Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: A Comprehensive Guide for Users

Understanding SEC Form 4

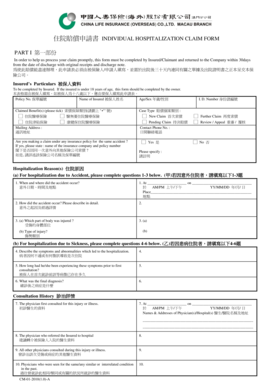

SEC Form 4 is a crucial filing required by the U.S. Securities and Exchange Commission (SEC) from corporate insiders—executives, directors, and beneficial owners of more than 10% of publicly traded companies—after any transaction involving the securities of their company. This form serves to disclose the buying or selling activities of these insider participants.

The primary purpose of SEC Form 4 is to provide transparency in the trading activities of company insiders, which can offer critical insights to investors regarding the perceived value of the company's stock. By monitoring these transactions, stakeholders can form hypotheses about the company's financial health and management's outlook.

Fundamental components of SEC Form 4

SEC Form 4 comprises specific components that are designed to capture essential details concerning the insider's transactions. The form requires pertinent information about the reporting person, including their name, relationship to the company, and the title or position they hold. Furthermore, the transaction information must detail the nature of the transaction, including the date, amount of securities involved, price per share, and the type of transaction (whether it’s a purchase, sale, or gift).

Understanding what constitutes a transaction is critical; it includes not just sales and purchases but also conversions of other types of securities, transfers between family members, and other movements that affect the ownership of shares. It's essential for insiders to file SEC Form 4 within two business days of any such event to keep the market informed.

The filing process for SEC Form 4

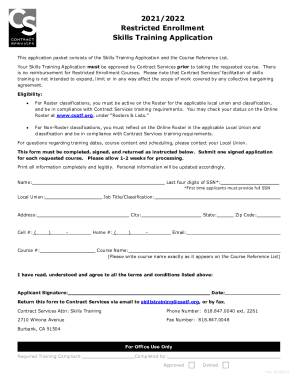

Filing SEC Form 4 requires careful attention to detail to ensure compliance with SEC regulations. Follow these steps for an effective filing process. First, gather all necessary documents, including transaction records, to provide accurate information on the form. It’s critical to have a clear understanding of the nature of the transactions you are reporting.

Next, complete the form accurately, ensuring that all sections are filled out to reflect the true nature of your transactions. Once everything is filled out correctly, submit the form through the SEC's electronic filing system, EDGAR. It’s essential to review your filing prior to submission to avoid common mistakes such as misreporting transaction types or failing to include relevant details.

Navigating the electronic filing system

The SEC utilizes the Electronic Data Gathering, Analysis, and Retrieval system (EDGAR) for all filing requirements, including SEC Form 4. EDGAR ensures that the filings are accessible to the public and facilitates efficient management of disclosures. To navigate EDGAR effectively, insiders must have a basic understanding of how to use the system to submit their forms.

When filing a Form 4, you’ll first create an account on EDGAR, after which you can fill out the form directly on the platform. It’s wise to prepare for troubleshooting potential issues, such as log-in problems or system outages. In such cases, having a plan to resolve these issues quickly ensures that filings are timely and avoid unnecessary penalties.

Analyzing SEC Form 4 reports

Reviewing SEC Form 4 reports is essential for understanding the market dynamics influenced by insider trading. Different types of transactions listed on these forms can signal various insights to investors; for instance, significant purchases by insiders may indicate their confidence in the company, while frequent selling could raise red flags about underlying issues. Additionally, the timing of filings can provide clues about potential market moves or earnings announcements.

Investors and analysts often utilize SEC Form 4 data to gauge the sentiment of company leaders regarding future performance. By analyzing patterns over time, stakeholders can make informed investment decisions or adjust their strategies based on perceived insider confidence.

Corporate governance and SEC Form 4 compliance

SEC Form 4 plays a vital role in enhancing corporate governance by ensuring transparency in insider trading activities. Compliance with the form’s regulations fosters trust in the markets, as investors gain confidence that insider trades are reported accurately and in a timely manner. Corporations must cultivate best practices surrounding the completion and filing of Form 4 to comply with SEC regulations.

Failure to comply can lead to severe legal and financial repercussions, including fines and loss of investor trust. Companies that prioritize filing accuracy not only uphold regulatory standards but also reinforce their commitment to ethical governance practices.

Mergers and acquisitions: The relevance of SEC Form 4

In the context of mergers and acquisitions (M&A), SEC Form 4 filings gain particular significance. During M&A activities, insider trades can reflect executives' confidence in the deal's success or unveil concerns over forthcoming changes. Timely SEC Form 4 filings during these transactions can provide valuable insights and context that help analysts predict stock performance in reaction to M&A news.

Noteworthy case studies showcase how insider trading activities around M&A announcements can lead to extreme fluctuations in stock prices. Investors closely watch Form 4 filings to gain a better understanding of the sentiments of management during these pivotal corporate events.

Leveraging technology for SEC Form 4 management

Utilizing document management solutions can help streamline the process of creating, filing, and managing SEC Form 4. Tools like pdfFiller are designed to empower users to edit PDFs, eSign documents, and enhance collaborative efforts from a cloud-based platform, making document management accessible anytime and anywhere.

Not only does pdfFiller simplify the creation of SEC Form 4 filings, but it also offers interactive features that allow users to track changes and collaborate with team members through the platform. The use of such technology can significantly reduce errors, increase efficiency, and maintain compliance with regulatory requirements.

Related products and solutions for comprehensive document management

In the quest for efficient SEC Form 4 management, users can also benefit from various complementary tools that integrate with pdfFiller. These tools facilitate comprehensive document management by enabling the seamless execution of various tasks related to form completion and compliance.

Integrations with compliance software can enhance accuracy and tracking of required filings, while features for automating reminders for deadlines can ensure timely submissions. By deploying these tools alongside pdfFiller, teams can significantly improve their document management capabilities.

FAQs: SEC Form 4 clarified

Individuals or corporates often have questions regarding SEC Form 4 to enhance their understanding of the filing requirements. Common queries include deadlines for filing, the types of transactions that need to be reported, and best practices for avoiding penalties. Addressing these questions upfront can save time and potential mistakes in the filing process.

For instance, challenges may arise regarding interpretation of what constitutes a transaction or when to file. Expert insights suggest that creating a checklist of filing requirements can streamline the process and ensure compliance with SEC guidelines.

Best practices for monitoring SEC Form 4 filings

To maintain a firm grasp on SEC compliance, insiders and their companies must establish effective monitoring practices for SEC Form 4 filings. This process can include utilizing tools that keep users informed about their filing obligations as well as setting up alerts for any changes or new filings related to their securities.

Moreover, ongoing monitoring fosters an environment where transparency is prioritized, reassuring investors of the company's commitment to adherence to regulatory requirements. Understanding the frequency of changes in compliance regulations also enables insiders to remain proactive regarding their filing responsibilities.

Spotlight: Key areas of SEC Form 4 reporting

Throughout the years, SEC Form 4 filings have revealed significant trends in insider trading activities. Recently, analyses have highlighted the trading patterns of executives and how these activities respond to market conditions, macroeconomic indicators, or corporate performance metrics. Insights into executives' trading activity can sometimes foreshadow pivotal shifts in company strategies or stock valuations.

Moreover, understanding the impact of insider transactions can enrich one's view of market behaviors. By shining a light on such transactions, stakeholders can assess the effectiveness of corporate governance practices and the proportionality of stockholder value.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sec form 4?

How do I make changes in sec form 4?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.