Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

Editing beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary designation form - A comprehensive how-to guide

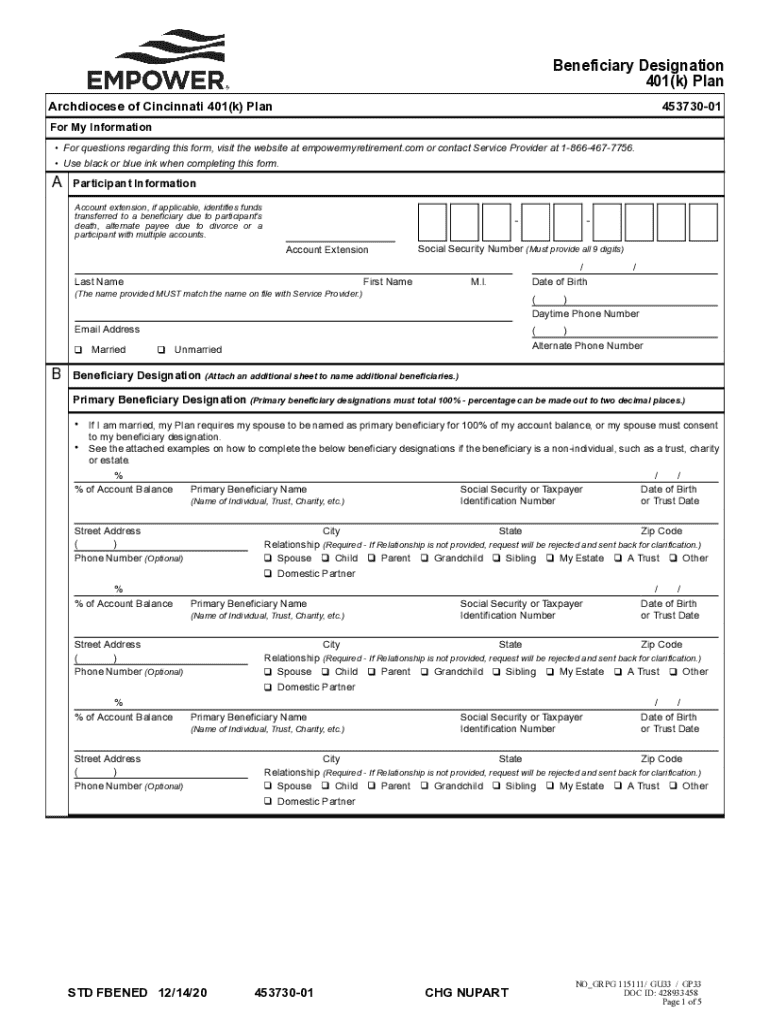

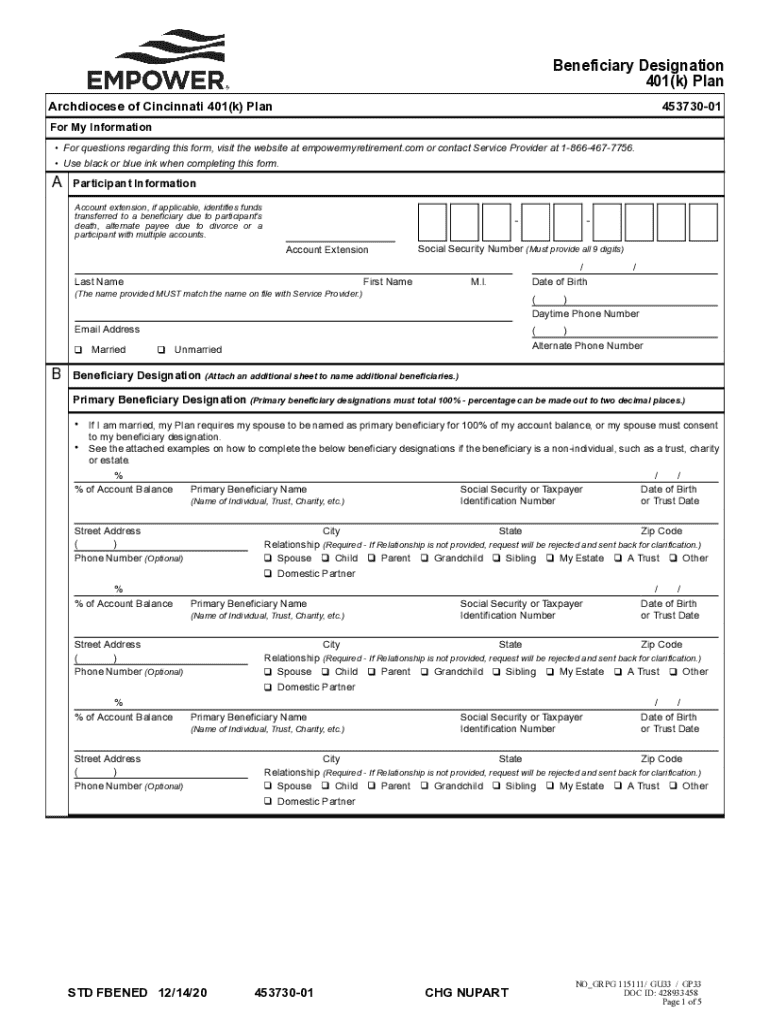

Understanding the beneficiary designation form

A beneficiary designation form is a legal document that allows individuals to specify who will receive their assets, such as life insurance proceeds, retirement accounts, or trusts upon their death. This critical document serves the purpose of ensuring that the deceased's wishes are honored, eliminating ambiguity and potential conflicts among family members or heirs.

