Get the free Ccf_gift Annuity_brochure

Get, Create, Make and Sign ccf_gift annuity_brochure

Editing ccf_gift annuity_brochure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ccf_gift annuity_brochure

How to fill out ccf_gift annuity_brochure

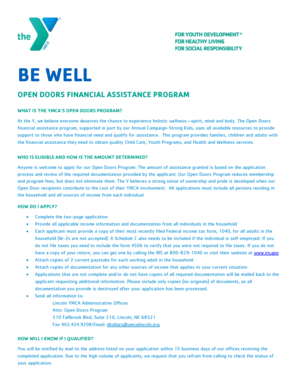

Who needs ccf_gift annuity_brochure?

Comprehensive Guide to the ccf_gift annuity_brochure form

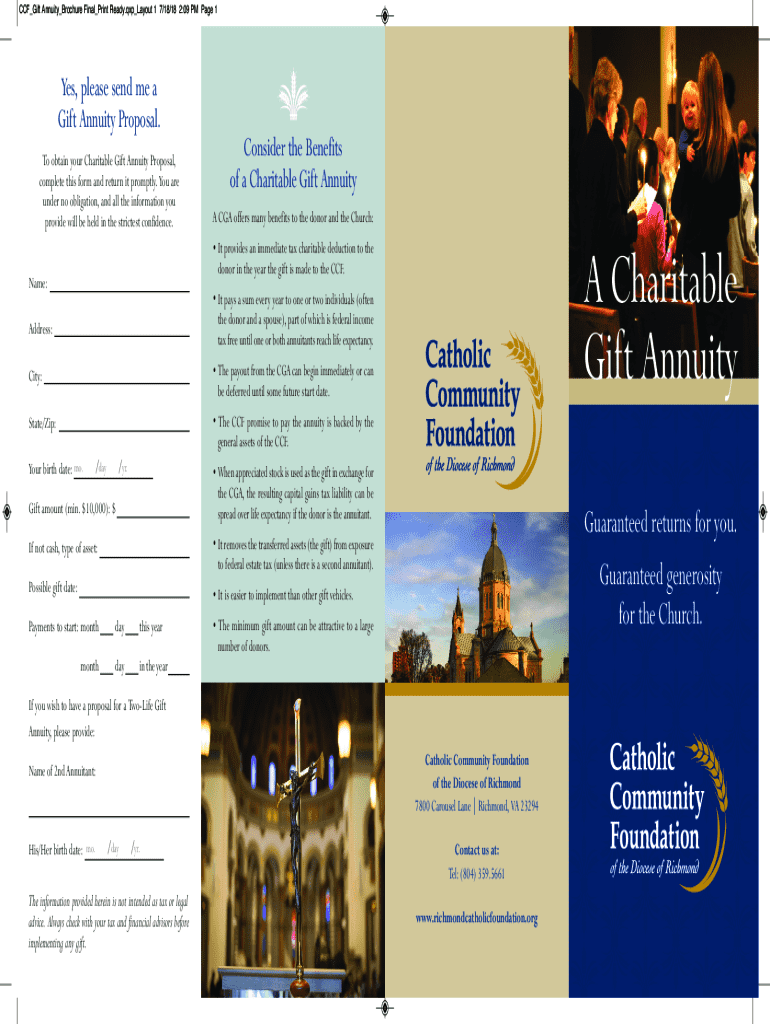

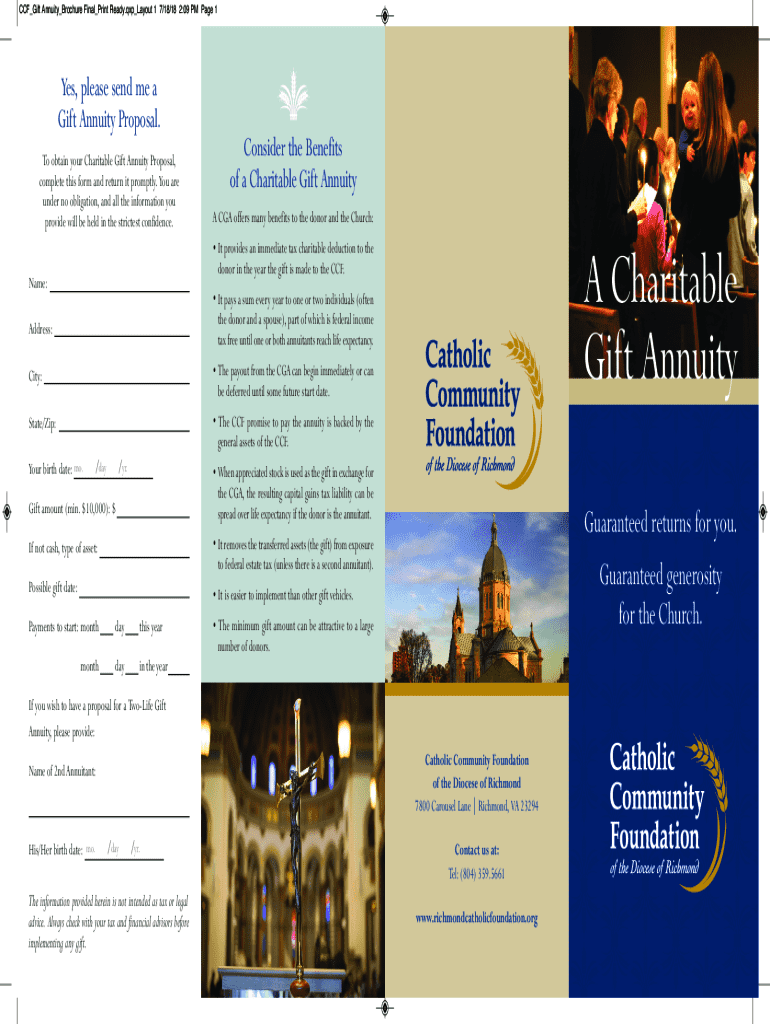

Understanding charitable gift annuities

Charitable gift annuities (CGAs) serve as a powerful tool for both donors and charitable organizations. Simply put, a CGA is a financial arrangement where a donor makes a contribution to a charity in exchange for a promise of fixed annual payments for the donor's lifetime. This not only secures income for the donor but also provides critical funding for charitable causes.

Benefits of establishing a charitable gift annuity

Donors reap multiple benefits from charitable gift annuities. First and foremost, they receive a guaranteed lifetime income stream, which can help stabilize their financial future. This is particularly beneficial for retirees seeking steady cash flow without the worry of market fluctuations.

