Get the free Resale Certificate

Get, Create, Make and Sign resale certificate

How to edit resale certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out resale certificate

How to fill out resale certificate

Who needs resale certificate?

A Comprehensive Guide to the Resale Certificate Form

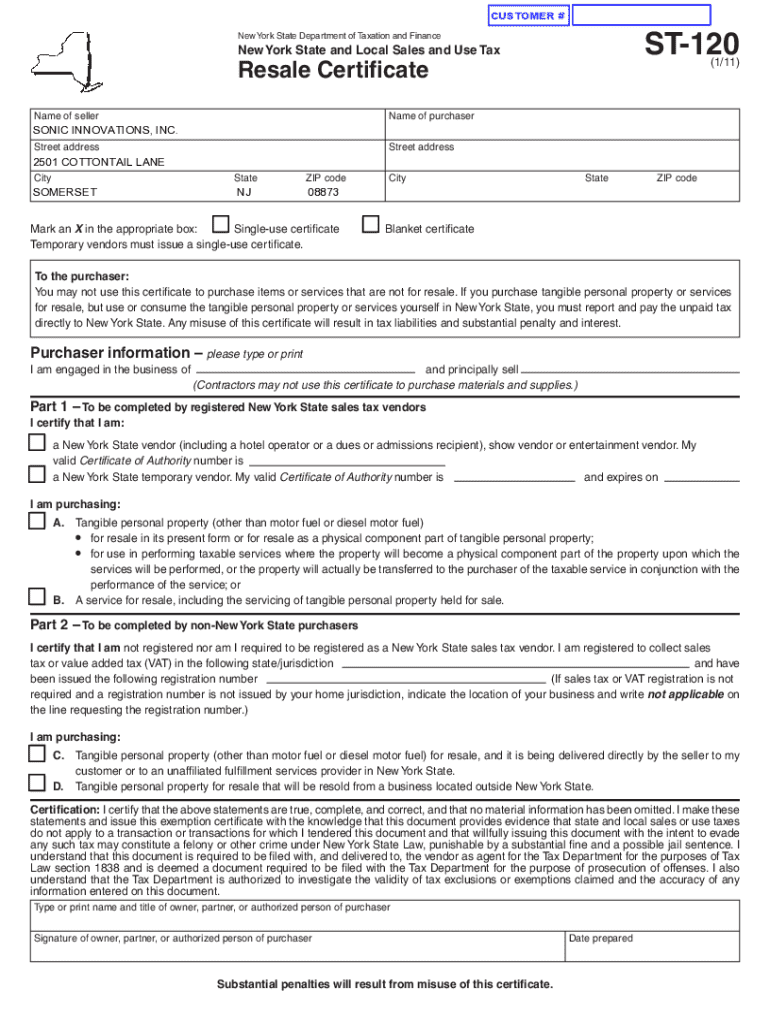

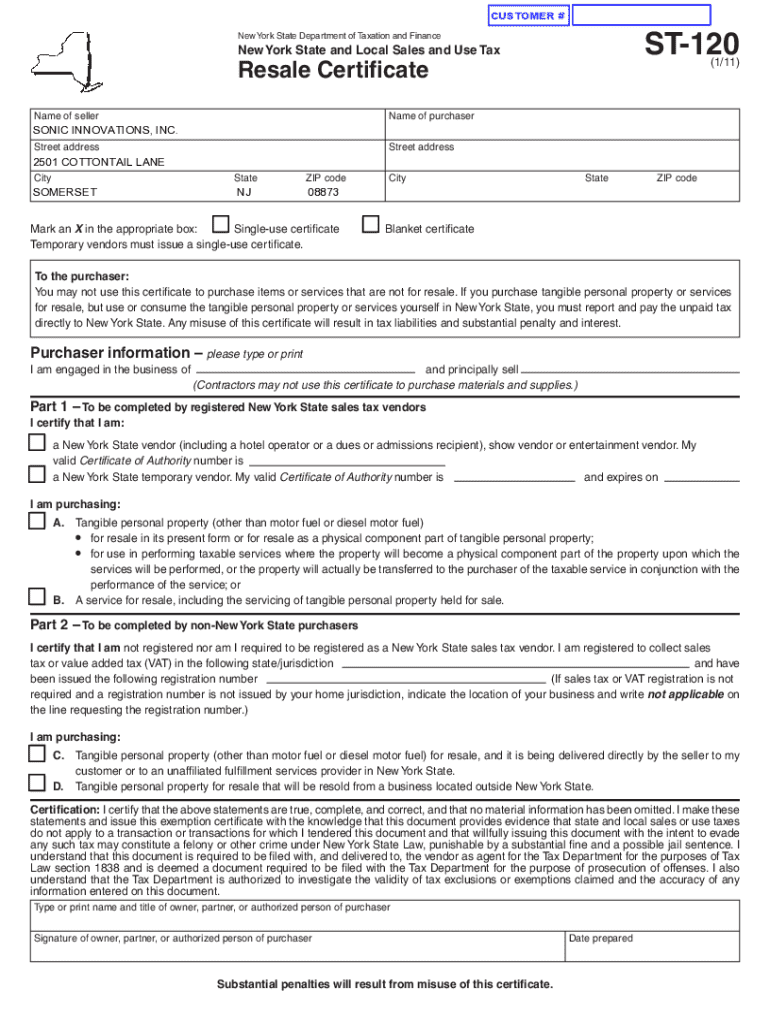

Understanding the resale certificate

A resale certificate is a crucial document for businesses that allows buyers to purchase goods tax-free, provided those items are intended for resale. This form serves as proof that the buyer is eligible for a sales tax exemption on their purchase, which can significantly benefit cash flow and operational costs.

For businesses, utilizing a resale certificate is not just advantageous; it is often necessary for compliance with tax regulations. This certificate streamlines transactions between retailers and suppliers, ensuring that tax is collected only at the final point of sale to the end consumer.

Who can use a resale certificate?

To qualify for using a resale certificate, a business must be registered for sales tax within its respective jurisdiction. This requirement varies by state, and businesses must adhere to local regulations governing sales tax exemptions.

Businesses eligible to issue a resale certificate include sole proprietorships, partnerships, Limited Liability Companies (LLCs), and corporations. However, individuals making purchases for personal use or those not in the business of reselling cannot utilize this certificate to avoid sales tax.

Key components of a resale certificate form

A properly filled resale certificate form is vital for ensuring that transactions are tax-exempt. The form typically requires several key components to validate the exemption and must be filled out accurately for it to be accepted by sellers.

Essential information includes the buyer’s details such as the name, business address, and sales tax ID, alongside the seller’s company name and address. Additionally, a description of the items being purchased for resale should be included to clarify the nature of the transaction.

Steps to fill out the resale certificate form

Completing a resale certificate form correctly is vital for ensuring that sellers can accept it without concern. Here’s a step-by-step guide to help navigate the completion of the form.

Editing and managing your resale certificate form

Once you have your resale certificate form, it’s essential to keep it organized and update it as necessary. Using pdfFiller can streamline this process, allowing you to easily modify and manage your documents from any location.

