Get the free Form 5500

Get, Create, Make and Sign form 5500

Editing form 5500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500

How to fill out form 5500

Who needs form 5500?

Your Complete Guide to Form 5500

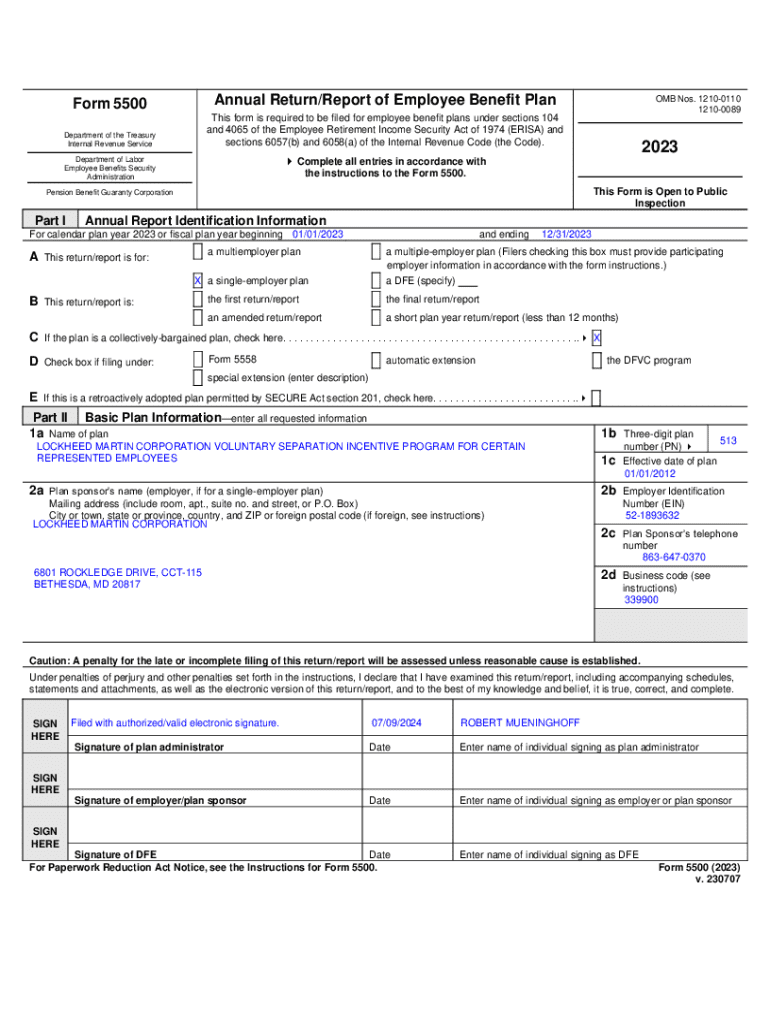

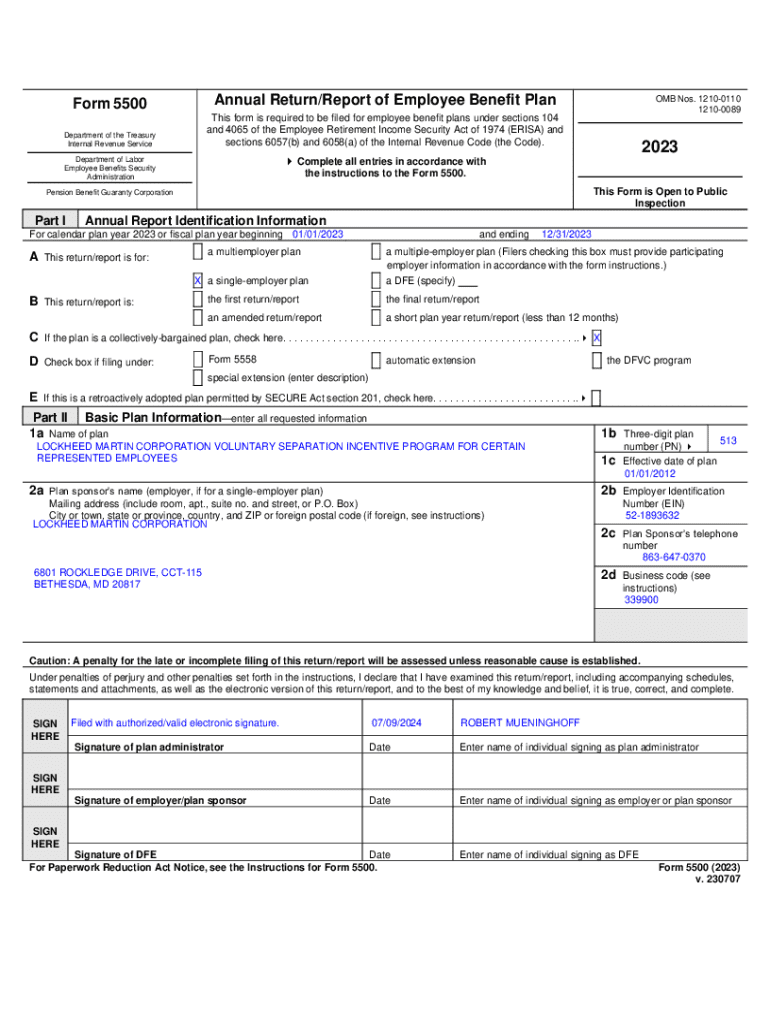

Understanding Form 5500

Form 5500 serves as an essential reporting tool that provides the federal government with important annual information about employee benefit plans. Originally designed to fulfill the requirements of the Employee Retirement Income Security Act (ERISA), the form offers insights into the conditions of various plans, including pensions and health benefits.

The primary purpose of Form 5500 is to encourage transparency and compliance among plan administrators. By collecting this data, the Department of Labor (DOL) can monitor the compliance of employee benefit plans with federal regulations, ensuring that participants are adequately protected.

Understanding Form 5500 is critical for employers as failure to file accurately can lead to substantial penalties. Beyond legal compliance, the data reported on this form can help employers evaluate the efficacy of their benefit offerings.

Who needs to file Form 5500?

Generally, any business that maintains an employee benefit plan is required to file Form 5500. This includes both private-sector employers and certain tax-exempt organizations. Notably, larger employers with 100 or more participants must file the comprehensive version of Form 5500, while those with fewer participants may qualify for the simpler Form 5500-SF.

However, certain plans are exempt from filing requirements. For instance, unfunded, insured, or one-participant retirement plans may not require filing. Understanding these exemptions is crucial for businesses aiming to remain compliant.

Filing requirements

The filing requirements for Form 5500 vary depending on the complexity of the benefit plan. Understanding the type of form required is pivotal for compliance and reporting accuracy. Generally, there are three main types of Form 5500 that entities may need to utilize.

Filing due dates are critical to maintain compliance with reporting obligations. Generally, the due date is the last day of the seventh month after the end of the plan year, but an extension can be sought through Form 5558.

It's essential to know that the filing timeframes and any extension options can vary based on the type of business or plan size, making early preparation advisable.

The filing process

Preparing to file Form 5500 requires careful attention to detail and organization. Businesses should begin by gathering all necessary documentation, such as financial statements and administrative records, which will be crucial for completing the form accurately.

Before starting the actual filing process, it is beneficial to set up an account with the Department of Labor (DOL), allowing you to access the necessary electronic filing system.

Once prepared, filling out Form 5500 involves understanding not just the basic requirements of eligibility but also the more intricate details of data reporting. Accuracy is key, as errors can result in compliance issues or penalties.

Common errors to avoid

It's imperative during the filing process to avoid common pitfalls that many filers encounter. Errors such as failing to provide required schedules, inaccuracies in participant counts, or incorrect financial data can lead to rejections or penalties.

