Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

How to Guide: Form 990

Understanding IRS Form 990

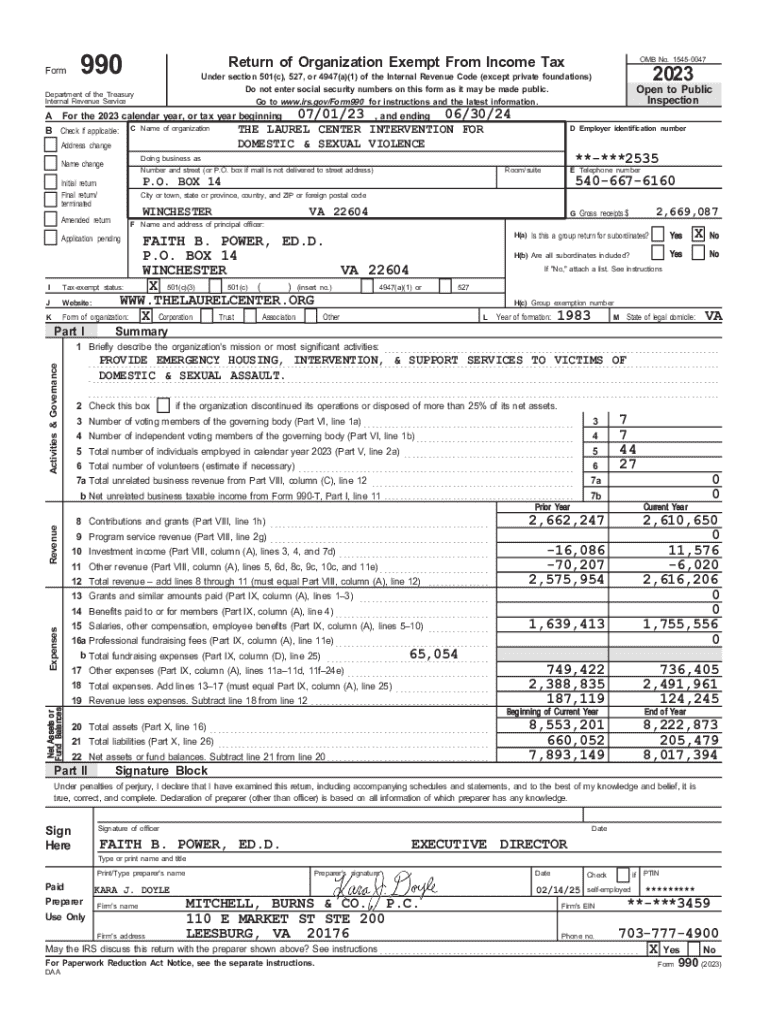

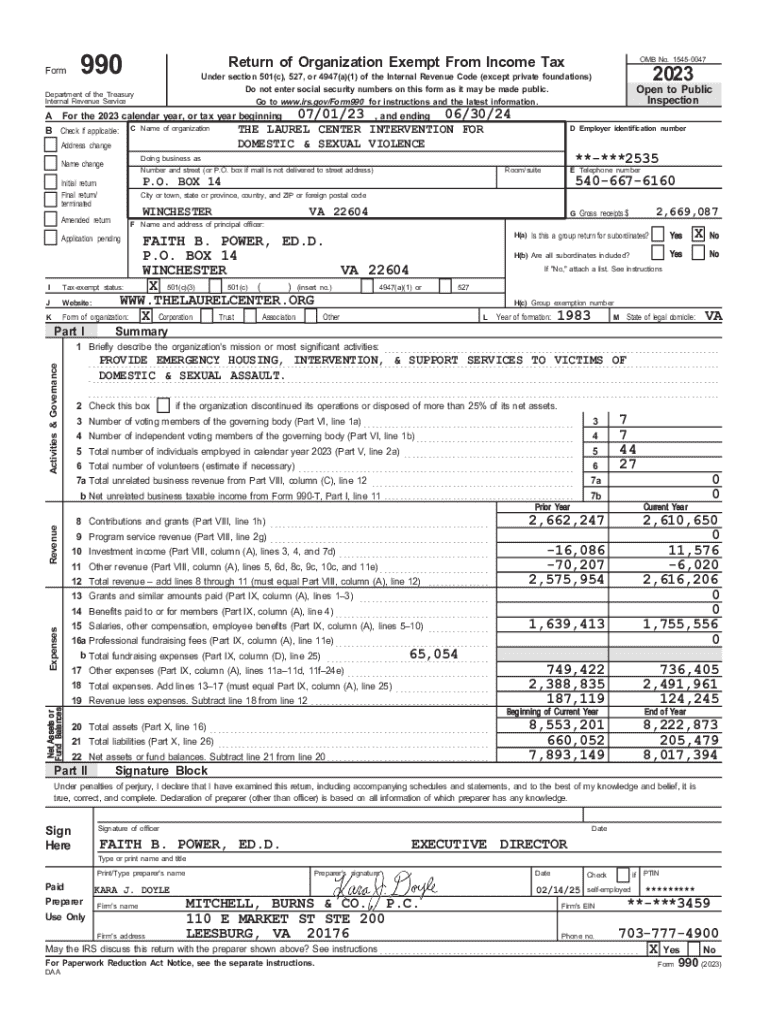

IRS Form 990 serves as the annual information return for tax-exempt organizations, detailing their financial activities and compliance with tax codes. This form is integral to maintaining eligibility for tax-exempt status, as it provides the IRS with a snapshot of an organization's finances, governance, and operations. Nonprofits are often required to submit this form, and its content is available for public inspection, which promotes transparency in the nonprofit sector.

