Get the free P45 Part 1a

Get, Create, Make and Sign p45 part 1a

Editing p45 part 1a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out p45 part 1a

How to fill out p45 part 1a

Who needs p45 part 1a?

P45 Part 1A Form - How-to Guide Long-Read

Understanding the P45 Part 1A form

The P45 Part 1A form is an essential document in the UK that provides information about an employee's tax and employment status when they leave a job. This form is crucial for both the employee and the new employer when starting a new job, as it outlines the tax information from the employee's previous employment.

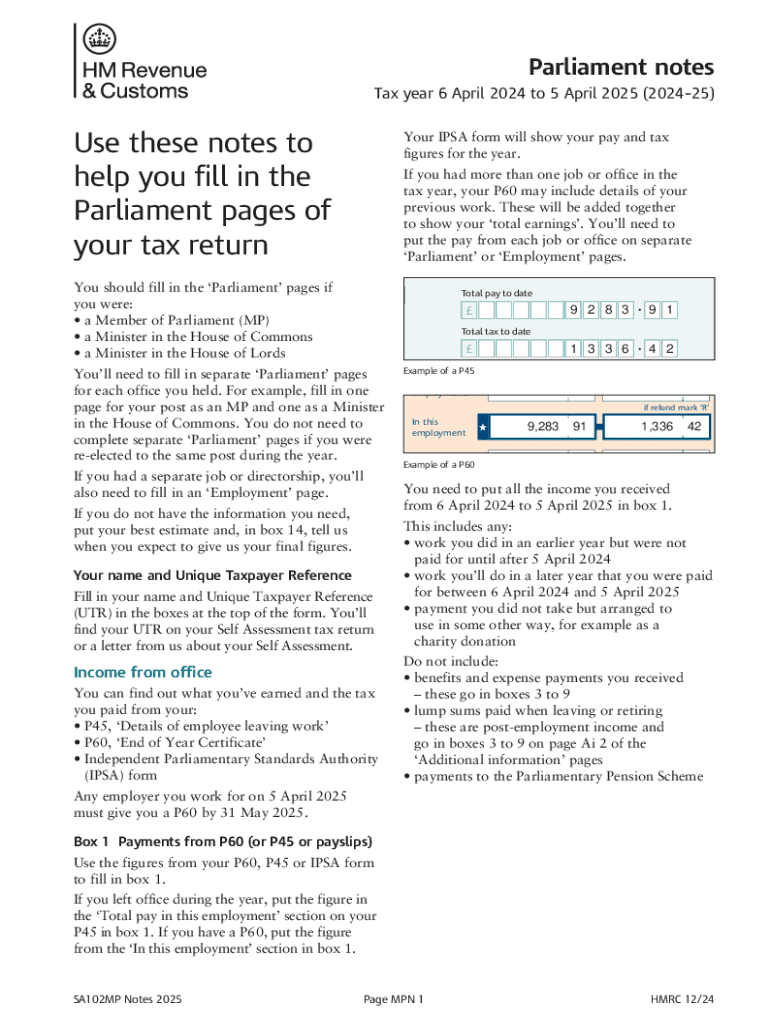

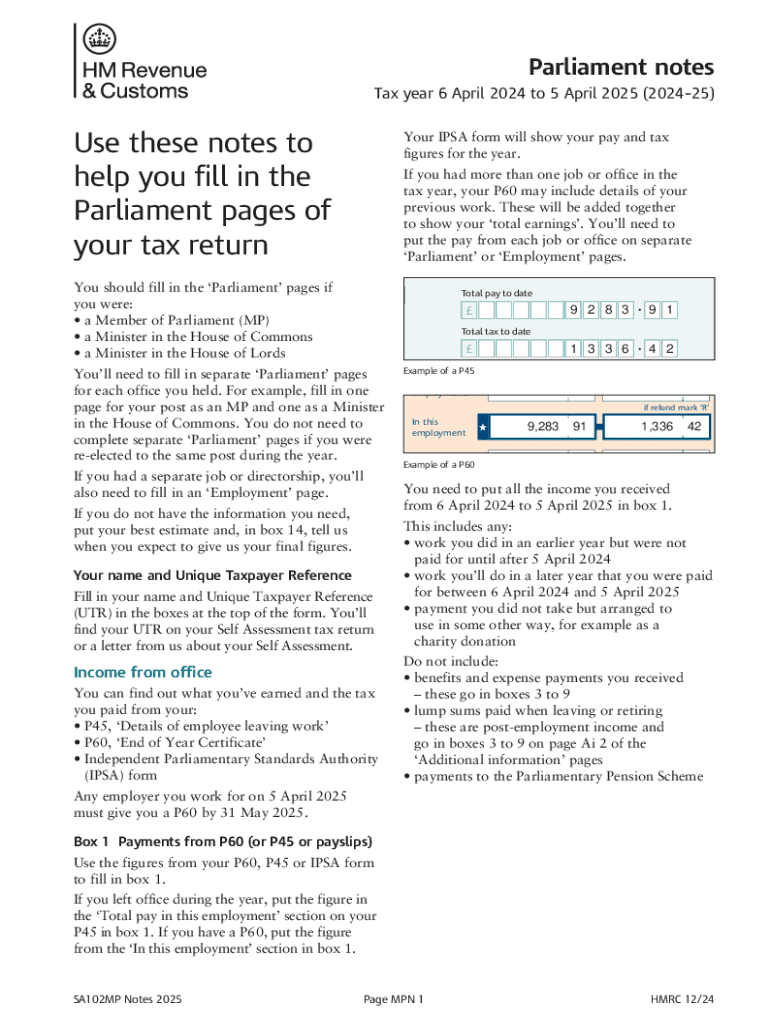

Component-wise, the P45 Part 1A includes several key sections: personal details like your name and National Insurance number, the details of your employer, your tax code, and earnings to date. It serves not only as proof of your employment history but also as a guide to your tax liability.

