Get the free New Hire Payroll Set-up Package Instructions

Get, Create, Make and Sign new hire payroll set-up

Editing new hire payroll set-up online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new hire payroll set-up

How to fill out new hire payroll set-up

Who needs new hire payroll set-up?

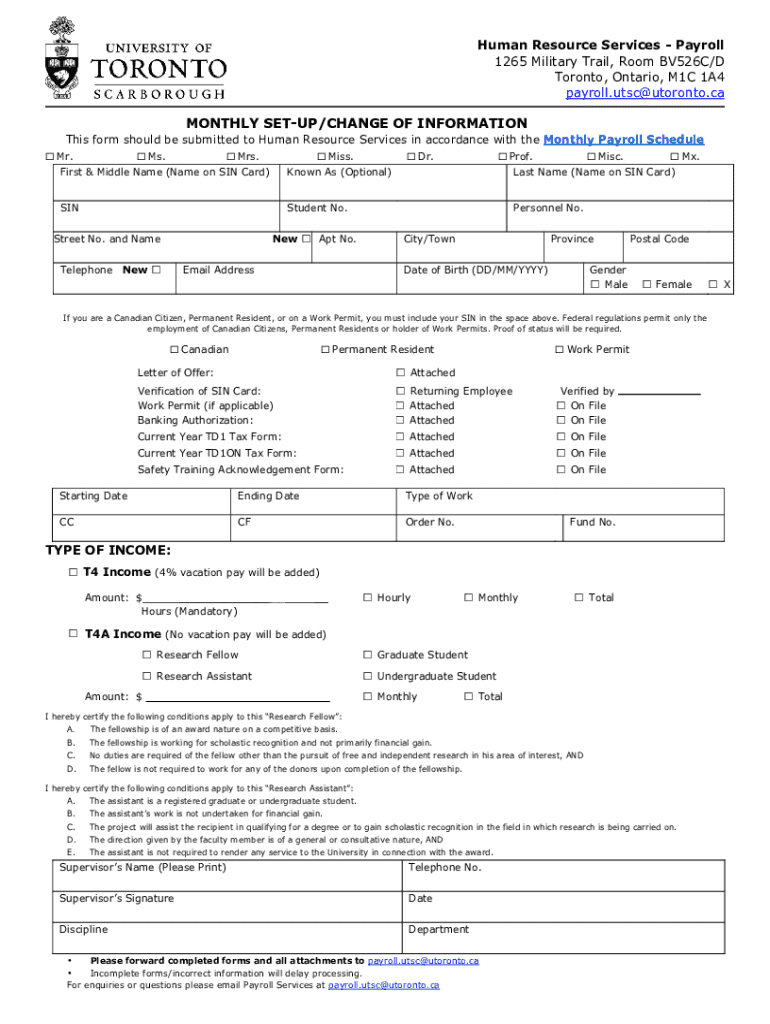

Understanding the New Hire Payroll Set-Up Form

Understanding the new hire payroll set-up form

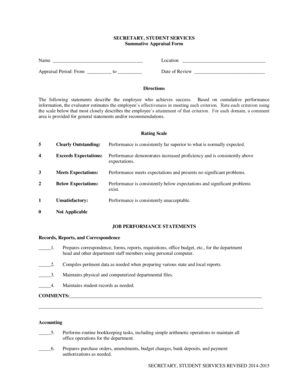

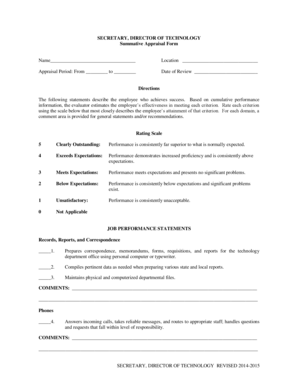

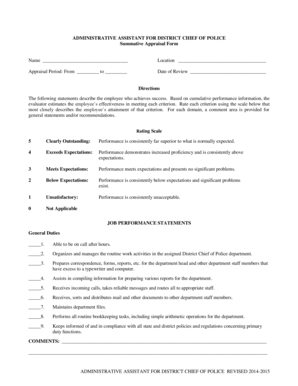

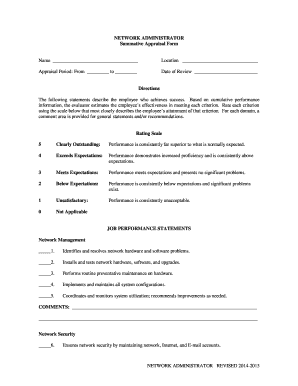

The new hire payroll set-up form is a critical document that every new employee must complete when joining a company. Its primary purpose is to collect essential information needed for payroll processing, ensuring that employees get paid accurately and on time. This form streamlines the integration of new hires into the payroll system, allowing employers to comply with various regulatory and tax requirements while providing employees with the necessary details for their earnings.

Completing the new hire payroll set-up form accurately is crucial for both employees and employers. Missteps can lead to delayed payments, incorrect tax withholdings, or administrative headaches. Moreover, new hires must provide accurate information ranging from personal details to bank account specifics, ensuring they are set up for direct deposit if that option is chosen. It promotes a smooth transition into the company's payroll structure, fostering a positive start to the employment experience.

