Get the free Arizona Form 165pa Schedule K-1

Get, Create, Make and Sign arizona form 165pa schedule

How to edit arizona form 165pa schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 165pa schedule

How to fill out arizona form 165pa schedule

Who needs arizona form 165pa schedule?

Understanding Arizona Form 165PA Schedule Form: A Comprehensive Guide

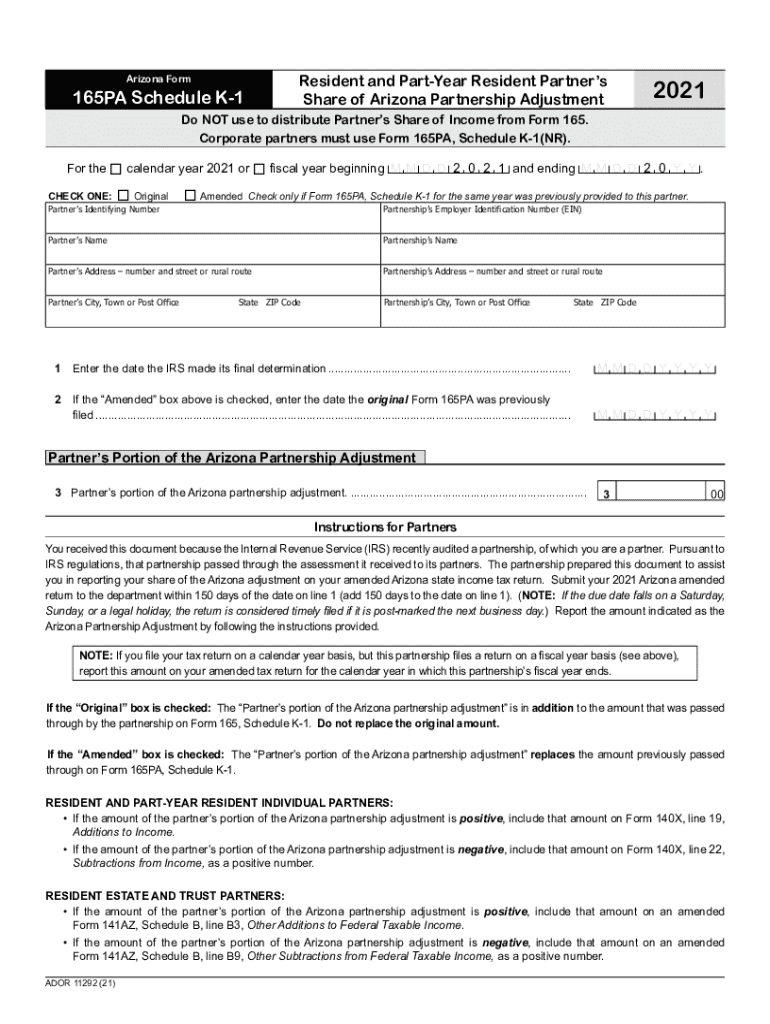

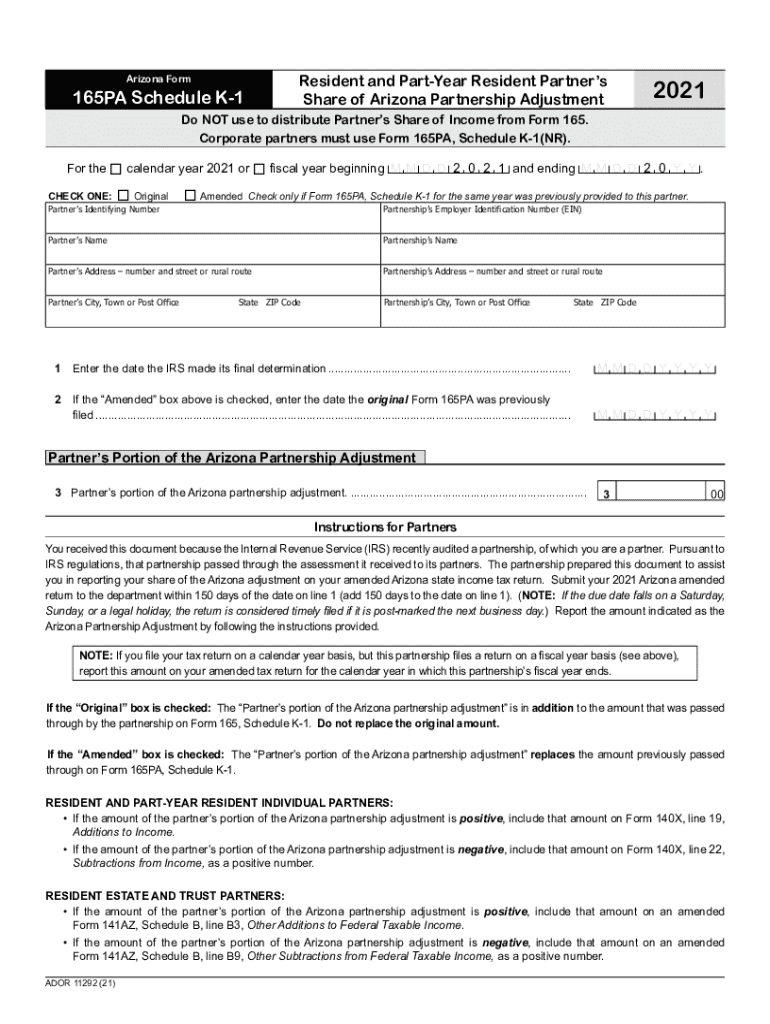

Overview of Arizona Form 165PA

Arizona Form 165PA is an essential document primarily utilized by partnerships and LLCs to report their income, deductions, and credits to the Arizona Department of Revenue. This form serves as a way for these entities to comply with state tax obligations, ensuring all partners are appropriately accounted for in terms of income division. Properly completing the Arizona Form 165PA is crucial for both residents and non-residents engaging in business within Arizona, providing a clear outline of income and obligation.

The use of Arizona Form 165PA is not limited to local partnerships. Non-resident partners with income sourced from Arizona must also file, thereby emphasizing the form's importance for a broad range of businesses operating in or alongside Arizona’s economy.

Who should use this form?

Arizona Form 165PA is specifically designed for partnerships and limited liability companies (LLCs) that want to report income on behalf of their partners. Eligible entities encompass both resident and non-resident partnerships, including multi-member LLCs, that are conducting business within the state. Entities that meet these criteria and engage in any business activity, whether selling products, providing services, or earning rental income, must file this form.

To determine eligibility, a business should assess its structure and operations. If a partnership has more than one member and earns income, regardless of its operational base in Arizona or abroad, filing the Arizona Form 165PA is necessary to maintain compliance with state tax regulations.

Key components of Arizona Form 165PA

The Arizona Form 165PA is composed of several key sections designed to capture detailed information about the partnership. Comprehensive understanding and accurate completion of these sections are vital to avoid misreporting that can lead to tax penalties. Main components include:

Additionally, understanding key terms such as "residency" and "partnership adjustments" is crucial. Residency affects tax payments based on where parties reside, while partnership adjustments refer to any modifications required to align with Arizona tax laws.

Step-by-step guide to completing Arizona Form 165PA

Completing Arizona Form 165PA requires gathering necessary information and following a systematic approach. Here's a step-by-step breakdown to guide you through the process.

