Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 - How-to Guide Long-Read

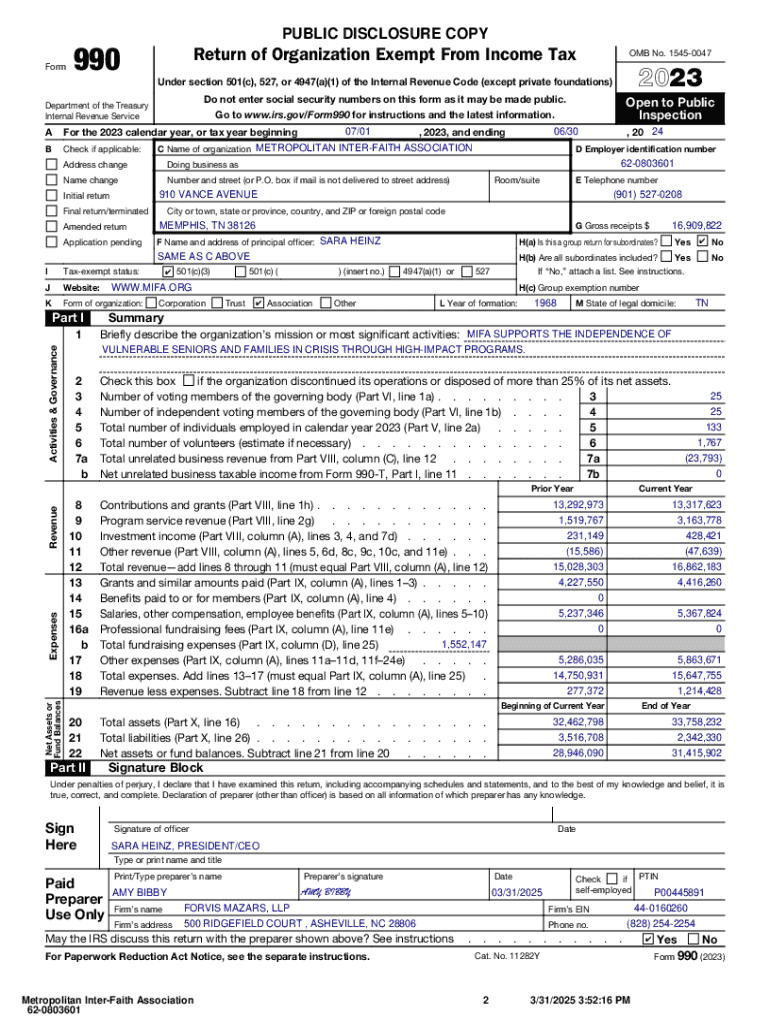

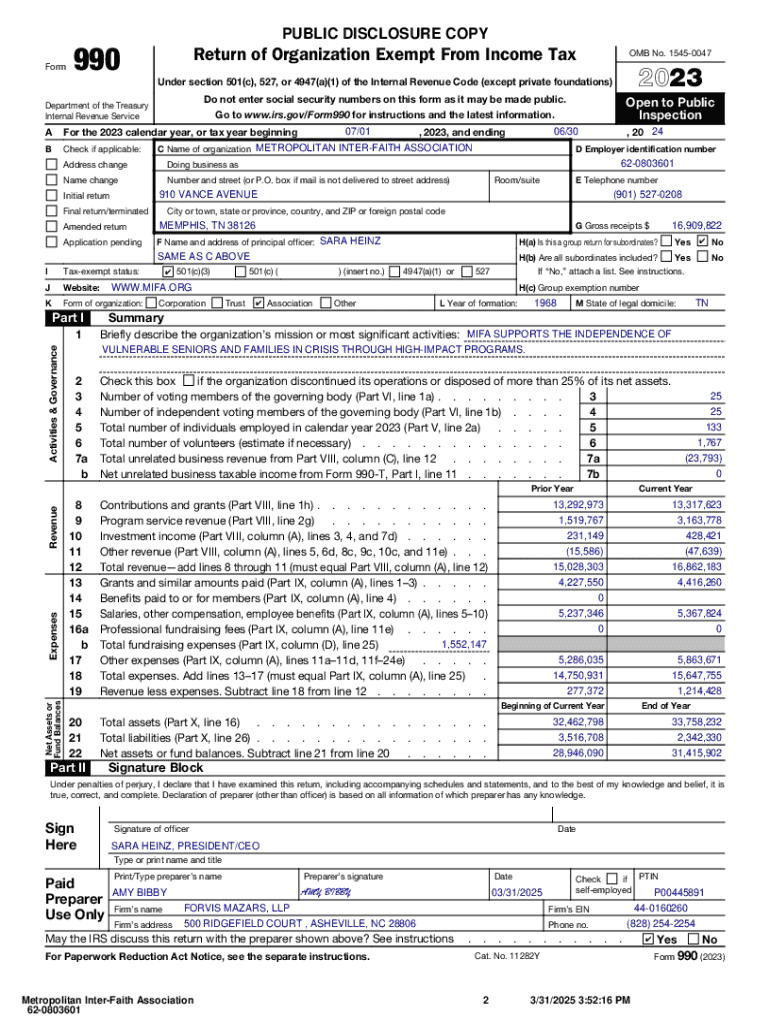

Overview of Form 990

Form 990 is an essential document used by non-profit organizations to report their financial information to the Internal Revenue Service (IRS). Its primary purpose is to provide transparency about an organization’s financial health, operational activities, and governance practices. This form is critical in ensuring non-profits maintain their tax-exempt status and offers invaluable information to donors, researchers, and the public.

The importance of Form 990 cannot be overstated. It operates as a financial report card for non-profits, detailing revenue, expenses, and program services. Beyond compliance, filing this form can help organizations demonstrate their accountability and build trust with stakeholders.

Who needs to file Form 990?

Essentially, any tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code must file Form 990 if its annual gross receipts exceed $200,000 or its total assets exceed $500,000. There are specific exceptions; for instance, churches, certain religious organizations, and governmental units might not need to file.

Understanding the structure of Form 990

Form 990 consists of various sections designed to capture a comprehensive view of a non-profit's activities. The main sections include: an overview of the organization's mission, a detailed account of its program services, its financial statements, and governance policies. Each of these components is crucial for the IRS to understand how the organization operates and utilizes its financial resources.

