Get the free Add/update Hsa Beneficiaries

Get, Create, Make and Sign addupdate hsa beneficiaries

How to edit addupdate hsa beneficiaries online

Uncompromising security for your PDF editing and eSignature needs

How to fill out addupdate hsa beneficiaries

How to fill out addupdate hsa beneficiaries

Who needs addupdate hsa beneficiaries?

Comprehensive Guide to Updating HSA Beneficiaries Form

Understanding HSA beneficiaries

A Health Savings Account (HSA) is a tax-advantaged account that allows individuals to save for medical expenses and offers significant tax benefits. Contributions made to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-exempt. This makes HSAs an invaluable tool in managing health care costs.

Selecting and updating beneficiaries for your HSA is crucial, as it ensures that your hard-earned savings go to the right people in the event of your passing. Proper beneficiary designation can simplify the transfer of assets and reduce potential tax burdens on your heirs, making it an essential aspect of financial and estate planning.

Types of beneficiaries

Beneficiaries of your HSA can be classified as primary or contingent. Primary beneficiaries are the first in line to receive the HSA assets upon your death. In contrast, contingent beneficiaries receive the assets only if the primary beneficiaries are no longer alive. It’s crucial to understand these distinctions when naming your beneficiaries.

The IRS allows various entities to be designated as beneficiaries. Individuals such as spouses, children, or friends can be named, as can charities or estates. Depending on whom you choose, the tax implications may vary. For example, a spouse as a beneficiary can treat the HSA as their own, whereas other individuals may face different tax consequences.

Key reasons for updating HSA beneficiaries

Updating your HSA beneficiaries is vital following significant life events such as marriage, divorce, birth of a child, or death of a previously designated beneficiary. Each of these events can alter your intent regarding who should inherit your assets. Failing to adjust your beneficiaries can lead to unintended consequences and potential disputes among heirs.

Additionally, your financial and estate planning needs may evolve over time. Changes in your relationships, financial situation, or estate laws might necessitate a revisitation of your beneficiary designations. Even if no major life changes occur, regularly assessing your beneficiary designations ensures compliance with current estate laws and your personal wishes.

Step-by-step guide to updating your HSA beneficiary

Step 1: Accessing your HSA information

To begin the update process for your HSA beneficiaries, the first step is logging in to your HSA account on pdfFiller. Use your credentials to access your secure dashboard, where pertinent account information is housed.

Once logged in, navigate to the 'Beneficiary' section. This area contains existing beneficiary designations, as well as the option to update your beneficiaries. Familiarize yourself with your current designations before making any changes.