Key components of the new hire payroll set-up form

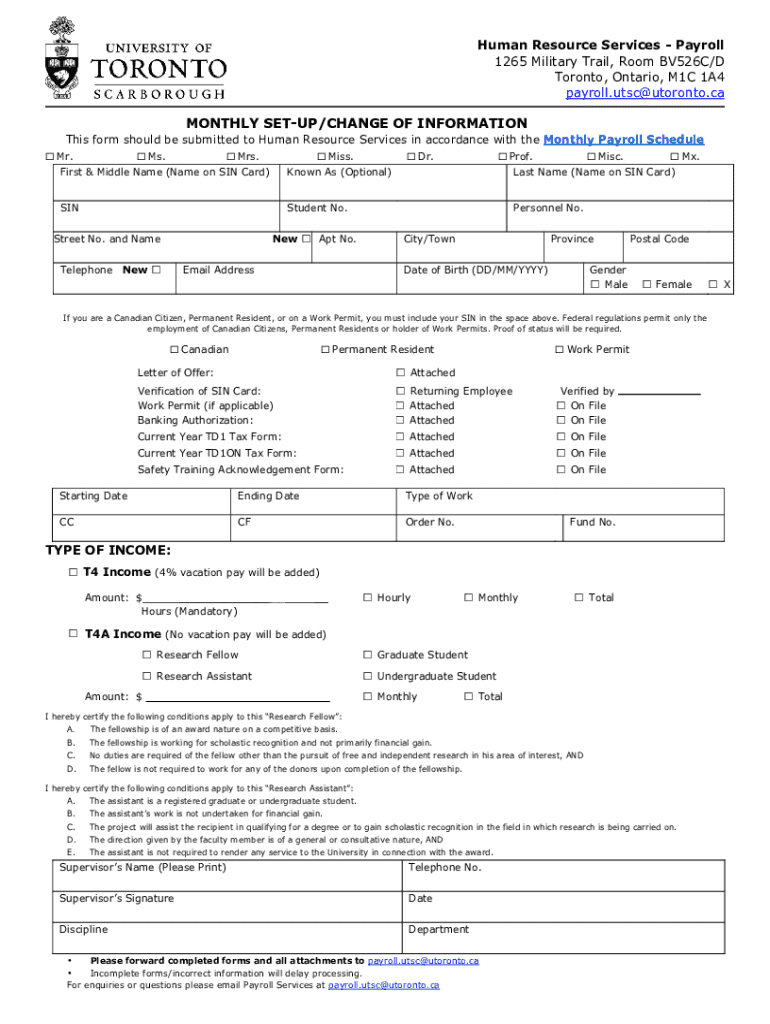

The new hire payroll set-up form encompasses several critical components that ensure comprehensive data collection. Firstly, the personal information section requires new hires to submit their full name, address, contact details, and Social Security Number (SSN). The SSN is vital for tax reporting and should be protected to avoid identity theft. Employers often require documentation to confirm the accuracy of this information, establishing a firm's due diligence.

Another essential element is the tax information section. Here, employees complete the IRS Form W-4, indicating their withholding allowances based on their unique financial situations. This form significantly influences how much tax will be deducted from each paycheck. In places where state taxes apply, employees may also need to fill out pertinent state-specific tax forms to comply with local laws. Ensuring this section is filled out accurately is crucial for long-term financial planning.

Banking information is another component that deserves careful attention. Employees wishing to set up direct deposit must input their bank name, account number, and routing number. This affords them the convenience of having their paychecks automatically deposited into their account, which is often safer and faster than paper checks. Additionally, employees might have the option to distribute their pay into separate accounts, such as checking and savings, which can be an excellent strategy for budgeting.

Lastly, the employment information section includes job title, department, start date, and salary details. This section not only confirms the nature of the employee's role in the company but also clarifies compensation expectations, serving as a reference point for payroll calculations. Employers must keep this information updated for compliance with tax and employment regulations.

Step-by-step process for filling out the new hire payroll set-up form

Filling out the new hire payroll set-up form can initially seem daunting, but it follows a straightforward process. The first step is to gather all necessary documents, which typically include a valid identification document and your Social Security card. This preparation will facilitate the completion of the form and ensure all required information is readily available.

Next, fill out your personal information thoroughly. Pay close attention to spelling and formatting; common errors include incorrect SSN formats and typos in personal details, which can lead to misunderstandings during the payroll process. After you’ve completed the personal information section, it’s time to focus on the tax information. Use resources or consult with someone knowledgeable to determine your withholding amounts as accurately as possible. Making mistakes here can have significant tax implications at the end of the year.

The next step is to provide your banking information, should you choose direct deposit. Be sure to double-check your account details to eliminate any errors, as this could delay your payments. Make sure you also choose your pay distribution method wisely—whether that’s all in one account or divided between multiple accounts—for better financial management.

Once you have completed all sections of the form, it's essential to review for any potential errors. Double-check every section, especially your personal and banking information, as mistakes can complicate payroll processing. After ensuring the accuracy of your information, submit the form following your company's submission guidelines, whether that’s in person, via email, or through an online portal.