Common variants of Form 990 include Form 990-EZ and Form 990-N. Form 990-EZ is a simplified version for smaller organizations that still require some level of detail but do not meet the filing thresholds for the full Form 990. In contrast, Form 990-N, also known as the e-Postcard, is designed for smaller organizations with less complex financial information and gross receipts below $50,000.

Filing requirements and deadlines

Filing Form 990 is not just a suggestion; it’s a requirement for most non-profits. Organizations must file this form annually to remain compliant with IRS rules and maintain their tax-exempt status. Alongside the core document, various supplemental schedules might be required depending on the organization’s activities. These may include details on governance, compensation, and specific programs.

The standard deadline for filing Form 990 is the 15th day of the 5th month after the organization’s fiscal year ends. For organizations with a fiscal year ending December 31, this typically translates to a May 15 deadline. If additional time is needed, a six-month extension can be requested using Form 8868, although it’s crucial to note that this extension only applies to the filing date and not to the payment of any taxes owed.

Preparing to complete Form 990

Completing Form 990 is a meticulous task that requires careful preparation. Prior to filling out the form, organizations should gather all necessary documentation, including financial statements, records of donations, and data regarding program activities. Accurate record-keeping is paramount, as it not only streamlines the filing process but also ensures compliance with IRS standards.

Furthermore, understanding IRS guidelines is crucial to ensure that all information reported is accurate and complete. Organizations should familiarize themselves with IRS resources and guidelines, which frequently update due to changes in tax law or reporting requirements. Leveraging these resources can increase the confidence and accuracy of the data reported.

