Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-To Guide

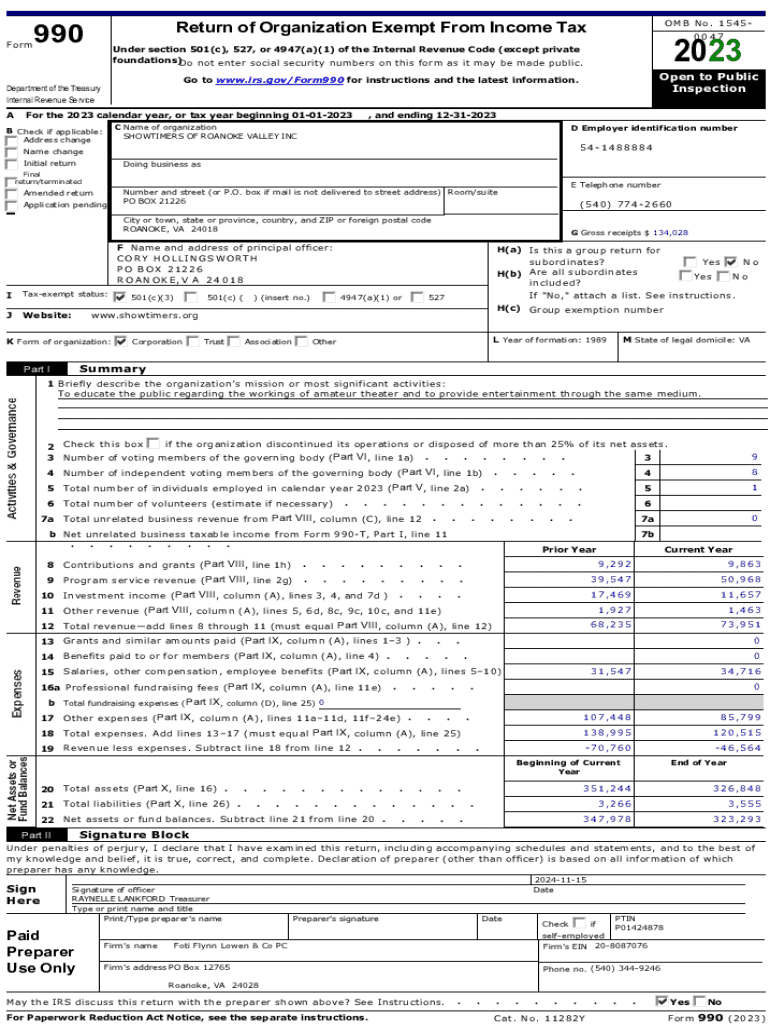

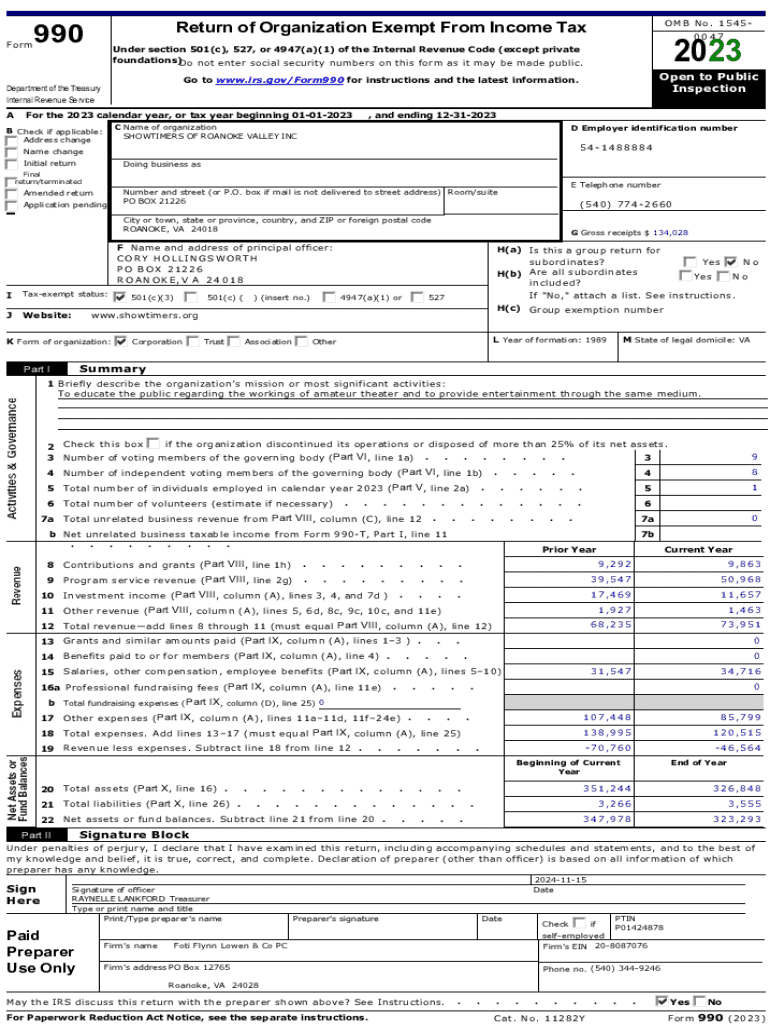

Overview of Form 990

Form 990 is a critical financial document that tax-exempt organizations, including nonprofits, must file annually with the IRS. Designed to provide transparency into the financial operations and governance of these entities, Form 990 serves both regulatory and informational purposes. It allows the IRS and the public to gain insights into how charities manage their resources and fulfill their missions.

The importance of Form 990 lies in its role as a tool for accountability. Nonprofits are entrusted with public funds and donations; thus, stakeholders—including donors, grantmakers, and regulatory bodies—rely on Form 990 to assess an organization’s financial health and operational practices. Additionally, it plays a central role in tax compliance and can illuminate trends and challenges within the nonprofit sector, making it a vital component for researchers and analysts.

Understanding the filing requirements

Certain organizations are mandated to file Form 990 based on their tax-exempt status and income thresholds. Organizations that gross $200,000 or more in annual revenue or have total assets of $500,000 must file the full Form 990. Smaller organizations may qualify to file Form 990-EZ, while those with gross receipts of less than $50,000 can opt for the streamlined e-Postcard (Form 990-N). Understanding these thresholds helps nonprofits determine their specific filing obligations.

Filing deadlines for Form 990 generally fall on the 15th day of the 5th month following the end of the organization's fiscal year. For organizations operating on a calendar year schedule, this means the due date is May 15. Extensions can be requested, allowing an additional six months to file. It's paramount for organizations to track these deadlines to maintain compliance and avoid penalties.

Detailed breakdown of Form 990 sections