Common missteps when completing the new hire payroll set-up form

Despite its importance, new hires often encounter common pitfalls when completing the payroll set-up form. One of the most significant mistakes is entering inaccurate personal or banking information. Errors such as misspelling names, incorrect SSNs, or wrong bank account numbers can lead to complications that delay the first paycheck or misallocation of funds.

Additionally, neglecting to consider tax implications can have long-lasting effects, including withholding too little or too much. New hires may underestimate their tax responsibilities, leading to financial strain later. Some may also forget to sign the form, which is an essential step in the completion process. Always be proactive and double-check that all required fields are filled in correctly before submission.

Best practices for new hires: ensuring compliance and accuracy

To navigate the payroll setup effectively, new hires should adhere to best practices that enhance compliance and precision. Keeping records of submitted documents is crucial. This includes making copies of the new hire payroll set-up form as well as any supporting documents. Documentation is essential in case discrepancies arise later, providing a paper trail for clarification.

Additionally, regularly updating payroll information as life changes occur—such as name or banking information—ensures your records remain accurate. Communication with HR about any changes is necessary, as they handle these documents. New employees should also familiarize themselves with their rights and responsibilities concerning payroll documentation, ensuring they understand the implications of their submissions and how to rectify issues should they arise.

Additional forms to consider during onboarding

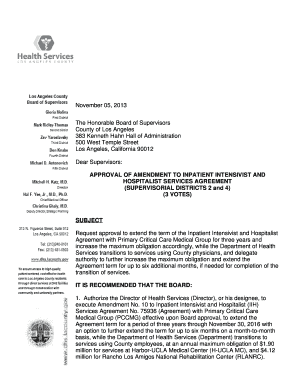

Beyond the new hire payroll set-up form, several other forms play vital roles during the onboarding process. The Form I-9, or Employment Eligibility Verification, ensures that employers validate an employee’s eligibility to work in the U.S. It's crucial for compliance with immigration laws and must be completed within three days of hire.

Another important aspect is the employee benefits enrollment forms. These forms allow new hires to select their benefits options, which could include health, retirement, and other employee perks. It's essential to review these options carefully to choose the best plan for individual needs. Additionally, emergency contact information forms should be completed to ensure that the company has current contact details for important situations. Lastly, acknowledging receipt and understanding of the employee handbook is crucial as it outlines company policies and expectations.

Using pdfFiller to streamline your new hire payroll set-up process

pdfFiller is an excellent tool for simplifying the process of filling out the new hire payroll set-up form. It offers interactive tools that allow users to access editable templates tailored for easy completion. This functionality drastically reduces the manual effort required to prepare the document. The platform is user-friendly, making it ideal for new hires who may be unfamiliar with form-filling processes.

One of the standout features of pdfFiller is the eSign capability, which facilitates quick and easy signing of documents. This feature ensures that employees can complete their paperwork without unnecessary delays, expediting the onboarding process. Moreover, pdfFiller allows for seamless collaboration with HR teams. Shareable links enable real-time collaboration, and changes can be tracked, which is particularly useful for keeping everyone in the loop regarding form updates.

The cloud-based nature of pdfFiller also means users can access and manage their documents from anywhere. Whether working remotely or on-site, new hires can easily check, update, or review payroll documentation, reducing the stress associated with managing vital forms. This capability allows users to stay organized and informed of any changes that may affect their payroll information.

Staying informed: ongoing maintenance of your payroll information

Continuous maintenance of payroll information is vital for ensuring smooth payroll processing. New hires need to conduct regular reviews of their payroll and personal information. This includes checking for any discrepancies in withholding or pay rates, especially after major life changes. Keeping an open line of communication with HR or payroll teams is critical for timely updates and clarifications regarding individual situations.

Additionally, having a practice of following up with HR after submitting forms can ensure that everything has been received and processed correctly. Staying informed and vigilant will not only contribute to a hassle-free payroll experience but will also enhance overall confidence in managing personal financial matters related to employment.

FAQs regarding the new hire payroll set-up form

Understanding the intricacies of the new hire payroll set-up form can lead to questions, especially for first-time employees. One common inquiry is: 'What if I make a mistake on my form?' The best course of action is to notify HR immediately, who can guide you on correcting or resubmitting the information. Another frequent question is, 'How can I amend my tax withholding after submission?' Usually, this can be done by submitting a new W-4 anytime significant life changes occur, such as marriage or changes in dependents.

Lastly, many wonder who to contact for assistance while filling out payroll forms. Direct communication with the HR department is the best approach—they are trained to provide guidance and troubleshoot any issues you may face during the process. Additionally, many companies provide resources, including how-to guides and FAQs, to help new hires navigate these forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in new hire payroll set-up without leaving Chrome?

Can I create an electronic signature for the new hire payroll set-up in Chrome?

How can I edit new hire payroll set-up on a smartphone?

What is new hire payroll set-up?

Who is required to file new hire payroll set-up?

How to fill out new hire payroll set-up?

What is the purpose of new hire payroll set-up?

What information must be reported on new hire payroll set-up?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.