Get the free Return of Organization Exempt From Income Tax 990

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: A Comprehensive How-to Guide

Understanding the return of organization exempt form

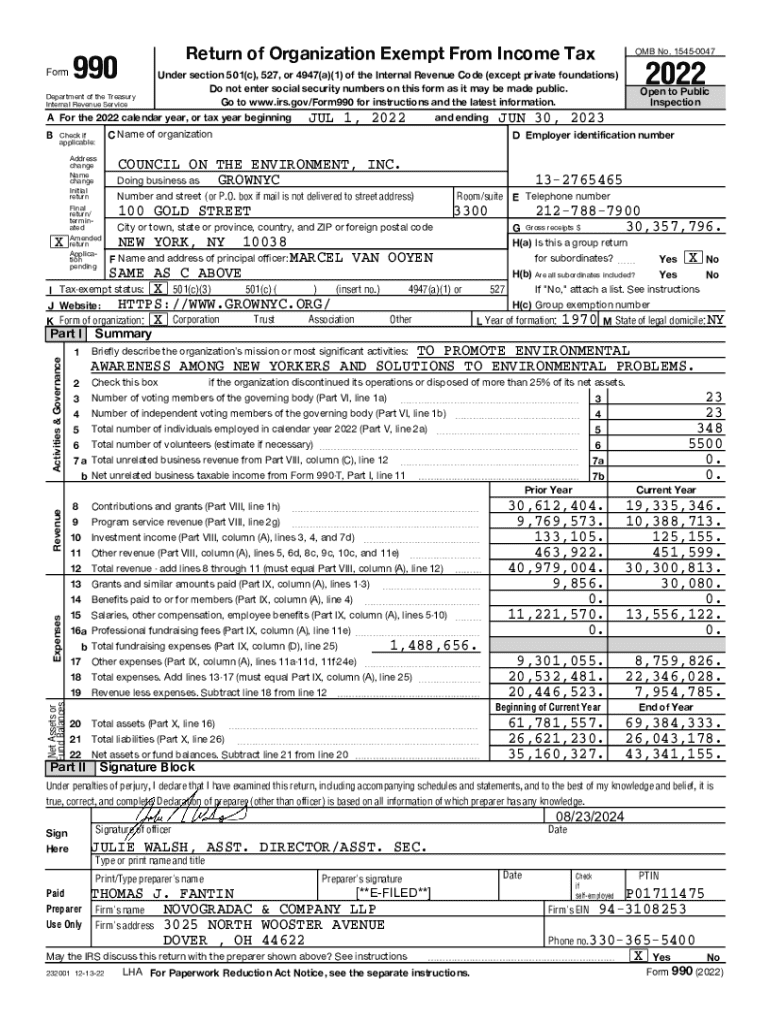

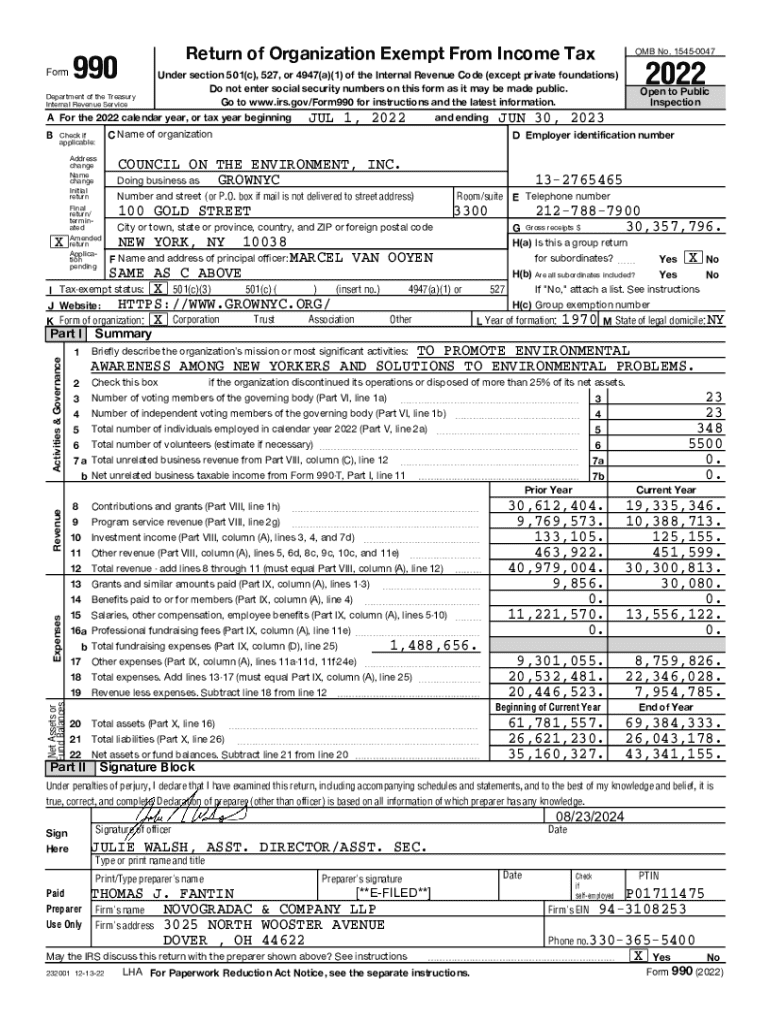

The Return of Organization Exempt Form, commonly referred to as Form 990, is a critical document for nonprofit organizations and those seeking tax-exempt status. This form serves as a financial report to the IRS, providing transparency about a nonprofit's income, expenditures, and operational activities. The primary purpose is to maintain compliance with federal laws governing tax-exempt entities, ensuring that they uphold public trust and accountability.

Filing this form is not just a regulatory requirement; it's a vital process for nonprofits to demonstrate their operational health and mission efficacy. Organizations that comply effectively can enhance their credibility among donors, regulatory bodies, and the general public. Any organization with gross receipts over a specific threshold or that is required to file under state law must submit this form to maintain tax-exempt status.

Who must file the return of organization exempt form?

Qualifying organizations that are required to file the Return of Organization Exempt Form include charities, religious entities, educational institutions, and various other nonprofit organizations. Generally, any organization recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code must file Form 990 yearly.

However, certain exceptions apply. Smaller nonprofits with gross receipts below the IRS threshold may be allowed to file a simpler version, such as Form 990-N, also known as the e-Postcard. Additionally, organizations that have been granted temporary or limited tax-exempt status or entities functioning solely for specific purposes, such as private foundations or religious organizations claiming exemption under section 501(c)(3), face different filing requirements.

Filing requirements for the return of organization exempt form

Filing the Return of Organization Exempt Form requires meticulous preparation of various documents. Nonprofits must gather financial statements, records of governance, and reports detailing program accomplishments, among other data. Specific documentation varies based on the organization's size and activities, but generally includes a balance sheet, income statement, and details on compensation packages for key employees.

