Understanding the Confirmation of Bank Account Form: A Complete Guide

Overview of confirmation of bank account form

A confirmation of bank account form is a formal document used to verify the ownership and details of a bank account. This form plays a crucial role in various financial transactions and processes, ensuring that both the bank and third parties can authenticate account information efficiently. When an organization requires assurance about a client’s or employee’s bank details, this form provides a systematic way to confirm those details, enhancing trust and facilitating smooth operations.

There are several common scenarios that may necessitate the use of this form. For instance, employers often need to confirm an employee’s bank details for payroll processing. Similarly, lenders may require this verification as part of the loan application process to ensure that loan funds are directed to the correct account. Additionally, applications for government benefits can also require a confirmation of bank account form to validate financial information.

Key components of the confirmation of bank account form

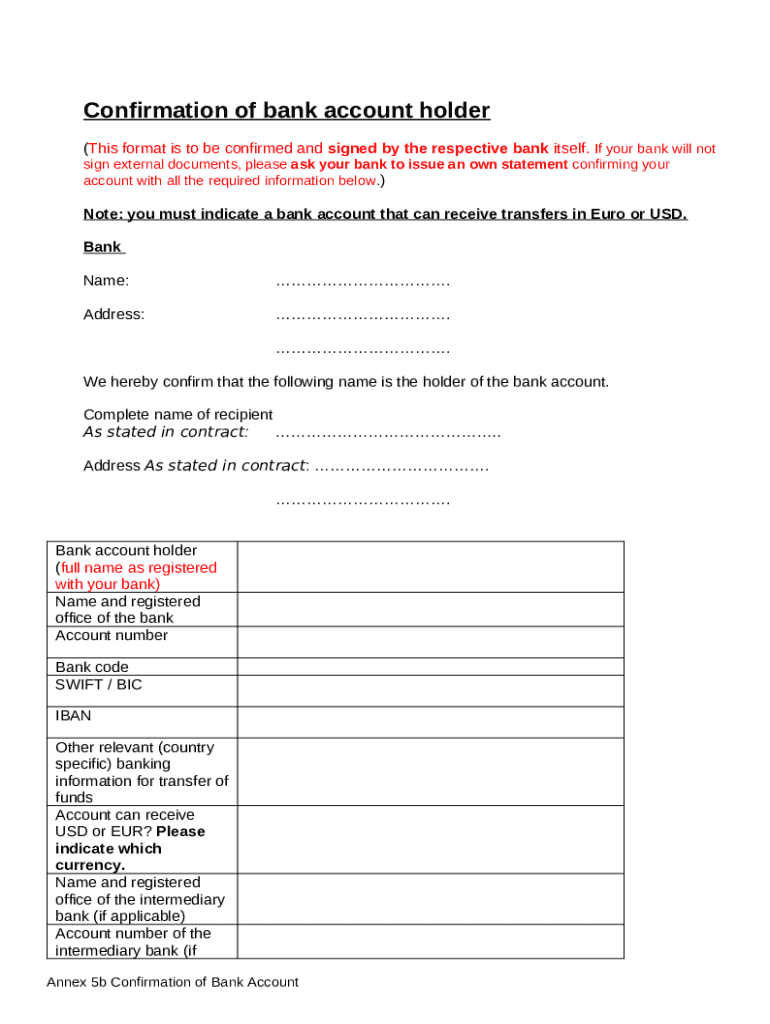

Understanding the layout of the confirmation of bank account form is essential for ensuring that all necessary information is captured correctly. The form typically includes the following components:

This includes the name of the bank, the branch, and the date the form is issued.

Here, the account holder provides personal details such as their name, address, and identification number.

This section contains specifics about the account, including the account number, account type, and the current balance.

Lastly, this section clarifies why the verification is being requested, such as for employment or loan applications.

Each section must be filled out with precise and accurate information. For example, acceptable identification documents might include government-issued IDs or Social Security cards. It's crucial to provide this information to avoid delays in processing.

Detailed instructions for completing the form

Completing the confirmation of bank account form requires careful attention to detail. Here’s a step-by-step process:

Collect all necessary personal and bank details. This includes identification information like a driver’s license or passport, and bank-specific information such as the account number and type.

When completing the form, ensure to use clear handwriting or type the information. Double-check that all sections are filled accurately. Misreporting data can lead to significant delays.

After filling out the form, take a moment to review each entry. Check for errors or omissions by comparing with your gathered documents to ensure everything aligns.

