Get the free 1099s Form

Get, Create, Make and Sign 1099s form

How to edit 1099s form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1099s form

How to fill out 1099s form

Who needs 1099s form?

Comprehensive Guide to the 1099s Form: Filing Made Easy

Understanding the 1099s form

The 1099s form is an essential tax document that serves multiple purposes, primarily focused on reporting certain types of income other than wages. Designed for independent contractors, freelancers, and certain types of payments, the 1099s form encompasses various reporting requirements to both the payee and the IRS. This form helps track income that a business or individual receives, ensuring transparency and compliance with tax obligations.

The significance of the 1099s form extends beyond just the payee; it also plays a crucial role in fulfilling IRS requirements. By issuing a 1099s form, businesses can correctly report payments made during the year, ensuring both the sender and recipient maintain accurate tax records. Common scenarios for issuing this form include hiring freelancers for a project or paying a landlord for rental agreements.

Who needs to use the 1099s form?

Eligibility to file a 1099s form encompasses a wide range of individuals and entities. Generally, if you pay someone $600 or more for services rendered, or if you have made certain types of payments like rent or royalties, you are required to file this form. This requirement comes with specific thresholds based on different types of payments, which are critical for both the payers and recipients.

Although the 1099s form is widely used, there are notable exceptions where it may not be necessary. For instance, payments made to corporations or certain types of service providers might not require a 1099 filing. Familiarizing yourself with these nuances can prevent unnecessary paperwork and ensure compliance with IRS regulations.

