Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

Editing form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

Form 5500-SF Form: A Comprehensive Guide for Filers

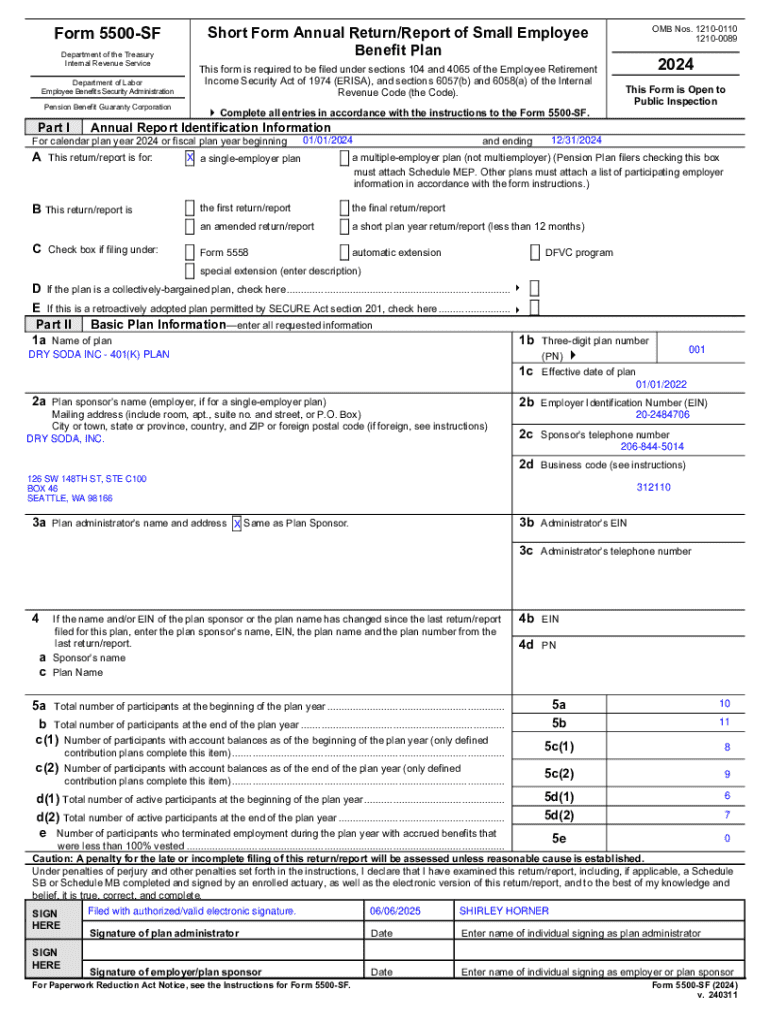

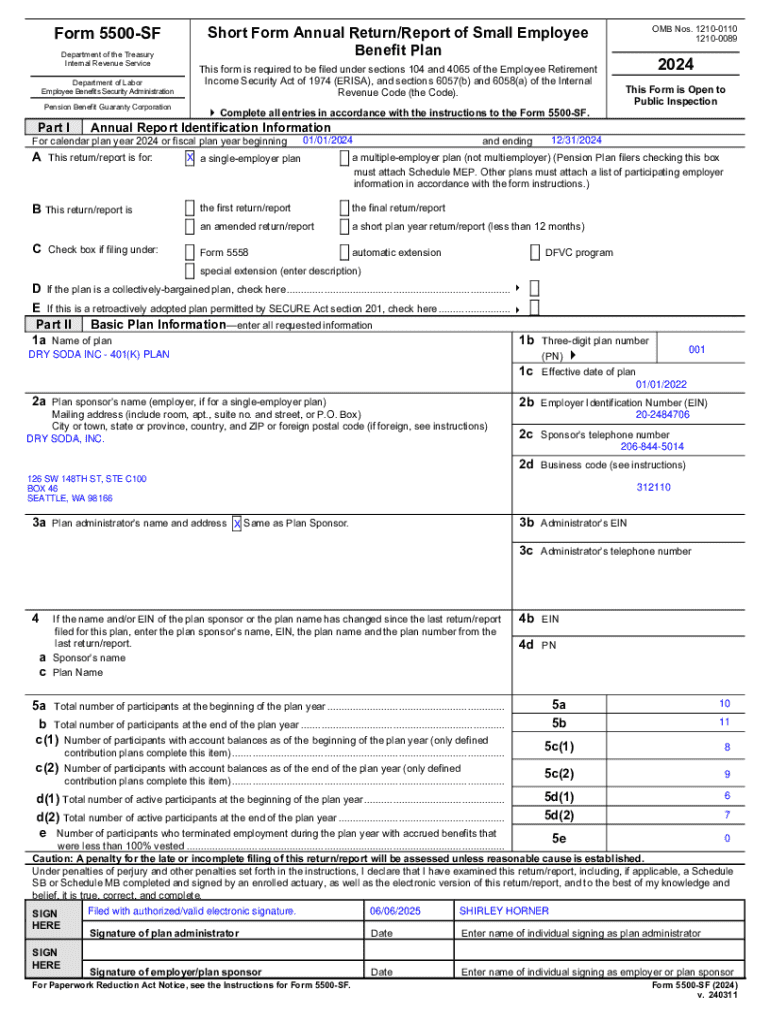

Overview of Form 5500-SF

The Form 5500-SF is a streamlined version of the Form 5500, designed specifically for smaller pension plans and to simplify the reporting process. Its purpose is to provide the U.S. Department of Labor with important information about the plan’s financial condition, investments, and operations. Accurate completion of this form is crucial, as it ensures compliance with the Employee Retirement Income Security Act (ERISA) and allows for proper oversight of pension plans.

