Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

A comprehensive guide to credit application forms

Understanding the credit application form

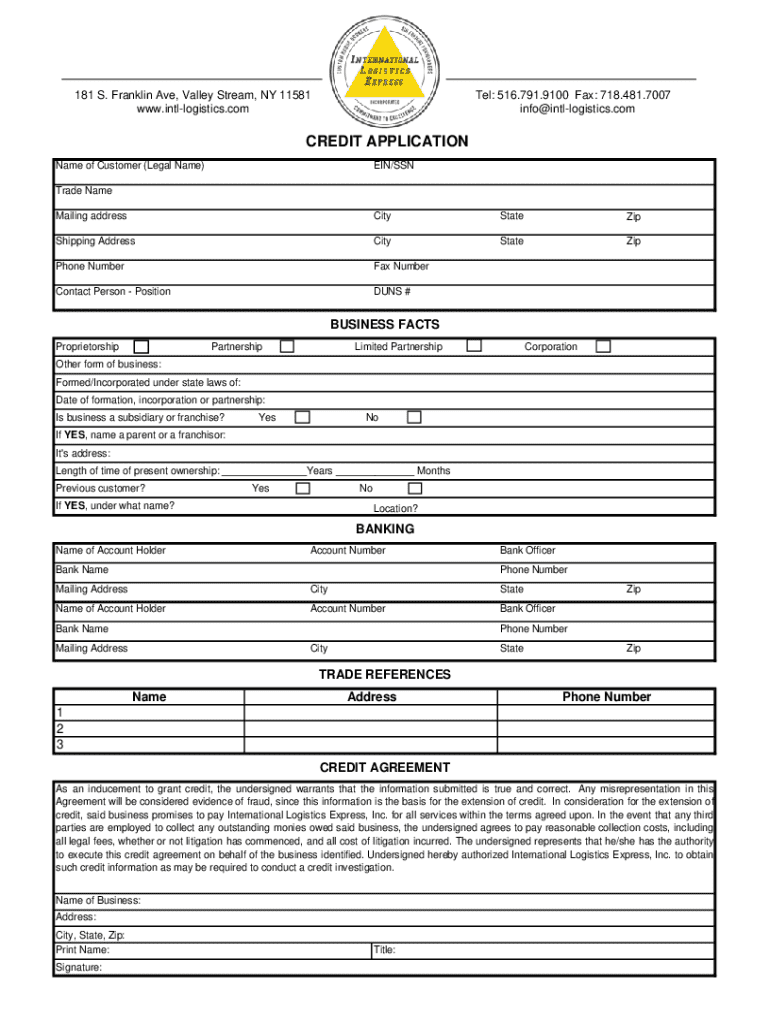

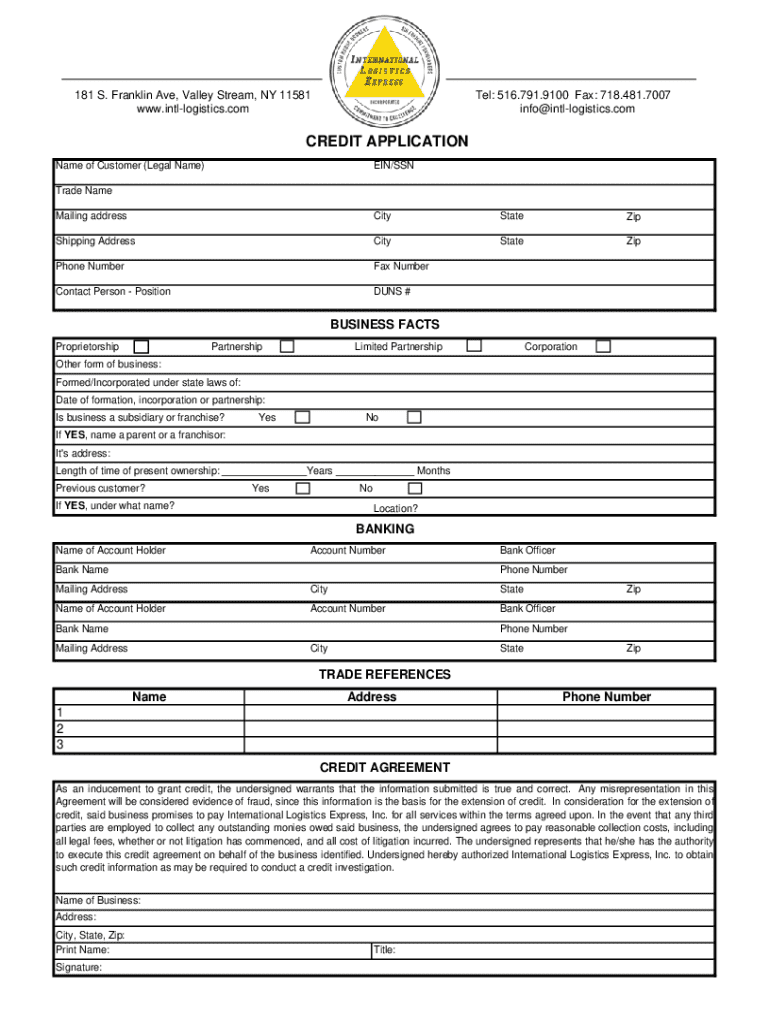

A credit application form is a crucial document used when seeking financing from lenders, including banks and credit unions. This form serves to collect detailed information about the applicant's financial situation, creditworthiness, and personal background. Its primary purpose is to help lenders assess the risk associated with granting credit, allowing them to make informed decisions.

Key elements typically included in a credit application form encompass personal information, financial details, and supporting documents. The form usually asks for your identification, income sources, employment status, current debts, and other financial obligations, all aimed at evaluating your ability to repay a loan.

Importance of the credit application form

The credit application form is integral for several reasons. First, it allows lenders to accurately assess financial eligibility. By reviewing the information provided, lenders can determine whether an applicant meets their lending criteria, which includes evaluating income, employment stability, and existing debt levels.

Moreover, the credit application form streamlines the loan approval process. A fully completed application allows lenders to expedite review and processing times, leading to faster loan decisions. Finally, it can impact your credit score. When you apply for credit, the lender conducts a hard inquiry on your credit report. Frequent applications could pose a risk to your score, making it vital to submit applications carefully.

Types of credit application forms

Various types of credit application forms exist, tailored to different borrowing scenarios. Personal credit applications are designed for individuals seeking personal loans, credit cards, or auto financing. Businesses, on the other hand, require business credit applications to secure loans, lines of credit, or merchant services.

Furthermore, there are secured versus unsecured credit applications. Secured applications require collateral, such as property or savings, while unsecured loans don’t, often resulting in higher interest rates. Lastly, applicants can choose between online and paper credit applications. The online format is typically quicker and more convenient, while paper forms may still be preferred by some traditional lenders.

Essential information required

Completing a credit application form accurately is vital. Essential information typically required includes:

Step-by-step guide to filling out the credit application form

Filling out the credit application form can seem daunting, but following a structured approach can ease the process. Here’s a step-by-step guide:

