Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding and Navigating Form 990: A Comprehensive Guide for Nonprofits

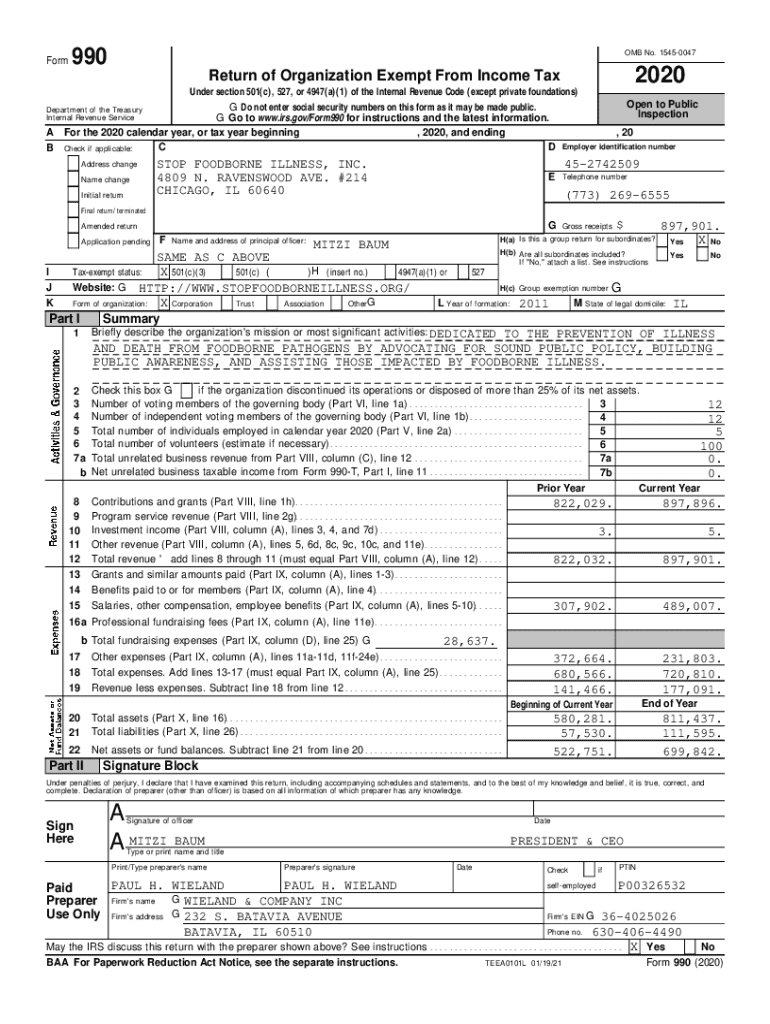

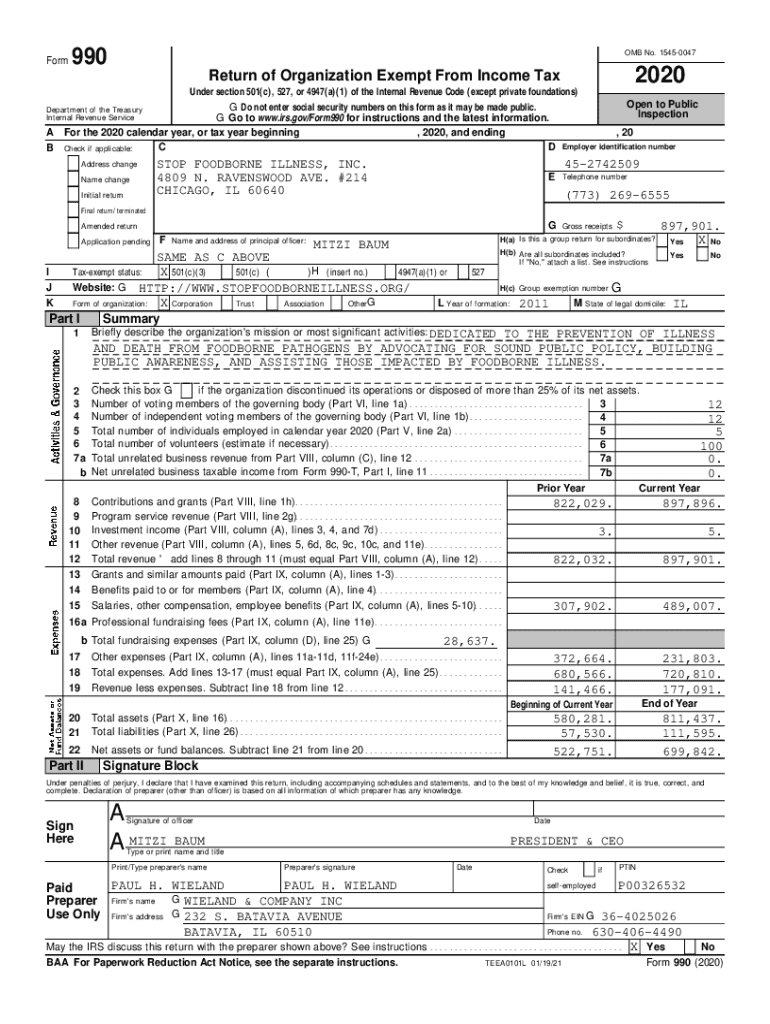

Understanding Form 990

IRS Form 990 is a critical document that nonprofit organizations must file annually to provide the IRS and the public with detailed information about their activities, finances, and governance. Unlike for-profit entities, nonprofits must maintain transparency to retain their tax-exempt status, making Form 990 essential for accountability. It features key financial data that informs stakeholders about how a nonprofit allocates its resources within the community.

The importance of Form 990 extends beyond compliance; it serves as a vital tool for organizations in promoting trust and credibility. Funders, potential donors, and the general public can scrutinize a nonprofit’s operations through this form, underscoring the importance of maintaining accurate and transparent financial records. Nonprofits use Form 990 not only for regulatory purposes but also for strategic planning, funding opportunities, and operational improvements.

Who must file Form 990?

Nonprofit organizations that have gross receipts over $200,000 or total assets exceeding $500,000 are generally required to file Form 990. Smaller organizations, with gross receipts under $50,000, may only need to file Form 990-N, also known as the e-postcard. However, it's crucial for organizations to understand whether they fall within exemption criteria; certain religious organizations and government entities, for instance, are not usually required to file.

Furthermore, the requirements can vary significantly based on organizational structure and income sources. Nonprofits must be mindful of their specific circumstances to ensure compliance with IRS regulations. Organizations that anticipate reaching the reporting thresholds in the future should develop a proactive strategy for filing to avoid potential penalties.

Filing modalities: How to submit Form 990

When it comes to filing Form 990, organizations have the option to submit either a paper version or an electronic version, with electronic submission being the preferred method for most nonprofits due to speed and efficiency. Electronic filings are typically processed more rapidly, ensuring that your organization can demonstrate compliance without unnecessary delays. Nonprofits should verify that they have registered with the IRS e-File system to facilitate this process.

