Get the free Personal Liability Claim Form

Get, Create, Make and Sign personal liability claim form

Editing personal liability claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal liability claim form

How to fill out personal liability claim form

Who needs personal liability claim form?

Personal Liability Claim Form: A Comprehensive How-to Guide

Understanding personal liability claims

Personal liability claims arise when a person is held responsible for accidents or damages that occur on their property or as a result of their actions. These claims can lead to significant financial implications for the responsible party, including compensation for damages and legal fees.

Common scenarios that might prompt a personal liability claim include accidental injuries occurring on your property, like slips and falls, or damage caused to third-party property, such as when a tree branch falls during a storm. Additionally, if you're faced with legal fees arising from a lawsuit filed against you, a personal liability claim may be necessary to cover these costs.

When to use a personal liability claim form

Recognizing the right time to file a personal liability claim is crucial. You should consider submitting a claim if you are involved in a situation where someone has incurred injuries or damages that you may be liable for. The sooner you act, the better, as many insurance policies require timely notification of claims to remain valid.

Not only does timely submission pave the way for a smoother claims process, but it can also mitigate the stress involved in damage management and legal proceedings. Furthermore, understanding how claims can affect your insurance premium is essential; filing multiple claims can lead to increased rates in the future.

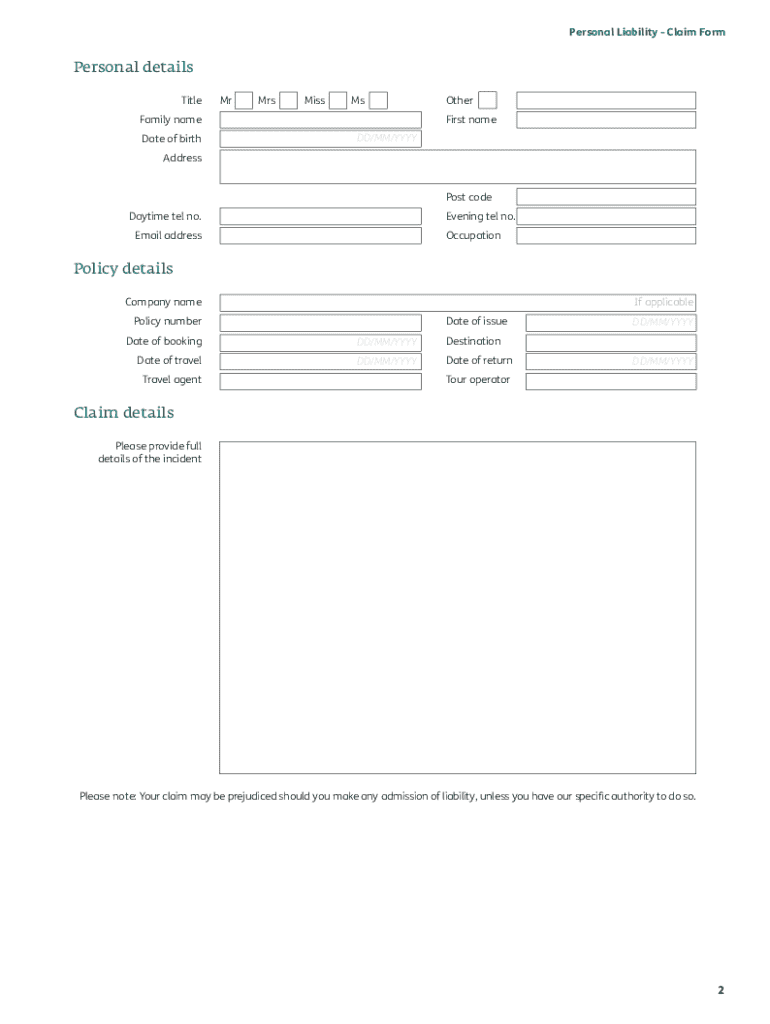

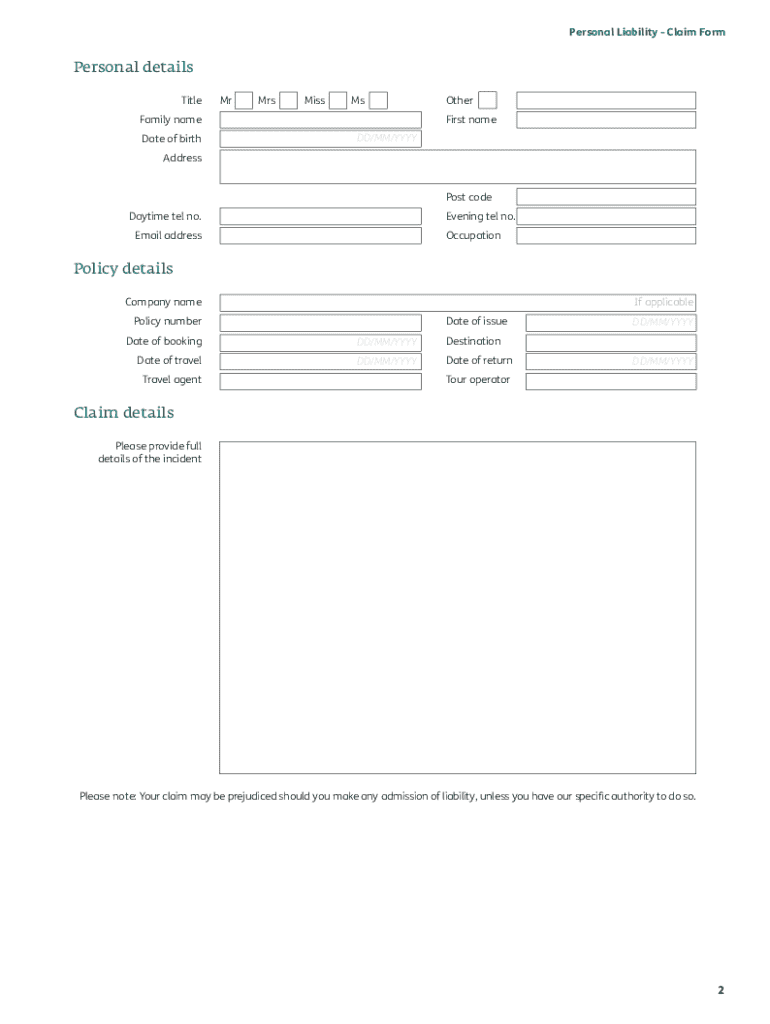

Overview of the personal liability claim form

The personal liability claim form serves as the initial step in documenting your claim with an insurance provider. This form enables you to present your side of the story and outline the damages or injuries in question.

Key components of the form include: 1. Claimant Information – Details about yourself as the claimant. 2. Details of the Incident – A thorough account of what happened leading to the claim. 3. Witness Information – Contact details for any witnesses present during the incident. 4. Financial Information Related to the Claim – An itemized list of damages or medical expenses incurred.

Step-by-step instructions for filling out the personal liability claim form

Successfully filling out a personal liability claim form requires careful preparation and attention to detail. Start with gathering pertinent documentation such as evidence of the incident like photographs or witness statements, and ensure you include any medical reports or bills related to the injuries sustained.

Consider the following while completing each section of the form: 1. Personal Information: Clearly fill out your name, address, contact details, and insurance information. 2. Describing the Incident: Be accurate and concise. Include the date, time, location, and a detailed narrative of what transpired. 3. Itemizing Losses and Damages: List each expense thoroughly, providing corresponding documentation for verification. 4. Common Mistakes: To avoid unnecessary delays, ensure that the form is signed and all required fields are filled out completely and accurately.

Editing and customizing the personal liability claim form

Utilizing tools like pdfFiller significantly streamlines the process of editing your personal liability claim form. However, it is essential to understand how to effectively use these tools.

To edit your form using pdfFiller: 1. Upload the PDF to your pdfFiller account. 2. Use various interactive tools to modify text fields and insert necessary information. 3. Don't forget to add signatures and initials where required, ensuring your document is complete.

