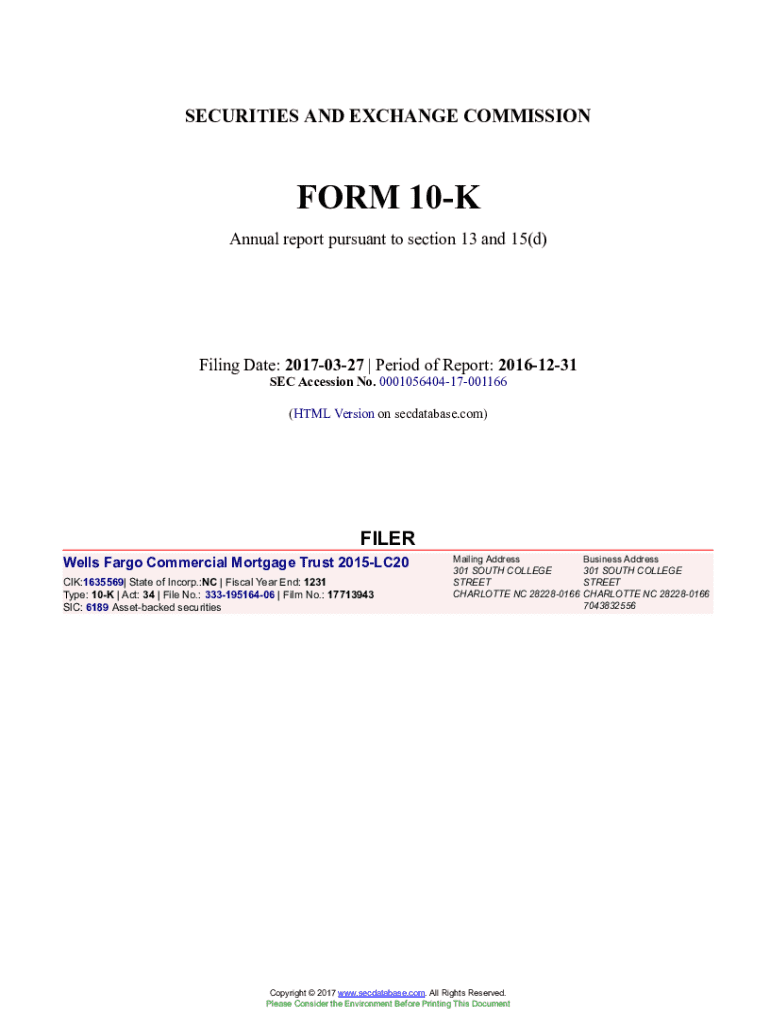

Get the free Wells Fargo Commercial Mortgage Trust 2015-LC20 Form 10-K Annual Report Filed 2017-0...

Get, Create, Make and Sign wells fargo commercial mortgage

How to edit wells fargo commercial mortgage online

Uncompromising security for your PDF editing and eSignature needs

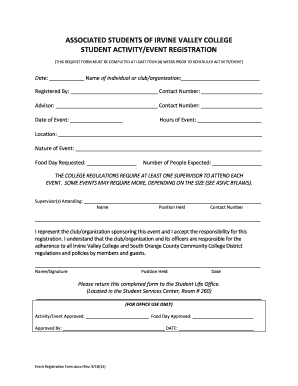

How to fill out wells fargo commercial mortgage

How to fill out wells fargo commercial mortgage

Who needs wells fargo commercial mortgage?

A Complete Guide to the Wells Fargo Commercial Mortgage Form

Understanding the Wells Fargo Commercial Mortgage Form

Commercial mortgages provide essential funding for purchasing or refinancing commercial real estate properties, a critical aspect of many businesses. The Wells Fargo Commercial Mortgage Form is a vital document in this financing process, laying the groundwork for both lender and borrower expectations. Completing this form accurately can significantly influence the speed and efficiency of the mortgage approval process.

The significance of the Wells Fargo Commercial Mortgage Form cannot be overstated. It serves as a formal request for a loan, detailing essential information about the borrower, the property in question, and the financial expectations of the lender. A well-prepared application can expedite decisions, potentially resulting in favorable loan conditions.

Key components of the Wells Fargo Commercial Mortgage Form

The Wells Fargo Commercial Mortgage Form is composed of several vital sections designed to gather comprehensive information about the borrower and the property. Understanding these components is crucial to filling out the form correctly.

The application process

Completing the Wells Fargo Commercial Mortgage Form is a step-by-step process involving careful attention and thorough documentation. Gathering all necessary information before starting ensures a smoother application experience.

Common mistakes to avoid include providing inaccurate information and forgetting required signatures on crucial sections, as these can lead to application rejection or significant delays.

Editing and signing the Wells Fargo Commercial Mortgage Form

Using tools like pdfFiller can streamline the editing of the Wells Fargo Commercial Mortgage Form. This platform offers features that enable users to modify fields and sections effectively.

Submitting the Wells Fargo Commercial Mortgage Form

Once the Wells Fargo Commercial Mortgage Form is completed and signed, the submission process begins. Understanding the different methods for submission is essential for ensuring timely processing.

After submission, it's essential to know what to expect. Processing times may vary, and you should remain proactive in following up to understand any subsequent actions needed on your part.

Managing your commercial mortgage application

Using pdfFiller to track your application can be beneficial. Organizing documents within the platform allows for better management and quick access to essential papers.

Troubleshooting common issues

Sometimes, technical issues may arise while filling out the Wells Fargo Commercial Mortgage Form. Knowing how to address these challenges is crucial.

Frequently asked questions (FAQs)

The Wells Fargo Commercial Mortgage Form often raises several questions from potential applicants. Here are some common inquiries.

Leveraging pdfFiller for effective document management

Utilizing pdfFiller for managing the Wells Fargo Commercial Mortgage Form grants users an array of cloud-based benefits. The platform not only enhances accessibility but also ensures the security of sensitive information.

Next steps after completing and submitting the form

Once the Wells Fargo Commercial Mortgage Form has been submitted, it’s important to maintain momentum in the home buying or refinancing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get wells fargo commercial mortgage?

Can I edit wells fargo commercial mortgage on an iOS device?

Can I edit wells fargo commercial mortgage on an Android device?

What is Wells Fargo commercial mortgage?

Who is required to file Wells Fargo commercial mortgage?

How to fill out Wells Fargo commercial mortgage?

What is the purpose of Wells Fargo commercial mortgage?

What information must be reported on Wells Fargo commercial mortgage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.