Important deadlines for filing Form 990 typically fall on the 15th day of the 5th month after the end of an organization’s fiscal year. Nonprofits should be diligent in tracking these dates, as late submissions can incur penalties. Moreover, requesting a six-month extension is possible through IRS Form 8868; however, this does not extend the payment deadline for any owed taxes.

Penalties for noncompliance

Failure to comply with Form 990 filing requirements can result in significant penalties, including fines for late submission and inaccurate reporting. The IRS can impose penalties starting at $20 per day, up to a maximum of $10,000, depending on the organization's size and circumstances. Additionally, continuing failure to submit the form can jeopardize a nonprofit’s tax-exempt status, which could lead to devastating consequences for an organization’s operations.

To mitigate penalties, organizations should establish a compliance calendar to track deadlines and filing obligations. This proactive approach includes seeking assistance from competent professionals or utilizing online platforms like pdfFiller to ensure that all forms are completed accurately and on time. By prioritizing compliance, nonprofits can foster a stronger reputation and trust with stakeholders.

Interactive tools for completing Form 990

Completing Form 990 can be an intricate process; however, utilizing interactive tools can significantly streamline the experience. Services like pdfFiller offer step-by-step guidance on how to fill out Form 990 accurately, reducing confusion for first-time filers. Moreover, creating checklists compatible with your processes can enhance efficiency, ensuring that all required information is supplied before submission.

Preventing common mistakes during filing is essential. Utilizing resources that highlight frequent errors can help organizations avoid simple pitfalls that could lead to compliance issues. An effective filing process fosters higher engagement from stakeholders and strengthens the organization’s credibility in the long run.

