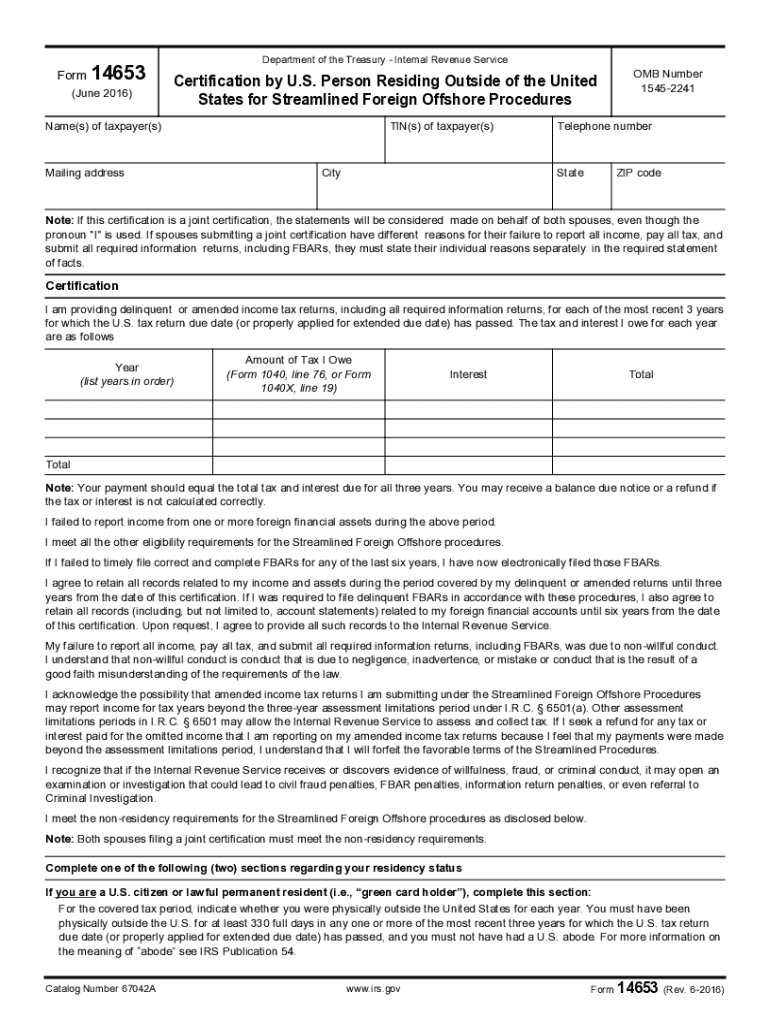

Get the free Form 14653

Get, Create, Make and Sign form 14653

Editing form 14653 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 14653

How to fill out form 14653

Who needs form 14653?

Understanding IRS Form 14653: A Comprehensive Guide for U.S. Expats

Understanding IRS Form 14653

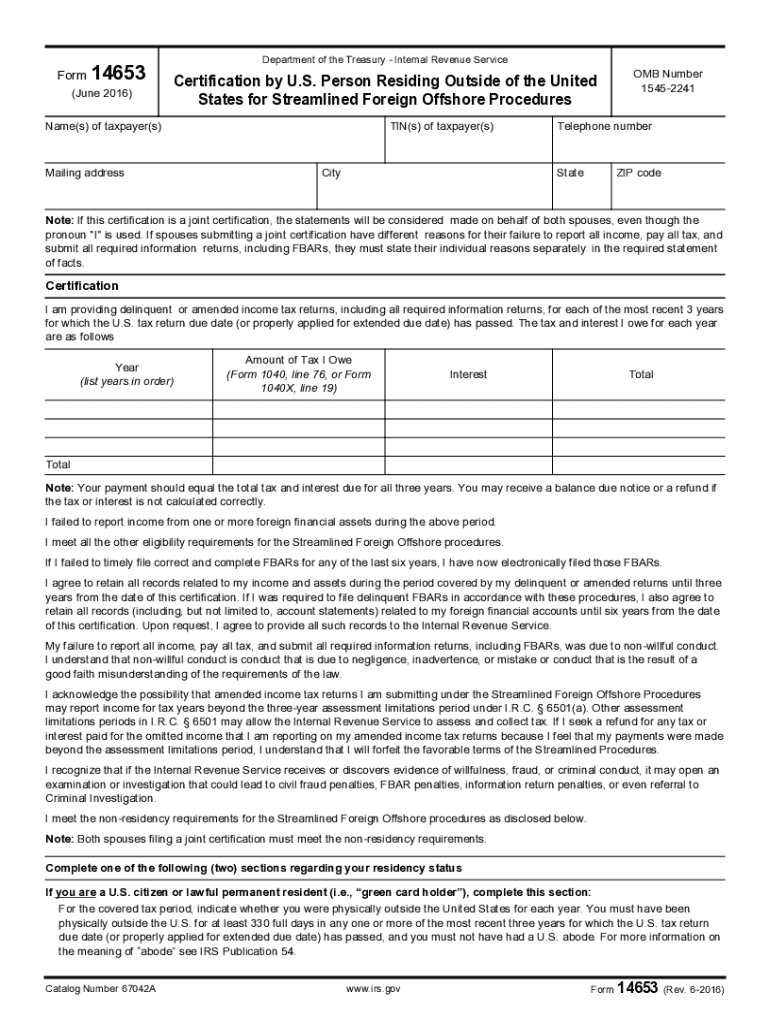

IRS Form 14653, also known as the ‘Application for the Streamlined Offshore Procedures,’ is crucial for U.S. citizens and residents living abroad who may be non-compliant with their tax obligations. This form facilitates access to the Streamlined Foreign Offshore Procedures (SFOP) which allow expats to catch up on their tax filings without the burden of excessive penalties.

