Get the free 2025 Personal Tax Credits Return

Get, Create, Make and Sign 2025 personal tax credits

Editing 2025 personal tax credits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 personal tax credits

How to fill out 2025 personal tax credits

Who needs 2025 personal tax credits?

2025 Personal Tax Credits Form - How-to Guide Long-Read

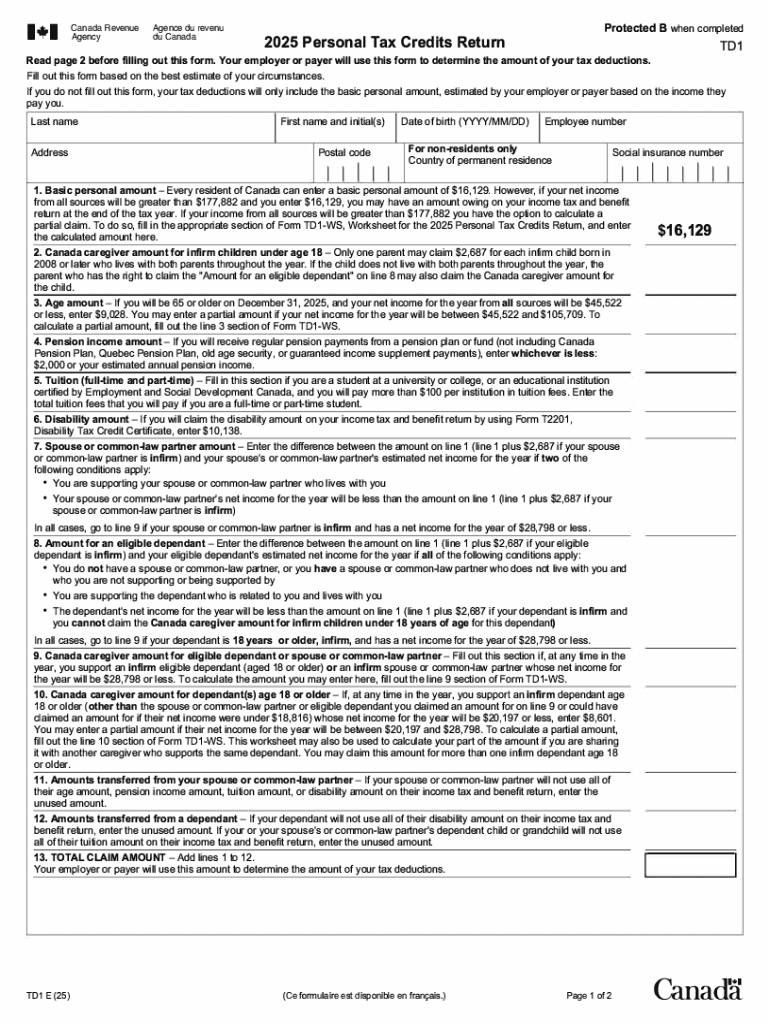

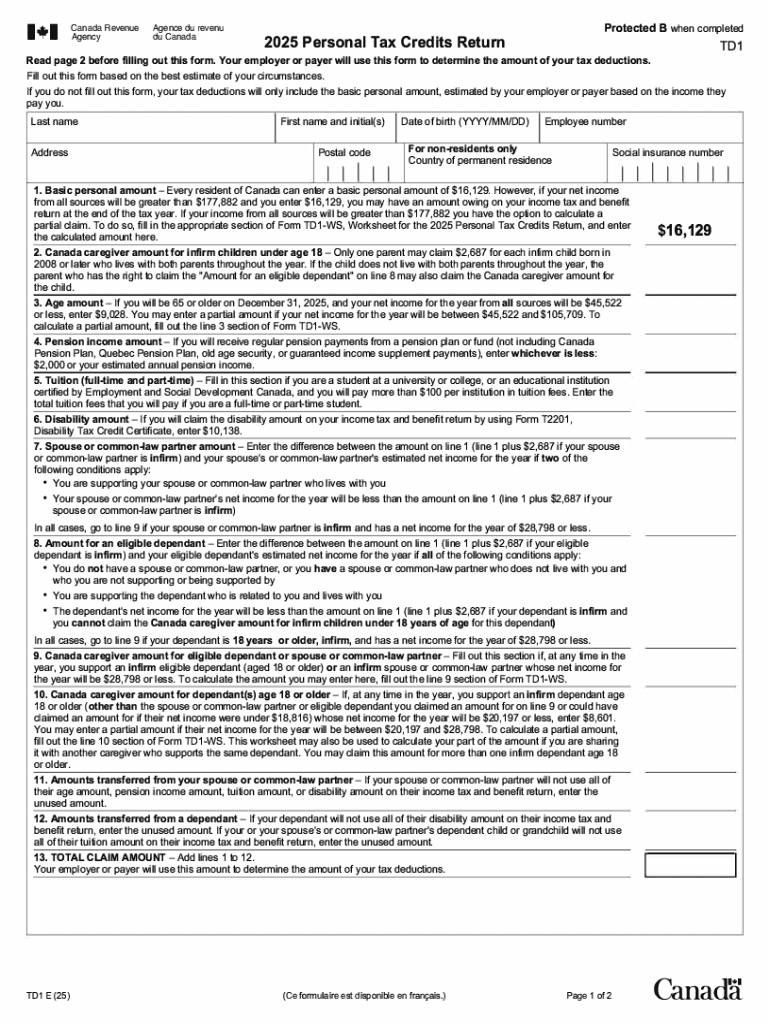

Understanding the 2025 personal tax credits form

Personal tax credits are essential tools for reducing your tax liability. Essentially, they are amounts that can be deducted from your total tax owed, potentially increasing your refund or lowering your total taxes owed. The 2025 personal tax credits form allows taxpayers to declare and claim various credits, acknowledging their specific financial situations and personal circumstances.

