Get the free Property Exemptions Trust & Life Estate Certification Form

Get, Create, Make and Sign property exemptions trust life

Editing property exemptions trust life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property exemptions trust life

How to fill out property exemptions trust life

Who needs property exemptions trust life?

Property exemptions trust life form: A comprehensive guide

Understanding property exemptions

Property exemptions refer to specific allowances that exempt owners from certain taxes associated with their properties. These exemptions are crucial tools for tax relief, enabling individuals to retain more of their income by reducing the taxable value of their property. By understanding property exemptions, homeowners can significantly lower their property taxes, affording them more financial flexibility.

The types of property exemptions can vary widely by region, but commonly include:

Overview of trust life form

A trust life form is a legal document that establishes a trust to hold and manage property for the benefit of designated beneficiaries. This mechanism can be particularly advantageous when seeking property exemptions since it allows for the strategic placement of assets in a manner that can maximize tax benefits.

The benefits of using a trust life form for property exemptions include:

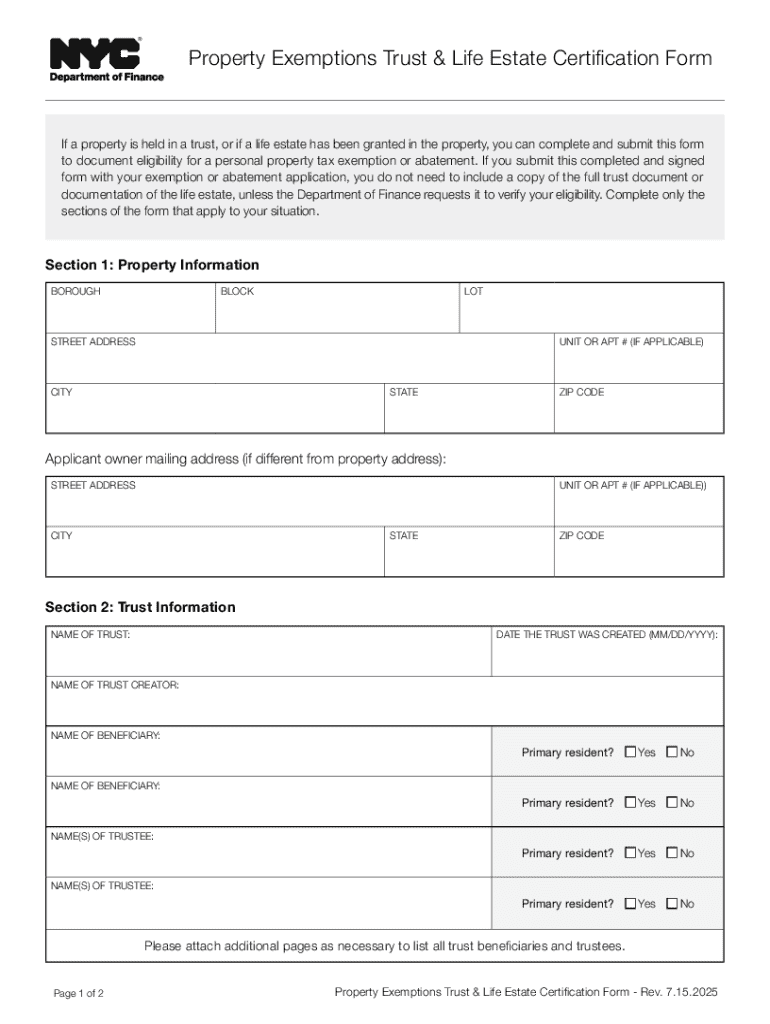

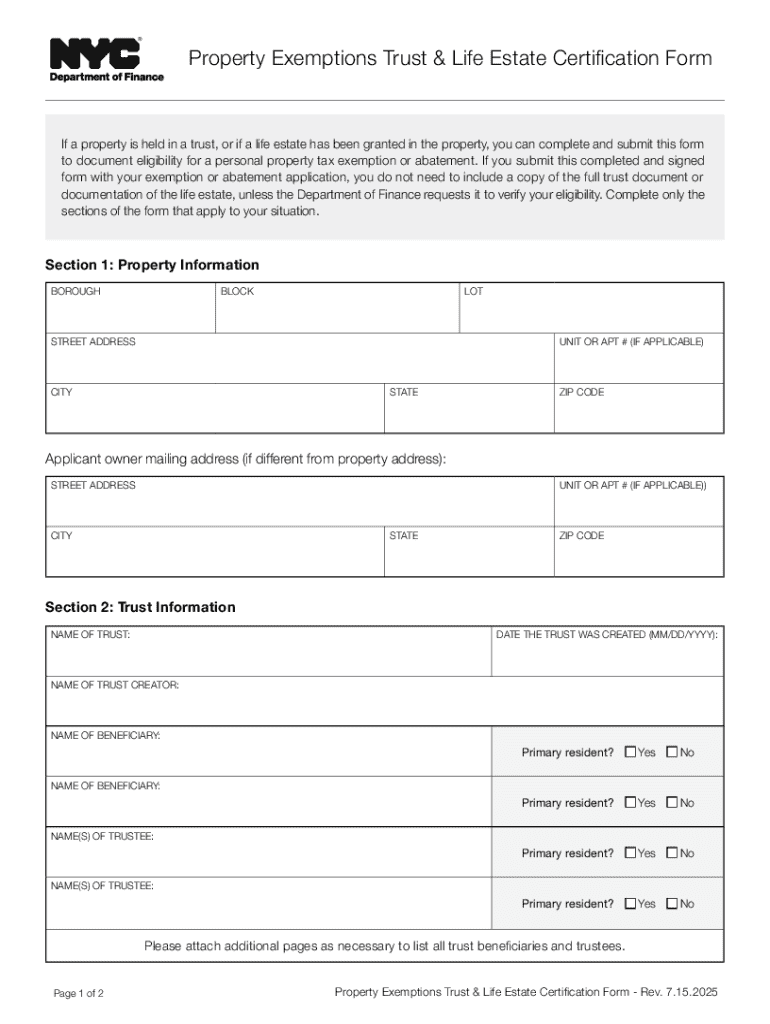

A trust life form generally consists of key components such as trust information, property details, and beneficiary designations. Each element plays a fundamental role in ensuring that the trust functions effectively and meets legal requirements.

Eligibility criteria for property exemptions

Qualifying for property exemptions is not a one-size-fits-all process. Generally, the following factors determine eligibility:

Steps to complete the property exemptions trust life form

Successfully completing the property exemptions trust life form involves several careful steps, beginning with gathering all necessary documentation. Essential documents include:

Following documentation, filling out the form can be broken down into these sections:

Common mistakes during completion include leaving out crucial information, not signing the form, or submitting incomplete documentation. Taking time to review thoroughly can mitigate these issues.

Editing and managing your property exemptions trust life form

Utilizing platforms such as pdfFiller to edit your property exemptions trust life form can enhance your document management experience. To begin, upload your form to pdfFiller. This process easily allows for making necessary adjustments.

Key features available on pdfFiller include:

For those collaborating on an application, pdfFiller allows multiple users to work on the same document, streamlining the process and saving time.

Submitting your property exemptions trust life form

Understanding submission methods is crucial for a successful application. You generally have two main options: online submission or through traditional mail. Each method has its procedures and time frames.

