Get the free Official Form 410

Get, Create, Make and Sign official form 410

Editing official form 410 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 410

How to fill out official form 410

Who needs official form 410?

Official Form 410 Form: A Comprehensive How-to Guide

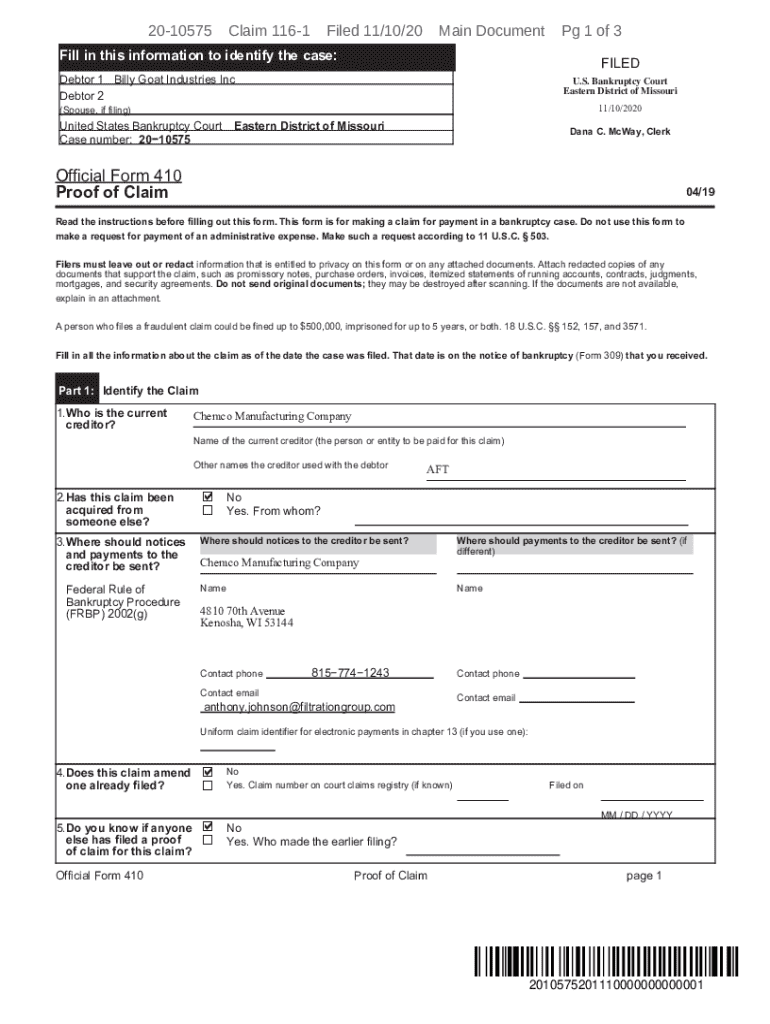

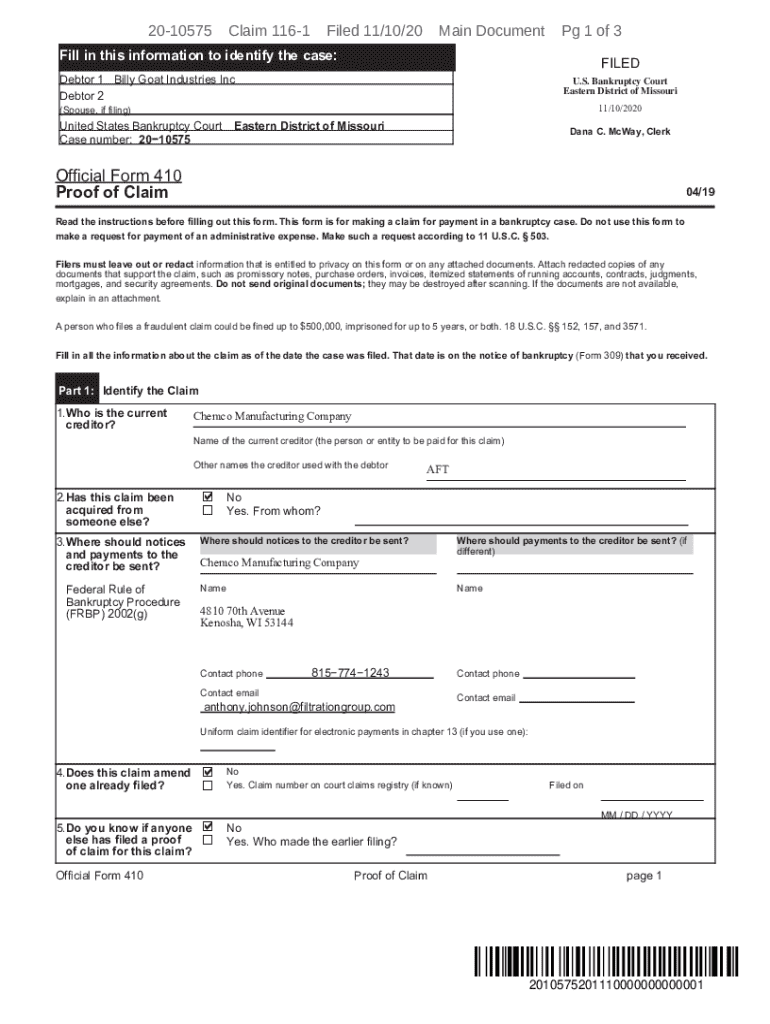

Overview of Official Form 410

Official Form 410 is a critical document used in bankruptcy proceedings, particularly for individuals and businesses filing under Chapter 13. It serves as a guide for debtors to report their financial status, proposed repayment plans, and other essential details necessary for court approval. Using this form correctly is vital as it helps ensure that the bankruptcy process proceeds smoothly and legally.