Submitting your personal liability claim form

Once your personal liability claim form is filled out and edited, it’s time to submit it. You have multiple submission options available to you.

Consider these methods: 1. **Online submission** through your insurance provider’s portal typically allows for quicker processing. 2. **Mailing the Form:** Ensure you address it correctly to avoid delays, and consider sending it via certified mail for tracking purposes. 3. **Faxing:** If you opt to fax the claim, double-check the number and ensure you send it in a format that is legible to the receiver. 4. **Tracking Your Submission:** Keep copies of everything submitted, and make note of any confirmation messages received from the insurer.

What happens after submission?

After you submit your personal liability claim form, the insurance company will review your submission and investigate the circumstances surrounding the incident. This review process can vary in duration based on the complexity of the claims.

Possible outcomes include: 1. **Claim approval**, which may lead to a timely payment of costs associated with the damages. 2. **Claim denial**, which requires understanding the reasons behind the decision. In cases of denial, you typically have the right to appeal, where you can present additional evidence or clarify miscommunication.

Collaborating with your insurance adjuster

Effective communication with your insurance adjuster is essential throughout the claims process. Being proactive and clear can facilitate smoother interactions and quicker resolutions.

When communicating: 1. Prepare questions in advance to ensure you understand the claims process. 2. Stay organized, presenting documents and evidence as needed. 3. Be open to follow-up interviews, as they can provide an opportunity for you to clarify details regarding the incident.

Managing your personal liability insurance after filing a claim

Post-claim management of your personal liability insurance is crucial for navigating potential long-term impacts on your coverage and premiums. After a claim, be aware that it may lead to increased rates when renewing your policy.

Consider these tips for managing your insurance moving forward: 1. Review your current policy to ensure it meets your needs. 2. Engage with your insurer to discuss potential adjustments to your coverage and premiums. 3. Make it a point to educate yourself on what influences premium calculations after filing a claim.

Frequently asked questions (FAQs) about personal liability claims

Understanding the nuances of personal liability claims can be complex. Here are some frequently asked questions that clarify common concerns.

Leveraging pdfFiller for efficient document management

Using pdfFiller not only facilitates filling out the personal liability claim form but also supports overall document management. This platform empowers users to manage their forms efficiently from anywhere, improving accessibility and workflow.

Advantages include: 1. An easy-to-use editing tool that ensures your documents are always up to date. 2. Secure storage solutions for all your forms and necessary documents. 3. Success stories from other users demonstrate how pdfFiller has streamlined their claims process and improved their overall document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete personal liability claim form online?

How do I edit personal liability claim form online?

Can I edit personal liability claim form on an Android device?

What is personal liability claim form?

Who is required to file personal liability claim form?

How to fill out personal liability claim form?

What is the purpose of personal liability claim form?

What information must be reported on personal liability claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.