Get the free 2024 Tax Return Questionnaire

Get, Create, Make and Sign 2024 tax return questionnaire

How to edit 2024 tax return questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 tax return questionnaire

How to fill out 2024 tax return questionnaire

Who needs 2024 tax return questionnaire?

2024 Tax Return Questionnaire Form: Essential Guide to Filing Your Taxes

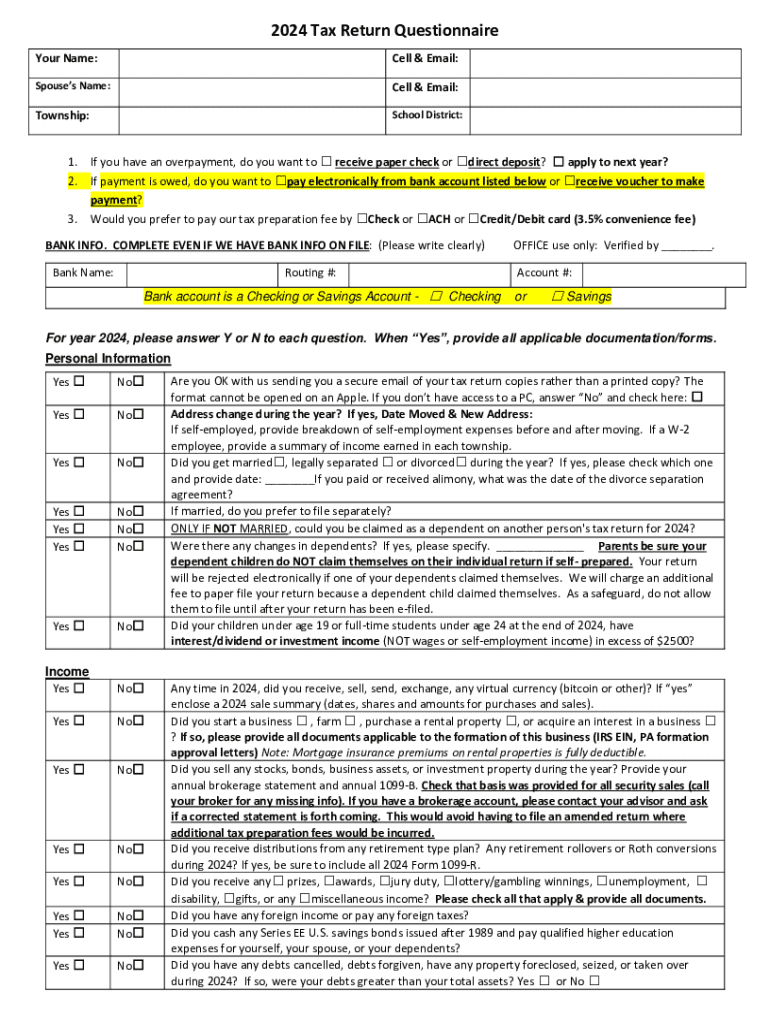

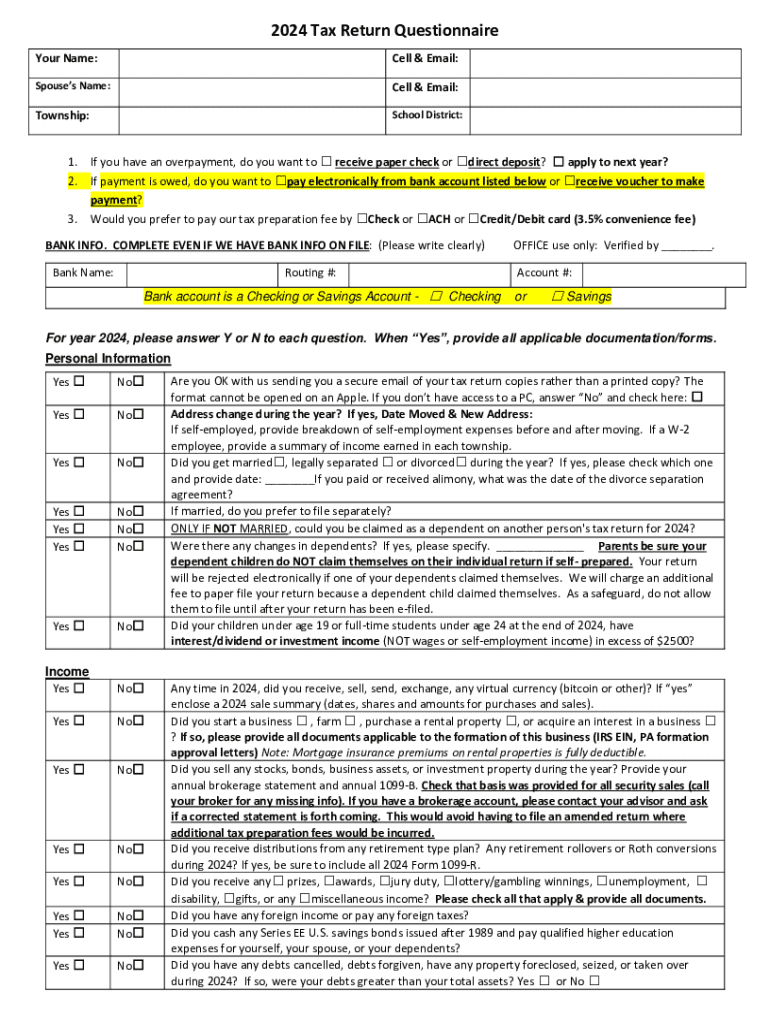

Understanding the 2024 tax return questionnaire form

The 2024 tax return questionnaire form acts as a vital tool in the tax filing process for individuals and teams alike. It is designed to gather necessary information that will be used to prepare tax returns accurately and efficiently. By filling out this form, taxpayers can ensure that all relevant details of their financial situation are accounted for, ultimately leading to proper tax filings and compliance with IRS regulations.

The importance of the questionnaire in tax preparation cannot be overstated. It serves as a roadmap that helps taxpayers navigate through the complexities of filing taxes. Furthermore, a well-completed questionnaire can reduce the likelihood of discrepancies and audits, ensuring that all required information is disclosed plainly and correctly.

Key components of the 2024 tax return questionnaire

To effectively complete the 2024 tax return questionnaire form, understanding its key components is essential. The form typically includes the following sections:

Preparing to fill out the questionnaire

Before diving into the questionnaire, proper preparation is key. Begin by gathering all necessary documents to ensure an accurate completion of the form. Essential documents include:

Additionally, consider your specific tax situation. If you are married, evaluate whether filing jointly or separately would benefit you more. Freelancers and business owners should also identify unique deductions that may apply. By assessing your situation through this lens, you can optimize the information you provide in your questionnaire.

Step-by-step instructions for filling out the form

Filling out the 2024 tax return questionnaire form can be broken down into manageable steps. Here's a detailed guide to navigate the process:

Utilizing pdfFiller's tools for enhanced document management

pdfFiller offers an array of tools designed to simplify the document management process, particularly when dealing with your 2024 tax return questionnaire form. One key advantage is the ease of editing PDFs, which allows users to customize the questionnaire quickly based on their unique tax situation.

In addition to editing, the process of eSigning the questionnaire has never been easier. pdfFiller provides a secure way to sign your forms electronically, ensuring compliance and reducing the hassle of printing and scanning. Furthermore, the platform’s collaboration features allow you to share your completed form with team members for their input or review, streamlining the entire filing process.