Avoid common pitfalls such as neglecting to sign the form or forget to include crucial documents. A thorough review process can save time and prevent follow-up issues.

Common uses for the confirmation of bank account form

The confirmation of bank account form serves multiple purposes across various sectors. Here are some common uses you might encounter:

Employers often require this form to confirm an employee's banking details for direct deposits.

When applying for a loan, banks typically necessitate this verification to affirm the account into which funds will be dispersed.

Individuals applying for various government support programs may be asked to provide this confirmation to ensure they meet financial requirements.

In legal matters, especially those pertaining to finance or estate cases, a bank account verification may be requested by courts.

These usage scenarios emphasize the importance of having a well-prepared confirmation of bank account form to ensure smooth proceedings in matters that involve financial transactions.

The verification process explained

Once the confirmation of bank account form is completed, it’s submitted to the bank for verification which follows a clear sequence of steps.

The completed form needs to be submitted, either physically or digitally, depending on the bank's requirements.

After submission, the bank will review the information. This process duration can vary between institutions, generally taking from a few hours to several days.

Once reviewed, the bank will send back a confirmation document indicating that the bank account details have been verified. This document may be required for further processes.

Understanding this process is essential for planning timelines, especially when the verification impacts critical deadlines for employment or loan approvals.

Interactive tools for managing your documents

With the digital transformation of document management, tools like pdfFiller provide seamless solutions for handling the confirmation of bank account form efficiently.

This platform allows you to upload and personalize the confirmation form easily. You can edit the document directly, adding necessary details without hassle.

pdfFiller also enables users to add electronic signatures for quick approval, making the process even more efficient. No need to print or scan — sign digitally!

Share the document securely with colleagues or clients using pdfFiller’s sharing options. You can set permissions to ensure that only authorized persons can edit or view sensitive information.

Utilizing an all-in-one document management platform like pdfFiller can significantly streamline the process of completing and managing the confirmation of bank account form.

FAQs about the confirmation of bank account form

Many individuals have questions about the confirmation of bank account form. Here are some frequently asked questions to clarify any uncertainties you may have:

If you realize there is an error after submission, contact the bank immediately for guidance on correcting the information. They will instruct you on what steps to take next.

The verification timeline varies by bank. Most banks complete the process within 1 to 5 business days, but this can be longer depending on their workload and your specific request.

Yes, you can use the confirmation of bank account form for different banks. However, ensure that you adhere to each bank's respective requirements and submission guidelines.

Having answers to these questions can assist in managing expectations and preparing properly when using the form.

Popular related forms and templates

In addition to the confirmation of bank account form, there are several other forms that may require similar bank and personal information. These related forms include:

Used to authorize an employer to deposit your wages directly into your bank account.

Commonly requires verification of bank account details as part of the financial assessment.

This often necessitates a bank account confirmation to facilitate direct payments from the state.

To manage these forms effectively, accessing downloadable templates tailored for bank-related confirmations through pdfFiller is a great resource.

Document management best practices

Once the confirmation of bank account form is filled out and submitted, it is equally important to manage your documents effectively. Here are some best practices to consider:

Maintain an organized digital or physical folder where all completed forms, including confirmations, are stored. Label them appropriately for easy retrieval.

Consider creating a submission log to track where and when documents were sent, along with any follow-up actions required.

Always safeguard sensitive information by using encrypted storage solutions and avoid sharing personal data via unsecured channels.

Effective management practices shield you from the risks of data breaches and ensure that documents are accessible when required.

User feedback and engagement

Continuously improving the usage of the confirmation of bank account form can be informed by user experiences. Feedback from individuals can highlight common challenges and improvements.

Surveys can provide insights into how individuals feel about the clarity and accessibility of the form process.

Invite users to share their positive experiences and tips on utilizing the confirmation of bank account form effectively with others.

By understanding how real users interact with the process, future updates and enhancements can better meet the needs of all stakeholders.

Seamless transition to other document management solutions

Leveraging pdfFiller for your confirmation of bank account form can also serve as a bridge for other document management needs. The platform offers a range of features that enhance document management across multiple contexts.

The same principles used for managing your confirmation of bank account form can be applied to various documents, from contracts to tax forms.

Gain access to functionalities such as advanced editing, secure sharing, and efficient archiving, making document handling comprehensive and user-friendly.

Utilizing such tools can drastically improve overall efficiency in handling documents, providing a consistent approach to all your document requirements.