Key terms associated with beneficiary designations include 'primary beneficiary,' the individual who will receive the assets first, and 'contingent beneficiary,' an alternate who will receive these assets if the primary beneficiary is deceased. Understanding these concepts is essential for making informed decisions.

Having a proper beneficiary designation is vital for various reasons. First and foremost, it provides peace of mind by ensuring your assets are distributed according to your wishes. Additionally, it can expedite the transfer of assets and avoid potential probate complications. Forms like these are commonly used for life insurance policies, retirement plans, and bank accounts.

Key components of the beneficiary designation form

A well-structured beneficiary designation form contains several key components. Initially, the form requires identifying information about the policyholder, including their full name, address, and Social Security number. These details establish ownership of the policy and clarify who has the authority to make designations.

Next, the form requires information about the beneficiary or beneficiaries, which may include their names, addresses, and, in some cases, their Social Security numbers. It's important to note the distinction between primary and contingent beneficiaries. While primary beneficiaries receive assets directly, contingent beneficiaries serve as back-ups in case primary beneficiaries cannot inherit.

Another critical aspect is the distribution methods, which specify how benefits will be divided among beneficiaries. This can include options like equal shares or specifying different percentages.

Steps to complete your beneficiary designation form

Completing a beneficiary designation form might seem straightforward, but careful attention is required. First, gather necessary documentation such as your identification, Social Security number, and pertinent details about your beneficiaries. It's essential to ensure you have any legal documents, like marriage certificates, if the beneficiary is a spouse.

Next, proceed by filling out the form correctly. Each section has specific instructions, so read these carefully. One common mistake is failing to clearly identify beneficiaries or incorrectly filling out the percentage distribution. Missing or providing incorrect information can lead to complications down the line.

Once you have filled out the form, reviewing your designation is critical. Double-check names, dates of birth, and contact information to avoid potential future disputes. Consider whether your choices reflect your current wishes.

Ensure you sign and date the form. Depending on your state's regulations, you may need additional signatures, such as witnesses. Finally, submit the form to the appropriate institution, whether it’s an insurance company or a financial institution, and retain copies for your own records.

Interactive tools for managing your beneficiary designation form

Utilizing digital tools like pdfFiller can streamline the process of managing your beneficiary designation form. The platform allows users to easily edit forms online, ensuring that your designations are always up to date. You can correct errors or make changes in a jiffy, without worrying about printing and filling out hard copies.

Another advantage of pdfFiller is its eSignature capabilities. Users can add legally binding signatures in real-time, which simplifies the process of collaboration, especially if more than one person is involved in the designation. This feature is particularly useful for entities that require multiple approvers or have team-based committee structures.

Frequently asked questions (FAQs)

Understanding the implications of a beneficiary designation is crucial for effective estate planning. One common question is, 'What happens if I don’t designate a beneficiary?' In this case, the assets may go through probate, causing delays and potentially leading to conflicts among heirs. It's a situation best avoided by making clear designations.

Another frequent inquiry revolves around changing beneficiary designations. Yes, you can update your beneficiary designation as life circumstances change, such as marriage, divorce, or the birth of a child. This process typically involves completing a new form with updated information.

Related topics and forms for further exploration

Beyond the beneficiary designation form, several other documents can aid in effective estate planning. Trust forms and wills provide frameworks for distributing your assets more comprehensively. Power of attorney documents also play a critical role in ensuring your wishes are honored if you become incapacitated.

When dealing with beneficiary designations, it's vital to be aware of legal considerations. Different states may impose specific laws governing how these forms are executed and how designations may be changed over time. Familiarizing yourself with your state’s regulations can prevent potential issues.

Support and resources

For users of pdfFiller, help is readily available through customer support. If you encounter any issues while filling out or submitting your beneficiary designation form, the support team can provide guidance. Additionally, pdfFiller offers various other tools and templates that make document management more efficient.

Explore webinars and tutorials provided by pdfFiller to enhance your document handling skills further. Becoming proficient in using the platform not only smoothes the process of managing your beneficiary designation form but extends to handling other important documents as well.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get beneficiary designation?

Can I edit beneficiary designation on an iOS device?

How do I complete beneficiary designation on an Android device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.