The platform offers robust tools for editing PDFs. By leveraging these features, you can update information quickly, ensuring that your resale certificate is always accurate and compliant with current regulations.

eSigning your resale certificate

Legal validity hinges on proper signatures on your resale certificate form. It's important to understand the implications of signatures, as they authenticate the document, confirming the legitimacy of the transaction.

Using pdfFiller for eSigning simplifies the process. You can electronically sign your documents within the platform, ensuring fast submission and compliance with e-signature laws.

Common questions about resale certificates

Despite their straightforward nature, resale certificates can lead to queries regarding their application and legal standing. Here are some frequently asked questions that can help clarify common concerns.

Related document management services

Businesses must manage additional documentation related to sales tax compliance, beyond just the resale certificate. Utilizing the right tools can streamline these processes and enhance productivity.

pdfFiller offers a suite of features tailored to optimize your document workflow. Whether it’s exemption certificates or related sales tax documents, effective management of these forms ensures that your business stays compliant.

Contacting support for your resale certificate needs

In the event you encounter difficulties with your resale certificate, numerous support avenues are available through pdfFiller. From addressing questions about the platform to seeking guidance on sales tax compliance, resources are readily accessible.

Furthermore, engaging with tax professionals can provide tailored advice regarding your resale certificate and additional sales tax matters. Consulting experts ensures compliance and minimizes the risk of costly errors.

Leveraging sales tax resources

Staying informed and connected within the realm of sales tax compliance can vastly benefit businesses. Joining communities and subscribing to updates can enhance knowledge and prepare businesses for evolving tax legislation.

Accessing educational materials not only empowers individuals but also supports teams in adopting best practices surrounding sales tax management. Utilizing available resources ensures that businesses remain proactive rather than reactive to regulatory changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find resale certificate?

How do I make edits in resale certificate without leaving Chrome?

Can I create an eSignature for the resale certificate in Gmail?

What is resale certificate?

Who is required to file resale certificate?

How to fill out resale certificate?

What is the purpose of resale certificate?

What information must be reported on resale certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.