Form 990 consists of several parts, each designed to capture specific information about the organization. Part I offers a summary, highlighting essential details like the organization’s mission and significant accomplishments during the year. This initial snapshot is crucial for providing context to the more detailed financial information that follows.

Part II outlines the program service accomplishments and details how the organization fulfills its mission through various programs. This section helps stakeholders understand the impact their contributions make. Part III delves deeper, specifying essential program information, including objectives and results achieved, which provides critical insights into the effectiveness of programs.

Part IV covers governance and management practices, such as board structure and conflict-of-interest policies, thereby showing the internal controls in place to ensure proper oversight. Ultimately, Part V presents financial statements detailing the balance sheet, income, and expenses, offering a complete financial overview necessary for accountability.

Preparing to complete Form 990

Preparation is key when it comes to completing the Form 990 efficiently. Organizations should gather required documentation, including detailed financial records, a mission statement, and prior year’s Form 990 to ensure consistency and accuracy in reporting. By having this information at hand, organizations can avoid unnecessary delays and misreporting.

Utilizing interactive tools and templates can streamline the completion process. For example, platforms like pdfFiller offer user-friendly solutions that enable users to edit PDFs, eSign documents, and collaborate seamlessly, ensuring that all necessary details are precisely captured before submission.

Filling out Form 990

Filling out Form 990 requires careful attention to detail. Begin with Part I, summarizing organizational structure and mission. As you continue through the form, ensure to provide precise data corresponding to each section’s requirements. For organizations filing Part II and Part III, it’s essential to articulate achievements accurately to reflect the organization's impact effectively.