Filers include small pension plans with fewer than 100 participants. This form plays a significant role in safeguarding the interests of plan participants and beneficiaries, making it essential for plan administrators to understand their filing obligations and requirements. By filing Form 5500-SF, plan administrators contribute to the transparency and integrity of the retirement plan system.

Key components of the Form 5500-SF

The Form 5500-SF consists of several key parts, each requiring specific information to paint a complete picture of the retirement plan's status. Understanding these components is essential for filling out the form accurately.

Part : Annual report identification information

This section collects basic identification details about the plan, including the plan name, plan sponsor information, and the plan year. Accurate data here is crucial as it lays the foundation for the form.

Part : Basic plan information

In this part, plan administrators provide details regarding the type of plan, the number of participants, and the plan's funding status. It's essential to include correct data to avoid compliance issues.

Part : Financial information

This section requires various financial details, including the value of plan assets, contributions, and benefits paid. Trustworthy financial reporting is vital for assessing the plan's health.

Part : Plan characteristics

Administrators must specify certain characteristics of the plan, such as whether it involves a trust or a pooled investment fund, giving insight into how the plan is structured.

Part : Compliance questions

This section includes critical compliance-related queries that ensure the plan adheres to necessary regulations. It’s vital for avoiding potential penalties.

Part : Pension funding compliance

Understanding the requirements for pension funding is crucial, including any changes made in the current plan year. This part assesses if the necessary contributions were made.

Part : Plan terminations and transfers of assets

If applicable, this section reports any asset transfers or plan terminations, which require specific disclosures to the Department of Labor.

Part : IRS compliance questions

Addressing IRS compliance is critical to ensure that tax ramifications are handled correctly. This part prevents issues related to the tax treatment of plan assets.

Changes to note for the 2023 filing

As regulations evolve, the 2023 filing of Form 5500-SF includes crucial updates that filers must observe. These changes usually reflect legislative adjustments or IRS guidance aimed at improving retirement plan transparency.

Filers from previous years should be aware of any new questions or reporting formats, as this could significantly alter how they prepare their submissions. This reinforces the necessity of staying informed about any updates to federal requirements or deadlines.

How to properly fill out Form 5500-SF

Filling out Form 5500-SF can be streamlined when approached systematically. Here are step-by-step instructions to guide you through the process:

Common mistakes to avoid include neglecting to report participant counts accurately, failing to update changes in plan characteristics, and overlooking financial discrepancies. Ensuring a meticulous review process helps prevent these errors.

Electronic filing requirement

The Form 5500-SF must be filed electronically using the EFAST2 processing system. This requirement enhances the efficiency and accuracy of reporting while making it easier for the Department of Labor to manage submissions.

Filing electronically through EFAST2 means that you’ll need to create an account on the system. When preparing to submit Form 5500-SF electronically, ensure you meet the technical requirements, including compatible software and internet access.

Deadlines and extensions

Filers must adhere to specific deadlines when submitting Form 5500-SF. Generally, the form is due on the last day of the seventh month after the plan year ends, typically falling around July 31 for most plans.

If additional time is needed, filers can use Form 5558 for an automatic extension of up to 3 months. Additionally, late filings can be addressed through the Delinquent Filer Voluntary Compliance (DFVC) Program, which allows plan administrators to comply without incurring late penalties.

Penalties for non-compliance

Non-compliance with Form 5500-SF filing can lead to significant penalties, including administrative fines levied by the Department of Labor for late or inaccurate submissions. Failing to meet reporting requirements compromises the retirement plan's integrity and could affect the benefits of participants and beneficiaries.

Understanding the specifics of potential penalties is crucial for all plan administrators. Besides administrative fines, certain plan types or sizes may face additional financial consequences that necessitate a thorough understanding of compliance obligations.

Assistance and support

Navigating the complexities of the Form 5500-SF can be challenging. Hence, plan administrators are encouraged to seek assistance when needed. The Department of Labor provides resources and guidance to aid in the filing process.

Additionally, professionals specializing in employee benefits law can offer insights into compliance and help prepare necessary documentation.

Utilizing pdfFiller for Form 5500-SF

pdfFiller offers a powerful platform to manage the intricacies of Form 5500-SF filing. With its user-friendly interface and innovative tools, users can seamlessly edit PDFs, eSign documents, and collaborate with team members in real time.

To effectively use pdfFiller for completing Form 5500-SF, follow this step-by-step guide:

By leveraging pdfFiller, users not only enhance their document management capabilities but ensure their Form 5500-SF submissions are complete and compliant.

Frequently asked questions

Understanding the nuances of Form 5500-SF can lead to several questions among plan administrators. Here are some commonly asked queries:

Answering these queries is pivotal for ensuring compliance and understanding the implications of timely filings, thereby safeguarding plan well-being and participant interests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 5500-sf online?

How do I edit form 5500-sf in Chrome?

How do I complete form 5500-sf on an Android device?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.