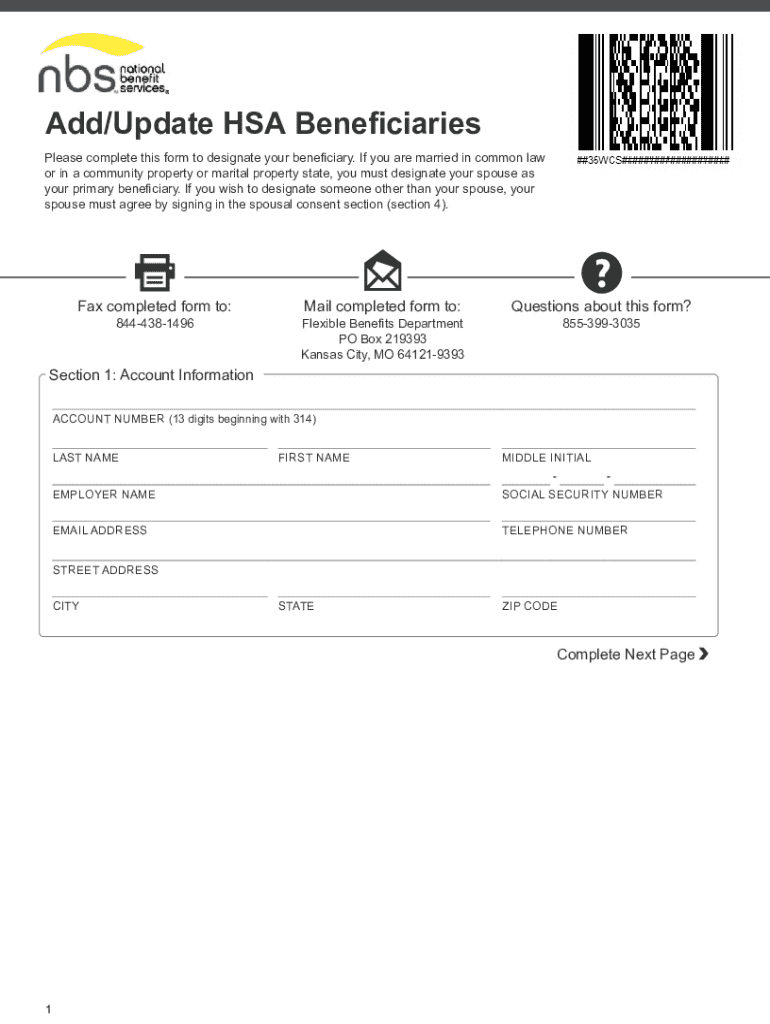

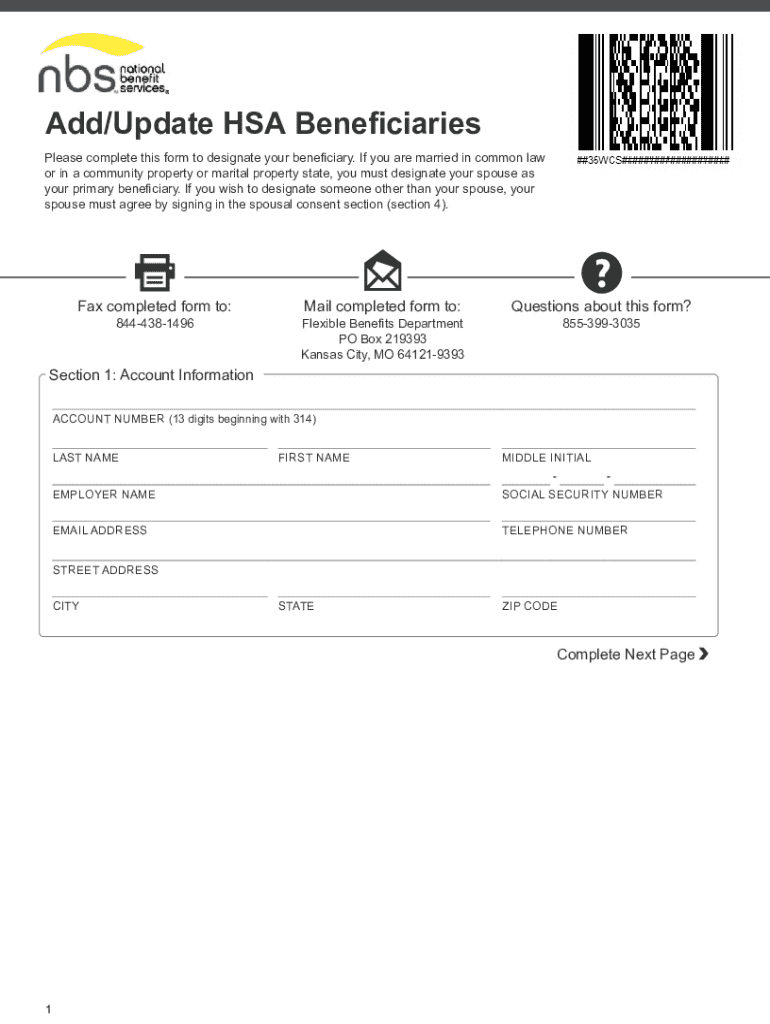

Step 2: Completing the beneficiary update form

When filling out the beneficiary update form, accuracy is paramount. Ensure you enter all the requested information about your new beneficiaries, including their full names, relationships to you, and contact information. This information is crucial for verifying and reaching them after your passing.

Review each field carefully before submitting to avoid errors or omissions. Additionally, be aware of any mandatory fields that must be filled; these are often marked clearly on the form. Consider double-checking the spelling of names and addresses to prevent complications.