Deadlines for filing Form 990 depend on the end of the organization’s fiscal year. Typically, organizations must submit their forms within 5 months after the conclusion of their fiscal year, with a possible six-month extension available. Moreover, variations by state may require additional local filings that must be carefully navigated to ensure complete compliance.

Step-by-step instructions for completing the form

Completing the Return of Organization Exempt Form can seem overwhelming, but breaking it down into sections makes it manageable. Every section plays a unique role in presenting a complete picture of the organization's functioning:

It's essential to ensure accuracy across all sections; minor errors can lead to complications during submission. Organizations often find it beneficial to have multiple team members review the form before filing to catch inconsistencies and to understand best practices for successful completion.

Variants of the return of organization exempt form

Different types of exempt entities utilize distinct variants of the Return of Organization Exempt Form, each tailored to the specific needs and requirements of the organization. For instance, larger nonprofits typically file Form 990, while smaller associations may qualify to file the condensed Form 990-EZ or the e-Postcard for entities with minimal gross receipts.

Understanding these distinctions is crucial for compliance, as the requirements across these forms can vary substantially. Smaller organizations often benefit from the streamlined process and reduced documentation requirements, alleviating the filing burden while ensuring they still meet IRS standards.

Key interactive tools for smooth filing

Using the right tools can significantly ease the process of completing the Return of Organization Exempt Form. pdfFiller provides features that empower users to edit PDFs, electronically sign documents, and collaborate seamlessly within teams to facilitate accurate and timely submissions.

In-app tutorials guide organizations through the nuances of the form, ensuring no section is overlooked. Collaboration tools allow different team members, from finance to governance, to input their data or feedback directly, making the filing process more efficient and thorough.