Accurate claims are crucial; errors can lead to a delay in refund processing and may even result in penalties. Therefore, understanding the specifics of the 2025 personal tax credits form is necessary to take full advantage of available credits and ensure compliance with tax laws.

Key changes in the 2025 form

The 2025 form introduces several notable adjustments compared to previous years, partly in response to changes in tax legislation. These adjustments may affect which credits are available and how they can be claimed. For instance, updates to eligibility criteria for certain credits may broaden accessibility for taxpayers.

Impact on taxpayers can be significant; for some, it might mean an increase in the tax refund, while others may see a reduction in claimed amounts. Staying informed about these changes will enable taxpayers to ensure they are maximizing their credits.

Who should use the 2025 personal tax credits form?

Anyone eligible for personal tax credits should consider filling out the 2025 personal tax credits form. This includes a wide range of taxpayers such as parents with children, individuals pursuing higher education, and those supporting dependents. Understanding these eligibility criteria is vital to ensure that you are fully benefiting from potential credits.

General requirements typically involve being a taxpayer as per IRS regulations and providing necessary identification, such as Social Security numbers. Specific situations like claiming dependents or education expenses significantly enhance potential credits. Understanding eligibility means being aware that the more credits you claim accurately, the broader the reduction in your tax liability and possibly an increased refund.

Detailed breakdown of the 2025 personal tax credits form components

The 2025 personal tax credits form is divided into several sections, each requiring specific information. Understanding these components is crucial for a successful filing. The personal information section requires general identification information, including names, addresses, and tax identification numbers.

Following this, accurate income reporting is critical; misreporting can cause claim denials. Most importantly, the section for claiming specific credits is where many taxpayers maximize their tax benefits. Each available credit, including the Child Tax Credit, Earned Income Tax Credit, and Education Credits, demands unique eligibility requirements and documentation.

Common mistakes often occur in this section, including misreporting income, missing documentation, and incorrectly claiming credits. It's essential to double-check all entries before submitting the form.

Interactive tools for managing your tax credits

Using online tools can dramatically simplify the process of filling out the 2025 personal tax credits form. Platforms like pdfFiller provide various features that enable users to edit forms easily, eSign documents, and collaborate seamlessly.

Navigating pdfFiller is user-friendly, and the availability of interactive templates further streamlines form completion. Users can fill in their information directly onto the PDF form and easily make any necessary adjustments or changes.

eSigning your form through pdfFiller ensures a secure signature. The steps involve selecting the signature tool, placing your signature in the appropriate area, and confirming the signature's validity and compliance with tax regulations.

Step-by-step instructions for filling out the 2025 form

To successfully fill out the 2025 personal tax credits form, start by gathering necessary documentation. Essential tax documents include W-2s, 1099s, and any documentation related to your claimed credits. Additionally, ensure you have your identification numbers, such as Social Security numbers or Individual Taxpayer Identification Numbers (ITIN). This foundational information will facilitate smooth completion.

Completing the form itself requires attention to detail. Follow a recommended order of filling, starting with personal information, then moving to income, and finishing with credit claims. This approach helps ensure that all relevant details are captured correctly. Consider a final review checklist to verify all information before submission.

Submitting your form can be done via online methods or by mailing paper copies. Online submissions are typically faster and enable easier tracking of your submission status, ultimately expediting your refund process.

Collaborating with team members on tax preparation

Collaboration can make managing the 2025 personal tax credits form much more efficient, especially for teams or families preparing taxes together. Utilizing pdfFiller allows you to share forms and relevant information securely among team members.

Assigning roles in this document creation process can prevent confusion: designate individuals responsible for gathering documentation, filling out specific sections, and ensuring accuracy. This clarity improves workflow and reduces the chance of errors.

Managing feedback and revisions on the document is straightforward with pdfFiller. Set permissions accordingly, allowing team members to edit where needed while protecting sections that shouldn't be altered.

Keeping your personal tax credits form up to date

Tax laws are subject to frequent changes, making it crucial to keep the 2025 personal tax credits form and your understanding of it up to date. Staying informed on annual changes and updates through IRS announcements or tax advisories helps you maintain compliance and optimize your credits.

Adjusting claims for future tax years is equally important. Conduct yearly reviews of your eligible credits based on changes in your financial situation or changes in IRS regulations. This proactive approach not only informs your current tax strategies but also sets you up for success in 2026 and beyond.

Frequently asked questions (FAQs) about the 2025 personal tax credits form

As taxpayers prepare to file with the 2025 personal tax credits form, numerous questions arise regarding eligibility, errors, and appeals. Clarifying the impact of changes in legislation on claims is paramount. Specific updates can alter both eligibility and the calculation of credits, so staying informed is essential.

What happens if you make an error after submission? Taxpayers may need to file an amended return to correct mistakes. Furthermore, knowing how to appeal a denied credit claim is essential; taxpayers should carefully follow IRS procedures, providing adequate documentation to support their position.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2025 personal tax credits online?

How do I edit 2025 personal tax credits online?

How do I fill out 2025 personal tax credits using my mobile device?

What is personal tax credits?

Who is required to file personal tax credits?

How to fill out personal tax credits?

What is the purpose of personal tax credits?

What information must be reported on personal tax credits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.