The importance of accuracy in completing Official Form 410 cannot be understated. Any errors or omissions can result in delayed proceedings or even dismissal of the bankruptcy case. Therefore, understanding its nuances is crucial for those involved in the process.

Getting started with Official Form 410

To begin your journey with Official Form 410, the first step is locating the form itself. It's readily available for download from various government websites, including the U.S. Courts website, which provides accurate and updated versions of all official bankruptcy forms.

Additionally, you can use platforms like pdfFiller to find and fill out the form easily. pdfFiller offers an intuitive interface for document management, making it ideal for accessing Official Form 410.

Required information and documentation

Before filling out Official Form 410, gather the necessary documentation that reflects your financial situation. Key documents include income statements, bank account statements, information on debts, and a list of creditors. Collecting all pertinent information beforehand streamlines the completion process and assures the accuracy of the data entered.

Step-by-step instructions for completing Official Form 410

Completing Official Form 410 can seem daunting, but breaking it down into sections simplifies the process. Each section requires careful attention to detail, beginning with the basic debtor information. Thereafter, you will provide details regarding your income, expenses, debts, and proposed repayment plans. Here’s a brief overview of what to expect:

While filling out each section, be mindful of common pitfalls such as underreporting income or failing to list all debts. Both can have significant consequences on your bankruptcy filing.

Filling the form using pdfFiller

Using pdfFiller to complete Official Form 410 makes the process even more efficient. Start by uploading the downloaded form onto the platform. Upon opening the document, pdfFiller's interactive tools allow you to fill in your details seamlessly. You can click on the field you wish to complete, enter your information, and even save your progress.

Editing and customizing Official Form 410

After completing the form, you may need to make adjustments if mistakes are identified. Editing in pdfFiller is straightforward. Simply access the completed form, click on the section you wish to change, and edit the text as needed. This feature ensures that your submission reflects the most accurate information.

Additionally, you can add custom elements such as footnotes or clarifying information. This is particularly useful if there are nuances in your financial situation that need further explanation. Furthermore, pdfFiller allows you to incorporate your branding or personal touches, making your document stand out when shared.

Signing and sharing Official Form 410

Once your form is complete and accurately filled, the next step is to sign it. PdfFiller provides an easy eSigning function. To electronically sign Official Form 410, simply click on the designated signature field and follow the prompts to insert your signature. Electronic signatures are legally binding and accepted in most jurisdictions, including bankruptcy filings, so this is a reliable method of signing your documents.

Sharing the completed form is likewise hassle-free with pdfFiller. You can email the document directly from the platform, download it for personal records, or share it via secure links. Always remember to maintain the confidentiality of your financial data when sharing this sensitive information with relevant parties.

Managing Official Form 410 after submission

Tracking the status of your Official Form 410 submission is essential after filing. Check for any updates or communications from the court regarding your case. If there are issues, address them promptly to avoid further complications. Keeping communication open with your bankruptcy attorney can also provide clarity during this period.

Storing your documents properly post-submission ensures easy access for future reference. PdfFiller offers excellent options for archiving forms digitally, which allows you to retrieve past submissions quickly. Implementing a solid document management strategy will help keep your financial data organized and accessible.

Troubleshooting common issues

Completing Official Form 410 can lead to certain challenges. Common errors include inaccurate income reporting or omission of debts. Resolving these mistakes early prevents complications down the line. Always double-check entries before submission. If you do encounter issues, consult with a bankruptcy attorney to ensure you stay on the right track.

FAQs related to Official Form 410

Users frequently ask about the timelines for submission and possible repercussions of errors. It's advisable to consult the local bankruptcy court's guidelines or your attorney for detailed timelines and repercussions. Understanding these factors can better prepare you for what to expect after filing.

Leveraging pdfFiller for document management

PdfFiller offers robust features designed to streamline your document creation and management processes, including the ability to collaborate with multiple stakeholders. Tools like real-time editing, comment features, and version control make it easy to work in teams, ensuring that you're always on the same page.

The benefits of using a cloud-based platform like pdfFiller are extensive. You can access your forms from anywhere, utilize secure storage solutions, and benefit from the comprehensive integration of document management functionalities as opposed to traditional systems.

User testimonials and success stories

Hearing real-life experiences can provide insight into how users approach Official Form 410. Testimonies highlight how the convenience of pdfFiller significantly improved their filing experience. For example, many users report successfully navigating the bankruptcy filing process for Chapter 13 due to the step-by-step breakdown and ease of collaboration available on the platform.

Additionally, users shared stories about how having an organized document management system mitigated stress during an intricate process. Having everything accessible in one cloud-based platform allowed for quick adjustments, leading to timely submissions and reducing anxiety associated with legal proceedings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find official form 410?

Can I create an eSignature for the official form 410 in Gmail?

How do I complete official form 410 on an iOS device?

What is official form 410?

Who is required to file official form 410?

How to fill out official form 410?

What is the purpose of official form 410?

What information must be reported on official form 410?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.