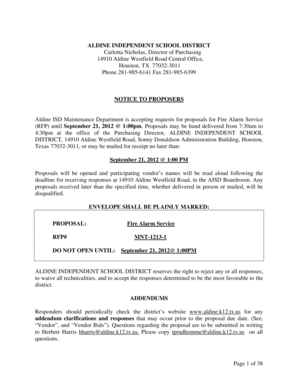

Get the free Travel Insurance Master Policy Certificate

Get, Create, Make and Sign travel insurance master policy

Editing travel insurance master policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out travel insurance master policy

How to fill out travel insurance master policy

Who needs travel insurance master policy?

Travel Insurance Master Policy Form: A Comprehensive How-to Guide

Understanding travel insurance master policy form

A travel insurance master policy form serves as a comprehensive insurance solution that provides protection for multiple travelers under a single policy. This form is fundamentally different from individual travel insurance policies, which cover only one person’s trip. The master policy typically targets organizations or groups, allowing them to manage travel risks collectively while simplifying documentation and claims processes.

Master policies are particularly beneficial for businesses, travel agencies, frequent travelers, and clubs, as they consolidate coverage, reduce administrative effort, and provide a group premium rate, which can often be more economical. Understanding the key differences between individual and master policies is crucial since individual policies tailor to personal trips, while master policies cater to broader travel needs across a large group.

Key components of a travel insurance master policy form

When filling out the travel insurance master policy form, it's essential to understand the key components included in the policy. These components lay the ground for any coverage you will be receiving. For instance, the coverage types, limitations, exclusions, policy limits, and deductibles are all part of the broader framework of the insurance landscape.

However, the policy may come with limitations and exclusions such as pre-existing conditions and certain activities that are not covered. Understanding these limitations is critical for avoiding surprises when filing claims. Additionally, comprehending the policy limits and deductibles will help travelers gauge their financial responsibilities in different scenarios.

Who should use a travel insurance master policy?

A travel insurance master policy is ideally suited for specific groups, facilitating comprehensive and efficient coverage. Organizations and businesses with employees who frequently travel for work can benefit significantly. Similarly, travel clubs or frequent travelers can utilize the master policy for group trips, streamlining insurance management and reducing costs.

For corporates managing employee travel, a master policy provides assurance and security to staff members while on business trips, minimizing legal risks for the organization. The collective nature of the master policy translates to lower premiums, making it a financially sound choice for large groups. Each group can leverage these policies for distinct advantages that suit their specific travel needs.

Preparing to fill out the travel insurance master policy form

Filling out the travel insurance master policy form requires meticulous preparation to ensure accurate and comprehensive submission. Essential information includes the traveler’s details, comprising names, ages, and contact information, tailored to each individual within the group. Trip details such as travel dates, destinations, and purpose, as well as specific coverage needs, are also critical for a successful application.

Additionally, gathering supporting documents like previous policy documents, IDs, travel documentation, and payment methods will streamline the process. Proper preparation will boost your chances of swift processing, making your travel experience smooth and secure.

Step-by-step guide to filling out the travel insurance master policy form

Completing the travel insurance master policy form might seem daunting, but breaking it down section by section can simplify the process. Start with personal information where you will list each traveler's details, ensuring that all information is accurate and legible. Next, proceed to trip details, providing crucial information concerning dates, travel locations, and any other pertinent trip-related factors.

It's essential to double-check entered values to avoid any errors that could lead to complications in claims. Reading and clarifying coverage limitations is also advisable to avoid misunderstandings later on. A thorough review will help ensure your policy meets your specific needs without unexpected restrictions.

Utilizing interactive tools on pdfFiller

Engaging with interactive features on pdfFiller enhances user experience significantly. The platform offers e-signature capabilities allowing seamless approval processes without the need for printing and scanning. This aspect is especially useful when multiple stakeholders are involved, ensuring swift responses and improved communication. Additionally, pdfFiller’s real-time collaboration tools enable team members to review, edit, and finalize documents efficiently.

Navigating these interactive tools is straightforward. Users can upload and edit their travel insurance master policy form directly on the platform. By sharing documents, you can request signatures or feedback from team members, ensuring that the final version of the document aligns with everyone's expectations before submission.

Managing your travel insurance master policy online

Managing your travel insurance has never been easier with digital solutions available online. By accessing your policy through pdfFiller, you can view and store your entire policy in a secure cloud-based environment. This ensures that you have easy reference to essential documents whenever you need them, whether for review or claims.

Being proactive about modifications means you prepare for any unexpected changes in your travel plans. By utilizing the online tools available, you can ensure your coverage is always relevant and effective.

FAQ section: Common queries about travel insurance master policy form

Travelers often have pressing questions about their travel insurance and the master policy form. For instance, if you need to change your details post-submission, it is vital to contact your insurance provider directly to make the necessary adjustments. Timely communication ensures that your information is accurate and up-to-date, particularly essential for claims processes.

Best practices for choosing a travel insurance provider

Selecting the right travel insurance provider is crucial to ensuring you receive the best coverage for your needs. To make informed decisions, comparing different providers based on policy features is essential. Look for coverage specifics like trip cancellation options, medical coverage caps, and customer support availability to gauge what would work best for your situation.

Critical factors to keep in mind include customer service ratings and claims response times, as these can directly impact your experience during an emergency. A provider that responds promptly to claims is invaluable, particularly in high-stress travel situations.

Final thoughts on maximizing your travel insurance experience

Maximizing your travel insurance experience primarily hinges on understanding your coverage. Read through your policy thoroughly to identify what is included and any limitations, ensuring you are well-prepared should the need to file a claim arise. Staying informed about any policy changes is equally important, as this can affect the security and effectiveness of your coverage.

Lastly, maintaining open communication with your insurance provider can foster a more conducive relationship, enhancing customer service and support during your travels. By following these comprehensive insights into the travel insurance master policy form, you can navigate your insurance needs confidently and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit travel insurance master policy in Chrome?

How do I complete travel insurance master policy on an iOS device?

How do I complete travel insurance master policy on an Android device?

What is travel insurance master policy?

Who is required to file travel insurance master policy?

How to fill out travel insurance master policy?

What is the purpose of travel insurance master policy?

What information must be reported on travel insurance master policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.