Get the free Form 1099-r

Get, Create, Make and Sign form 1099-r

Editing form 1099-r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1099-r

How to fill out form 1099-r

Who needs form 1099-r?

Understanding Form 1099-R: A Comprehensive Guide

Overview of form 1099-R

Form 1099-R is a critical tax document that reports distributions from retirement accounts, pensions, annuities, and other retirement-related sources. It is primarily used by account holders to report earnings from which federal taxes must be paid. Understanding it is essential for anyone who has received money from a pension plan, IRA, or other retirement accounts, as these distributions can significantly impact your annual tax return.

The significance of receiving a Form 1099-R lies in its detailed reporting of income that might be taxable. The IRS requires this form to ensure that individuals report the correct amount of income earned from their retirement accounts. Generally, this form is issued to individuals who have taken distributions during the tax year, making it vital for compliance with federal tax laws.

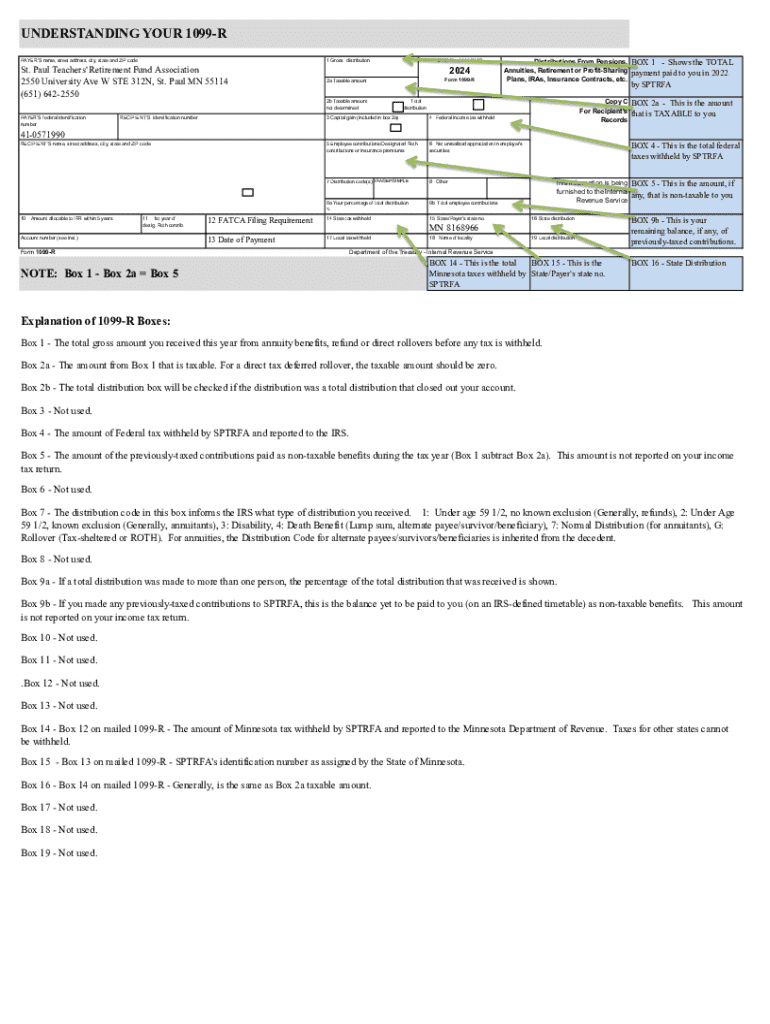

Understanding your 1099-R

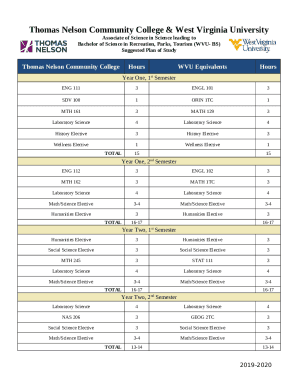

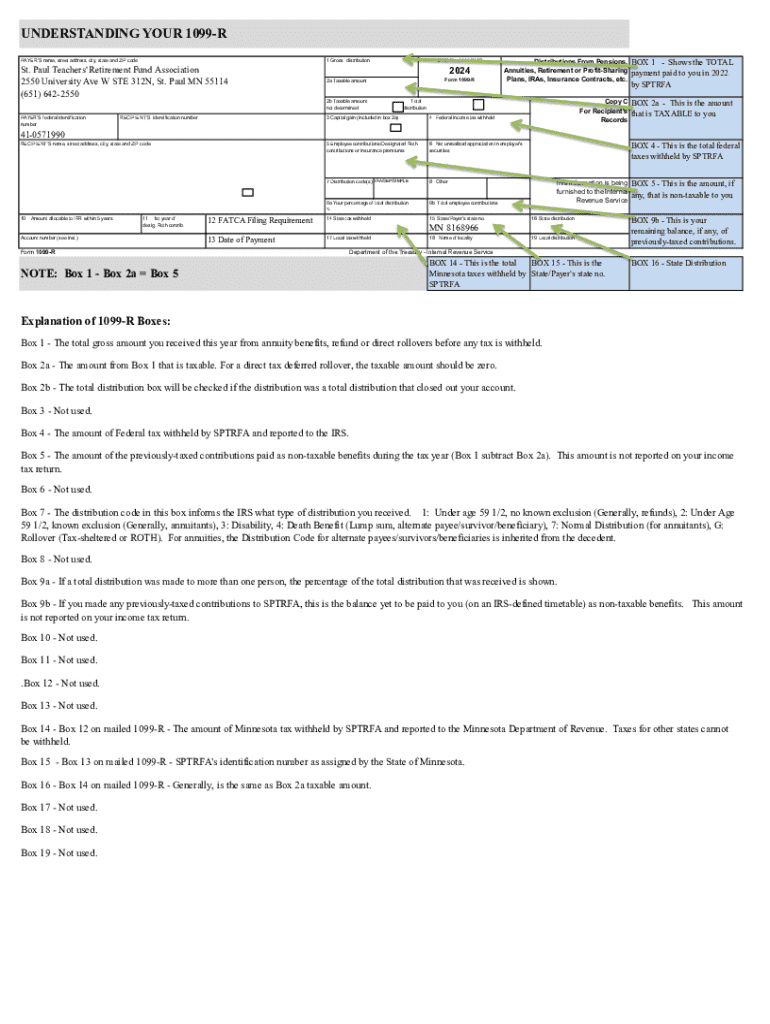

To effectively navigate Form 1099-R, it's essential to familiarize yourself with its key components. This form includes various boxes, each serving a specific purpose. For instance, Box 1 shows the total distribution amount, while Box 2 indicates the taxable amount of that distribution, which usually requires special attention during tax filing.

Moreover, understanding common terms such as "gross distribution," "taxable amount," and "total distribution" is crucial for accurate reporting. The form also includes distribution codes that are vital for tax implications. These codes clarify the nature of the distribution—whether it’s a rollover, early withdrawal, or other types—affecting how these amounts are taxed.