Moreover, there are notable tax advantages, as part of the contribution may be deductible from income taxes, and portion of the annuity payments may be tax-free. This dual benefit of income and tax deduction makes CGAs an attractive option for many.

Exploring the charitable gift annuity fact sheet

A charity’s fact sheet detailing their CGA program typically outlines key facts and figures. This document serves as an essential resource for potential donors, providing succinct insights into how CGAs work and how they compared to alternatives like charitable remainder trusts or direct gifts.

Donors often have questions regarding payout rates, tax implications, or the organization's financial stability. A well-structured fact sheet addresses these queries, ensuring clarity and confidence in the donation process.

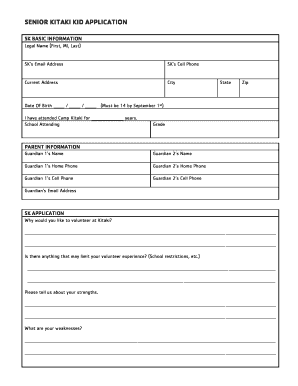

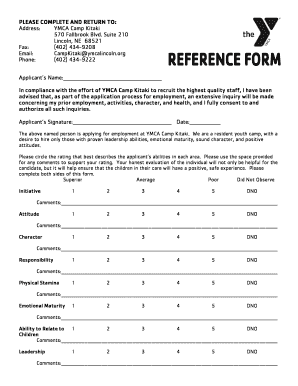

Step-by-step guide to completing the charitable gift annuity brochure form

Filling out the ccf_gift annuity_brochure form is a straightforward procedure when you know what to include. The primary sections of the form generally consist of personal details, specifics about the gift, and beneficiary information.