Public inspection regulations

Form 990 is not only a compliance document but also serves as a public record. Nonprofits are required to make their Form 990 filings available for public inspection, ensuring transparency in their financial activities. Typically, these documents can be viewed online or requested directly from the organizations. Public access fosters accountability and empowers stakeholders to make informed decisions.

Accessing Form 990 filings from other organizations can be insightful for comparative analysis and benchmarking. By reviewing similar organizations’ filings, prospective donors, and charity evaluators can assess the financial health and operational efficacy of a nonprofit, thereby promoting informed contributions. Transparency in this regard not only enhances trust but builds stronger relationships within the nonprofit community.

History and evolution of Form 990

Form 990 has undergone several key transformations since its inception. Initially designed to maintain records of charitable organizations, the form has expanded in scope to enhance transparency and accountability across the nonprofit sector. In response to various legislative changes, such as the Pension Protection Act of 2006, the IRS introduced additional reporting requirements, focusing on governance and executive compensation.

These updates reflect an ongoing commitment to better financial oversight and public accountability in the nonprofit sector. Organizations need to stay abreast of these changes to ensure compliance and adapt their reporting to reflect contemporary standards expected by stakeholders and regulatory bodies.

Utilizing Form 990 for charity evaluation research

Form 990 serves as an invaluable resource for assessing nonprofit performance and funding efficiency. Donors and evaluators can analyze various financial indicators from the form to make informed decisions about where to allocate resources. Key metrics, such as revenue sources and expenditures toward program services, allow stakeholders to understand the efficacy of an organization’s mission and the impact of their contributions.

Beyond basic evaluations, Form 990 helps create benchmarks and insights into operational best practices across nonprofits. By utilizing tools and resources to effectively interpret data from Form 990, stakeholders can engage in deeper analysis, ensuring their decisions align with their values and community needs.

Third-party sources for Form 990 assistance

Navigating the complexities of Form 990 can be a daunting task, but various third-party sources are available to simplify the process. Nonprofits can leverage specialized software tools designed for Form 990 completion and eFiling, such as those provided by pdfFiller. These platforms offer features that enable users to edit, eSign, and collaborate within a cloud-based environment, streamlining the filing process.

In addition to software, consulting options are also available for organizations requiring more personalized or complex guidance. Engaging with nonprofit professionals can provide tailored insight into both compliance and operational efficiency based on specific organizational needs, enhancing strategic decision-making while ensuring adherence to filing requirements.

Frequently asked questions about Form 990

It’s common for nonprofits, especially new filers, to have queries regarding Form 990. One prevalent concern is understanding the key sections involved in the form and what specific details need to be reported. Organizations may also wonder about exceptions from filing based on their income or operational structure. Addressing these FAQs is critical for ensuring compliance and reducing anxiety around the process.

Another point of confusion often arises with regard to public access to Form 990 filings. Organizations should be prepared to answer questions about how stakeholders can access their documents and the implications of such transparency on operational credibility. Providing clear, comprehensive information helps demystify the filing process and fosters a transparent culture within the nonprofit sector.

Navigating and managing your Form 990 documents

Managing Form 990 documents becomes significantly easier with the right tools, such as pdfFiller. This platform empowers users to edit PDFs seamlessly and fill out forms accurately, also offering eSigning capabilities for complete transparency in document management. Collaborating with team members on Form 990 becomes straightforward, ensuring all hands are on deck for preparing filings without confusion.

Moreover, by leveraging cloud-based platforms, organizations can secure their Form 990 documents while accessing them from anywhere. This capability ensures that teams can work together in real-time, enhancing productivity and accountability without compromising data security. The right tools can elevate a nonprofit’s operational efficiency and contribute to successful compliance.

Staying updated: Changes in Form 990 requirements

Keeping track of new IRS regulations regarding Form 990 is crucial for compliance and organizational success. Subscribing to newsletters from the IRS or relevant nonprofit organizations can be an excellent way to remain informed. Actively engaging with peer networks can also provide valuable insights into evolving best practices in reporting standards.

Regular participation in webinars and workshops hosted by leading nonprofit authorities can enhance knowledge and ensure that organizations are well-equipped to manage their tax responsibilities. By fostering a culture of continuous learning and adaptation, nonprofits can better prepare for changes and reinforce their commitment to transparency and best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 990 online?

How do I edit form 990 straight from my smartphone?

How do I complete form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.