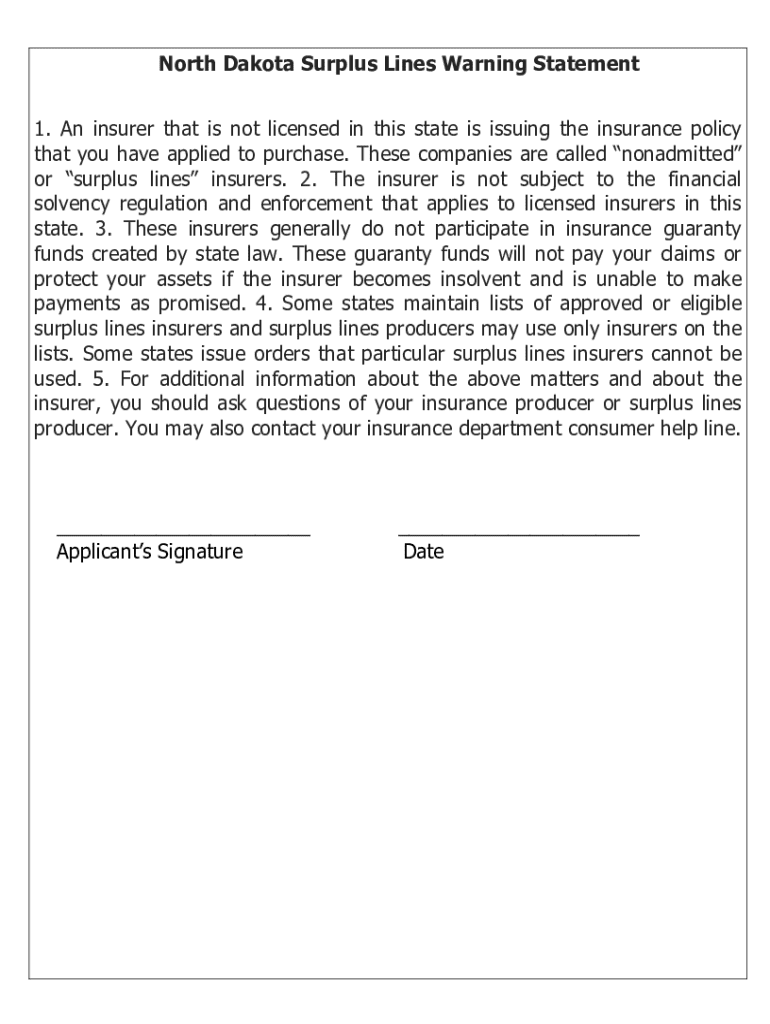

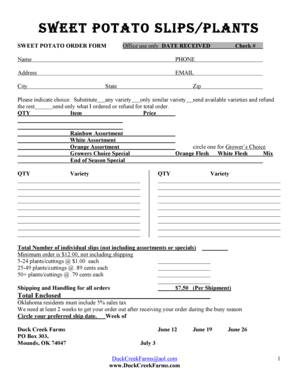

Get the free North Dakota Surplus Lines Warning Statement

Get, Create, Make and Sign north dakota surplus lines

How to edit north dakota surplus lines online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north dakota surplus lines

How to fill out north dakota surplus lines

Who needs north dakota surplus lines?

Navigating the North Dakota Surplus Lines Form: A Comprehensive Guide

Overview of surplus lines insurance in North Dakota

Surplus lines insurance plays a crucial role in North Dakota’s insurance landscape, designed to cover risks that cannot be found through standard insurance channels. This form of insurance offers a solution for policyholders who require specialized coverage, ensuring their unique needs are met effectively.

The significance of surplus lines lies in its ability to fill gaps in coverage, particularly for higher-risk industries or unique business ventures. It is governed by a robust set of regulations to maintain integrity and reliability in coverage availability in North Dakota. These regulatory frameworks are designed to protect consumers while ensuring that only qualified insurers operate within the state.

Understanding the North Dakota surplus lines form

The North Dakota surplus lines form is paramount in documenting the placement of surplus lines coverage in the state. This form collects essential information about the insurance transaction, ensuring regulatory compliance while facilitating communication between agents and the state.

Accurate completion and submission of this form is critical; any inaccuracies can lead to delays or issues in policy issuance. Moreover, proper documentation is vital for auditing and maintaining transparency in insurance transactions.

Types of risks covered under surplus lines

Surplus lines insurance covers a myriad of risks, especially those that conventional insurers shy away from. Examples include high-risk liability coverage for contractors, environmental liability, and professional liability for specialized professions. Each of these categories often requires unique coverage provisions due to their inherent risks.

Industries such as construction, entertainment, and technology are prime candidates for surplus lines. For instance, a technology startup developing new software might need error and omissions coverage that is not typically available through standard carriers.

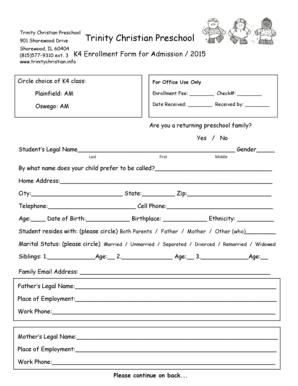

Eligibility requirements for surplus lines insurers

To qualify as a surplus lines insurer in North Dakota, certain eligibility criteria must be met. These criteria ensure that only financially stable and reputable insurers can provide surplus lines coverage. Insurers must be licensed outside of North Dakota and are typically required to maintain a certain level of financial performance.

