Get the free Non Superannuation Withdrawal Form

Get, Create, Make and Sign non superannuation withdrawal form

How to edit non superannuation withdrawal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non superannuation withdrawal form

How to fill out non superannuation withdrawal form

Who needs non superannuation withdrawal form?

Understanding the Non Superannuation Withdrawal Form: A Comprehensive Guide

Understanding non superannuation withdrawals

A non superannuation withdrawal refers to the extraction of funds from an individual's pension or superannuation account under conditions that do not conform to the standard retirement age or usual withdrawal criteria. These withdrawals serve various purposes, allowing access to funds in specific situations like financial hardship, medical emergencies, or other pressing circumstances. One key distinction is that non superannuation withdrawals often come with different rules and processes compared to standard superannuation withdrawals.

Eligibility for non superannuation withdrawals often depends on individual circumstances. For instance, you may qualify if you can demonstrate necessary financial hardship, unexpectedly high medical expenses, or other substantial conditions warranting immediate access to your funds. Differentiating between superannuation and non superannuation withdrawals is crucial. While superannuation withdrawals are primarily linked to retirement, non superannuation withdrawals provide more flexible options in times of need, subject to specific rules.

Types of non superannuation withdrawals

Non superannuation withdrawals generally fall into several categories, each with distinct implications and requirements. The most common types include lump sum withdrawals, where a single disbursement is made from the superannuation fund, and partial withdrawals, allowing individuals to access only a portion of their total funds. This can be particularly beneficial for individuals who need urgent financial assistance without depleting their entire savings.

Specific circumstances often dictate the acceptance of a withdrawal request. Common scenarios include financial hardship—where individuals face significant challenges in meeting basic daily living costs—and medical expenses stemming from unexpected health crises. Each case typically requires thorough documentation to support the application and justify the need for withdrawal.