Accessing your 1099-R

Accessing your Form 1099-R is convenient and can be done through various channels. To retrieve it online, start by visiting your retirement plan provider’s website. You will typically need your account credentials, which may require setting up an online account if you haven't done so already.

Once logged in, look for a section labeled 'Tax Documents' or '1099 Forms.' Most providers allow you to download your form as a PDF, making it easy to store and print for your records.

If you prefer a mailed version, you can request the document from your provider directly. Typically, you'll need to contact their customer service, providing your account details. Expect the mailed version to arrive within a few weeks, depending on your provider's processing time.

What to do after receiving your 1099-R

Once you receive your Form 1099-R, it’s crucial to review the document for accuracy. Check all entries against your records, particularly the distribution amounts and coding. Errors can lead to incorrect tax filing and potential penalties, so it’s advisable to address any discrepancies immediately.

In case discrepancies are found, contact the issuer promptly for clarification and correction. If you have multiple 1099-R forms, ensure that you compile all relevant information before filing your tax return to maintain a consistent and accurate reporting.

Filing with your 1099-R

Understanding tax implications is vital when it comes to filing your taxes with Form 1099-R. The taxable amounts reported on this form must be included on your income tax return. It’s important to note how the tax treatment varies depending on your age and the type of distribution. For example, early withdrawals made before age 59½ may attract additional penalties.