Verification of an insurer’s eligibility involves checking their financial ratings, licensing status, and compliance with state regulations. The North Dakota Insurance Department maintains a list of approved surplus lines insurers, which agents should reference before proceeding with any transactions.

Step-by-step guide to filing the North Dakota surplus lines form

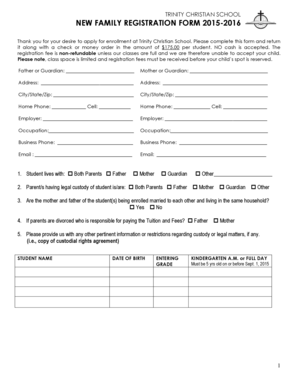

Step 1: Gathering necessary information

Before filling out the North Dakota surplus lines form, agents need to gather relevant data, including policyholder details, risk information, and coverage specifications. Having this information at the ready can expedite the form completion process.

Effective communication with the policyholder can facilitate quick access to the necessary data points. Make sure to also check if supplementary documentation is needed based on the individual risk’s requirements.

Step 2: Completing the surplus lines form

Completion of the surplus lines form requires attention to detail. Generally, every section of the form must be accurately filled, including:

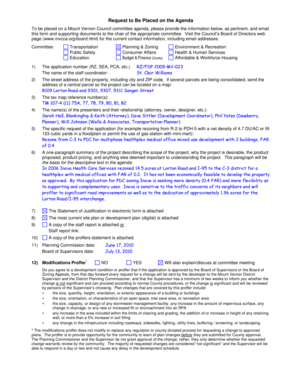

Step 3: Submitting the surplus lines form

Once the surplus lines form is completed, submission can be carried out via several methods including online filing or through physical mail. Agents must be mindful of submission guidelines and deadlines set by the North Dakota Insurance Department.

Late submissions can incur penalties and may affect the coverage status. Regular filing schedules and maintaining a keen awareness of deadlines will help ensure compliance.

Recordkeeping best practices for surplus lines transactions

Effective recordkeeping is crucial for all surplus lines transactions. This not only helps maintain compliance but also supports quick access to information during audits. Keeping comprehensive records of all filings, communications, and policy documents ensures that no essential detail is overlooked.

Recommended documents to retain include all submitted forms, correspondence with policyholders, and proof of premium payments. Adequate retention periods should align with North Dakota’s regulations, often suggesting a minimum duration to keep records post-policy expiration.

Quarterly filings and annual reporting requirements

North Dakota mandates regular quarterly filings and annual reporting from surplus lines agents. These filings help ensure that all transactions are accounted for and adhere to state laws. Keeping precise records will facilitate these reporting processes.

Key dates for quarterly filings include the end of each calendar quarter, with specific deadlines set by the North Dakota Insurance Department for submission. Annual reports typically summarize the year's filings and provide a comprehensive overview of all surplus lines activities.

Provisions for audits and cancellations

Audit procedures for surplus lines transactions are a critical aspect of maintaining regulatory oversight. The North Dakota Insurance Department may conduct audits to verify compliance with regulations and to ensure that all transactions have been accurately reported.

If a cancellation of a surplus lines policy is necessary, there are specific protocols that must be followed. This often includes notifying the insured, filing appropriate forms, and addressing any financial implications related to the cancellation.

Frequently asked questions (FAQs) about surplus lines in North Dakota

Many agents and policyholders have questions regarding surplus lines and the corresponding forms. Common queries often pertain to the eligibility of risks, submission processes, and necessary documentation. Addressing these questions is vital for ensuring understanding and compliance in transactions.

For instance, agents frequently ask about the types of risks that qualify for surplus lines coverage, while policyholders might inquire about premium calculations and the coverage limitations imposed by surplus lines policies.

Support and resources for surplus lines insurance

For those navigating the North Dakota surplus lines form, access to reliable support and resources is crucial. The North Dakota Insurance Department provides guidance and assistance for both agents and policyholders. Their contact information is readily available for consultations regarding surplus lines.

In addition, using platforms like pdfFiller can enhance the experience of managing surplus lines documentation. With tools for editing, signing, and collaborating on forms, pdfFiller empowers users to streamline their processes efficiently.

Innovations in surplus lines insurance management

The evolution of technology has brought significant advantages to surplus lines insurance management in North Dakota. Going paperless provides numerous benefits including cost savings, efficiency, and enhanced data security. Using digital platforms, agents can submit forms quickly and securely, reducing the chance of errors.

Technology-driven solutions, such as those offered by pdfFiller, streamline compliance tracking, making it easier for agents to stay informed about changes to regulations and reporting requirements. These innovations not only simplify the filing process but also empower users to manage their documents seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify north dakota surplus lines without leaving Google Drive?

How do I complete north dakota surplus lines online?

How do I fill out north dakota surplus lines on an Android device?

What is north dakota surplus lines?

Who is required to file north dakota surplus lines?

How to fill out north dakota surplus lines?

What is the purpose of north dakota surplus lines?

What information must be reported on north dakota surplus lines?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.