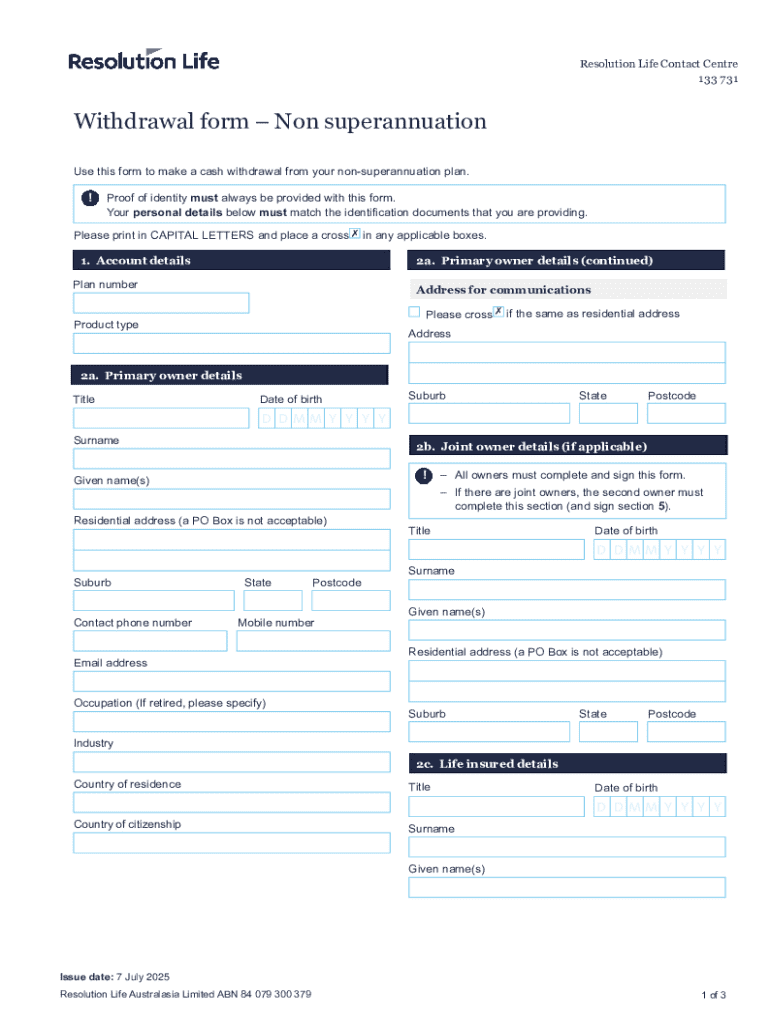

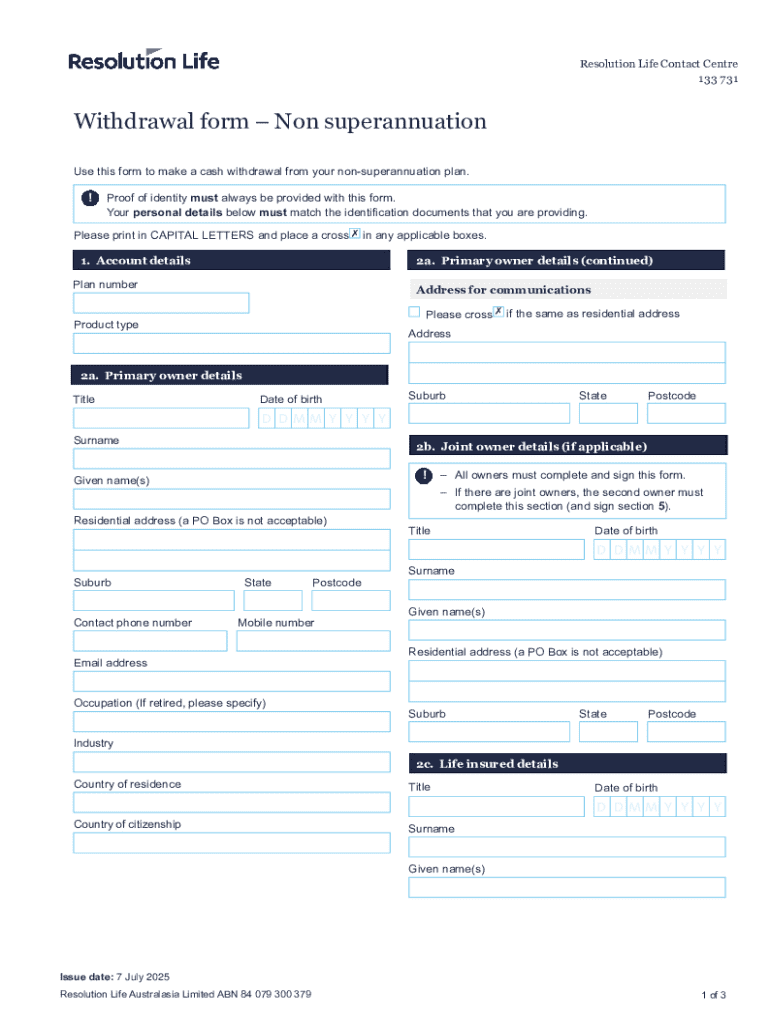

Overview of the non superannuation withdrawal form

The non superannuation withdrawal form is a critical document designed for those seeking early access to their superannuation or pension funds outside of standard terms. The primary purpose of this form is to document the request, detail the reasons for accessing the funds, and provide the superannuation fund with the necessary information to process the withdrawal efficiently. Ensuring accurate completion of this form is paramount, as any discrepancies or errors could delay the processing of your request.

Common uses of the form include applications for urgent financial needs, medical emergencies, or consolidating funds from multiple superannuation accounts. Understanding its content and structure will help individuals navigate the procedure more effectively, enabling a smoother experience when dealing with financial institutions.

Step-by-step guide to completing the non superannuation withdrawal form

Gather necessary documentation

Before initiating the withdrawal process, gather all necessary documents that validate your request. Identification documents, such as a government-issued ID, driver's license, or passport, are essential in verifying your identity. In addition to identification, ensure that you collect financial documents like bank statements or proof of hardship that correlate with your request. Properly organizing this documentation ensures a smoother and faster application process.

Access the non superannuation withdrawal form

Finding the non superannuation withdrawal form is straightforward, especially on platforms like pdfFiller. Simply navigate to the relevant section on the website and search for the non superannuation withdrawal form. It’s critical to use the correct version of the form as outdated documents may include previous regulations or instructions that are no longer applicable.

Fill out the form

Filling out the non superannuation withdrawal form involves several key sections. Start with your personal information, including your name, contact details, and superannuation account number. Clearly indicate your reason for withdrawal, which may include financial hardship or medical needs, and specify the amount you wish to withdraw. Accuracy is essential, as any errors can lead to rejection or processing delays.

