Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

How to edit form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

A comprehensive guide to completing Form 5500-SF

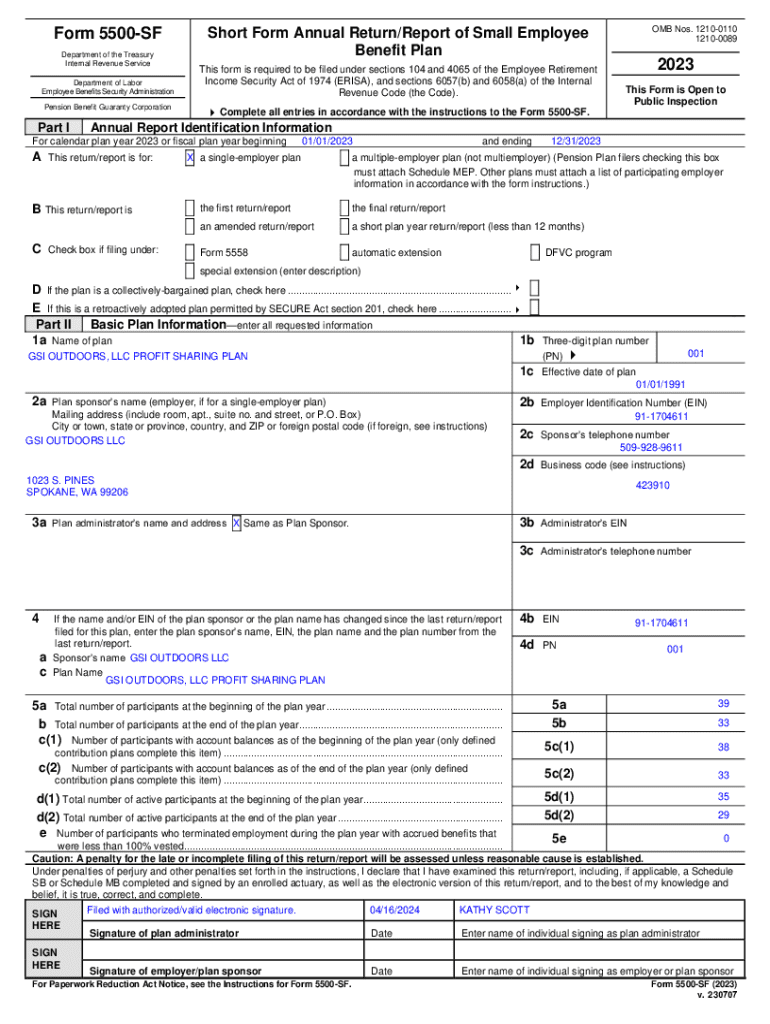

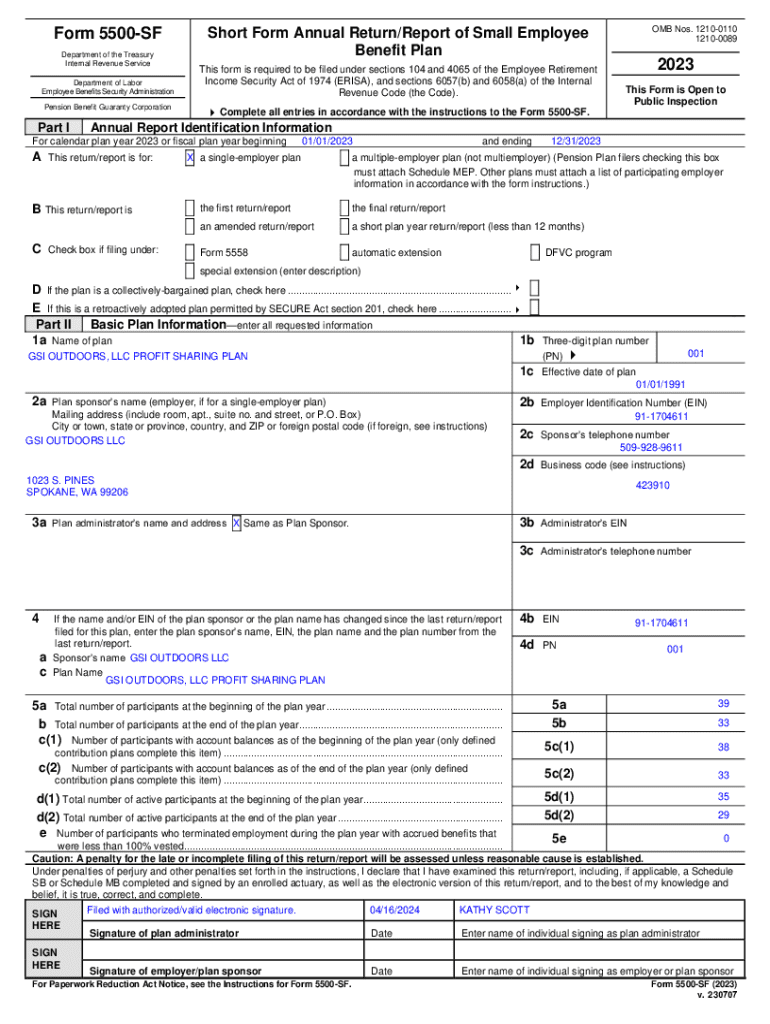

Overview of Form 5500-SF

Form 5500-SF serves as a streamlined alternative to the regular Form 5500, primarily aimed at small employee benefit plans. This form is crucial for ensuring compliance with the Employee Retirement Income Security Act (ERISA) and for reporting essential information about retirement plans, welfare benefit plans, and other types of employee benefit plans.

Essentially, any small employee benefit plan with fewer than 100 participants can leverage Form 5500-SF. By simplifying the reporting process, the form encourages accurate completion and timely submissions, thus supporting employees' benefits and the integrity of plan operations.

Types of plans required to file

Small employee benefit plans that can use Form 5500-SF include plans like 401(k) plans, health and welfare plans, and profit-sharing plans, provided they meet eligibility criteria under ERISA. In contrast, large plans exceeding 100 participants must file the full Form 5500, which includes additional data requirements.

To specifically differentiate, small plans typically have simplified reporting guidelines, allowing for less complex financial disclosures compared to their larger counterparts, which often face more stringent compliance standards and reporting demands.

Key features of pdfFiller for Form 5500-SF users

pdfFiller offers a range of features tailored to simplify the completion of Form 5500-SF. Users benefit from its cloud-based document management, allowing access from any device. This not only provides convenience but also enables collaboration across teams, facilitating easier communication and editing.

Furthermore, pdfFiller's edit and eSign capabilities enhance the filing experience. Users can easily modify text, add necessary notes, and ensure their digital signature is affixed without any hassle.

Comprehensive filing instructions

Completing Form 5500-SF necessitates adherence to specific guidelines. It's important to be aware of the filing deadlines to avoid delays that could lead to penalties. The filing can be done electronically through the ERISA Filing Acceptance System (EFAST2) or by mailing the form directly to the IRS. Electronic filing is considerably faster and should be the preferred method.

In streamlining the filing process, understanding each section of the form is crucial. The key parts include identification information, basic plan information, financial details, plan characteristics, compliance questions, pension funding compliance, and more.