Step-by-step guide to filling out Form 990

Filling out Form 990 requires attention to detail. Here’s a section-by-section breakdown of important components when completing this form: Starting with Part I, organizations will give a summary of their mission and key achievements. Part II focuses on program services, where detailed descriptions and qualification of these activities must be explained.

Next, Part III outlines financial statements which require accuracy in reporting all sources of revenue and expenses. Special care should be taken in Part IV, which deals with governance and management practices, as this section reflects how well the organization is led and operated.

Utilizing interactive tools such as pdfFiller can alleviate the complexity of filling and editing Form 990. These tools enable organizations to efficiently manage their documentation and ensure accuracy in reporting.

Common mistakes to avoid when filing Form 990

Filing Form 990 is a process where mistakes can easily occur, and recognizing common errors is essential for accurate reporting. Frequent pitfalls include misreporting financial data and providing incomplete information. These mistakes can result in significant complications, including possible fines from the IRS or loss of tax-exempt status.

To mitigate errors, implementing best practices is vital. Double-checking entries and confirming that all required fields are complete can significantly enhance the accuracy of the filed document. Organizations may also want to seek professional assistance if they feel uncertain about specific details, as an accountant could provide valuable insights and ensure all financial information is correctly reported.

E-signing and document management with pdfFiller

Today's digital landscape offers remarkable tools for streamlining administrative tasks, and pdfFiller stands out with its e-signing capabilities. To eSign Form 990 using pdfFiller, users simply upload their completed form, select the e-sign tool, and follow the prompts to add their digital signature. This process not only makes submissions easier but also ensures a level of security and authenticity that is paramount in financial reporting.

Moreover, pdfFiller facilitates collaborative efforts among team members. The platform allows multiple users to edit and provide input on the document, ensuring everyone involved in the process can contribute effectively. This collaboration feature can be particularly beneficial in larger organizations where various departments may need to share information for comprehensive reporting.

Navigating post-filing processes

Once the Form 990 has been filed, there are subsequent responsibilities to uphold. One of these is compliance with public inspection regulations, which require organizations to make their Form 990 available for public review. This transparency not only promotes accountability but can also enhance the organization’s reputation among donors and the general public.

Organizations should also recognize the penalties for non-compliance. Late, incomplete, or incorrect filings can lead to fines, loss of tax-exempt status, or even audits by the IRS. Therefore, adhering to IRS regulations and deadlines is vital to maintaining compliance and ensuring sustained operational viability.

Using Form 990 for analysis and research

Form 990 is not merely an IRS requirement; it serves as a rich resource for evaluating non-profit organizations. Researchers, journalists, and even potential donors can dive into the data reported on these forms to assess the health and effectiveness of non-profits. Specific metrics, such as administrative costs versus program spending, can provide insight into how effectively an organization uses its resources.

Finding additional data becomes much simpler with third-party resources that compile and analyze Form 990 filings. Websites like the GuideStar or the Foundation Center aggregate this information to facilitate a deeper understanding of sector trends, individual organization performance, and overall financial health within the non-profit sector.

FAQs about Form 990

As organizations embark on the journey of filing Form 990, several frequently asked questions arise concerning eligibility, processes, and specifics of completion. Among the vital inquiries is whether an organization qualifies for a filing exemption. Many individuals also ask about the implications of late filings and what penalties may incur due to non-compliance.

Understanding these common queries is crucial for any non-profit leader or accountant involved in the filing process. By addressing these FAQs, organizations can navigate the complexities of Form 990 more effectively and ensure their reports reflect true operational status.

Additional tools and support from pdfFiller

pdfFiller is dedicated to empowering users with comprehensive document solutions, including a suite of interactive features designed specifically for managing Form 990. Users can easily edit, fill, and electronically sign documents, granting organizations the flexibility to handle their documentation needs from anywhere.

Furthermore, customer support is readily available to assist users in navigating any challenges they may face while using the platform. With a robust library of resources, video tutorials, and personalized assistance, pdfFiller equips users not only to complete Form 990 but to manage all their documentation with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 990 in Gmail?

How do I fill out the form 990 form on my smartphone?

How do I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.