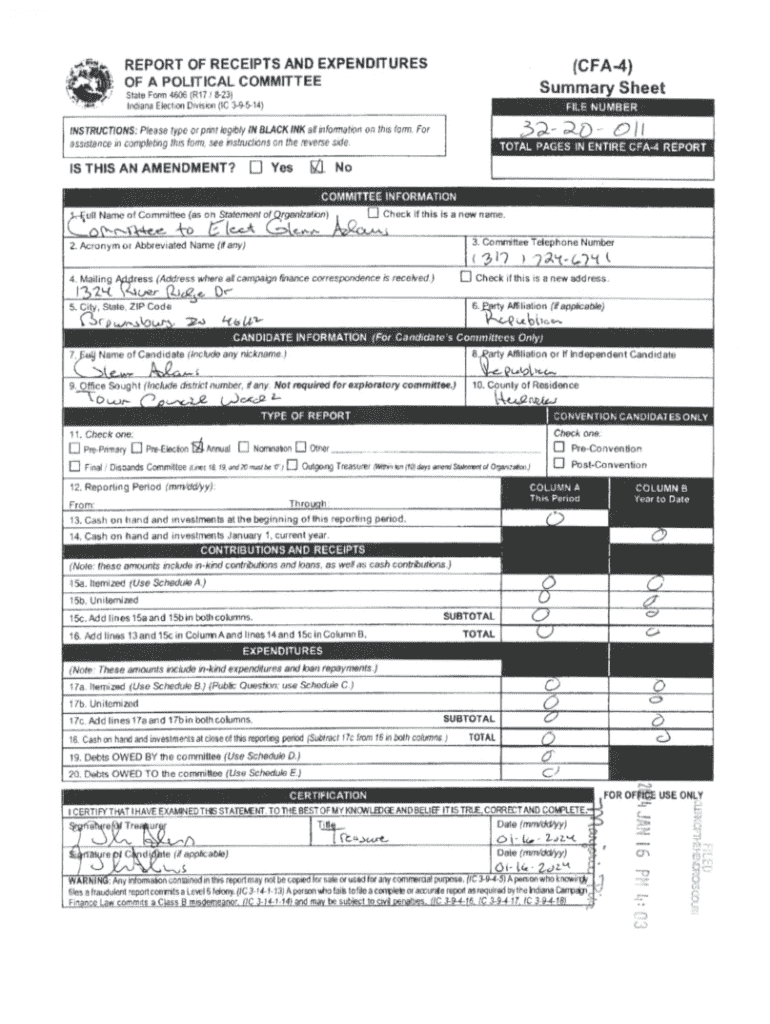

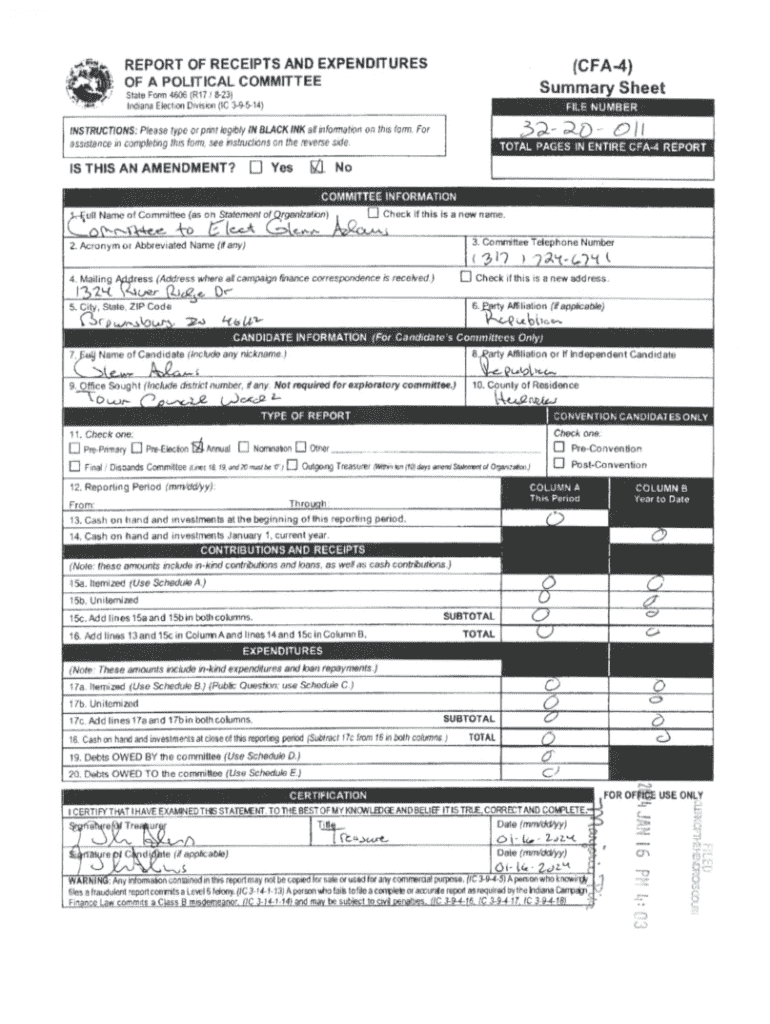

Get the free Report of Receipts and Expenditures of a Political Committee

Get, Create, Make and Sign report of receipts and

Editing report of receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out report of receipts and

How to fill out report of receipts and

Who needs report of receipts and?