The primary purpose of Form 14653 is to provide information about the filer’s financial situation and non-compliance, essentially telling the IRS your story while requesting a more lenient approach to your tax situation. Realizing the importance of this form can be the difference between facing stiff penalties and resolving tax issues in a more manageable way.

Eligibility criteria for filing Form 14653

Filing Form 14653 is specifically targeted towards U.S. citizens and residents living outside the United States who have not filed their tax returns or Foreign Bank Account Reports (FBARs) for previous years. To qualify for its provisions, expats need to meet certain eligibility criteria that can significantly affect their tax compliance.

Eligibility requirements include: - You must be a U.S. citizen or a resident alien who has lived outside the U.S. for at least 330 full days during the last three years. - You should have failed to file your required tax returns or FBAR not out of willful neglect but based on non-willful conduct.

Streamlined Foreign Offshore Procedures (SFOP)

The Streamlined Foreign Offshore Procedures (SFOP) were introduced as part of the IRS’s efforts to encourage compliance among U.S. citizens and residents living abroad. These procedures offer a simpler pathway to rectify prior non-compliance with reduced penalties for qualifying individuals.

The benefits of SFOP for U.S. expats include a significant reduction in penalties typically associated with foreign account reporting. Moreover, under SFOP, those who qualify might resolve their tax obligations almost cost-effectively, maintaining essential financial privacy while addressing IRS concerns.

Required documentation for Form 14653

When completing IRS Form 14653, having the proper documentation is essential. Failing to provide required documents could lead to delays in processing your application and put you at risk for penalties.

Commonly required documents include: - Copies of prior year tax returns (generally the last three years). - Eligibility forms showing that the filer meets non-willful criteria. - Foreign Bank Account Reports (FBAR) for those years if applicable.

Step-by-step guide to completing Form 14653

Completing Form 14653 requires careful attention to detail. Here’s a section-by-section breakdown to ensure accuracy and compliance with IRS requirements.

The essential sections to complete include: - Personal information: Provide your name, address, and taxpayer identification number. - Narrative statement: Describe your circumstances regarding tax non-compliance, emphasizing the non-willful nature of your failure to file. - Financial disclosures: Accurately disclose the necessary financial information, including foreign income, bank accounts, and asset values for the tax years being reported.

Avoid common mistakes like leaving sections incomplete or misrepresenting income levels. Precision is key to ensure no unnecessary complications arise during processing.

How to submit Form 14653

Submitting Form 14653 can be done either via paper or electronically, depending on your preference and capabilities. You must choose the method that best suits your situation to ensure timely processing.

Deadlines for submission can vary based on individual circumstances, but timely completion is essential to avoid complications. Once submitted, tracking your submission status can help ensure that you are informed about the process—keeping communication channels open with the IRS will also help mitigate any delays.

After you file: What to expect

Once you submit Form 14653, the IRS processes your application. Expect potential outcomes, such as acceptance into the streamline program or requests for more information. Patients and readiness to provide additional documentation will facilitate a smoother process.

If the IRS contacts you for additional information, responding promptly with the requested documents or clarifications can significantly affect the outcomes. Understanding IRS procedures and being prepared for follow-up questions can ease the path toward resolution.

The role of tax professionals in navigating Form 14653

Tax professionals, such as certified public accountants (CPAs) or tax preparers, play a valuable role in simplifying the filing process of Form 14653. With specialist knowledge, they can navigate complex tax laws and help maximize your benefits under SFOP.

When considering a tax professional, assess their experience with expat tax issues, their understanding of IRS guidelines, and their communication style to ensure they can address your specific needs effectively.

Mitigating penalties with Form 14653

One of the most significant advantages of filing Form 14653 is the opportunity to mitigate penalties associated with late tax filings. Understanding the implications of not filing, including potential fines and interest, is crucial for expats.

Effective use of Form 14653 can help reduce or eliminate these penalties, especially when the application includes comprehensive and accurate documentation demonstrating non-willful conduct. It’s wise to consider case studies or past experiences shared by other expats to show how timely submission of Form 14653 has led to successful outcomes.

Frequently asked questions (FAQs) about Form 14653

Form 14653 generates various questions among U.S. expats. Addressing common misconceptions, such as whether inclusion in the streamlined program clears all tax debts or how long processing may take, can alleviate concerns.

Further clarification on eligibility, submission processes, and expected outcomes facilitates smoother navigation through the complexities of filing. Offering particulars such as timelines or required documentation can also enhance users' readiness before filing.

Practical tips for successful Form 14653 applications

Completing Form 14653 successfully means adhering to best practices in filled documentation and maintaining records. For example, always double-check your entries for accuracy and completeness before submitting your application.

Additionally, consistent record-keeping across tax years helps demonstrate your efforts in achieving compliance. Utilize available online resources, such as tools for editing and signing documents through pdfFiller, to streamline your experience further.

Related forms and procedures for U.S. expats

Understanding other relevant IRS forms alongside Form 14653 is critical for managing your tax responsibilities comprehensively. For instance, forms like 8898, which focuses on expatriation, might also be pertinent depending on your individual tax circumstances.

A comparison of Form 14653 with other relevant IRS forms illuminates your broader obligations and roles. This context can enhance your knowledge and empower better decision-making on when and how to file.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 14653 to be eSigned by others?

How can I get form 14653?

How can I edit form 14653 on a smartphone?

What is form 14653?

Who is required to file form 14653?

How to fill out form 14653?

What is the purpose of form 14653?

What information must be reported on form 14653?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.