To ensure complete accuracy, a thorough proofreading of the entire filing before submission is critical. Employing collaborative tools, like those provided by pdfFiller, can streamline the review process and enhance overall accuracy.

Special considerations

If your organization finds itself in a situation where a Form 5500 is filed late, it's essential to be aware of the delinquent filing process. The DOL offers the Delinquent Filer Voluntary Compliance Program (DFVCP), which allows businesses to minimize penalties while bringing their filings up to date.

Financial penalties for late filings can be significant, emphasizing the importance of timely submission. The penalties may escalate with budget constraints or compliance deadlines, making early preparation crucial.

If you’ve already missed a deadline, don’t panic. Taking immediate steps to file even a late form can significantly reduce the repercussions and guide you back toward compliance.

Documentation and compliance

Form 5500 is not submitted in isolation; various schedules must accompany it based on the specifics of the benefit plans being reported. For instance, Schedule A for insurance information and Schedule C for service providers must be included as needed.

Understanding the audit requirements is also vital. Plans that have 100 or more participants must include an audit report with their Form 5500 submission. Known as the 80-120 rule, it specifies audit necessities based on participant counts, creating a clear framework for compliance.

After submission

Once Form 5500 has been submitted, monitoring the status of your filing becomes imperative. Checking the status ensures that there are no outstanding issues and that your filing has been accepted by the DOL.

In the event of rejection, it’s critical to take immediate action to rectify and resubmit the form. Understanding the reasons for denial can help prevent future mistakes.

Making amendments and handling duplicates

If you find you need to amend your Form 5500 after submission, do not worry. The process for amending a filed form is straightforward and can often be done quickly through the DOL's online platform.

Handling duplicate filings also requires a clear understanding of how the DOL treats such cases. Always maintain thorough records, and in cases of accidental duplicates, follow the DOL guidelines to ensure proper resolution.

Frequently asked questions (FAQs)

Understanding the broader implications of Form 5500 prompts frequent inquiries from employers. For instance, many ask if Form 5500 pertains only to employee benefit plans, to which the answer is no. Form 5500 is designed to cover a range of benefit plans including those in the health, retirement, and welfare sectors.

The information required in the form includes participant information, plan assets, and financial statements, among other details. Each item in the form plays a crucial role in providing a clear picture of the plan's status.

Additionally, employers frequently wonder if they need to disclose Form 5500 information to plan participants. The answer is yes—ERISA mandates that plan participants receive specific information about retirement plans and health benefits, ensuring transparency.

Additional considerations

A comprehensive understanding of Form 5500 cannot be disconnected from the broader context of the Employee Retirement Income Security Act (ERISA). This legislation establishes standards to protect participants in retirement plans, making compliance with Form 5500 a critical element of employer obligations.

Another important aspect includes fidelity bond requirements, which mandate that plans must carry a fidelity bond covering plan officials. This requirement is designed to protect funds against losses due to dishonest acts.

Engaging with recommended topics related to employee benefits can fortify your understanding of compliance strategies and foster a compliant workplace.

Utilizing pdfFiller for Form 5500

pdfFiller enhances the Form 5500 filing experience with its seamless document management capabilities. Users can effortlessly edit, sign, and collaborate on the form directly from the platform, making the often complex filing process manageable.

The eSigning feature enables quick approvals and streamlines the collaboration process within your team, ensuring that no step is overlooked. pdfFiller empowers users to navigate regulations efficiently, reducing the stress often associated with these submissions.

Moreover, accessing pdfFiller from anywhere allows busy professionals the flexibility they need to manage documents on the go. This cloud-based platform not only simplifies the filing process but also provides peace of mind as you handle sensitive information securely and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 5500 in Gmail?

How do I edit form 5500 in Chrome?

How can I edit form 5500 on a smartphone?

What is form 5500?

Who is required to file form 5500?

How to fill out form 5500?

What is the purpose of form 5500?

What information must be reported on form 5500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.