Be mindful of important deadlines; failing to submit your form on time can jeopardize your exemption eligibility. After submission, tracking your application status may vary by jurisdiction, so familiarize yourself with the relevant process to follow updates.

What to do after submission

After submitting your property exemptions trust life form, it’s vital to monitor its status. This can usually be done through the local assessment office or the respective agency governing property taxes.

If you encounter a denial of your application, there are steps you can take, including:

Interactive tools and resources

To assist you further, utilizing interactive tools like a property exemption calculator can help estimate potential savings. Additionally, FAQs addressing common queries can provide clarity on complex topics.

Links to additional government forms and regulations may also be beneficial, guiding you through the necessary paperwork efficiently.

Customer support for property exemptions

If you need assistance at any stage, contacting pdfFiller can be invaluable. The platform offers various support options, including live chat and email inquiries.

Recognizing the diverse needs of users, pdfFiller also provides language assistance, making it easier for individuals with varying language backgrounds to navigate the application process.

Community support resources and forums are also available, fostering a collaborative atmosphere where users can share insights and experiences.

Case studies and success stories

Exploring real-life examples of successful property exemption applications highlights the transformative impact of the process. Consider individuals who, through meticulous attention to their trust life forms and an understanding of property exemption criteria, managed to significantly reduce their tax burdens.

These stories not only inspire but also illustrate how strategic planning can influence property tax management, making homeowners more confident in navigating their financial futures.

Maximizing your property exemption benefits

Finally, to optimize your property exemption benefits, it's crucial to maintain compliance with applicable regulations. Regularly reviewing your property status, keeping updated on changing laws, and ensuring your trust is aligned with your financial planning aspirations can help leverage your exemptions effectively.

By exploring additional benefits available through trusts and incorporating your exemptions into financial strategies, you can ensure your property continues to serve as a foundation for security and growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit property exemptions trust life from Google Drive?

Can I create an electronic signature for the property exemptions trust life in Chrome?

How can I fill out property exemptions trust life on an iOS device?

What is property exemptions trust life?

Who is required to file property exemptions trust life?

How to fill out property exemptions trust life?

What is the purpose of property exemptions trust life?

What information must be reported on property exemptions trust life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.