Common mistakes to avoid with Arizona Form 165PA

While navigating Arizona Form 165PA, several common pitfalls can hinder successful submissions. Being aware of these can streamline the filing process and mitigate frustration.

Being mindful of these common mistakes ensures a smoother filing experience and reduces the likelihood of complications.

Frequently asked questions (FAQ)

Navigating the Arizona Form 165PA can raise various questions, particularly regarding compliance and submission processes. Here are the answers to some frequently asked questions:

Additional considerations

When dealing with partnerships, especially those operating across state lines, certain additional considerations come into play. Multi-state partnerships may need to navigate differing tax obligations, requiring a comprehensive review of each state’s partnership regulations.

Annual updates to Arizona tax law can significantly impact your filing. Keeping abreast of changes ensures compliant and optimized tax situations for partnerships. Regularly check the Arizona Department of Revenue’s website for the latest updates.

Related forms and documentation

In conjunction with Arizona Form 165PA, various related forms may also need to be considered for comprehensive partnership tax filing. Each of these documents serves distinct purposes:

Understanding how Form 165PA connects with these documents will provide partners a more holistic view of their tax responsibilities.

Utilizing pdfFiller for Arizona Form 165PA

Utilizing pdfFiller for Arizona Form 165PA streamlines the process of document creation and management. A cloud-based platform vastly improves accessibility, allowing users to edit, eSign, and collaborate on the necessary forms from virtually anywhere.

Final tips for managing Arizona Form 165PA

Managing Arizona Form 165PA does not conclude with its submission. Tracking your submission and maintaining accurate records are essential best practices. Keeping copies of submitted forms, communications, and any supporting documents safeguards against future discrepancies.

If complexities arise during the filing process, seeking professional guidance from tax advisors or accountants knowledgeable in Arizona tax law is advisable. They can provide tailored advice ensuring compliance and optimizing tax strategies for your partnership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify arizona form 165pa schedule without leaving Google Drive?

How do I edit arizona form 165pa schedule on an iOS device?

Can I edit arizona form 165pa schedule on an Android device?

What is azizona form 165pa schedule?

Who is required to file arizona form 165pa schedule?

How to fill out arizona form 165pa schedule?

What is the purpose of arizona form 165pa schedule?

What information must be reported on arizona form 165pa schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.