Integrating your 1099-R information into your tax return is usually a straightforward process, but consulting a tax professional can help if your financial situation is complex. The option to use tax software can also assist in ensuring accuracy, with many programs designed to handle inputs from forms like 1099-R efficiently.

Managing your 1099-R documents

Safekeeping your Form 1099-R is essential for both personal and tax-related purposes. Secure storage options for your documents include both physical and digital solutions. While keeping printed copies is helpful, utilizing cloud storage can offer easy access and safekeeping. Tools such as pdfFiller are ideal for managing your documents, allowing you to store, edit, and organize your forms efficiently.

Moreover, editing and annotating your 1099-R documents with pdfFiller is straightforward. You can use their interactive tools to make necessary changes and electronically sign, making the form easily shareable while ensuring it remains secure.

Frequently asked questions about form 1099-R

If you haven’t received your Form 1099-R, it’s crucial to inquire with your retirement plan provider. Sometimes, oversight occurs, especially if you’ve moved during the tax year. Be proactive in obtaining the necessary documents to avoid complications at tax time.

Receiving a 1099-R electronically is often an option and can be more efficient. Many providers allow you to opt-in for electronic delivery during your account setup. If you suspect that you have received the 1099-R in error, contacting your provider immediately is essential to rectify the situation.

Helpful tips related to form 1099-R

When evaluating your retirement plan options, consider how distributions can affect your financial health. Make informed decisions on when to withdraw funds, as early withdrawals may incur penalties and tax implications. Also, remain aware of potential penalties for early withdrawal, understanding the rules associated with your specific retirement account can save you money.

Leveraging available resources aimed at tax guidance specific to retirement distributions can further enhance your knowledge. Whether consulting with a tax professional, using online resources, or referring to IRS publications, being well-informed can help you navigate complexities associated with retirement distributions.

Related documentation and forms

Should you receive Form 1099-R, other documentation may also be relevant to your tax situation. For instance, if you have interest income, you might also see Form 1099-INT, or dividends reported on Form 1099-DIV. Understanding how each relates to your overall financial picture can help streamline your tax preparation process.

Cross-referencing these forms with IRS guidelines will also provide clarity on how to report your income accurately. Familiarizing yourself with other IRS publications related to retirement distributions will enhance your preparedness during tax season.

Contact information for tax assistance

Getting additional support for tax concerns related to your Form 1099-R is easily attainable. The IRS provides various helplines and online resources for taxpayers seeking assistance. Their website offers extensive guidance on retirement distributions and tax-related topics, making it a valuable resource.

Alternatively, seeking assistance from a tax professional can offer personalized guidance tailored to your financial circumstances. Professional directories, such as those found on platforms like pdfFiller, can connect you with qualified experts.

Testimonials/success stories

Many users have shared their experiences managing their 1099-R forms through pdfFiller, highlighting the ease of document handling and organization. For instance, one user noted how streamlined the editing and signature process was, making their tax filing less stressful.

Case studies illustrate that utilizing pdfFiller has helped individuals accurately manage their tax documents, further simplifying the filing process. The platform's interactive tools and features have empowered many users to maintain organization and compliance during tax season.

Conclusion of insights

Successfully managing Form 1099-R requires attention to detail and understanding of tax implications related to retirement distributions. From accessing and reviewing your documents to filing your taxes accurately, each step plays a crucial role in compliance and financial health. Utilizing tools like pdfFiller ensures a seamless experience allowing for efficient document handling.

Engaging with the features offered by pdfFiller can significantly simplify the complexities associated with Form 1099-R, offering peace of mind as you tackle your taxes and retirement planning.

Interactive tools and resources

pdfFiller provides various tools designed to enhance your experience when managing your 1099-R. With features like e-signing, cloud storage, and collaborative capabilities, users can efficiently navigate their document needs. Access interactive resources made available through pdfFiller to simplify your tax filing process and enhance your overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 1099-r in Chrome?

How can I fill out form 1099-r on an iOS device?

How do I fill out form 1099-r on an Android device?

What is form 1099-r?

Who is required to file form 1099-r?

How to fill out form 1099-r?

What is the purpose of form 1099-r?

What information must be reported on form 1099-r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.