Common pitfalls to avoid when completing the 2024 tax return questionnaire

As you navigate your 2024 tax return questionnaire form, be vigilant against common pitfalls that could lead to complications. Mistakes such as incorrect Social Security numbers, misspelled names, or misreported income can result in delays or IRS audits.

To safeguard against these errors, double-checking your information is imperative. Take the time to look over every section, ensuring that figures match your supporting documents. Doing so can prevent costly mistakes and lead to a smoother tax filing experience.

Post-submission: What to expect after filing your tax return

After successfully submitting your 2024 tax return, it's important to understand what happens next. The IRS will review your return, and this process can sometimes take several weeks, especially during peak filing season.

You may receive communication from the IRS if they require further information or clarification. It's critical to respond promptly and accurately to any inquiries to avoid delays in processing your return or receiving your refund.

Related tax forms that may be needed

While the 2024 tax return questionnaire form is central to your tax filing process, there are several related forms you might need to accompany your submission. For instance:

Frequently asked questions about the 2024 tax return questionnaire

Taxpayers often have questions when completing their 2024 tax return questionnaire form. Here are some commonly asked questions along with their corresponding answers:

Getting help

Filing taxes can be daunting, but there are resources available if you need assistance. Professional tax services can help you navigate complicated tax situations and provide personalized advice. Additionally, online forums and tax-related websites can offer a wealth of information and community support for individuals navigating their tax obligations.

If you're using the 2024 tax return questionnaire on pdfFiller, their customer support team is readily available to assist you with any questions you might have during the tax filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2024 tax return questionnaire without leaving Chrome?

Can I sign the 2024 tax return questionnaire electronically in Chrome?

How do I fill out 2024 tax return questionnaire on an Android device?

What is tax return questionnaire?

Who is required to file tax return questionnaire?

How to fill out tax return questionnaire?

What is the purpose of tax return questionnaire?

What information must be reported on tax return questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.