The importance of Form 990 extends beyond regulatory compliance; it enables donors, grant-makers, and the public to evaluate the financial health and operational integrity of charitable organizations. By analyzing Form 990, stakeholders can make informed decisions regarding contributions and partnerships.

Key components of Form 990

Form 990 consists of several key sections, each serving a distinct purpose:

Filing requirements for Form 990

Every tax-exempt organization that meets certain revenue thresholds is required to file Form 990 annually. Generally, organizations with gross receipts exceeding $200,000 or total assets above $500,000 must submit the standard Form 990. Smaller organizations may qualify for Form 990-EZ or Form 990-N, also known as the e-Postcard.

However, there are exemptions. Organizations classified under 501(c)(3) for religious or educational purposes that normally have less than $50,000 in gross receipts may be exempt from filing, unless they are part of a larger organization that does file.

Filing modalities

Organizations have the option of eFiling Form 990 through IRS-approved software or submitting a paper return. eFiling is often faster and reduces the chance of errors, and organizations are encouraged to check if they are eligible for this method.

Filing deadlines can vary; typical forms must be submitted by the 15th day of the fifth month after the end of the organization's fiscal year. For organizations with a fiscal year ending July 31, for example, the deadline would be December 15.

Special situations

Multi-state organizations need to be aware of additional regulations that may require them to file specific documents in each state where they operate. Additionally, if an organization has a short tax year, differing regulations apply and help must be sought for the appropriate filings.

Preparing your Form 990

When preparing Form 990, organizations should gather the necessary documentation ahead of time to ensure a smooth filing process. This documentation includes:

Filling out Form 990 can seem daunting due to the sheer amount of information required. Organizations should take it step-by-step while paying close attention to each section. Double-check each figure and confirm alignments with financial records to avoid penalties or rejections from the IRS.

Common mistakes to avoid

Common mistakes in Form 990 include misreporting revenue, failing to disclose all board members, incomplete program descriptions, and inaccuracies in financial statements. Organizations should employ internal checks to prevent these errors. It is critical to keep a keen eye on financial values to ensure accuracy and consistency across provided documentation.

Review and submission process

Before submitting Form 990, conducting an internal review is vital. This process may include an internal audit involving key financial personnel or board members. The objective is to ensure that all information is accurate, complete, and reflective of the organization's activities during the past year.

Once the internal review is complete, final checks like confirming signatures and ensuring all necessary schedules are attached should be performed before submission. After submission, organizations receive a confirmation from the IRS, and tracking is essential to ensure the form was successfully filed.

Post-filing considerations

After filing Form 990, organizations should keep track of their submission dates and maintain a log of digital timestamps for reference. Should the IRS need additional information or raise inquiries, organizations must respond promptly and appropriately to maintain transparency and compliance.

Common IRS inquiries include requests for clarification on specific revenues or compliance with board member compensation reporting. Organizations can address these queries by referencing their submitted documentation, ensuring accuracy in communication.

Understanding public inspection regulations

Form 990 is publicly accessible under IRS regulations, thus serving as a vital tool in promoting transparency within the nonprofit sector. Individuals, donors, and researchers can access these forms to scrutinize an organization’s finances, governance, and program effectiveness.

Organizations should be prepared for public requests for their Form 990, establishing clear protocols for efficient access. This process not only meets legal obligations but also bolsters trust and credibility with stakeholders.

How to handle public requests

When responding to public requests for Form 990, organizations should have policies in place to provide timely access. Efficient systems, such as online repositories or contact points, can facilitate this process, ensuring they can handle inquiries collaboratively and effectively.

Utilizing Form 990 for charity evaluation research

Form 990 serves as an invaluable resource for assessing the effectiveness and financial health of charities. Researchers and donors can derive insights into revenue patterns, expenditure management, and the overall performance of nonprofits, enabling informed decision-making.

Furthermore, applying Form 990 data can significantly bolster grant applications. Foundations often require transparency regarding financial history and program success, making Form 990 a critical component in supporting funding requests.

Resources for finding historical data

Various platforms aggregate Form 990 data for research purposes, including IRS databases and charity watchdog sites. Users should familiarize themselves with these resources, enabling streamlined access to historical data for analysis.

When interpreting this data, focus on both quantitative metrics such as revenue and expenses as well as qualitative aspects including governance and program effectiveness to achieve a balanced view of an organization.

Alternatives and variants of Form 990

While the standard Form 990 applies to many organizations, smaller nonprofits may use alternate forms. Form 990-EZ is a simplified version intended for organizations with gross receipts under $200,000 and total assets under $500,000, while Form 990-N is an e-Postcard designed for organizations with gross receipts under $50,000.

Choosing the appropriate form is crucial for compliance. Misfiling can result in penalties or negative implications for an organization’s tax-exempt status. Other related forms, such as Form 990-T (used for unrelated business income tax) and Form 1023 (application for tax-exempt status), are also essential in the nonprofit landscape.

Third-party resources for Form 990 assistance

Organizations often benefit from professional services specializing in Form 990 preparation. These services not only provide expertise in navigating the complexities of the form but also reduce the workload and potential errors in reporting.

Individuals or organizations opting for self-filing may leverage online tools like those provided by pdfFiller to streamline the process. These platforms offer features such as document editing, e-signature options, and collaborative capabilities, allowing teams to manage Form 990 elegantly and efficiently.

FAQs about Form 990

Common questions regarding Form 990 often include topics around filing deadlines, exemptions, and the specifics of required disclosures. Organizations should stay informed of annual changes to IRS requirements and adjust their filing practices accordingly.

For further guidance, the IRS provides helplines and comprehensive resources on their website, where organizations can seek clarifications on confusing aspects or recent updates. It’s essential to remain proactive in seeking assistance to ensure compliance and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 990 online?

Can I sign the form 990 electronically in Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.