Step-by-step guide to filling out the 1099s form

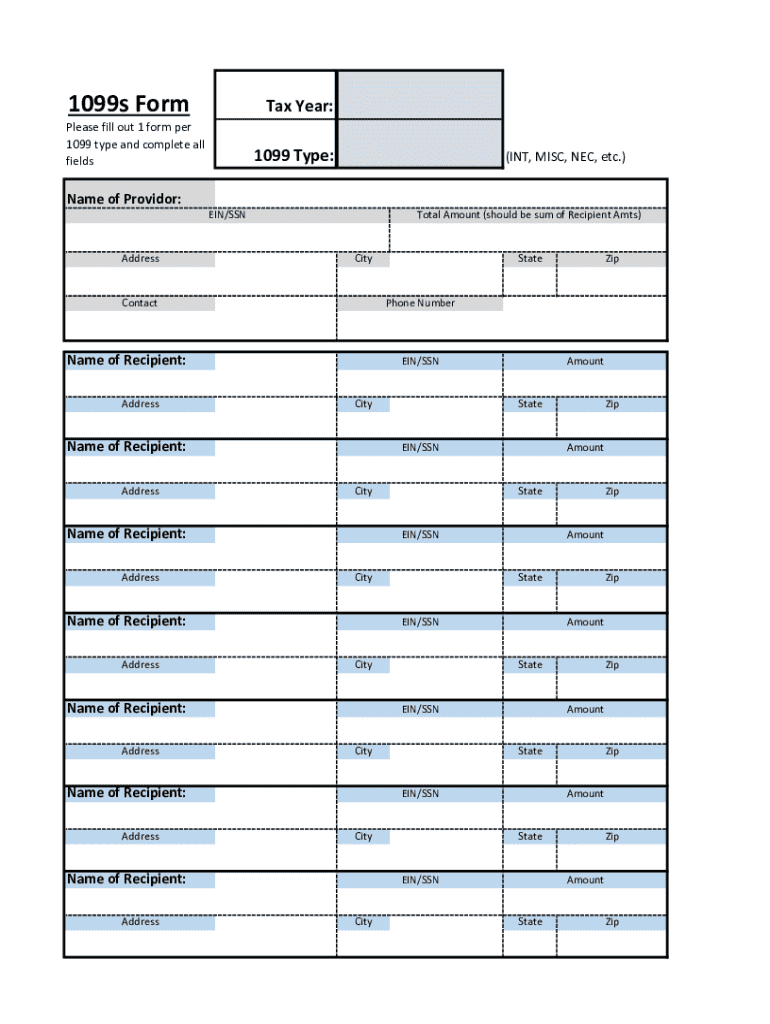

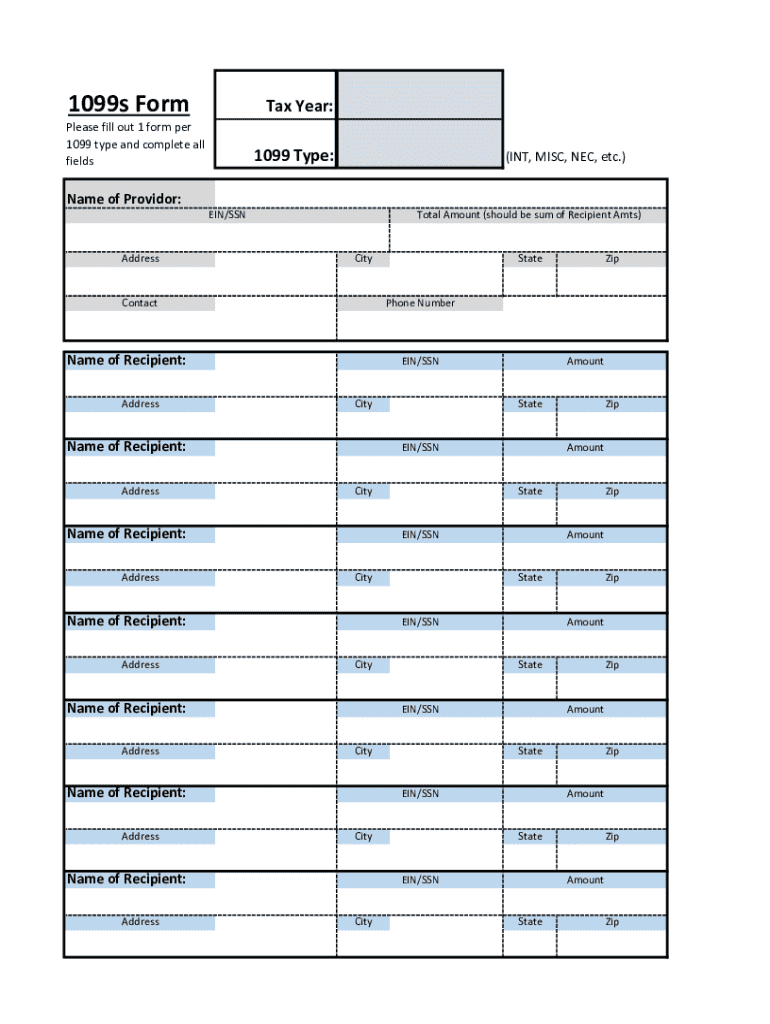

Filling out the 1099s form accurately is vital for compliance. Start by gathering necessary information about both the payee and payer. This includes names, tax identification numbers, and addresses. Thorough accuracy in data collection ensures that the reports filed are correct, reducing future issues with the IRS.

When you begin filling out the form, take note of the sections labeled Box 1 through Box 17. Each box requires specific information which can vary based on the type of income being reported. Common pitfalls include transposing numbers or entering incorrect amounts, leading to potential discrepancies that could complicate your tax situation later.

Before submitting the form, a thorough review is crucial. Double-checking entries ensures that you catch any mistakes, preventing complications that can arise from inaccuracies. Utilize tools available on platforms like pdfFiller to streamline data entry and enhance accuracy.

Electronic vs. paper filing

Deciding between electronic and paper filing for your 1099s form can significantly impact your experience. Electronic filing, such as through pdfFiller, offers several advantages including enhanced editing capabilities, collaborative options, and eSigning functionalities, which expedite the filing process. It allows for seamless interaction among team members and the ease of trackability.

For those who prefer traditional methods, paper filing instructions are straightforward. You can print the 1099s form, fill it out manually, and send it to the IRS via postal mail. Keep in mind, however, that paper filing may take longer to process, and mistakes can be more difficult to rectify.

Important deadlines to remember

Staying on top of filing deadlines for the 1099s form is crucial to avoid penalties. For electronic filing, the deadline is typically at least a month after the due date for paper filing. Generally, businesses must file their 1099s forms by January 31 of the following tax year. Late filings can result in fines ranging from $50 to $270, depending on how long after the deadline the form is filed.

Understanding the impact of missed deadlines is essential. The IRS imposes strict penalties, which can escalate the longer you wait to submit the correct documentation. Timeliness is key to avoid additional financial burdens.

Frequently asked questions about the 1099s form

Addressing common inquiries about the 1099s form can alleviate confusion for both filers and recipients. Mistakes on a 1099s form can often be corrected by filing a corrected version. If you do not receive a 1099s form that you believe you should have, it’s advisable to contact the payer directly. Knowing how to approach these situations can reduce stress and ensure compliance with tax obligations.

Misconceptions often arise around 1099s forms, particularly regarding who is required to submit them and the types of income that must be reported. Being informed is crucial for accurate reporting and avoiding penalties.

Frequently used terms in 1099s filings

Familiarity with terminology associated with the 1099s form can streamline your filing process. Common terms include 'payee', referring to the recipient of the payment, and 'payer', which designates the entity making the payment. Understanding 'gross income' is also essential, as it refers to the total income before any taxes or deductions.

Having a glossary of these terms readily available can be immensely helpful for reference while navigating the 1099s form. This ensures that all parties involved in the filing process have a clear understanding of their roles and responsibilities.

Managing your 1099s form

Proper management of your 1099s form involves not only filing accurately but also organizing your records systematically. Storing digital copies securely enhances accessibility while reducing the risk of losing vital documents. Methods such as using cloud-based platforms like pdfFiller can streamline this process, allowing for easy retrieval and sharing.

Utilizing pdfFiller for document management enhances your experience by ensuring all forms, including the 1099s form, are easily editable, signable, and shareable. This comprehensive solution allows individuals and teams to collaborate effectively, centralizing all documents in one cloud-based platform.

Additional resources and tools

Engaging with interactive tools and resources available on pdfFiller allows users to navigate the complexities of 1099s management effortlessly. These features offer templates and customizable options that can simplify the filing process significantly. Accessing relevant IRS resources is also critical for ongoing education about tax compliance, especially as legislation evolves.

Taking advantage of these resources can heighten your understanding of the tax process, making you a more informed taxpayer and enhancing your overall filing experience.

Learning from the past: A brief history of the 1099s form

The 1099s form is not a new concept; its origins date back to early 20th century tax practices, evolving significantly to accommodate the changing economic landscape. Initially, it was a means to track self-employed income but has now expanded to include various payment categories. Recent changes in tax legislation have further adapted the form to ensure proper reporting mechanisms are in place.

Understanding this history not only provides context but also emphasizes the importance of staying informed about ongoing changes in tax regulations, which can affect how the 1099s form is utilized. Such knowledge fosters better preparation for individuals and businesses alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 1099s form in Chrome?

Can I create an electronic signature for signing my 1099s form in Gmail?

How do I complete 1099s form on an iOS device?

What is 1099s form?

Who is required to file 1099s form?

How to fill out 1099s form?

What is the purpose of 1099s form?

What information must be reported on 1099s form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.