Review and edit the form

Using tools like pdfFiller, review the completed document to ensure everything is accurate and comprehensive. Utilize editing functions to make any necessary adjustments. Common errors include missing signatures, incorrect account information, or inadequate justification for the withdrawal. Taking the time to carefully check your work can help you avoid unnecessary complications down the line.

Signing the document

Signing is a crucial step in this process. You can utilize options for electronic signatures through pdfFiller, which can speed up processing times and reduce paper-based hassle. Make sure your signature aligns with the one used in your identification documents to authenticate your identity and request effectively.

Submit the form

Once the form is completed and signed, the next step is to submit it. Submit via pdfFiller for easy processing, or you may also choose to send it through traditional channels like email or an online portal specified by your superannuation fund. Understanding different submission channels ensures you choose the most efficient method, potentially expediting the timeframe of your withdrawal request.

Managing your non superannuation withdrawal process

After submitting your non superannuation withdrawal form, staying informed about its status is vital. Tracking your application allows you to be proactive in addressing any issues that may arise. Common issues include missing documentation or misunderstandings related to the reasons for withdrawal. In case of any difficulties, reaching out to the customer service department of your superannuation fund is recommended.

Keep a record of all communications and documentation related to your withdrawal request. If you need assistance, having important contact information for support can enable quicker resolutions. Document management features in pdfFiller, like document tracking and reminders, can enhance your experience.

Frequently asked questions about non superannuation withdrawals

A common question regarding the non superannuation withdrawal process is, 'How long does the withdrawal process take?' While the time frame often varies depending on the superannuation fund and the complexity of your request, typical processing can take a few days to several weeks. Be attentive to follow-up notices from your fund during this period.

If your form is rejected, you might be left wondering what to do next. The first step is to review the reasons for rejection, as outlined in the communication from the fund. You may then have the opportunity to amend the request and resubmit your form. Additionally, can multiple accounts be accessed simultaneously? Withdrawals can usually be carried out from multiple accounts, but each request will need to be processed separately.

Lastly, consider how often you can make a non superannuation withdrawal. Depending on your superannuation fund, there may be limits to the frequency of withdrawals allowed. Regularly reviewing the policies of your specific fund can keep you informed and avoid any inconveniences.

Additional tools and resources on pdfFiller

pdfFiller offers interactive tools for document management that can greatly enhance your experience when filling out the non superannuation withdrawal form. Utilize the platform’s capabilities for safe document storage, easy access, and seamless collaboration while working on your forms. The editing tools available can also significantly streamline processes for other forms and documents you may need to manage.

As you navigate the online platform, take advantage of resources and guides provided to help you utilize features tailored to your needs. Whether you are preparing other important documents or managing paperwork for your team, pdfFiller’s versatile functionalities simplify the processes.

User testimonials and success stories

Many individuals have shared their success stories regarding their experiences with the non superannuation withdrawal process. Users frequently commend the intuitive nature of pdfFiller, which simplifies the form-filling experience and enhances accessibility. Case studies highlight numerous people who have successfully navigated their financial challenges after utilizing this platform for their withdrawal forms.

Feedback shows an overall appreciation for the user-friendly features, which streamline document management and facilitate collaboration between members of teams needing to complete similar forms. Such experiences reinforce the value of having a centralized platform like pdfFiller for navigating often complex procedures.

Final thoughts on non superannuation withdrawals

Staying informed about non superannuation withdrawals is crucial for anyone considering this financial pathway. Regulations and policies governing withdrawals can change, making it essential to be adaptable and well-informed. Regularly reviewing updates from your superannuation fund can prevent misunderstandings and ensure that your withdrawal requests comply with current policies.

Ultimately, understanding the ins and outs of the non superannuation withdrawal form, along with utilizing resources like pdfFiller, empowers individuals to manage their withdrawals effectively and confidently pursue their financial objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the non superannuation withdrawal form electronically in Chrome?

Can I create an eSignature for the non superannuation withdrawal form in Gmail?

How do I complete non superannuation withdrawal form on an Android device?

What is non superannuation withdrawal form?

Who is required to file non superannuation withdrawal form?

How to fill out non superannuation withdrawal form?

What is the purpose of non superannuation withdrawal form?

What information must be reported on non superannuation withdrawal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.