Managing and submitting the completed form

Submitting the Return of Organization Exempt Form can be done electronically or via paper filing, with electronic submission often preferred for its speed and reduced risk of errors. Organizations should familiarize themselves with the IRS e-filing process to ensure compliance and to take advantage of prompt processing times.

Tracking submissions is crucial; retaining copies of sent forms and confirmations of electronic submissions helps safeguard against potential disputes. Keeping these records accessible not only ensures compliance but also aids during audits and when preparing subsequent filings.

Public inspection regulations

Legal obligations require nonprofits to maintain transparency, allowing the general public access to filed Return of Organization Exempt Forms. This transparency is vital for fostering public trust and accountability, with stipulations that these forms must be accessible within a specified time frame after submission.

All Form 990 submissions must be made available for public inspection, ensuring that stakeholders can scrutinize an organization's financial and operational practices. Noncompliance with these regulations can result in fines and further scrutiny from regulatory bodies.

Penalties for non-compliance

Noncompliance with the Return of Organization Exempt Form can lead to significant repercussions for organizations. Potential fines for late or inaccurate filings can accumulate over time, substantially affecting an organization’s financial position. Furthermore, failing to submit the required documentation can jeopardize tax-exempt status, leading to more severe consequences, including potential loss of funding.

Real-world examples illustrate the impact of non-compliance; several nonprofits have faced dissolution or severe operational limitations due to failure to adhere to filing requirements, emphasizing the necessity of diligence and timely submission.

Historical context of the return of organization exempt form

The Return of Organization Exempt Form has evolved significantly throughout its history, reflecting changes in legislative requirements and societal expectations regarding transparency in the nonprofit sector. Initially introduced to streamline tax-exempt reporting, it has undergone several iterations to better capture detailed information about various organizations’ operations and finances.

Significant legislative changes have influenced the form, including reforms in the Taxpayer Bill of Rights and the 2006 Pension Protection Act, which aimed to enhance accountability within the sector. These changes highlight the ongoing need for nonprofits to adapt to legislative requirements and public scrutiny.

The role of the return of organization exempt form in charity evaluation

The Return of Organization Exempt Form plays a crucial role in evaluating the effectiveness of charitable organizations. Donors and grant makers often review these forms to assess an organization’s financial health, program efficiency, and alignment with their own philanthropic goals.

Best practices dictate that organizations utilize their filings to effectively communicate their mission, accomplishments, and operational strategies. Demonstrating impact through the form creates transparency and instills confidence among stakeholders—critical for attracting current and future funding.

Fiduciary reporting and additional obligations

Filing the Return of Organization Exempt Form is closely linked to fiduciary responsibilities. Board members and executives are tasked with ensuring organizational compliance with both the form’s requirements and the broader legal and ethical obligations governing nonprofit operations.

Organizations may face additional reporting requirements based on their activities, such as disclosures related to lobbying efforts or financial transactions involving board members. Resources are available to help organizations navigate these complexities, ensuring that contributions to fiduciary compliance are appropriately reported.

Frequently asked questions about the return of organization exempt form

A common query among organizations is regarding the distinction between Form 990, Form 990-EZ, and Form 990-N. While all pertain to the Return of Organization Exempt Form, they differ primarily in the size of the organization and the complexity of financial reporting required.

Another frequent concern pertains to penalties. Organizations often mistakenly believe that minor errors on their forms won’t lead to consequences. However, even minor inaccuracies can trigger audits. Guidance from experts is invaluable in ensuring compliance, making platforms like pdfFiller particularly useful for organizations seeking to simplify their filing process.

Next steps after filing the return of organization exempt form

After submitting the Return of Organization Exempt Form, organizations should stay informed about processing timelines and possible follow-ups. Understanding the timeline ensures organizations can track the status of their submissions and address any issues that arise promptly.

Moreover, preparing for potential audits or reviews by maintaining organized records of financial activities and program outcomes helps facilitate accurate reporting in subsequent years. Continuously revising and updating compliance protocols further strengthens an organization's position for future filings, ensuring persistent adherence to legal requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the return of organization exempt in Chrome?

How can I edit return of organization exempt on a smartphone?

How do I edit return of organization exempt on an iOS device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.