Navigating common filing challenges

Navigating the intricacies of filing Form 5500-SF requires awareness of potential hurdles. Each year may bring updates to the filing process, making it essential to stay informed. For instance, adjustments for the 2023 filing cycle might include new compliance questions or changes in asset reporting requirements.

Additionally, if deadlines are missed, employers may utilize the Delinquent Filer Voluntary Compliance (DFVC) Program, which allows plans to rectify missed filings. However, understanding the penalties associated with late filings is crucial, as these can impact a plan's credibility and future compliance status.

Tools and resources for filing Form 5500-SF

To simplify the completion of Form 5500-SF, pdfFiller offers interactive tools designed specifically for tackling complex forms. The platform not only hosts the form but also provides various resources to assist users in understanding their filing requirements.

When additional support is needed, pdfFiller's customer service offers assistance with specific questions about the form. Users can also leverage community forums to exchange knowledge and receive insights from fellow filers.

Frequently asked questions about Form 5500-SF

As with any regulatory form, common questions often arise regarding Form 5500-SF. Those who qualify to file the form typically include employers with plans covering fewer than 100 participants, ensuring their plans align with ERISA requirements. After filing, if corrections are necessary, a new form may need to be submitted to reflect the changes accurately.

Furthermore, electronic filing requirements dictate that all Form 5500 submissions must occur through EFAST2 unless a specific exemption is met. Not filing at all can lead to severe repercussions, including financial penalties and loss of plan benefits.

Additional forms and extensions

When deadlines loom, understanding extensions is vital. Form 5558 is the official document to request an extension for Form 5500 filings and must be completed before the original due date. As a useful alternative, extending time can help avoid rushing through the form and ensure all information is accurate.

Exploring other options for filing extensions is also worthwhile. Various circumstances can allow for additional time, ensuring compliance while accommodating the need for meticulous reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 5500-sf?

How do I make changes in form 5500-sf?

Can I sign the form 5500-sf electronically in Chrome?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.