Having this form is imperative for maintaining accurate employment records. It ensures that new employers can apply the correct tax code to your earnings right from the start, helping you avoid potential tax issues later.

The role of the P45 Part 1A in taxation

The P45 Part 1A form has a direct correlation with the taxation process in the UK. It provides your new employer with essential details about your previous income and tax paid which influences how they will tax your future earnings. Understanding this form is crucial to manage your tax-related risks effectively.

Tax codes displayed on the P45 Part 1A informs your new employer about the tax reliefs you're entitled to. It's essential to check if the tax code is correct; an incorrect tax code may result in paying too much or too little tax, leading to potential issues with the HMRC.

Several misconceptions surround the P45 Part 1A form, primarily regarding its validity and necessity. Some may assume that once they stop working, they don’t need to worry about their P45—this is far from true. Understanding your P45 can help clarify any tax-related questions or concerns you may have.

Obtaining your P45 Part 1A form

You receive your P45 Part 1A form from your employer when you leave a job. It is an obligation for employers to provide this form on your last working day, facilitating a smooth transition into your next role.

To request your P45 Part 1A, follow this step-by-step process:

If your employer fails to provide a P45, you should report this issue to the HMRC. During this time, you may need to use a P46 form until you get your P45.

Filling out the P45 Part 1A form

Filling out the P45 Part 1A form correctly is important for ensuring a smooth transition to your next job. There is specific key information required including your address, tax code, and National Insurance number. The accuracy of this information is crucial in determining tax liability.

Common errors to avoid while filling out the P45 include incorrect personal details or not checking for updates to your tax code. Always double-check and validate your information before submission.

To ensure accurate completion, refer to your payslips for consistency, and make use of online resources, such as pdfFiller, to streamline the editing and signing process.

Using your P45 Part 1A form

Your P45 Part 1A form is invaluable for future employment. New employers need to process this document to set your tax code correctly and to prevent emergency tax rates from applying.

Don’t overlook the significance of submitting your P45 to new employers. If you fail to provide one, your new employer may have to tax you at the basic rate, which can result in overpayment.

In situations where you don't have your P45 for your new job, you should discuss the issue with your new employer and possibly fill out a 'P46' as a temporary measure until you receive the P45.

Managing your P45 Part 1A documentation

Proper management of your P45 Part 1A form is essential for maintaining your employment records. Store it securely but also ensure easy accessibility for future reference. A physical copy should be kept in a safe place, while a digital version can be backed up for easier access.

Digital solutions like pdfFiller allow for easy uploads and backups, ensuring your P45 is secure and readily available when needed. Utilizing cloud-based document management promotes an organized workflow and instant access from anywhere.

Special circumstances surrounding the P45 Part 1A

There are various scenarios concerning the P45 Part 1A form, including the situation for employees on temporary contracts. Temporary workers are issued a P45 each time they leave a role, which ensures accurate tax coding for their next position.

For self-employed workers, a P45 is not applicable, but they should have documentation proving their income status. Furthermore, managing multiple P45s due to switching jobs frequently can get complicated; make sure to keep each in chronological order for smooth processing.

Frequently asked questions about the P45 Part 1A

One common question regarding the P45 Part 1A is whether the form is valid indefinitely. The answer is no; tax regulations change and you may need updated forms.

If you change jobs mid-year, you can receive a new P45 reflecting your earnings up to that point in the tax year. It’s essential to understand how emergency tax may apply if no P45 is available when starting a new job.

Leveraging pdfFiller for your P45 Part 1A needs

pdfFiller offers seamless electronic signing features that make managing your P45 Part 1A forms hassle-free. Sign forms online, easily share and collaborate with your employers, which simplifies the process considerably.

Additionally, pdfFiller provides advantages for editing your PDFs, ensuring that any document processing is streamlined, particularly for sensitive tax forms like the P45 Part 1A. Using this platform for your tax documentation can ease compliance hassles.

Latest updates and regulations regarding P45 forms

Changes in employment law can affect how P45 Part 1A forms are processed. It’s essential to remain informed about any legal updates that may impact tax regulations and employer obligations.

Key dates in 2025 might bring new rules regarding the issuance of P45 forms. Future legislation may further streamline the process, making it more beneficial for employees transitioning jobs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my p45 part 1a in Gmail?

How do I edit p45 part 1a in Chrome?

How can I fill out p45 part 1a on an iOS device?

What is p45 part 1a?

Who is required to file p45 part 1a?

How to fill out p45 part 1a?

What is the purpose of p45 part 1a?

What information must be reported on p45 part 1a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.