Understanding the Report of Receipts and Form: A Comprehensive Guide

Understanding the report of receipts

A report of receipts is a crucial document that outlines income or funds received by an organization or individual. This report serves various purposes in financial reporting, campaign finance, and regulatory compliance, acting as a transparent record of monetary transactions. Depending on context, such reports are not just formalities; they represent accountability and transparency in financial activities, which are increasingly valued by stakeholders, donors, and regulatory bodies.

For non-profits and political campaigns, accurate reporting of receipts is essential. Misrepresentations can lead to audits or legal challenges, ultimately damaging reputation and trust. Hence, organizations must understand the importance of their report of receipts—a commitment to transparency that speaks volumes about their integrity.

Key components of the report of receipts

A comprehensive report of receipts includes several key components that provide a detailed breakdown of all income sources. Understanding what constitutes receipts is vital for accurate reporting. Receipts may include donations, grants, sales, and any other form of income relevant to the organization’s activities.

When filling out the report, accuracy is paramount. Essential information fields often required in the report include:

Common errors in completing a report of receipts include missing information, miscalculating amounts, or not reporting all income sources. To avoid these pitfalls, double-check entries, and ensure comprehensive documentation for each income type.

Step-by-step guide to filling out the form

Filling out the report of receipts form can be straightforward if organized and informed. Here’s a step-by-step guide to assist you in navigating the process smoothly.

Gather required documents

Before you start, collect all necessary documents. This includes bank statements, invoices, and any other documentation that can verify receipts. Having everything readily available streamlines the process and ensures you don't overlook any sources when filling out the report.

Accessing the report of receipts form

To access the official report of receipts form, visit the pdfFiller website. The platform offers easy navigation to an array of forms, and you'll likely find the report of receipts form readily available as part of its extensive library.

Completing the form section by section

Let’s break down the form sections for clarity:

Once you have completed the form, thoroughly review your entries. pdfFiller offers tools that can assist you in editing your submissions to ensure accuracy.

eSigning and submitting the report

With the form completed, the next step is to eSign and submit it. The use of electronic signatures has gained traction due to its convenience and the legal validity it holds in many jurisdictions.

Benefits of eSigning

Electronic signatures expedite the signing process and are securely stored in the cloud, ensuring no loss of data. They are recognized in legal contexts, making them a reliable option for confirming your submission.

How to eSign using pdfFiller

To eSign your report on pdfFiller:

Submission options

You can submit the report of receipts electronically via pdfFiller or print it for physical submission. The digital route is preferred due to speed and efficiency but ensure to adhere to any specific submission guidelines outlined by relevant authorities.

Managing your reports and receiving confirmation

Once submitted, tracking the status of your report ensures that you are kept informed of any updates or requests for further information. pdfFiller includes features that allow users to monitor submission statuses effectively.

What to do if there are issues

In the event of issues arising—such as request for clarifications or corrections—prompt and clear communication with the regulatory body is vital. Maintain all forms of correspondence and documentation pertaining to your report for your records.

Importance of record keeping

Keeping accurate records of your receipts and submissions is crucial. It not only clarifies your financial status but also aids in future reporting and ensures compliance with financial regulations. Use categorization and organized storage options to maintain clarity in your financial document management.

Additional tools and resources on pdfFiller

Aside from the report of receipts form, pdfFiller offers various tools and templates that can streamline your document management.

Interactive tools for document management

Leverage pdfFiller's interactive tools to facilitate document creation and management. The platform supports collaborative editing, making it easier for teams to work together.

Templates available on pdfFiller

Explore a range of related templates that can simplify other reporting or compliance needs, ensuring no aspect of your financial documentation is overlooked.

Customer support and learning center

pdfFiller’s customer support and learning center provide resources to address any questions or challenges that users might face. From FAQs to responsive support teams, help is readily available.

Frequently asked questions (FAQs)

Some common queries arise concerning the report of receipts that can help users navigate their submissions more effectively.

Common queries about receipts reporting

Troubleshooting common issues

Sometimes users encounter issues when using the pdfFiller platform; these can include difficulties in submitting or accessing forms. Familiarize yourself with available support resources for quick resolutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the report of receipts and electronically in Chrome?

How do I edit report of receipts and on an iOS device?

How do I edit report of receipts and on an Android device?

What is report of receipts and?

Who is required to file report of receipts and?

How to fill out report of receipts and?

What is the purpose of report of receipts and?

What information must be reported on report of receipts and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.