Start by providing accurate personal information, such as full name, address, and contact details. Next, enter relevant details about the gift, including the type of asset and its estimated value. Finally, make sure to specify the beneficiaries who will receive the annuity payments.

Utilizing interactive tools for charitable gift annuity management

Accessing the pdfFiller platform can streamline the process of managing your charitable gift annuity paperwork. This robust tool allows for easy editing of PDFs and includes features like eSigning, making it more convenient to handle documents securely and efficiently.

Additionally, pdfFiller encourages real-time collaboration, making it easier for teams to work together on various documents. Save your completed forms directly to the cloud and share them with stakeholders for feedback.

Common scenarios for using a charitable gift annuity

Charitable gift annuities are particularly advantageous in various life scenarios. For example, retired individuals can establish CGAs to guarantee a steady income stream while simultaneously supporting a cause they care about. This setup allows them to secure their financial future while contributing to charitable organizations.

In contrast, these annuities also play a vital role in estate planning. By creating a CGA, individuals can ensure a legacy that supports specific charities while also enjoying potential tax benefits during their lifetime.

How to give through charitable gift annuities

Funding a charitable gift annuity can take various forms, whether through cash, securities, or even real estate contributions. Each method has its own advantages and implications for both income and tax benefits, making it crucial for donors to understand their options.

For instance, cash contributions provide immediate funding, while securities can leverage potential appreciation. Real estate donations create both income and the possibility of significant tax deductions that could carry forward to future years.

Exploring annuity payments: income now or income later?

One of the most appealing aspects of charitable gift annuities is flexibility in payout options. Donors typically have the choice to either receive payments immediately or defer them to a later date. This decision can have significant implications for both current income and future financial planning.

Understanding when to take payments can help maximize financial outcomes according to personal needs and tax situations. Tailoring payments to fit financial goals is essential, particularly for those planning retirement or managing other financial commitments.

Calculating your benefits: tools and resources

Calculating the potential benefits of a charitable gift annuity can be simplified through various online tools that help assess expected payments and tax implications. Many charities offer calculators that allow prospective donors to customize parameters based on age, gift amount, and other relevant factors.

Utilizing these tools will help donors make informed decisions by evaluating how CGAs fit into their overall financial strategy. Understanding the financial impact of a CGA over time is critical for ensuring that donors maximize both income and charitable impact.

Frequently asked questions about the charitable gift annuity process

Potential donors often have common queries about the steps involved in completing the ccf_gift annuity_brochure form. It's essential to clarify concerns regarding legal implications, payment structure, and the security of contributions. By addressing these misunderstandings, aspiring donors can feel more confident in their philanthropic efforts.

Some donors might worry about the rigidity of commitments or the tax consequences of contributions. Providing clear and concise answers to these common questions is crucial for empowering individuals to make informed philanthropic decisions.

Next steps after completing the charitable gift annuity brochure form

Once you've filled out the ccf_gift annuity_brochure form, the next logical step is submission. Most organizations will specify how to send in completed forms, whether electronically or through traditional mail. Make sure to double-check that all required fields are filled out correctly to avoid any potential delays.

After submission, keep an eye out for follow-up communications, whether confirmation of receipt or further instructions regarding the management of the gift annuity. Tracking your annuity's progress is vital to ensuring transparency and satisfaction with your philanthropic contributions.

Contact information for further support

For any additional questions, pdfFiller provides a wealth of resources to assist users with the ccf_gift annuity_brochure form. Their platform is designed to empower users in managing their documents and offers various support channels, including live chat and customer service emails.

Whether you need help in completing the form or have questions related to tax implications, pdfFiller’s team is readily available to ensure your charitable giving experience is smooth and beneficial.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ccf_gift annuity_brochure for eSignature?

How do I make changes in ccf_gift annuity_brochure?

How do I fill out the ccf_gift annuity_brochure form on my smartphone?

What is ccf_gift annuity_brochure?

Who is required to file ccf_gift annuity_brochure?

How to fill out ccf_gift annuity_brochure?

What is the purpose of ccf_gift annuity_brochure?

What information must be reported on ccf_gift annuity_brochure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.