Common mistakes to avoid

When completing a credit application form, it’s easy to make mistakes that could delay approval or lead to rejection. Common pitfalls include:

Best practices for a successful submission

To enhance your chances of a successful credit application, consider these best practices:

Editing and managing your credit application

Tools like pdfFiller simplify the management of your credit application form. Once completed, you can edit your form hassle-free. Simply upload your document to pdfFiller's platform, where you can make modifications as needed.

Moreover, pdfFiller enables users to add eSignatures quickly, ensuring your application is legitimate and ready for submission. If you need collaboration, pdfFiller allows team members to work on the application together, making it easier to gather necessary information and finalize the document.

Troubleshooting common issues

Even with proper preparation, issues can arise after submitting your credit application form. Here are steps to address common problems:

A comprehensive look at sample credit application forms

Examining sample credit application forms can provide valuable insights. Different industries may have unique requirements that tailor the application to their needs. For instance, a home mortgage application may include specific questions about property details and down payments, while a personal loan application may focus more on monthly income and existing debts.

Understanding variations across different lenders is essential. Some lenders may require additional documents such as bank statements, while others only need basic information. Familiarizing yourself with these variations can prepare you for what to expect when applying.

Interactive tools for document management

Utilizing pdfFiller’s interactive features can significantly enhance your document management process. With its cloud-based solutions, you can access your credit application from any location, ensuring convenience and flexibility. The platform also allows you to track the status of your application, providing peace of mind as you await approval.

Cloud-based solutions further streamline collaboration with individuals or teams. This way, you can easily share documents and communicate requirements, no matter where you or your team members are located.

Frequently asked questions (FAQs)

As you navigate the credit application process, you may encounter questions. Here are some frequently asked ones:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the credit application electronically in Chrome?

Can I create an electronic signature for signing my credit application in Gmail?

How do I complete credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.