Common mistakes include underreporting revenue, inaccuracies in mission statements, and failing to document program outcomes adequately. Avoid these pitfalls by double-checking figures and ensuring thorough documentation support each claim. After completing the form, e-signing through pdfFiller not only adds legitimacy but also allows for seamless collaboration among team members involved in the filing process.

Filing options for Form 990

Organizations have options when submitting Form 990, primarily e-filing or paper filing. E-filing has become increasingly popular due to its speed, efficiency, and instant confirmation of receipt. However, paper filing remains an option, especially for organizations not ready to transition to digital platforms. Understanding the pros and cons of each can assist organizations in making informed choices regarding how to file.

To e-file using pdfFiller, simply upload the completed Form 990 document and follow the platform's straightforward submission process. This ensures that your filing is processed efficiently and allows for easy tracking of submission status. Remember to keep a copy of the confirmation received for your records.

Understanding penalties for non-compliance

Non-compliance with Form 990 filing requirements can lead to significant penalties. Organizations that fail to file on time may incur fines. If inaccuracies are found in the filed information, additional penalties could apply. Consequences extend beyond monetary fines; persistent non-compliance can lead to losing tax-exempt status, which can have devastating effects on a nonprofit’s ability to operate and attract donations.

To avoid these threats, it's imperative to maintain diligent record-keeping, ensure timely filings, and conduct thorough reviews for accuracy before submission. Using tools like pdfFiller supports organizations in their compliance efforts by simplifying document editing and submission.

Public inspection regulations

Form 990 is not only a compliance requirement; it also serves as a public document that allows transparency in the nonprofit sector. Organizations are required to make Form 990 available for public inspection, thereby ensuring accountability to donors and the community they serve. The information reported is critical for stakeholders who wish to evaluate an organization's effectiveness and financial integrity.

Anyone can request to view Form 990, and organizations must be prepared to provide copies upon request. The importance of this transparency cannot be overstated; it reinforces public trust and aids in fostering relationships with donors and beneficiaries alike.

Form 990 in context

Historically, Form 990 has evolved alongside the nonprofit sector itself. Initially introduced to ensure accountability, its design and requirements have adapted over the years to meet changing needs and standards of transparency. Recent trends show a growing emphasis on nonprofit impact measurement and increased scrutiny from the public and donors, which places even greater importance on accurate reporting.

Current trends also suggest that organizations are adopting technology to streamline their reporting processes. Form 990 remains a pivotal tool not only for compliance but also for charity evaluation research, as it contains rich data for analysts attempting to assess the state of the sector and identify best practices.

Additional filing resources

Organizations completing Form 990 may benefit from various third-party resources designed to assist in the filing process. Many organizations offer detailed guidelines, FAQs, and professional services tailored to nonprofit compliance. Specific IRS resources are also vital for understanding changes in regulations or expectations regarding Form 990.

pdfFiller enhances this process by providing tools such as live chat support, tutorials, and webinars that guide users through their form completion journey, ensuring they have all necessary resources at hand for accurate filings.

Frequently asked questions (FAQs)

Many first-time filers have common questions about Form 990. One prevalent misconception is that all nonprofits must file. In reality, only those meeting specific income thresholds are required to file, while others can opt for a simpler e-Postcard. Clarifications on reporting specifics, deadlines, and how to manage amendments are frequently sought. Addressing these questions not only demystifies the process but empowers organizations to maintain compliance confidently.

For example, first-time filers might inquire about the average time taken to complete the form, which typically ranges between 15 to 20 hours depending on the organization's complexity. Utilizing resources like pdfFiller can significantly reduce this time and improve accuracy by providing intuitive document management tools.

Importance of continuous compliance

Continuous compliance with Form 990 is essential for maintaining an organization’s tax-exempt status and ensuring credibility with stakeholders. Annual updates and renewals keep organizations aligned with best practices and evolving regulations. Regular monitoring of Form 990 requirements allows organizations to stay prepared ahead of deadlines and avoids potential penalties associated with non-compliance.

Utilizing document management solutions like pdfFiller can aid in ongoing compliance efforts. The platform supports nonprofits by offering tools for efficient document creation, editing, and storage, ensuring that organizations have the necessary resources to stay compliant year after year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the form 990 form on my smartphone?

Can I edit form 990 on an Android device?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.