Step 3: Submitting your changes

Once you have completed the form, you will have multiple options to submit your changes electronically via pdfFiller. Follow the platform's prompts for submitting your updated beneficiary designations. After submission, you should receive a confirmation notification indicating that your changes have been received and processed, along with a confirmation number.

Troubleshooting common issues

While updating your HSA beneficiaries, you may experience challenges such as difficulty logging into your account or accessing the necessary forms. If you cannot remember your credentials, utilize the password recovery option to regain access promptly. It's essential to resolve access issues before attempting updates.

If you encounter problems while completing the beneficiary form, recheck your entries against the requirements stipulated on the form. Many users may hesitate to reach out for help, but contacting support through pdfFiller is a viable option if you’re still having difficulty. Their team can assist with any technical issues or questions you might have during the process.

FAQs regarding HSA beneficiary management

It’s advisable to review your HSA beneficiaries at least once a year or after any significant life changes. Regular checks help ensure that your designations still align with your current wishes and that no outdated information exists on file.

In situations where you do not designate a beneficiary, the HSA funds may become a part of your estate. This can complicate matters and may result in extended legal proceedings or increased estate taxes. Hence, naming a beneficiary is highly recommended.

Yes, you can name multiple beneficiaries for your HSA. Doing so can help in distributing the assets according to your wishes. Ensure you provide clear instructions on how the assets should be divided, either in specific percentages or shares among the designated beneficiaries.

The role of pdfFiller in managing your HSA forms

pdfFiller simplifies the process of updating your HSA beneficiaries by providing a streamlined, user-friendly interface for managing forms. Users can easily navigate the platform to find the beneficiary update form and other related documents without getting lost in complex menus.

The interactive features of pdfFiller empower users to edit PDFs, sign documents electronically, and share forms securely. These capabilities enhance collaboration, making it easier for users to manage their documents anytime, anywhere. Testimonials indicate that many users appreciate the intuitive design and helpful support resources available through the platform.

Additional tools for HSA management

In addition to updating your HSA beneficiaries, pdfFiller offers an array of tools to help manage your HSA account effectively. Users can access resources that aid in managing contributions and withdrawals, ensuring that they make the most of their HSA for healthcare costs. Educational materials are also available to help users understand how HSAs work and maximize their benefits.

Moreover, pdfFiller provides interactive calculators to evaluate the growth potential of HSA funds over time. These tools allow individuals and teams to map out their health savings strategies with a data-driven approach, ensuring they are well-prepared for future medical expenses.

Related forms and publications

Handling HSA management may also involve other forms, such as distribution forms and claim forms. pdfFiller hosts links to those forms along with guidelines that outline best practices for managing HSA accounts effectively. Access to these relevant documents ensures users can address their HSA needs holistically.

Keeping informed about HSA regulations

Staying up-to-date with the regulations surrounding HSAs is crucial for effective management. Recent updates on federal regulations impact how beneficiaries are designated and the overall management of HSAs. Regularly reviewing policy changes allows you to adjust your accounts accordingly and remain compliant with the law.

pdfFiller provides subscription options for updates related to HSA policies, ensuring that you are informed of any changes that may affect your account. Engaging with these updates can help safeguard your savings and ensure optimal use of your HSA.

Connecting with pdfFiller support

Accessing personalized assistance is straightforward through pdfFiller. Users can reach out via multiple contact options for help with their HSA beneficiary updates or any other form-related inquiries. These include email support and chat options, ensuring timely assistance.

In addition to personalized help, pdfFiller provides an extensive knowledge base filled with FAQs and helpful articles. Users are encouraged to explore these resources to quickly resolve common queries. Stay connected through pdfFiller's social media channels for updates and promotions, providing another layer of accessibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit addupdate hsa beneficiaries from Google Drive?

How can I send addupdate hsa beneficiaries to be eSigned by others?

How can I edit addupdate hsa beneficiaries on a smartphone?

What is addupdate hsa beneficiaries?

Who is required to file addupdate hsa beneficiaries?

How to fill out addupdate hsa beneficiaries?

What is the purpose of addupdate hsa beneficiaries?

What information must be reported on addupdate hsa beneficiaries?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.